Developing Gini and Zenga Indices for the Analysis

advertisement

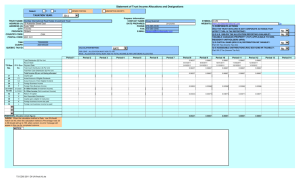

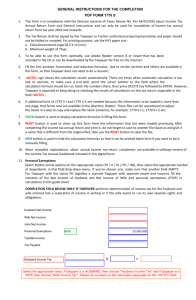

Gini and Zenga Indices AVAILABLE for the Analysis of Contextual Income Inequalities within Canada Bradley A. Corbett, PhD Associate Research Professor Richard Ivey School of Business University of Western Ontario Our Team Bradley A. Corbett Richard Ivey School of Business, University of Western Ontario, London, Ontario, Canada Francesca Greselin Dipartimento di Metodi Quantitativi per le Scienze Economiche e Aziendali, Universit_a di Milano Bicocca, Milan, Italy Leo Pasquazzi Dipartimento di Metodi Quantitativi per le Scienze Economiche e Aziendali, Universit_a di Milano Bicocca, Milan, Italy Rebecca Williams University of Western Ontario, London, Ontario, Canada Ricardas Zitikis Department of Statistical and Actuarial Sciences, University of Western Ontario, London, Ontario, Canada The study of Income Inequality is… …a measure of income distribution in a society. Gini Coefficient • Based on Lorenz curve • Defined as A/(A+B) • When A=0, Gini=0; represents perfect equality • When B=0, Gini=1; represents perfect inequality • Uses ratio of lower incomes to overall mean of the population Global Changes in the Labour Market, Incomes and the Canadian Context OECD (2011) • Income inequality is on the rise in nearly all member countries • High earner incomes are increasing twice as fast as low earner incomes – Loss of middle class jobs such as manufacturing in developed countries – Shift from an industrial to a service economy • Increase in technical jobs (higher associated incomes) • Increase in sercvice jobs (lower associated incomes) – Higher education no longer guarantees the prospect of a ‘better life’ but the ‘right education’ is now important Some additional mitigating factors in Canada – Poverty among aboriginal peoples – Exploitation of natural resources in some provinces Changes in the Tails of the Income Distribution Frenette, Green & Milligan (2007) • Study of income inequality in Canada from 1980-2000 • Argued existing [survey] data sources may have missed changes in the tails of the income distribution • Demonstrated that the Census was a better data source than the standard Survey of Labour and Income dynamics • Also argued many of the changes in the distribution of income have occurred in the tails of the distribution over time • Changes in the tails may not be adequately detected by the Gini Index if the mean remains stable while the tails grow fat Scatter Plot of Canadian Census Divisions: Gini vs. Zenga Gini Index Quintiles in Canada: 2006 Census, After Tax, Census Families Gini and Zenga Indices Available • 2006 Canadian Census (2005 Incomes) – – – – – a 20% sample from the 2006 Census (~6 Million) Household incomes Incentive for low income to submit tax (2000) Missing data supplemented by tax data Sampling Weights based on Census • Provincial and Census Division levels of analysis • Income includes market income + government transfers • One family member per household selected Gini and Zenga Indices are AVAILABLE for Merging: Provincial and Census Divisions in Canada (2006 Census; Provincial shown below) Economic Families No Adjustments GINI Census Families Adjusted No Adjustments Before Tax After Tax Before Tax After Tax Before Tax After Tax BC 0.45481 0.42086 0.41603 0.37584 0.46636 0.43117 Alberta 0.47456 0.43898 0.43568 0.39430 0.48730 0.45117 Saskatchewan 0.44137 0.40688 0.40275 0.35478 0.45575 0.42123 Manitoba 0.43836 0.40314 0.39709 0.36183 0.45347 0.41783 Ontario 0.45483 0.41539 0.41592 0.37004 0.46837 0.42783 Quebec 0.43504 0.39750 0.38983 0.34236 0.44338 0.40523 New Brunswick 0.41026 0.37520 0.36600 0.32483 0.41904 0.38304 Nova Scotia 0.42159 0.38550 0.37850 0.33618 0.43059 0.39351 PEI 0.39318 0.36127 0.34777 0.30838 0.40098 0.36821 Newfoundland & Labrador 0.42057 0.37953 0.38094 0.33326 0.43297 0.39080 Contact Info: Bradley A. Corbett, PhD Richard Ivey School of Business University of Western Ontario 519-850-2971 bcorbet@uwo.ca