Stephen Hetherington on Law Reports

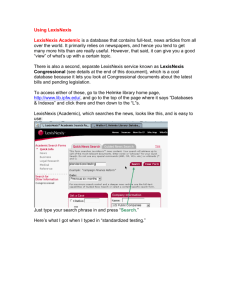

advertisement

Law Reports Stephen Hetherington, Publishing Manager 20 May 2014 Who are we? • We have a team of 17 editors working exclusively on our law reports titles. Between them, they have almost 200 years’ experience in editing law reports (and extensive knowledge of specialist subject areas). • We also have a separate team of 11 law reporters who attend court and write summaries of judicial decisions for our daily online law reporting service. • The editors working on our law reports titles have the following legal or publishing qualifications: • • • • • • 7 are members of the Bar of England and Wales 1 is a solicitor 4 have the Legal Practice Course qualification 15 have undergraduate law degrees or equivalent qualifications 6 have post-graduate law degrees 9 have London College of Communication certificates in advanced copy-editing and proof-reading All members of our team of law reporters are either barristers or solicitors. LexisNexis® Confidential 1 What do we publish? 21 different series of law reports All England Law Reports All England Commercial Cases All England European Cases Butterworths Company Law Cases Butterworths Family Court Reports Butterworths Human Rights Cases Butterworths Intellectual Property and Technology Cases Butterworths Local Government Reports Butterworths Medico-Legal Reports Construction Law Reports Industrial Relations Law Reports International Tax Law Reports International Trust and Estate Law Reports Law Reports of the Commonwealth Northern Ireland Law Reports Northern Ireland Judgments Bulletin Simon’s Tax Cases Simon’s First-tier Tax Decisions West Indian Reports Manx Law Reports Times Law Reports LexisNexis® Confidential 2 What do we publish? • Plus following 3rd party law reports (on Lexis Library) Bahamas Law Reports Costs Law Reports English Reports Estates Gazette Law Reports ICLRs (The Law Reports) Irish Reports Sessions Cases Scottish Civil Law Reports Scottish Criminal Case Reports LexisNexis® Confidential 3 Volume of content • 1,300 law reports published in 2013 • 39,000 pages (approx. 750 pages per week) • Print, CD, online LexisNexis® Confidential 4 What value do we add? • Case selection • Accuracy (copyediting) • Headnote (summary of facts, plus legal reasoning applied to those facts). Also includes case lists, catchwords, procedural history, references to Halsbury’s Laws/Halsbury’s Statutes etc. Note about whether legislative material still in force. • Categorisation (indexing) LexisNexis® Confidential 5 Selection criteria • Cases which make new law, either because they deal with novel situations or extend the application of existing principles • Cases where the judges restate old principles of law in modern terms or which are examples of modern applications of old principles • Cases where the law is clarified by an appellate court when inferior courts have reached conflicting decisions • Cases which interpret legislation likely to have more than a very narrow application • Cases which interpret commonly found clauses in, for example, contracts (especially commercial contracts such as charterparties) and wills • Cases where the courts clarify points of practice or procedure in common use LexisNexis® Confidential 6 Copyediting • House style • Check and add citations • Check for errors in the text – – – – – Typos Sentences that are difficult to understand Incorrect citations Factual errors Incorrect statements of the law LexisNexis® Confidential 7 Copyediting Text of judgment said: • ‘Accepting, as the Special Commissioners did, that Ch I was probably drafted on the basis that contributions and benefits would normally take a monetary form, I do not consider that the words used must be taken as an indication by Parliament that they could only extend to non-cash contributions.’ What it should have said: • Accepting, as the Special Commissioners did, that Ch I was probably drafted on the basis that contributions and benefits would normally take a monetary form, I do not consider that the words used must be taken as an indication by Parliament that they could only extend to cash contributions.’ Comment from judge: ‘You are quite right. Everyone has missed the error!’ LexisNexis® Confidential 8 Copyediting Text of judgment said: • ‘If the first hurdle is overcome there is no need to consider the second; the entity has already failed to fulfil the condition.’ What it should have said: • ‘If the first hurdle is not overcome there is no need to consider the second; the entity has already failed to fulfil the condition.’ Comment from judge: ‘… very well spotted. … It is fortunate that the error is reasonably obvious (or I hope it is) but not so obvious that I spotted it myself when reading and preparing my own draft (but then neither did counsel when they had an opportunity to proof read it!). …’ LexisNexis® Confidential 9 Copyediting Text of judgment said (quoting from a statute): • ‘… This section applies to securities falling within subsection (2) or (4) below. …’ What it should have said: • ‘… This section applies to securities other than securities falling within subsection (2) or (4) below. …’ LexisNexis® Confidential 10 Copyediting Text of judgment: • ‘… it is just unreasonable …’ What it should have said: • ‘… it is just and reasonable …’ Text of judgment: • ‘… crimes of humanity …’ What it should have said: • ‘… crimes against humanity …’ Text of judgment: • ‘… National Society for the Protection of Cruelty to Children …’ What it should have said: • ‘… National Society for the Prevention of Cruelty to Children …’ LexisNexis® Confidential 11 Copyediting Text of judgment said: • ‘Section 403(8) of the 1988 Act requires, in summary, that for the purposes of calculating for any accounting period the excess of profits over charges on income which can be surrendered, the profits must be calculated without regard to (a) deductions for losses or (b) deductions for allowances or (c) expenses of management, of other periods. These three categories appear, with one qualification, to correspond to the other three categories of reliefs which can be surrendered under s 403. The policy of the subsection appears to be to prevent the excess of profits over charges on income from being inflated by other reliefs carried forward from earlier years. It confines the surrenderable relief to the excess over profits in the accounting period.’ What it should have said: • ‘Section 403(8) of the 1988 Act requires, in summary, that for the purposes of calculating for any accounting period the excess of charges on income over profits which can be surrendered, the profits must be calculated without regard to (a) deductions for losses or (b) deductions for allowances or (c) expenses of management, of other periods. These three categories appear, with one qualification, to correspond to the other three categories of reliefs which can be surrendered under s 403. The policy of the subsection appears to be to prevent the excess of charges on income over profits from being inflated by other reliefs carried forward from earlier years. It confines the surrenderable relief to the excess over profits in the accounting period.’ This mistake (or these mistakes) were not picked up by a rival series of weekly law reports. LexisNexis® Confidential 12 Headnoting LexisNexis® Confidential 13 Headnoting Citation Case name Court Neutral citation Panel Hearing and judgment dates Catchwords Headnote LexisNexis® Confidential 14 Headnoting Headnote Notes Case list Introduction LexisNexis® Confidential 15 Headnoting Introduction Counsel and solicitors Judgment date Judgment LexisNexis® Confidential 16 Headnoting Judgment Disposition Reporter LexisNexis® Confidential 17 Q&A Any questions? LexisNexis® Confidential 18