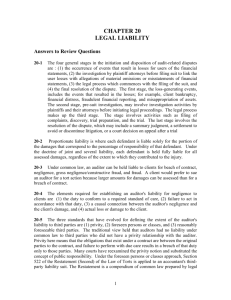

Draft Rules

advertisement

Companies Act, 2013 And Draft Rules 1 Broad overview of the new law and some key aspects relevant to different stakeholders Directors: • Duties of Directors clearly laid down – Higher accountability. • Requirement of independent directors for a wider group of companies (and not only listed entities). • Obligations to undertake Corporate Social Responsibility activities. • Nominee directors of financial institutions not deemed independent. Shareholders: • Ability to initiate class actions on account of mismanagement/fraud etc. • Ability to execute legally enforceable contracts relating to transfer of securities in a public company. Auditors: • Rotation of Auditors (maximum term of 5 years for individuals and two terms of five years for auditing firms) for certain classes of companies. Network firms not allowed to replace an outgoing firm. • Bar on providing non auditing services to a company, where it is appointed as an auditor. • Disqualifications on a number of grounds - holding of securities in the company by relatives, engaged in business relationship with the company etc. 2 Broad Overview... (Contd.) Promoters: • New category of ‘Promoters’ introduced. • Liability with respect to public offers and disclosure requirements, attached to category of persons qualifying to be ‘Promoters’ . • Defined to include persons who have ‘control’ over the affairs of the company. • ‘Control’ defined to include right to control management or policy decisions directly or indirectly including through shareholders, voting agreements or in any other manner. Companies: • Companies satisfying certain financial thresholds to undertake CSR activities. • Class of companies (to be notified) to have limited layers of subsidiaries. • New requirements for private placement of shares. • Buy-backs to have atleast 1 year gap. • Related party transactions to be subject to shareholders approval. • Mergers of Indian companies with foreign companies and vice-verse permitted subject to conditions. • New requirement for directors responsibility statement for all companies. • Listed companies and certain specified unlisted companies to have at least 1 woman director. 3 • Specified unlisted companies to have at least 1 independent director Broad Overview... (Contd.) Investors: • Ability to execute legally enforceable contracts relating to transfer of securities in a public company. • Articles may contain entrenchment provisions. • Mergers of Indian companies with foreign companies can only be done where foreign companies are in notified jurisdictions and subject to RBI approval. • Blanket exemption to private companies to issue shares of different class ( beyond equity and preference) eliminated. Shares with differential rights to be issued in accordance with Rules which are yet to be notified. • May be considered as “promoters’ if they have contractual rights which are considered to fall within the definition of “control”. 4 Control – Need for clarity through Rules? Definition of “control” under the Act : • Control shall include the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner; Section 469(1) of the Act, empower the Central Government to make rules “to carry out provisions of the Act”. Issue: In the context of the revised definition of “promoter” as discussed and considering the controversy surrounding the definition when used in other regulations/ policies, the expression “control” contextually under the Companies Act needs to be clarified through appropriate rules. Arguably the scope of the rule making authority is wide enough to permit this. 5 Evaluation of Certain Draft Rules 6 Audit and Auditors Disqualification of Auditors: • Draft rules propose financial threshold for investment in securities by relatives upto face value of INR 1 Lakh. • The term ‘relative’ has been widely defined to include a number of independent relatives (e.g. brother, sister, son-in-law), over whom the auditor may have no control whatsoever. • May result in situations where, due to the acquisition of securities by an independent relative ( e.g. son-in-law) of a partner of auditing firm, outside such partners’ knowledge, such partner (along with the entire firm) is disqualified to act as an auditor of a company. Issue: If a direct interest or a commonality of interest in the investment of auditor is the basis of “disqualification” these limits should be revised to reflect separate limits for different category of relatives: • Lower limit for dependent relatives like son, wife, etc. • Exclusion of independent relatives like brother, sister, son-in-law, grandson, etc. or a higher threshold for investments by them as commonality of interest cannot be presumed. 7 Audit and Auditors (Contd.) Selection of Auditors: • Draft rules provide that Board/Audit Committee are mandated to consider completed and pending proceedings against auditor. • To ensure compliance with the same, Auditor should certify details of completed and pending proceedings to Companies, (in relation to pending proceedings, of which such auditor has received notice), as part of the auditor certificate prescribed under the rules which currently only requires the auditor to certify that he is eligible and not disqualified. Reporting of Frauds by an Auditor: • CARO, 2003 currently provides for reporting of frauds on or by a Company. • Draft rules under Section 143 (12), only provide for reporting of fraud by officer or employees on a Company that the auditor is aware of. • Currently under CARO 2003, fraud reporting is not limited to any specific category of frauds. Considering the similar impact even other frauds may have on a company, suitable provisions may be made in orders to be issued under Section 143(11) for reporting of frauds by third parties (like vendors) involving the Company, which the auditor has notice of even where the officer or employees may not be fraudulently 8 involved. Corporate Social Responsibility Calculation of Net Profit: • Statutory Provision - Section 135(1) of the Act states that Net Profit shall be ‘calculated in accordance with Section 198 of the Act’, which provides for a number of adjustments like exclusion of profits from sale of undertaking, etc. • Draft Rules - net profit for Section 135 (1) to be “ profits before tax and exclude net profit of branches outside India”. • Issue - Rules should clarify that the profit before tax be computed under Section 198 only. Further exclusion of profit of branches may not be in conformity with Section 135 which provides for profits to be calculated under Section 198 only. CSR Spends: Draft rules provide that 2% of average net profits during every block of 3 years. • “At the risk of being in conflict with the Act”, the draft rules may consider clarifying the manner of computation of net profits if the Company has losses in one or more years in the past 3 yrs. 9 Corporate Social Responsibility (Contd.) Contributions: • Statutory Provision – Schedule VII provided for a specified list of activities which may be included by companies in their CSR Policy, which only included the Prime Minister National Relief fund or other Central / State Govt. funds as 3rd parties which could undertake CSR activities • Draft Rules – Now clarify that CSR contributions can be made by Companies to various organizations with atleast 3 years track record in related areas. 10 One Person Company (‘OPC’) Statutory Provisions: Section 3 and 4 of the Companies Act 2013 (“Act”) provide for setting up of OPCs for a ‘lawful purpose’. There are no restrictions/thresholds contemplated in the statute relating to formation / capital / change in status of OPC. Draft Rules: Lay down the following restrictions: • Only Indian Citizens resident in India (i.e. stay ≥ 182 days) can set up OPC. • No person can set up more than 5 OPCs. • If OPC’s capital > INR 50 Lacs or average annual turnover > INR 2 Crores, OPC to be converted into a private/public company and all the relevant conditions for such category will need to be satisfied. Section 469(1) of the Act, empower the Central Government to make rules “to carry out provisions of the Act”. Issue: Apart from possibly making the OPC route un attractive the draft Rules for OPC by imposing restrictions, appear to be in conflict with the substantive provision of the Act. 11 Some Important Rules yet to be notified Rules relating to the following matters are yet to be notified: • • • • • • • • • • Issuance of shares/debentures (including sweat equity, shares with differential rights). Buyback of shares Redemption of preference shares. Prospectus and Allotment of Securities (including GDRs) Acceptance of deposits by companies Mergers/arrangements Appointment and remuneration of managerial personnel Class of companies having a cap on number of subsidiaries Special courts Winding Up (including through summary procedure) 12