PowerPoint Slides 21

advertisement

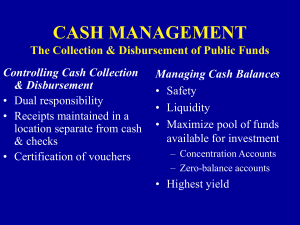

IBUS 302: International Finance Topic 21-Cash Management Lawrence Schrenk, Instructor 1 (of 30) Learning Objectives 1. 2. 3. Explain the importance of international cash balances.▪ Describe exposure netting and other cash management techniques. Describe transfer pricing, arms length price, and blocked funds.▪ 2 (of 30) The Management of International Cash Balances Decision Variables: Size of Cash Balances Currency of Cash Balances Location of Cash Balances Size of Cash Balances The Liquidity Trade-Off The cost of keeping “too much” cash on hand, i.e. the opportunity costs of holding cash (lower return). The cost of not keeping enough cash on hand, i.e. the trading costs associated with having too little cash (transaction costs, short-term debt costs, etc.) The variability of cash flows. Costs in dollars of holding cash Size of Cash Balances Trading costs increase when the firm must sell securities to meet cash needs. Total cost of holding cash Opportunity Costs The investment income foregone when holding cash. Trading costs C* ▪ Size of cash balance ▪ Currency of Cash Balances By maintaining cash balances in a particular currency, the MNC is essentially speculating in that currency. Strategies: Pooling Netting Location of Cash Balances Should the firm have centralized cash management in the home country? Or should the firm let each affiliate handle it locally? Where are borrowing costs lowest and investment returns highest? New Challenges Cash Flow Complexity Political Risk Legal and Ethical Issues Tax Issues Foreign Exchange (FX) Exposure 8 (of 28) Cash Management Techniques Pooling Netting Multicurrency Accounts Hedging 9 (of 28) Pooling Company and all its subsidiaries must maintain accounts at the same bank Notional pooling: Positive and negative balances are aggregated each day to calculate interest earned or due; funds are not actually transferred but merely totaled Some type of credit facilities are usually required to support negative balances in the pool Most pooling is currently single-currency/one country 10 (of 28) Exposure Netting Bilateral Netting Purchases between two subsidiaries are periodically netted against each other. Payments netted in different currencies are converted to a common reference currency. Multilateral Netting . Purchases between multiple subsidiaries are periodically netted against each other. Payments are combined ina common, reference currency. Exposure Netting MNC has the following foreign exchange transactions: $20 $30 $40 $10 $10 $35 $25 $60 $20 $30 Transactions: 12 Value: $350 $30 $40 Exposure Netting MNC has the following foreign exchange transactions: Disbursements Receipts US Canada Germany UK US — 30 35 60 Canada 20 — 10 40 Germany 10 25 — 30 UK 40 30 20 — Total Dis. Total R. Net Exposure Netting Disbursements: Disbursements Receipts US Canada Germany UK US — 30 35 60 Canada 20 — 10 40 Germany 10 25 — 30 UK 40 30 20 — Total Dis. 70 85 65 130 Total R. 350 Net Exposure Netting Receipts: Disbursements Receipts US Canada Germany UK Total R. US — 30 35 60 125 Canada 20 — 10 40 70 Germany 10 25 — 30 65 UK 40 30 20 — 90 Total Dis. 70 85 65 130 350 Net Exposure Netting Net Cash Flows: ▪ Disbursements Receipts US Canada Germany UK Total R. Net – 35 60 125 55▪ 10 40 70 US — 30 Canada 20 — Germany 10 25 — 30 65 UK 40 30 20 — 90 Total Dis. 70 85 65 130 = 350 Exposure Netting Net Cash Flows : ▪ Disbursements Receipts US Canada Germany UK Total R. Net US — 30 35 60 125 55 Canada 20 — 10 40 70 (15) Germany 10 25 — 30 65 0 UK 40 30 20 — 90 (40) Total Dis. 70 85 65 130 350 0 Exposure Netting Complete Table : Disbursements Receipts US Canada Germany UK Total R. Net US — 30 35 60 125 55 Canada 20 — 10 40 70 (15) Germany 10 25 — 30 65 0 UK 40 30 20 — 90 (40) Total Dis. 70 85 65 130 350 0 Exposure Netting NOTES 1. Total disbursements must equal total receipts. 70 + 85 + 65 + 130 = 125 + 70 + 65 + 90 = 350 2. Total net must equal zero. 55 – 15 – 40 = 0 19 (of 28) Bilateral Netting Bilateral Netting reduces transactions by half: $20 $10 $30 $40 $20 $15 $10$25$35 $25 $60 $20 $10 $30 Transactions: 6 Value: $90 $10 $30$10$40 Bilateral Netting Transactions: Disbursements Receipts US Canada Germany UK US — 10 25 20 Canada 0 — 0 10 Germany 0 15 — 10 UK 0 0 0 — Total Dis. Total R. Net Bilateral Netting Disbursements: Disbursements Receipts US Canada Germany UK US — 10 25 20 Canada 0 — 0 10 Germany 0 15 — 10 UK 0 0 0 — Total Dis. 0 25 25 40 Total R. 90 Net Bilateral Netting Receipts: Disbursements Receipts US Canada Germany UK Total R. US — 10 25 20 55 Canada 0 — 0 10 10 Germany 0 15 — 10 25 UK 0 0 0 — 0 Total Dis. 0 25 25 40 90 Net Bilateral Netting Net Cash Flows: Disbursements Receipts US Canada Germany UK Total R. Net US — 10 25 20 55 55 Canada 0 — 0 10 10 (15) Germany 0 15 — 10 25 0 UK 0 0 0 — 0 (40) Total Dis. 0 25 25 40 90 0 Exposure Netting NOTES 1. Total disbursements must equal total receipts. 25 + 25 + 40 = 55 + 10 + 25 = 90 2. Total net must equal zero. 55 – 15 – 40 = 0 25 (of 28) Key Idea Expose netting never changes… Net Cash Flows Expose netting does change disbursements and receipts. Expose netting decreases transactions and total value of cash flows. 26 (of 28) Multilateral Netting Two Suggestions: Use the one set of values you know… Net cash flows to each unit. Start the calculations with the subsidiaries and end with the parent. 27 (of 28) Multilateral Netting Net Cash Flows: Disbursements Receipts US Canada Germany UK Total Dis. US Canada Germany UK — Total R. Net 55 — (15) — 0 — (40) 0 Multilateral Netting Canada pays its net cash flow to parent: Disbursements Receipts US Canada Germany UK Total Dis. US — Canada Germany UK Total R. Net 15 55 — (15) — 0 — (40) 0 Multilateral Netting England pays its net cash flow to parent: Disbursements Receipts US Canada Germany UK Total Dis. US — Canada Germany 15 UK 40 — Total R. Net 55 (15) — 0 — (40) 0 Multilateral Netting Germany pays its net cash flow to parent: Disbursements Receipts US Canada Germany UK Total Dis. US — Canada Germany 15 0 UK 40 — Total R. Net 55 (15) — 0 — (40) 0 Multilateral Netting All other transactions are zero: Disbursements Receipts US Canada Germany UK Total R. Net US — 15 0 40 55 Canada 0 — 0 0 (15) Germany 0 0 — 0 0 UK 0 0 0 — (40) Total Dis. 0 Multilateral Netting Disbursements: Disbursements Receipts US Canada Germany UK Total R. Net US — 15 0 40 55 Canada 0 — 0 0 (15) Germany 0 0 — 0 0 UK 0 0 0 — (40) Total Dis. 0 15 0 40 0 Multilateral Netting Receipts: Disbursements Receipts US Canada Germany UK Total R. Net US — 15 0 40 55 55 Canada 0 — 0 0 0 (15) Germany 0 0 — 0 0 0 UK 0 0 0 — 0 (40) Total Dis. 0 15 0 40 55 0 Multilateral Netting Multilateral netting is even more effective: $10 $30 $40 $20 $40 $15 $15 $15$25 $15 $10 $10 $10 $10 Transactions: 2 Value: $55 Multilateral Netting with Central Depository Some firms use a central depository as a cash pool to facilitate funds mobilization and reduce the chance of misallocated funds. $15 $55 Central depository $40 Multilateral Netting with Central Depository Consider the net cash flows of the affiliates with the rest of the world: Affiliate U.S. Canada Germany U.K. Total Net Receipts Net Excess Cash from Multilateral from Transactions Netting with Third Parties Net Flow $55,000 $20,000 $35,000 ($15,000) ($30,000) $15,000 0 $75,000 ($75,000) ($40,000) ($25,000) ($15,000) ($40,000) Multilateral Netting with Central Depository Net cash flows after multilateral netting and net payments from external transactions $35 $15 Central depository $75 $15 Netting and FX The examples have used dollars. Where do other currencies fit in? 39 (of 28) Transfer Pricing The Transfer Price is the price that for accounting purposes, is assigned to goods and services flowing from one division of a firm to another division. Controversial even for a domestic firm. Consider the example of a firm that has one division that mills lumber and another that makes furniture. The transfer price of the lumber is a political as well as economic and accounting issue. International Transfer Pricing Added complications : Differences in tax rates Exchange rate restrictions on the part of the host country. Most countries have regulations controlling transfer pricing. In the U.S., the tax code requires transfer prices to be arms length prices. Arms Length Price A price that a willing seller would charge a willing unrelated buyer. The IRS prescribes three methods for estimating an arms length price Comparable uncontrolled price. Resale price: the price at which the good is resold by the affiliate is reduced by overhead and profit. Cost-plus approach: an appropriate profit is added to the cost of the manufacturing affiliate. Blocked Funds Restrictions on the movement of funds in a specific currency. A form of political risk is the risk that the foreign government may impose exchange restrictions on its own currency. Blocked Funds Strategies Additional strategies for unblocking funds: Direct negotiation Export creation Using the blocked funds to buy goods and services for the MNC. Transfer local expatriates from home payroll to the local subsidiaries payroll. Transfer pricing Swaps