Bitcoin and taxes - Bitcoinference 2015

advertisement

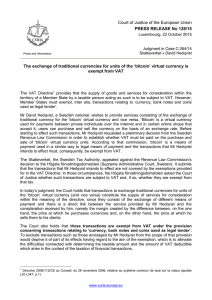

Bitcoin and taxes Dr Aleksandra Bal International Bureau for Fiscal Documentation (IBFD) Amsterdam Bitcoinference 2015 22 February 2015 Agenda Bitcoin status Bitcoin and income taxes Bitcoin and VAT 2 Bitcoin status Money in economic sense Money in legal sense Medium of exchange Unit of account Store of value Central management Legal tender status Physical carrier Electronic money Link to traditional monetary system Identifiable issuer 3 Bitcoin status Tax authorities’ views on Bitcoin status United States property Australia neither money nor a foreign currency but an asset Netherlands not: legal tender, financial product, electronic money Denmark not currency Norway asset not currency Finland not: currency, security or financial product Finland currency 4 Bitcoin and income taxes Income tax rules vary from country to country. Some countries tax everything (e.g., the United States), whereas others only selected types of income (e.g., Netherlands). Types of transactions relevant for income tax purposes Exchanges of bitcoins for legal currency Exchanges of bitcoins for other goods and services (barter) Bitcoin mining Distinction: business activity versus transactions performed in private capacity Long- vs. short-term capital gain 5 Bitcoin and VAT VAT is harmonized in the European Union. The Court of Justice of the European Union is the supreme court in VAT matters. VAT is levied on supplies of goods and services for consideration Types of transactions relevant for VAT purposes Exchanges of bitcoins for legal currency Exchanges of bitcoins for other goods and services Bitcoin mining 6 Bitcoin and VAT VAT exemption for bitcoin transactions? Article 135 of the VAT Directive: Member States must exempt: (d) transactions, including negotiation, concerning deposit and current accounts, payments, transfers, debts, cheques and other negotiable instruments; (e) transactions, including negotiation, concerning currency, bank notes and coins used as legal tender, with the exception of collectors' items… 7 Bitcoin and VAT Tax authorities’ views on VAT exemption Exemption No exemption Belgium Norway Finland Estonia United Kingdom (exceptions) Australia Singapore Referral to the Court of Justice of the European Union: Case C-264/14, Skatteverket v. David Hedqvist 8 Bitcoin and taxes Dr Aleksandra Bal E-mail: a.bal@ibfd.org PhD thesis “Taxation of virtual currency”: http://hdl.handle.net/1887/29963 Summary of research on virtual currency: https://www.youtube.com/watch?v=3PDi-ZTMCHY 9