Taxation Laws Amendment Bill, 2012

advertisement

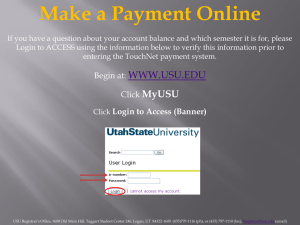

Legal Update - September 2012 Nancy Andrews and Pieter Cronje AGENDA Financial Services Laws General Amendment Bill, 2012 Taxation Laws Amendment Bill, 2012 Questions Financial Services Laws General Amendment Bill, 2012 (“The Bill”) Stated aim of the Bill is to: ensure a sound and well regulated financial services industry promote financial market stability by strengthening the financial sector regulatory framework enhance the supervisory powers of the regulators, as well as the powers of the Minister of Finance in dealing with potential risks to the financial system Amendments to the Pension Funds Act (“the PFA”) Most extensive amendments to the PFA EVER!!!!! 48 sections have been amended - virtually an amendment to each section. Not all sections will be discussed in this session, but A document titled “CLAUSE BY CLAUSE MOTIVATION OF AMENDMENTS”, available on FSB website Amendments to PFA cont…….. Sections of the Act to be covered : 1 - Definitions 7 - Trustee Boards 8 - Principal Officers 12 - Rule amendments 13A - Contributions 13B - Administration 14 - Transfers 15 - Surplus 19 - New Section 25 - Inspections and Investigations 30 - Pension Funds Adjudicator 33 - Directives 37A - 37D Implications for Funds, Employers and Administrators Definitions: Definitions will be changed to ensure: consistency, to correct previous errors, to deal with current definitions which create practical difficulties on implementation. Some changes: Actuarial surplus (registrar to prescribe method of calculation) Surplus accounts (establish only if rules allow for it) Fund return (definition improved to address practical challenges) Contingency reserve account (no general account – each for specific contingencies) Unclaimed benefit (to include non-member spouse portion and death benefits) Member (to apply it to beneficiary fund beneficiaries) Official Website (Registrar can now communicate through official website instead of gazette) Section 7 Section 7A: New requirement that composition must at all times comply with rules (and Act) Requirement to fill vacancy within 30 days of vacancy arising New section imposing whistle blower duties on individual trustees New reporting requirements on trustees removed from office Section 7C: New additional duties imposed on the board as a collective, not as individuals Duty to act independently Duty to comply with requirements prescribed by the Registrar Section 7D: The duty to give adequate info to members is amended to provide that: Info requirements may be prescribed (PF 130 and King III) New amendment to clarify what was already the practice: Board can delegate its functions under the Act to, administrators That delegation must be in writing and provided for in rules Board remains responsible despite delegation Section 8: Principal Officers Relaxation to the previous requirements Effectively, you can now go without a PO for 45 days Effect will be that PO must now be out of country for at least 45 days before need arises to appoint another person Duty to appoint another person within 30 days (from the 45 day period) Submission to allow for Deputy Principal Officers (in principle acceptance) SECTION 9A: VALUATORS Also additional requirements for appointment, similar to auditors New whistle blowing duties imposed on valuator Section 12 - Rule Amendments The 60 day period will be replaced by 180 day period This is period from resolution to change rules to submission of rule amendment to Registrar As under s 4 (unregistered rules), Registrar can call for more info If info not provided within 180 days, amendment lapses Section 13A Contributions SIGNIFICANT AMENDMENTS: New subsection 8 imposes personal liability on: ● every shareholder who controls the company and director who is regularly involved in the management of the company’s overall financial affairs ● every member who controls or is regularly involved in the management of the close corporation’s overall financial affairs ● a person who is regularly involved in the management of the employer’s overall financial affairs if not a Co or CC. Section 13B: Administration ADMINISTRATION: New provisions exempting certain entities from the need to have s13B licence: Investment Administrators; Authorised user as defined in Securities Services Act; Long term insurer; Manager of a domestic or foreign collective investment scheme Sets out further reqs that application for approval must comply with. NB: fit and proper reqs, capacity, qualifications, financial soundness In considering application, Registrar may call for more info or rely on info from other sources, subject to right to respond Section 13B: Administrators ADMINISTRATORS: Empowers Registrar to prescribe financial resources to be kept by administrators to meet their obligations Imposes obligation to keep those resources separate from assets of fund Provides clearly that info relating to fund belongs to fund, not administrator Imposes duty to maintain fund info and records and not destroy without consent of fund Imposes duty to provide fund info to fund upon request Imposes whistle blowing duties on administrators Registrar will no longer need to wait for an inspection before taking action against administrator Can now rely on info that has come to his knowledge Previous administrator, if removed, can be required by Registrar to pay for costs of new administrator/fund Section 13B: Administrators ADMINISTRATORS: Draft directive • • • • Introduce capital adequacy requirements Requirement of Quarterly reporting introduced The appointment of a monitoring person required Allowance for the using of facilitation accounts Section 14: Transfers Registrar will also be allowed to withdraw or amend s 14 certificates if as a result of legislative amendments, an approved scheme will be prejudicial to members No section 14 approval will be required where the transferor fund is valuation exempt and a transfer is made to a long-term insurer registered under the Long-term Insurance Act Registrar may now exempt transactions that would otherwise fall under s14 from the provisions of s14 Section 14A & B Section 14A Amendment to clarify that a pension increase must be granted at least once every three years and be made payable within six months of the effective date of the actuarial valuation This doesn't apply to outsourced pensioners or pensioners who elected to receive level pensions Section 14B Board must now also take into account the balance in contingency reserve accounts when limiting pension increases Section 15: Surplus Section 15B: Fund return (instead of nett investment earnings of fund) to be added to former members minimum benefits A new provision which provides that on a dissolution of a contingency reserve account in circumstances where fund is not being liquidated credit balance must be transferred to member surplus account or be used for the benefit of members and former members Some requirements the Registrar had to satisfy himself of are being removed because they are apparently too onerous A fund or stakeholder can now apply to Registrar to withdraw approval of a surplus scheme Section 15C It is now made clear that future surplus can be apportioned directly for the benefit of members and former members No need to pay to surplus account Section 15D Moneys in the MSA can only be used for the benefit of former members who left after SAD Section 15: Surplus Section 15 E Credit balance in employer surplus account can be used to pay debt due by employer for s15B(6) improper use Section 15F: Now requires agreement (no longer negotiation) for approval of transfer from reserve account to employer surplus account Now requires that prior allocation to reserve account be equitable and reasonable More onerous requirements than before Very few funds will be affected as most 15F applications have been submitted by now Section 15K Tribunal appointed will now make a determination instead of performing duties of a board Fund no longer selects tribunal, it can only propose Implication is that only Registrar appoints tribunal members All amendments to surplus legislation will apply prospectively. Sections 19(5)D Section 19(5)D A fund may not without prior approval of the Registrar take control of another entity Control means having more than 15% voting rights Sections 25 and 26 Section 25 The Registrar may publish the outcome of on-site visits and inspections Details and outcome published when deemed in public interest Section 26 Registrar can appoint one or more trustee Section 30: The Pension Funds Adjudicator Section 30T: The Board of the FSB is the accounting authority of the Adjudicator for purposes of PFMA Board of FSB must comply with PFMA Section 30V: Insulting, anticipating determinations or interfering with functions of Adjudicator Amount of fine : not exceeding R 1 million Imprisonment not exceeding 1 year (increased from 3 months) Or both imprisonment and a fine Sections 33 A & 37: Directives and Penalties Section 33 A Registrar can now publish directive on website Also other information Section 37 Reinstatement of penalties Any person who: breaches s4, 10, 13A, 13B, 31 or 35 Induce someone to become member of unregistered fund If in any application to the Registrar you deliberately make a misleading, false or deceptive statement or conceals any material fact guilty of an offence and liable to a fine not exceeding R10 million or imprisonment for period not exceeding 10 years, or to both such fine and such imprisonment Section 37A: Pension benefits not reducible …… New subsection 4 allows funds to pay benefit to a third party if member provides proof that he or she cant open a bank account Such payment then regarded as payment to member Poorly worded and may lead to abuse by among others, loan sharks Section 37C: Payment of death benefits Now makes it clear that any benefits that remained unpaid by the fund on the date of the death of a member can be dealt with under 37C Specifically allows for payment of death benefits to unclaimed benefit funds Section 37D: Deductions Addition of a paragraph providing that employees’ tax due to SARS ito fourth schedule can be deducted from member’s share. Current 37D(4)(c): “A non-member spouse is entitled to the accrual of fund return from the expiry of the period referred to in paragraph (b) (ii) until payment or transfer thereof, but not to any other interest or growth.” That was 120 day period of election Proposed amendment says from date of deduction Implications for Funds, Administrators and Employers PENSION FUNDS When amendments passed by parliament Review rules to ensure compliance Review communication and other policies Review SLA’s and other docs issued to fund to ensure they are in line with new law AMINISTRATORS Review SLA’s with funds Amendments dealing with docs important Take note of info given to Registrar (s37 penalties) EMPLOYERS s13A amendments very serious Management of small and medium sized companies are at risk Taxation Laws Amendment Bill, 2012 1. Co-ordination of deduction and exemption rules in respect of Employer-owned employee-related insurance policies 2. Cession of Employer-owned insurance policies to Retirement Funds 3. Exemption for compulsory annuity income stemming from non-deductible retirement contributions 4. Clean break principle when dividing retirement interest on divorce Deduction and exemption rules for employer-owned policies The principle • Premiums with post tax contributions then policy proceeds tax free • Premiums with pre tax contributions then policy proceeds taxable Bill realigns the link between taxable proceeds and deductible premiums Cession of employer-owned policies To cover the transfer of deferred compensation policies to retirement funds for the benefit of the member Bill to allow the cession of such a policy to a pension and provident fund without triggering a tax event Cession to RA fund will result in fringe benefit tax to be paid on the portion that fall’s outside the annual deductible contributions Exemption from compulsory annuity income Bill proposes that non-deductible contributions will be exempt from income tax regardless if it is paid as a lump sum or annuity All non-deductible contributions will be aggregated Will be applied first against lump sum then against annuity income Clean-break Principle Bill introduces clean-break principle in public sector funds All pre 13 September 2007 divorces exempt from tax Any amount payable after 1 March 2012 in respect of divorce order after 13 September 2007 be taxed in the hands of the non-member spouse QUESTIONS?