IAS 34 Interim Financial Reporting

advertisement

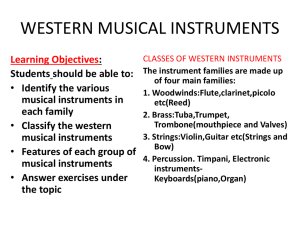

Diploma in IFRS Module 6 Financial Instruments, Interim reporting and Disclosure Standards www.charteredaccountants.ie EDUCATING SUPPORTING REPRESENTING Introduction and Overview Learning Objectives On completion of this module, you should be able to: • • • • • • Define a financial instrument Distinguish between debt and equity instruments and, in hybrid instruments, account for both elements, taking account of the presentation requirements of IAS 32 Financial Instruments: Presentation Understand the recognition, classification, de-recognition and measurement principles in IAS 39 Financial Instruments: Recognition and Measurement and IFRS 9 Financial Instruments Understand how to measure and account for impairment losses Explain how to account for hedging contracts Understand the scope and extent of disclosure requirements and the nature of both qualitative and quantitative disclosures required by IFRS 7 Financial Instruments: Disclosures Introduction and overview • • • • • • • • Explain the objective of preparing interim reports Outline the main contents to be included in the report Apply the recognition and measurement principles in IAS 34 Interim Financial Reporting to specific applications Distinguish between adjusting and non-adjusting events under IAS 10 Events after the Reporting Period Illustrate the disclosure required for non-adjusting events Understand the need for the disclosure of related party transactions Define related parties listed under the standard Outline the disclosure required for related parties and the need to disclose the name of the ultimate parent company Financial Instruments • • • • Major project replace IAS 39 with IFRS 9 Dynamic nature, OBSF, additional risks IAS 32 Presentation (formerly included disclosures) IFRS 7 Disclosure standard Financial instruments IAS 32 Financial Instruments Presentation IAS 32 Presentation of Financial Instruments IAS 32 Presentation of Financial Instruments Substance over Form IAS 32 Presentation of Financial Instruments Compound Instruments – debt and equity • • • • • Split proceeds date of issue of instrument Calculate debt first – equity is residual Identify similar loan agreement with no convertible element Discount principal and interest using straight loan interest rate Deduct debt from net proceeds = equity IAS 32 Convertible loans IAS 32 Convertible Loan IAS 32 Convertible loans IAS 32 Convertible loan IAS 32 Convertible loan IAS 32 Presentation • Treasury Shares Deducted from equity • Puttable Financial Instruments What are they? Liability normally Equity if pass 5 criteria Holder entitled pro rata share of net assets on liquidation Instrument subordinate to all others All instruments in class have similar features There is only a redemption or repurchase obligation Total cash flows based substantially on profit/loss IAS 32 Classification IAS 32 Classification IAS 32 Classification IAS 39 Recognition and Measurement • • Must be a party to contractual provisions Classification Financial assets – 4 categories until 1.01.2015 IAS 39 Recognition and Measurement Financial assets at fair value through profit or loss Financial assets are classified into this category if: • • • they are acquired principally for selling in the near future they are part of a portfolio of identified financial instruments that are managed together and there is recent evidence of short-term and actual profit-taking ; or they are derivatives, other than a financial guarantee contract, that is not designated as an effective hedging instrument (e.g. forward and options contracts) IAS 39 Recognition and Measurement Held-to-maturity financial assets • Have fixed or determinable payments and fixed maturity for which the reporting entity has a positive intent and ability to hold until maturity. Rarely used as there are tainting rules Loans and receivables • Non-derivative financial assets with fixed or determinable payments that are not quoted in an active market Available-for-sale financial assets • These are non-derivative financial assets which do not fit into any of the above three categories (i.e. the default category) IFRS 9 Financial Assets • Business Model Objective to collect contractual cash flows • Contractual Cash Flow Characteristics Only instruments with contractual cash flows of interest and principal qualify These are measured at amortised cost but if do not pass tests must fair value through profit and loss Examples Effective from 1st January 2015 IFRS 9 Financial Liabilities IAS 39 and IFRS 9 Two categories Amortised cost; and Fair value through profit and loss Examples Derecognition of Financial Assets IAS 39 and IFRS 9 IAS 39 Can only be derecognised if either of the following occurs: • • the contractual rights to future cash flows have expired as the customer has paid or the option has expired; or the financial asset has been transferred along with substantially all of the risks and rewards of ownership of the asset. IFRS 9 Will only be derecognised if: • • • the contractual rights to the cash flows have expired; the entity transfers the asset and has no continuing involvement in it; or the entity transfers the asset and retains a continuing involvement in it BUT the transferee has the practical ability to transfer the asset for its own benefit, not the entity’s. Derecognition Financial Assets Derecognition Financial Liabilities IAS 39 When discharged – paid off, cancelled or expired IFRS 9 When eliminated and no longer required to transfer economic resources If exchange substantially different terms assume settled old and created new liability Measurement IAS 39 and IFRS 9 • Initial Measurement Fair value Transaction costs FA not held at FVTPL – in price Others - expensed Subsequent Measurement under IAS 39 Amortised Cost Approach Subsequent measurement IFRS 9 Measurement The Fair Value Approach • IFRS 13 Fair value measurement (May 2011 – effective 1st January 2013) Fair value hierarchy Level 1 – 3 Disclosure • All fair value changes through profit and loss except for irrevocable election for equity instrument NOT held for trading – through OCI Measurement The Fair Value Approach Measurement Financial Liabilities IAS 39 and IFRS 9 • • • • Amortised cost – majority Fair value through Profit and Loss Option to elect fair value Own credit portion – profit IAS 39 - OCI Measurement – Financial Liabilities IFRS 9 Fair Value Measurement - IFRS 13 and IFRS 7 Fair Value Measurement • • • Exit Price – orderly transaction Hypothetical transaction Improve transparency re measurements Reclassifications IAS 39 • • From FVTPL to loans/receivables – rare Possible Held to Maturity – to reclassify as Available for Sale IFRS 9 • • • Will permit reclassification ONLY if change to the business model Switch from Amortised Cost to FVTPL – calculate profit/loss Switch from FVTPL to Amortised Cost – fair value is cost Impairments – Amortised Cost Financial Assets • • • Annual review Available for sale – review for possible recycling through profit Evidence of impairment – judgement Significant financial difficulty of the issuer; A breach of contract, e.g. default in interest or principal payments; the lender has granted the borrower a concession not normally considered; It is likely that the borrower will enter bankruptcy; An active market has disappeared due to overall financial difficulties; or There is evidence of a measurable decrease in the estimated future cash flows from a group of financial assets. Impairments – Amortised Cost Financial Assets Measurement Financial assets carried at amortised cost Financial assets carried at cost Financial assets held at fair value as available for sale Impairment - Example Impairment - Example IAS 39 Impairment Example IAS 39 Impairment Example IAS 39 Impairment Example Derivatives Embedded Derivative – split net proceeds where following preconditions exist • • • the economic characteristics and risks of the embedded derivative are not closely related to those of the host contract; a separate instrument having the same terms as the embedded derivative would be characterised as an independent derivative; and the hybrid instrument is not accounted for as FVTPL. Can only apply when contract is first entered into – not reassessed unless significant modification of cash flows Hedging (IAS 39) • • Why does hedging exist? Three types of hedging relationships Fair value hedge Cash flow hedge Hedge of a net investment in foreign operations Hedging (IAS 39) • Formal documentation Identification of instrument, details of hedged item, details of nature of risk being hedged, explanation how will assess effectiveness • Effectiveness of Hedging Not just at inception but throughout period The range 80% - 125% Hedging (IAS 39) Hedging (IAS 39) Hedging (IAS 39) - Accounting for a Fair Value Hedge Hedging (IAS 39) – Fair Value Hedges Reporting of Gains and Losses • • gains/losses from remeasuring the hedging instrument at fair value should be recognised immediately in profit and loss; gains/losses on the hedged item attributable to the hedged risk should adjust the carrying amount of the hedged item and be recognised immediately in profit or loss. Example – Fair Value Hedge Example Fair Value Hedge Hedging (IAS 39) Cash Flow Hedges Example Cash Flow Hedging Example Cash Flow Hedges Example Cash Flow Hedge Example Cash Flow Hedge Example Cash Flow Hedge Cash Flow Hedge Example Cash Flow Hedge Example Cash Flow Hedge Example Hedge of a net investment in a foreign operation • A foreign operation • Loans or receivables - not likely to be settled in the foreseeable future and thus is, in substance, part of the entity’s net investment in that foreign operation. It includes long-term loans granted by another subsidiary but excludes trade receivables and payables. • Accounting treatment is similar to a cash-flow hedge with gains and losses that are found to be effective being recognised in equity. • The gains and losses of the ineffective portion are recognised in profit and loss. On disposal the cumulative gain or loss on the hedging instrument is recycled to profit and loss. Hedge of an investment in a foreign operation Case Study 1 IAS 32 and 39 Case Study 1 IAS 32 and 39 Case Study 1 IAS 32 and 39 Case Study 1 Solution Case Study 1 Solution Case Study 1 Solution Case Study 1 Solution Case Study 1 Solution Case Study 1 Solution IFRS 7 Financial Instruments: Disclosure Objective • • Significance and impact Nature and extent of risks Significance for financial position Disclosures by categories Example Close Bros IFRS 7 Financial Instruments: Disclosure Fair value – financial assets and liabilities Additional Disclosure • • • • maximum credit exposure; extent of the risk being mitigated by the use of derivatives; changes in fair value attributable to credit risk during the year and cumulatively; and changes in the fair value of credit derivatives during the year and cumulatively. Example Deutsche Bank AG IFRS 7 Financial Instruments Disclosure Reclassifications Reclassifications in and out of a category. If reclassified out of AFS/FVTPL categories into amortised cost categories: • amount reclassified; • fair value of reclassified financial asset for each period until derecognised; • fair value gain/loss recognised in profit/loss or OCI in year of reclassification; • amount of gain/loss that would be recognised in profit/loss or OCI in each reporting period after reclassification until derecognition; • the effective interest rate and estimated cash flows expected to be recovered on the date of reclassification; • a description of the rare circumstances resulting in reclassification. Example Munchener Ruckversichrungs Gesellschaft AG IFRS 7 Financial Instruments Disclosure Collateral Details of assets pledged, terms and conditions Example Deutsche Bank AG Impairment allowance Details of defaults and breaches Example Domino Printing Group IFRS 7 Financial instruments Disclosure Significance of financial instruments – financial performance Gains and losses, interest income and expenses, fee income and expenses should all be disclosed as follows: • net gain or loss classified by category of financial assets and liabilities; • total interest income and expenses using the effective interest rate method; • fees, income and expenses other than those included in arriving at the effective rate of interest; • interest income on impaired financial assets accrued; and • impairment losses for each class of financial asset. IFRS 7 Financial Instruments Disclosure Hedge Accounting Hedging in general • • • description of each type of hedge description of the financial instruments designated as hedging instruments and their fair value at the end of the reporting period the nature of the risks being hedged Cash flow hedges • • • • • • periods when cash flows are expected to occur and affect profit or loss description of previously-applied hedge accounting to a forecast transaction that is no longer expected to apply amount recognised in OCI during the period under the cash-flow hedge reserve recycling for the period out of the cash-flow hedge reserve amount of recycling included in the initial cost or other carrying amount of a non-financial asset or liability the ineffectiveness recognised directly in profit and loss IFRS 7 Financial Instruments Disclosure Fair value hedges • gains and losses on the hedging instrument or on the hedged item attributable to the hedged risk Hedging net investments in foreign operations • The ineffectiveness recognised in profit or loss Fair value disclosures • Level 1-3 hierarchy Example Sandvik AB IFRS 7 Financial instruments Disclosure The nature and extent of risk arising from financial instruments Credit risk Market risk Liquidity risk IFRS 7 Financial instruments Disclosure Credit risk The following should be disclosed: • the maximum exposure at the end of the reporting period; • any collateral pledged as security; • information about the credit quality of financial assets not overdue nor impaired; and • the carrying amount of impaired financial assets. Market risk The following should be disclosed: • a sensitivity analysis for each risk including details of methods and assumptions used and any changes from the previous period; and • if the above reflects interdependencies between risk variables, it must also disclose an explanation for the method adopted, the underlying assumptions and an explanation of the objective of the method used and its limitations. IFRS 7 Financial instruments Disclosure Liquidity risk The following should be disclosed: • a maturity analysis for financial liabilities; and • a description of how the entity manages its liquidity risk. Example Sandvik AB SECTION 2 IAS 34 Interim Financial Reporting IAS 34 Interim Financial Reporting Introduction Prescribes minimum content Prescribes the principles Not mandatory Encourages half yearly and within 60 days IAS 34 Interim Financial Reporting Definitions and Basic Concepts Interim period – half or quarterly Interim financial report - complete or condensed Basic and diluted EPS IAS 34 Interim Financial Reporting Content of Interim Report An entity preparing interim financial statements may present a complete set of financial statements which comprise: • • • • • a Statement of Financial Position; a Statement of Comprehensive Income; a Statement of Changes in Equity; a Statement of Cash Flows; and notes, comprising a summary of significant accounting policies and other explanatory notes. IAS 24 Interim Financial Reporting Minimum components If prepare a set of condensed financial statements. The minimum content: • • • • • • • • • a condensed Statement of Financial Position; a condensed Statement of Comprehensive Income; a condensed Statement of Changes in Equity; a condensed Statement of Cash Flows; and selected explanatory notes. the headings/subheadings used in the most recent annual financial statements. In the Statement of Changes in Equity all material movements in equity in the interim period must be disclosed separately. In the Statement of Cash Flows – aggregation but more than O, F and I Additional line items if omission misleading IAS 34 Interim Financial Reporting Comparative figures IAS 34 Interim Financial Reporting Minimum Explanatory Notes • • • a statement that the same accounting policies and methods were used in the interim financial statements as in most recent annual financial statements; explanatory comments about the seasonality or cyclicality of interim operations; the nature and amount of items affecting assets, liabilities ,equity, net income or cash flows that are unusual because of their size, nature or incidence; • the nature and amount of changes in estimates reported in prior interim periods • details of changes in debt and equity securities; • dividends paid; • segment information in accordance with IFRS 8 Operating Segments; • material events subsequent to end of the interim period not reflected in the interim fin sts; • details of changes in the composition of the entity; and • details of changes contingent assets /contingent liabilities since end of the last reporting period. IAS 34 Interim Financial Reporting Compliance with IFRS If an entity’s interim financial report complies with IAS 34, that fact may be disclosed. Recognition and Measurement Same accounting policies interim report as in its annual financial statements. The only exception to this rule is where an accounting policy change has been made after the date of the most recent annual financial statements, but this change will be reflected in the next set of annual financial statements. Revenues received seasonally, cyclically or occasionally Revenues should not be anticipated or deferred, if not appropriate at the end of the financial year e.g. a retailer does not divide forecasted revenue by two to arrive at its half-year revenue figures. Instead, reports actual results for the 6 month period. If wishes to demonstrate cyclicality, it could include revenue for the 12 months up to the end of the interim reporting period and comparative information for the corresponding previous 12month period. IAS 34 Interim Financial Reporting Costs The rule on revenues also applies to costs. Costs that are incurred unevenly during an entity’s financial year should be anticipated or deferred for interim reporting purposes if, and only if, it is also appropriate to anticipate or defer that type of cost at the end of the financial year. A cost - not meet the definition of an asset at the end of an interim period is not deferred in the Statement of Financial Position at the interim reporting date. When preparing interim financial statements, the entity’s usual recognition and measurement practices are followed. The only costs that are capitalised are those incurred after the specific point in time at which the criteria for recognition of the particular class of asset are met. Deferral of costs as assets in an interim Statement of Financial Position in the hope that the criteria will be met before the year-end is prohibited. Greater use of estimates in interim reports IAS 34 Interim Financial Reporting The Standard provides a number of examples of the use of estimates in interim financial reports. These include: • Inventories. Full stock taking is not usually undertaken at interim periodend; • Classification of current/non-current assets and liabilities; • Provisions. Usually the provisions reported in the last annual financial statements are updated, rather than full calculations made at the interim date; • Pensions. An independent actuarial valuation is not required at the interim date, as this is a very costly exercise. Extrapolation of previous valuations is usually made; • Income taxes; • Contingencies; and • Revaluations. Professional valuations are not required at the interim date. IAS 34 Interim Financial Reporting Application of recognition and Measurement Principles • • • • • • Employer payroll taxes and insurance contributions Major planned periodic maintenance or overhaul Provisions Year end bonuses Contingent lease payments Intangible assets IAS 34 Interim Financial Reporting • • Recent developments IFRIC 10 Interaction with IAS 36 Could goodwill w/d be reversed? Example John Lewis Partnership IAS 34 Interim Financial Reporting IAS 34 Interim Financial Reporting IAS 34 Interim Financial Reporting Key Points SECTION 3 Events after the Reporting Period IAS 10 • • • Events after the Reporting Period The need for disclosure Definition Adjusting Events Provide evidence of conditions that exist at reporting date Examples • Non adjusting events Indicative of conditions that arose after the reporting period Examples IAS 10 Events after the Reporting Period • • Date of authorisation Accounting for events after the reporting period Non adjusting events - disclose Adjusting events – adjust financial statements • • • Proposed Dividends Going Concern Disclosure – non adjusting events IAS 10 Events after the Reporting period Self Test Questions Question 1 Mountain plc acquired some non-current investments during the year ended 30 April 2011. The investments had maintained their value during the year ended 30 April 2011 but shortly after the end of the financial year, market conditions changed and there was a significant decline in the value of the investments. The investments had not recovered their value by the date on which the financial statements were authorised for issue. Requirement State with reasons how this item should be dealt with in the financial statements of Mountain plc for the year ended 30 April 2011. IAS 10 Events after the Reporting Period Solution This is a non-adjusting event after the reporting period. The diminution in value of the non-current investments is attributable to factors which have arisen after the date of the Statement of Financial Position. The figure reported in the Statement of Financial Position for noncurrent investments as at 30 April 2011 should not be adjusted. If the diminution in value is material it should be disclosed as a note to the financial statements. [IAS 10] IAS 10 Events after the Reporting Period Question 2 Included in IOM Productions plc’s inventory as at 30 April 2011 were 1,000 DVDs which had cost £10 each. Shortly after 30 April 2011 it was discovered that these DVDs were leaking a poisonous chemical which meant that the DVDs could not be used and had to be scrapped. It was agreed that the DVDs had probably started leaking some time before 30 April. Because of the leak it was necessary to clean and redecorate the store room. This cost 6,344. The work was started shortly before the financial statements were authorised for issue but was not paid for until after that date. Requirement State with reasons how this should be dealt with in the financial statements of IOM Productions plc for the year ended 30 April 2011. IAS 10 Events after the Reporting period Solution As far as having to scrap the digital DVDs tapes is concerned, this is an adjusting event after the reporting period. The inventory was impaired as at the date of the Statement of Financial Position and should be written off in the financial statements for the year ended 30 April 2011. Inventory as at 30 April 2011 should be written down by £10,000. [IAS 10] There was no liability for the cleaning and redecoration of the store room as at 30 April 2011. Also the amount may not be material. No adjustment to or disclosure in the financial statements for the year ended 30 April 2011 is necessary. [IAS 37] IAS 10 Events after the reporting period - Examples Glaxo Smith Kline Plc 40 Post balance sheet events On 17th February 2010, GSK received a Complete Response letter from the FDA regarding the new drug application for Horizant Extended Release tablets for restless legs syndrome. The letter indicated that questions remained that precluded the approval of Horizant for restless legs syndrome at that time. GSK is evaluating the letter and considering the appropriate next steps. The Group’s intangible assets include £85 million in relation to this compound. It is not yet possible to determine the amount, if any, of any impairment that may be recorded in future periods, pending completion of a full analysis of the situation. IAS 10 Events after the Reporting period - Rio Tinto Plc 48 Events after the statement of financial position date On 29 January 2010, US$2.0 billion of Facility D of the Alcan facility was paid. An additional US$2.0 billion was paid on 26 February 2010, leaving US$4.5 billion outstanding on the facility. All of Tranches A and B of the Alcan facility have now been repaid. Facility B of the acquisition facility is a revolving facility of which US$2.1 billion was undrawn at 31 December 2009. On 5 February 2010, in accordance with the acquisition facility agreement, proceeds from the sale of the majority of Alcan Packaging to Amcor were used to cancel US$2.0 billion of the outstanding capacity. At the same time, the Group voluntarily surrendered the remaining US$0.1 billion of the facility. Rio Tinto completed the sale of Alcan Packaging global pharmaceuticals, global tobacco, food Europe and food Asia divisions to Amcor for a total consideration of US$1,948 million on 1 February 2010. The consideration has been adjusted to exclude the Medical Flexibles operations and to reflect the actual business performance over the past six months. The final consideration remains subject to certain customary post-close adjustments. IAS 10 Events after the Reporting period - Rio Tinto Plc The sale of Maules Creek to Aston Resources was completed on 18 February 2010. The sale of the Alcan Packaging Food Americas division to Bemis Company Inc., for a total all-cash consideration of US$1.2 billion was completed on 1 March 2010. These divestments have not been reflected in the 2009 results, and will be reflected in the period in which the sales are completed. On 1 March 2010, Rio Tinto announced that it has agreed to acquire 15 million shares in Ivanhoe Mines Ltd. at a subscription price of C$16.31 per share, increasing its ownership in Ivanhoe Mines by 2.7 per cent to 22.4 per cent. The total consideration for this acquisition is C$244.7 million. The shares are being issued to Rio Tinto in satisfaction of an agreement with Ivanhoe Mines in 2008 to finance equipment for the Oyu Tolgoi copper-gold complex in Mongolia’s South Gobi region. After the completion of the acquisition, Rio Tinto will own 98.6 million shares of Ivanhoe Mines. If Rio Tinto were to execute all of its shares purchase warrants and convert its US$350 million loan into shares it would own approximately 267.6 million shares of Ivanhoe Mines representing 44.0 per cent of Ivanhoe Mines. IAS 10 Events after the Reporting Date EXAMPLE SFS Group Y/e 31st December 2009 Lonmin Plc Y/e 30th September 2009 Case Study 3 Kyle Ltd Case Study 3 Kyle Ltd Case Study 3 Kyle Ltd Case Study 3 Kyle Ltd Case Study 3 Kyle Ltd IAS 24 Related Party Disclosures • • • Why disclose RPTs Objective of IAS 24 Definitions (see next slide) IAS 24 Related Party Disclosures Related party A party is related to an entity if: (a) directly, or indirectly through one or more intermediaries, the party: i. controls, is controlled by, or is under the common control of another entity; ii. has an interest in the entity that gives it significant influence over the entity; or iii. has joint control over the entity; (b) the party is an associate of the entity; (c) the party is a joint venture in which the entity is a venturer; (d) the party is a member of key management personnel of the entity or its parent; (e) the party is a close member of the family of any individual referred to in (a) or (d); (f) the party is an entity that is controlled, jointly controlled or significantly influenced by, or for which significant voting power in such entity resides with, directly or indirectly, any individual referred to in (d) or (e); or (g) the party is a post-employment benefit plan for the benefit of employees of the entity, or of any entity which is a related party of the entity. IAS 24 Related Party Disclosures Related-party transaction • A related party transaction is a transfer of resources, services or obligations between related parties, regardless of whether a price is charged. Close members of the family of an individual • These are the family members who may be expected to influence, or be influenced by, that individual in their dealings with the entity. They may include: the individual’s domestic partner and children; children of the individual’s domestic partner; and dependants of the individual or the individual’s domestic partner. Key management personnel • These are the persons having authority and responsibility for planning, directing and controlling the activities of the entity, directly or indirectly, including any director (whether executive or otherwise) of that entity. IAS 24 Related Party Disclosures The following are NOT related parties: • • • • two entities simply because they have a director or other member of key management personnel in common; two venturers simply because they share joint control over a joint venture; providers of finance, trade unions, public utilities, government departments and agencies simply by virtue of their normal dealings with the entity; customers, suppliers, franchisors, distributors, agents with whom an entity transacts a significant volume of business, merely by virtue of the resulting economic dependence. IAS 24 Related Party Disclosures - Disclosures Disclosure of parent - subsidiary relationship • • Disclosed, irrespective of transactions between the parties. Must disclose the name of its parent and, if different, the name of the ultimate controlling party. This disclosure enables users to appreciate the existence of control, even in the absence of any related party transactions between the two parties. Disclosure of compensation of key management personnel • • All employee benefits as defined in IAS 19 Employee Benefits, including employee benefits to which IFRS 2 Share Based Payments applies. Must disclose compensation to KMP in total and for each of the following categories: short-term employee benefits, such as salaries; post-employment benefits, such as pensions; other long-term benefits, such as long-service leave; termination benefits, such as redundancy payments; and share-based payments. IAS 24 Related Party Disclosures Disclosure of related party transactions a) the nature of the related party relationship; b) the amount of the transactions; c) the amount of outstanding balances, their terms and conditions, security, the nature of consideration to be provided in settlement, and details of any guarantees given or received; d) provision for doubtful debts; and e) any bad debts written off Disclosure of related-party transactions - separately for: a) the parent; b) entities with joint control or significant influence over the entity; c) subsidiaries; d) associates; e) joint ventures in which the entity is a venture; f) key management personnel of the entity or its parent; g) other related parties. IAS 24 Related Party Disclosures Examples IAS 24 gives examples of transactions that should be disclosed if they are with a related party including: Purchases or sales of goods (finished or unfinished) Purchases or sales of property and other assets Rendering or receiving of services Leases Transfer of research and development Transfers under licence agreements Transfers under finance arrangements (including loans and equity contributions in cash or in kind) Provisions of guarantees or collateral Settlement of liabilities on behalf of the entity or by the entity on behalf of another party IAS 24 Related Party Disclosures Example Archer plc owns 75% of the ordinary shares of Swift Ltd. Bow Ltd owns 35% of the ordinary shares of Mitchell Ltd. During the current year, there were no transactions between Archer plc and Swift Ltd, but there were transactions between Bow Ltd and Swift Ltd and between Archer plc and Bow Ltd. Requirement Outline the related party disclosures required in the separate financial statements. IAS 24 Related Party Disclosures Solution The following disclosures are required in the separate financial statements: Archer Plc The existence of a parent-subsidiary relationship between Archer plc and Swift Ltd (even though there are no transactions between the two entities in the current year). Bow Ltd If Bow Ltd has significant influence over Swift Ltd (although this might not be the case since the company is controlled by Archer plc), then Swift Ltd is a related party of Bow Ltd. This fact must be disclosed in the financial statements of Bow Ltd, since there have been transactions between the companies. Details of transactions & any outstanding balances must also be disclosed. Swift Ltd The existence of a parent-subsidiary relationship between Archer plc and Swift Ltd (even though there are no transactions between the two entities in the current year). If Bow Ltd is a related party (see above) the nature of the relationship must be disclosed, together with details of the transactions between the companies and any outstanding balances. IAS 24 Self Test Questions Bally Plc IAS 24 Self Test Solution Bally Plc IAS 24 Self Test Solution Bally Plc IAS 24 Self Test Question Pigeon Group IAS 24 Self Test Solution Pigeon Group IAS 24 Self Test Solution Pigeon Group Case Study 4 Salmon Plc Case Study 4 Salmon Plc Case Study 4 Salmon Plc Solution Case study 4 Salmon Plc Solution Module 6 Learning Objectives Now that you have completed this module, you should be able to: • Define a financial instrument • Distinguish between debt and equity instruments and, in hybrid instruments, account for both elements, taking account of the presentation requirements of IAS 32 Financial Instruments: Presentation • Understand the recognition, classification, de-recognition and measurement principles in IAS 39 Financial Instruments: Recognition and Measurement and IFRS 9 Financial Instruments • Understand how to measure and account for impairment losses • Explain how to account for hedging contracts • Understand the scope and extent of disclosure requirements and the nature of both qualitative and quantitative disclosures required by IFRS 7 Financial Instruments: Disclosures Module 6 Learning Objectives • Explain the objective of preparing interim reports • Outline the main contents to be included in the report • Apply the recognition and measurement principles in IAS 34 Interim Financial Reporting to specific applications • Distinguish between adjusting and non-adjusting events under IAS 10 Events after the Reporting Period • Illustrate the disclosure required for non adjusting events • Understand the need for the disclosure of related party transactions • Define related parties listed under the standard • Outline the disclosure required for related parties and the need to disclose the name of the ultimate parent company