the presentation slides

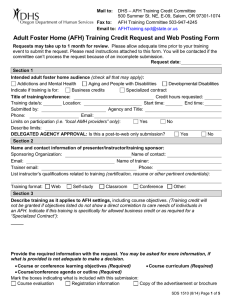

advertisement

Connected body transactions Overview Introduction Requirements Disclosure Audit approach Current issues Introduction ‘Related parties’ are discussed within: UK financial reporting standards (FRS 8 Related Party Disclosures) Charities SORP (paragraphs 221-233) Related party transactions can deliver value for money and encourage innovation however they also pose a risk that transactions are not in the best interests of the trust It is important to have transparent disclosure Introduction The Academies Financial Handbook (AFH, or Handbook) interprets requirements for the academy sector The academy sector must also demonstrate regularity, propriety and value for money of public funds ‘Connected bodies’ are discussed within the AFH Note: This presentation will not cover disclosure of an employee’s remuneration where the employee is also a trustee – please refer to our other presentations Requirements of the AFH Requirements were clarified within 2013 AFH V2 (S2.6) and are refined each year Version Applicability 2012 AFH 1 Sept 2012 – 31 Aug 2013 2013 AFH 1 Sept 2013 – 6 Nov 2013 2013 AFH V2 7 Nov 2013 – 31 Aug 2014 2014 AFH 1 Sept 2014 – 31 Aug 2015 Requirements apply to contracts that are agreed or renewed on or after 7 November 2013 Definition of ‘connected bodies’ Defined in detail within S2.6.2 – 2.6.3 of the 2013 AFH: Member or trustee Individual or organisation connected to a member or trustee (including close family member, business partner or controlled organisation) Individual or organisation that can appoint a member or trustee Individual or organisation recognised by the Secretary of State as a sponsor Goods/services to be ‘at cost’ For these purposes we mean the ‘full cost’ of resources used in supplying the goods or services, including: direct costs (the costs of any materials and labour used directly in producing the goods or services) indirect costs (a proportionate and reasonable share of fixed and variable overheads) Full cost must not include an element of profit Proper procurement Goods/services procured from connected bodies are subject to normal procurement requirements Trust’s financial regulations should outline procurement processes and handling conflicts of interest S2.5.3 of the AFH refers to: annex 4.4 of HM Treasury’s Managing Public Money contractual thresholds as provided in the Official Journal of the European Union (OJEU) Further guidance available at https://www.gov.uk/government/collections/buying-forschools Statement of assurance and open book agreement Statement of assurance From the connected body to the trust confirming that their charges do not exceed the cost of goods or services Open book agreement Requirement for the connected body to demonstrate clearly, if requested, that their charges do not exceed the cost of goods or services Applicability to employment contracts Provisions do not apply to contracts of employment Principles of regularity, propriety and value for money still apply Salaries paid should be appropriate to the individual’s skills and experience and the salary rates paid in the wider market Financial disclosure Guidance provided in the Accounts Direction Note 29 (Coketown Accounts) Section 7.6 Why do we need these rules? We need these rules to help us mitigate and/or identify potential risks to public funds Related party transactions face significant scrutiny within the academy sector. These rules ensure: Public accountability and transparency Concerns of our regulators, including NAO and PAC, are addressed Transparency helps manage both real and perceived conflicts of interest What if the rules aren’t followed? We will follow up – if it is not clear whether related party transactions were properly entered into Breaches – will be taken seriously A financial notice to improve – may be issued if the rules are breached, and future connected party transactions may need our approval Audit approach Auditors should focus on whether trustees have met their obligations Potential tests: declarations of business interests have been complete trust’s procurement and tendering process followed trust has obtained and reviewed statements of assurance trust has requested, under the open book arrangement, a clear demonstration that the charges do not exceed the cost of supply governors who provide services are not receiving a profit no connected party receives payment under preferential terms if employees are providing external consultancy within normal working hours that the income is received into trust’s accounts Reporting issues The auditor should report issues as follows: Regularity report: This conclusion should be modified where requirements have not been met. To note, connected body transactions are considered material by nature Management letter: Findings should be reported where it is unclear whether requirements have been met We will follow up if it is apparent that the auditor has omitted issues that we subsequently identify Outcomes from 2012/13 financial statements (1) Around 1,000 trusts disclosed related party transactions Around 150 trusts disclosed related party transactions of >£100k Around 20 trusts disclosed related party transactions of >£500k Outcomes from 2012/13 financial statements (2) Auditors’ findings: Outcome Reason Volume Modified regularity report Lack of register of interests 1 Inadequate procurement 11 Finding within management letter Assorted concerns with related party transactions c.200 Our findings: Inadequate disclosure for around 250 trusts Further enquiry of 50 trusts with work ongoing to fully understand these transactions Outcomes from investigations EFA investigations have identified a number of related party transactions that pose a significant risk to public funds, including: Funds passing to connected organisations with no apparent benefit to the academy trust Normal procurement processes being circumvented, including lack of open tender Breach of Charity Commission rules that prohibit more than 50% receiving benefit from the trust A number of further investigations are underway Investigation reports available on gov.uk Future plans The Public Accounts Committee recommends that we reconsider our policy which permits related party transactions We continue to review outcomes from 2012/13 and consider how the existing policy framework can be strengthened further Any developments will be reflected within a future version of the AFH Summary – What you should do Read the relevant version(s) of the Handbook – available on the gov.uk website, and may also be accessible via forthcoming EFA ‘Information Exchange’ Assure yourself that you have met and continue to meet the requirements – Register of business interests – Procurement policy and process – Review of individual transactions Prepare to make the necessary disclosures and confirmations in your financial statements Webinar timetable Interactive webinars Date Academies Financial Framework (academies) 15 July 2014 at 11am Academies Financial Framework (auditors) 15 July 2014 at 2pm You can register for the webinars at https://registration.livegroup.co.uk/academyfinance/ You can submit questions for the panel in advance when you register, or log back in later and submit your questions If you can’t attend on 15 July, you can watch a recording of the webinar online after the event Thank you for watching