Estate Planning Using Life Insurance

Estate Planning Using Life Insurance

Presented by

< Life Insurance Producer’s Name >

< Life Insurance Producer’s Company >

< Securities Offered Through: >

< Life Insurance Producer’s Address >

< Life Insurance Producer’s Telephone Number >

< Life Insurance Producer’s State Insurance License >

July 2013

VLCM-OC-239A

1 of 16

Circular 230 Disclosure

This material is not intended to be used, nor can it be used by any taxpayer, for the purpose of avoiding U.S. federal, state or local tax penalties. This material is written to support the promotion or marketing of the transaction(s) or matter(s) addressed by this material. Pacific Life, its distributors and their respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor.

2 of 16

Pacific Life Insurance Company

Newport Beach, CA

(800) 800-7681 • www.PacificLife.com

Pacific Life & Annuity Company

Newport Beach, CA

(888) 595-6996 • www.PacificLife.com

Please Note: This presentation is designed to provide introductory information in regard to the subject matter covered.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity

Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues. Insurance products and their guarantees, including optional benefits and any fixed subaccount crediting rates, are backed by the financial strength and claims-paying ability of the issuing insurance company, but they do not protect the value of the variable investment options. Look to the strength of the life insurance company with regard to such guarantees as these guarantees are not backed by the broker-dealer, insurance agency or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability of the life insurance company. Variable insurance products are distributed by Pacific Select Distributors,

Inc.

, (member FINRA & SIPC), a subsidiary of Pacific Life Insurance Company, and an affiliate of Pacific Life & Annuity Company, and are available through licensed third-party broker-dealers.

Consult your attorney or tax advisor for complete up-to-date information concerning federal and state tax laws in this area.

Investment and Insurance Products: Not a Deposit – Not FDIC Insured –

Not Insured by any Federal Government Agency – No Bank Guarantee – May Lose Value

3 of 16

You Want to Leave Your Estate to Your Family,

However…

4 of 16

A Substantial Portion of Your Large Estate May

Pass to the Government to Pay Estate Taxes *

* According to the American Taxpayer Relief Act of 2012, the federal estate, gift and generation skipping transfer (GST) tax exemption amounts are all $5,000,000 (indexed for inflation effective for tax years after 2011); the maximum estate, gift and GST tax rates are 40%. As of

January 1, 2013, the annual gift tax exclusion is $14,000 per donee (indexed for inflation).

5 of 16

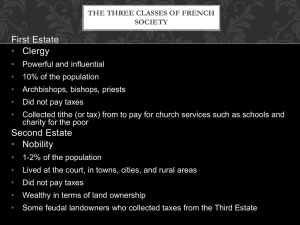

Estate Planning Exemption Amount

Federal Estate, Gift & Generation Skipping Transfer Tax Exemption Amounts * :

Year

2013

Exemption

$5,250,000

Credit

$2,045,800

Highest Tax

40%

* According to the American Taxpayer Relief Act of 2012, the federal estate, gift and generation skipping transfer (GST) tax exemption amounts are all $5,000,000 (indexed for inflation effective for tax years after 2011); the maximum estate, gift and GST tax rates are 40%. As of

January 1, 2013, the annual gift tax exclusion is $14,000 per donee (indexed for inflation).

6 of 16

With Planning…

You Can Meet Your Estate Planning Objectives

7 of 16

The Strategy

Select proper tools & techniques

Provide estate liquidity when needed

Establish irrevocable life insurance trust (ILIT)

8 of 16

How Estate Planning Works

Typical Plan

• Take advantage of the amount exempt from federal estate taxes

• Use unlimited marital deduction to transfer remaining estate to survivor without federal estate tax at first spouse’s death

9 of 16

Estate Planning Using Life Insurance with an Irrevocable Life Insurance Trust (ILIT)

• Removes life insurance death benefit proceeds from taxable estate

• Preserves bulk of estate and provides support for your heirs

• Provides executor with liquid funds to pay estate taxes and other settlement costs

10 of 16

How Estate Planning Works

ILIT

• ILIT-owned life insurance to remove policy proceeds from taxable estate at the death(s) of the insured(s)

• If properly structured, life insurance policy proceeds are paid to ILIT income* and estate tax-free,** providing estate liquidity

* For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2) (i.e., the “transferforvalue rule”); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under

IRC Sec. 101(j).

** According to the American Taxpayer Relief Act of

2012, the federal estate, gift and generation skipping transfer (GST) tax exemption amounts are all

$5,000,000 (indexed for inflation effective for tax years after 2011); the maximum estate, gift and GST tax rates are 40%. As of January 1, 2013, the annual gift tax exclusion is $14,000 per donee (indexed for inflation).

11 of 16

The ILIT

Grantors/Insureds

Irrevocable Life

Insurance Trust

Life Insurance Policy

Executor Heirs

12 of 16

13 of 16

For You…

• Removes life insurance death benefit proceeds from taxable estate

• Provides support for heirs after your death

• Preserves bulk of your estate for your heirs

• Provides executor with liquid funds to pay estate taxes and other settlement costs

14 of 16

For Heirs…

• Receive any remaining ILIT assets

15 of 16

Consider Estate Planning if You…

• Desire to designate the beneficiaries of your estate

• Want to maximize the wealth passing to your heirs

• Are concerned about having a taxable estate

• Life insurance owned by an ILIT if your want to pass estate tax-free * death benefit to your heirs

* According to the American Taxpayer Relief Act of 2012, the federal estate, gift and generation skipping transfer (GST) tax exemption amounts are all $5,000,000 (indexed for inflation effective for tax years after 2011); the maximum estate, gift and GST tax rates are

40%. As of January 1, 2013, the annual gift tax exclusion is $14,000 per donee (indexed for inflation).

VLCM-OC-239A PT-40181-02 16 of 16