Student Employment Information Session

advertisement

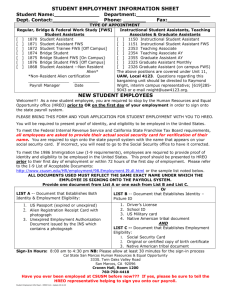

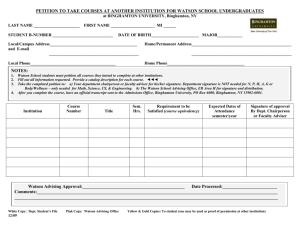

Student Employment Information Session Student Employment Coordinator: Cyndy Gordon fawork@binghamton.edu Student Employment Services • Part of Financial Aid Services • We provide a centralized location for Student Employment job postings online through eRecruiting Types of Student Employment • Federal College Work Study (on and off campus) • On-campus part-time jobs (Student Assistant) • Off-campus part-time jobs How does Federal College Work Study (FCWS) Work? • Apply File your FAFSA online http://www.fafsa.ed.gov • Eligibility Based on financial need • Earn Be hired in a FCWS position Common Questions About FCWS • How much can I earn? • Why doesn’t my FCWS appear on my tuition bill? • What happens if I don’t get a FCWS job? • More answers to your questions can be found at http://www2.binghamton.edu/financial-aid/types-ofaid/student-employment/student-employmentinformation.html Off-Campus FWS • FWS eligible students work in local non-profit agencies in the community • Offers unique experiences not available on campus • Hired directly by participating agency Non FWS Opportunities • On-campus part-time jobs Do not require FWS No limit on earnings • Off-campus part-time jobs Work for an employer off campus On Campus Student Employment Criteria • Student must be enrolled at least part time • Students on academic or disciplinary suspension, are not eligible to be employed on the 2 student payrolls • Departments should limit student employees to work 20 hours per week (Mandatory for F-1 or J-1 visa holders - all jobs on campus combined including jobs for the private employers on campus) • Students employed by and attending Binghamton University are exempt from FICA taxes (unless in “career title”) if registered to take at least 6 credits. I-9 Requirements • • • • Federal Law requires that the I-9 be completed by the student no later than the first day of employment and all required documents need to be provided to Human Resources no later than the third day of employment. I-9s can be completed in The Payroll Distribution Center located in Couper Administration Building Room 240 Federal Law requires that the employee must show ORIGINAL documents (no copies, faxes, etc) If the I-9 is not completed within the time frames outlined above, you are required to stop working immediately and will not be allowed to restart until the I-9 form is completed Tips To a Positive Work Experience Making a good impression will help you with future employment • • • • • Arrive on time for work Call if you cannot come to work Turn cell phones off while working Ask what the proper attire should be Complete and submit attendance records in a timely manner • Comply with the University’s policies regarding sexual harassment and the drug and alcohol policy Student Employment Benefits • As employees of the State of New York, Student Assistants and Federal Work Study students are eligible for membership in the NYS Retirement system • Must complete election form to accept/decline • 3% contribution • Also eligible for membership at SEFCU Work Criteria • Students may work a maximum of 20 hours/week while classes are in session (includes all jobs on campus). • F-1/J-1 employees are restricted to 20 hours/week while classes are in session as a condition of the Visa. • When classes are not in session students can work up to a total of 40 hours • It is the responsibility of the STUDENT and the DEPARTMENT to ensure hourly limits are adhered to. Pay Rates • Minimum Wage Rates • State $8.00/hr • Federal $7.25/hr • Maximum $17.91/hr • Make sure you know your rate of pay • Make sure rate is on time sheet correctly • All time records must be signed by a supervisor and originals sent to HR in a timely fashion Effective Dates 2013-2014 • All Federal College Work Study employees may begin work for the new academic year on 8/22/2013 • FCWS employees with full academic year grants must stop work effective 5/16/2014 • FCWS employees with Fall Only grants must stop working effective 12/13/2013 • Student Assistant employees can work through the summer as long as they are registered for the following fall semester. • Student Assistants working in the summer will not be exempt from Social Security/Medicare taxes (FICA) unless proof of summer class enrollment is presented to Human Resources. Graduating in May 2014 • Graduating seniors on the Student Assistant payroll may not work past 5/16/2014 unless they are going to be attending a SUNY college or university for advanced degrees in the fall Time Record Completion • • • • • • • Time Sheets—Use your “B” number not your social security number. Original time records must be submitted at the close of EACH pay period by Friday Supervisor Signature is REQUIRED to process time records If supervisor is out, there should be a back-up person for signature. Ask your supervisor who this person is Time records are due no later than NOON on the Friday following the end of the pay period (***Check Student Payroll Deadlines Document for early deadlines) Time records must be legible and complete – Names must match name on SS card, verify hourly rate. Make sure your hours total up properly to nearest ¼ hr. and verify pay rate on time record. Keep your own copy of timesheet or log in the dates and hours you work for your own records. Helpful Websites • http://www2.binghamton.edu/humanresources/new-employees/new-student-asstfcws.html Need Help? Contacts: • Student Employment/Payroll: Jonathan Roma x7-3321 Jessica Williams x7-6952 Jena Pasquale x7-5327 jroma@binghamton.edu jfwillia@binghamton.edu jpasqual@binghamton.edu

![Laborer Recyclable [posting]](http://s3.studylib.net/store/data/006686214_1-3308c6dd146b5b89a38fa77d3b3e6da5-300x300.png)