Grants Management for PIs - University Research Services

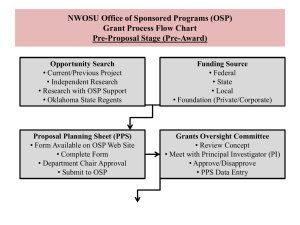

advertisement

Overview of rules, regulations, and procedures necessary to manage an externally funded project Review Principle Investigator’s (PI) responsibilities Summary of information of PIs necessary responsibilities Understanding “why” this is important URSA provides faculty support for proposal preparation, awards management, research compliance and safety, and other aspects of research Awards management Who we are (org chart; department assignments) Manuals, policies, forms Website at: www.gsu.edu/research/index.html Office of Sponsored Programs (OSP) Marca Gurule, Associate Director Handles non-financial aspects of grants management Any official contact with agency officials Research Financial Services (RFS) Michael Mathisen, Associate Director Accounting of expenditures Generating financial reports A sponsor awards Georgia State University Research Foundation (GSURF) that subcontracts out to Georgia State University’s (GSU) funds Expectation is that GSU has policies and procedures in place to make sure funds are spent according to Federal guidelines and are not misused Auditors come on campus to check Roles and Responsibilities of Georgia State University Employees Engaged in Sponsored Project Management and Oversight are on URSA’s website Notice of Award Getting an Account Number Terms & Conditions of Award Both PIs and OSP may receive notifications If PI only receives, then must send to OSP within 7 days OSP will likewise send to PI Negotiations: Changes in budget by sponsor may mean PI wants to make changes in goals/scope of work Done by PI, in consultation with OSP and Legal Affairs (if contract) All major changes to budget should be “re-routed” using Proposal Approval Form Don’t announce to public until get “official notification” (and agency allows you) Notice of Grant Award (NGA) Letter Check Contract PIs are not the “authorizing official” of GSU OR GSURF Can’t sign anything for University Must get IRB/IACUC approval prior to establishment of project number Can get approval for general methods and make amendments later Letters of cooperation from sites Obligated to comply with all regulations involving human subjects, animals, health and safety. Get copies of compliance letters from subcontractors, other sites Proposal Approval Form PI certified to adherence of GSU’s: Conflict of Interest Policy Intellectual Property Policy Terms and Conditions of Award Follow all relevant GSU, State of Georgia, Federal laws, and regulations How is the Regulatory Hierarchy Determined? OMB Circulars A-21 or A-122, A-110, & A-133 Agency Policy Manual (i.e. NIH GPS, NSF GPM, DHHS, & Selected FAR Clauses Terms and Conditions of Award Notice University’s Policies and Procedures You 11 “Green Sheet” issued by OSP Done after official NOA & Compliance requirements Based on information from Proposal Approval Form & NOA Speedtype or Project ID SP000 plus 5 numbers (e.g., SP00010111) OSP & RFS Officers Account numbers – code source of funding Federal, state, nonprofit, and for-profit Types of projects Research, basic, and applied Instruction Other Budget categories set up based on awarded budget “Funded” based on annual budget, even if awarded 5 years Cost sharing is when PIs commit “other” resources to pay for some of the costs associated with a sponsored project Noted on Proposal Approval Form and submitted budget or just in the narrative Should only do it when is required But, if in proposal, must document Can cost share anything that can be a direct cost on a project Companion accounts for cost share Must have funds transferred using a budget amendment Project reports (both technical and financial) Close out Cost accounting principles Requirements regarding making changes to original proposal (Prior Approval) Some changes PI can make without any approval Some changes require approval from sponsor Expanded authorities (Federal Awards) authorizes institution (via OSP) to approve some changes Need agency approval for: Change in scope or specific aims Change in methodology (may not need approval) Change in Key Personnel. PI always needs OSP and agency approval. Other personnel depends on T&C Expanded authority allows expenditures 90 days before start date for Federal grants Need to set up account through Institutional Prior Approval System (IPAS) Pre-Award (defined as period before official start date) Advance Account (prior to receiving official notification) Requires chair and dean authorization Available under Awards Management: www.gsu.edu/research/awards_management.html Select IPAS - Institutional Prior Approval Form Depends on T&C: Make sure you know! Ask OSP!!! GSU requires an IPAS completed if change is more than 25% of a budget category Expanded authorities allow change in expenditures of a single cost category in original budget up to 25% of the total costs. More need agency approval Purchase of equipment may need agency approval (NIH > $25,000) Travel may need approval (especially foreign) Can’t transfer between indirect and direct costs Can’t transfer from participant support costs Carryover of unobligated balances from one budget period to another may be automatic (IPAS Form not necessary) NIH requires indication in progress report if estimated unobligated balance (including prior-year carryover) is expected to be greater than 25 percent of the current year’s total approved budget Expanded authorities allow request for oneyear no-cost extension past the project end date (IPAS Form) Must be “prior approval” request to OSP before end date of the grant and best if submitted one (1) month before Any further requests for no-cost extensions must be done to the sponsor. Make request through OSP Expenditures Federal Cost Accounting Principles Costs charged to a sponsored project must be directly beneficial to project: Personnel (salaries and fringe benefits) Subcontracts Consultants Supplies for research Equipment (more than $5,000) Travel Charge Costs that are allowable Direct Costs are: Reasonable: Would a reasonable person think this was a cost for this sponsored project? Allocable: Be attributable to project. But can be distributed proportionally between projects if use some reasonable basis for the distribution Allowable: Must be a cost that is permitted to be charged as a Direct Cost F&A also known as Indirect Costs Costs to support research such as building depreciation, libraries, operation and maintenance, general departmental administration, and support for conducting research Percentage of the Direct Costs Split between University and College/Dept Should be used (to the extent necessary) to support project Examples of costs typically not charged as Direct Costs because considered Indirect Costs: Administrative and Clerical Costs Printer Toner, Copy Paper, Copying Costs Cell Phones/Telephone service Routine Postage General Office Supplies and Equipment Computers (unless scientifically justified) PDAs/Blackberries If above “routine” use of these items (e.g., distributing classroom material, surveys) Or project is considered a major project (definitions in policy) Or need a computer for an exclusively scientific use Justification establishes reason for exception Putting item in approved budget not sufficient Have to include it in budget justification with a reason that indicates why it is an exception at the time of application (so approved by agency) If not in approved proposal has to be reviewed on a case by case basis by OSP Officer Costs that are typically not allowed: Food Allowed when traveling away from ATL Food for participants, typically an exception, but need to get sponsor approval Alcohol Never allowed except for scientific purposes Follow GSU’s standard rules Expenses are audited for presence of unallowable costs Charges at Staples, Office Depot, etc. are always suspect Need good documentation If no Indirect Costs charged to the project, then okay Defined as Georgia State University’s Employees and must comply with GSU’s Human Resource Policies: Faculty Graduate Students Staff Commitment = payroll (salary) = effort T&C will tell you who they consider “committed” PI and other faculty Commitment is what you specified in your grant application or approved budget (commitment is for the budget year) Not specific to the academic year or summer So “fulfill” your commitment anytime during the budget year Academic year, typically, corresponds to a course buyout but doesn’t necessarily have to Summer salary corresponds to how much you are paid in the summer Need to plan out budget year so fulfill commitments Commitment = Payroll (Salary) Many Federal agencies allow differences between commitment and actual effort to be 25% (commit 10% only work 8%) Check terms and conditions of award But can’t change scope or specific aim Larger change? Need to get agency approval Committed Effort % Actual Effort % % Change in Effort Committed Effort % If more than 25% than have to ask permission from sponsor for reduction of committed effort “prior approval” Commit Commit 50% 50% Charge 20% 20% Commit 50% If more than 25% than have to ask permission from sponsor for reduction of committed effort “prior approval” 60% Change in Effort Commit 25% Charge 20% 20% Commit 25% If more than 25% than have to ask permission from sponsor for reduction of committed effort “prior approval” Change in Effort Commitment = payroll (salary) = effort Personnel Effort Reporting is required to document effort spent on sponsored project Certify % of effort spent on project Typically corresponds to % of salary ERS system Happens 3 times a year Required for all personnel who are paid from a grant Acts like a receipt All faculty certify their own PI certifies everyone else (in grant) Committed Effort (for budget year) = Salary Charged (over budget year) = (within 25% of effort committed) ERS System: Certify Actual Effort Certified (for semester worked) (% charged = certified effort + 5% Total Effort) No more than 50% time allowed (20 hours a week) Requirements for tuition waiver Requirements for health care Hiring from outside your department/consultation with home department Hiring new staff Named in grant can immediately hire Sponsored funded positions (employment only and until have funds) Vacation time terminates at end of grant Expedited procedure; if use approved positions described on URSA’s website (and HR’s website) Advertising positions: new procedures Personnel Action Form (PAF) Interviewing 3 people Completion of interview forms HR/AA paperwork and review Background checks Approval to offer position Someone who is contributing expertise to project Hourly, daily, or flat fee Travel/expenses can be paid as part of consultant payment or separately Cannot be a GSU employee or Co-PI on grant Federal grants can’t pay Federal employees State of GA employees & University system need to use different consultant agreements. Need to obtain permission Policy and procedures Expedited procedure Don’t have to interview or post position Can be a Postdoc Associate (hired as staff with fringe benefits) Or, Fellows who are individuals with own funding paid as a stipend. Not paid GSU fringes In general, GSU’s rules, regulations, and procedures govern non-sponsored expenses , govern sponsored projects Finance and Administration divisions. Forms and procedures: www.gsu.edu/finance/forms.html Business managers/post-award administrators should help Equipment is anything = $5,000 or more Also known as Capital Equipment Equipment belongs to GSU (not you or, typically, agency) State contracting (preferred vendors) Sole source bids Tax exempt form on Finance - Business Services Participant support costs are those costs paid to (or on behalf of) participants in meetings, conferences, symposia, and workshops Registration fees, travel allowances, manuals and supplies, tuition, and stipends (no F&A charges) Subject fees are payments made to human subjects who are participating in your research to compensate them for their time Cash or gift cards. Refer to URSA Website P’Cards are a method for making purchases Training required (but training geared to use with state funds; “allowable” not accurate for sponsored projects) Can only charge allowable direct costs (especially scrutinized by auditors) Further info: www.gsu.edu/accounting/purchasing-pcard.html Forms: www.gsu.edu/accounting/purchasing-forms.html Handout has a checklist to differentiate the three ways people can be involved in a grant Individuals who are contributing expertise to the project Must have a consulting agreement if payment over $5,000 Step by step guide available: www.gsu.edu/accounting/paymentcontrators-consultants.html Formal Agreement between GSURF and other institution Subcontract typically have a PI Terms & Conditions of award apply to subcontract Even if got institutional support letter during proposal process, once awarded, need to set up formal subcontract If not part of original proposal, may have to go back to the agency (depends on agency) Complete request for subcontract form (OSP) Need statement of work and budget for subcontract OSP will, then, use a standard subcontract form and submit form to the OSP office of the PI’s institution to be processed Can only be for one year. Amended annually by sending request for subcontract If want own terms, PI must work with OSP and Legal dept and then get final approval by Legal dept Invoices from subcontract Responsible for certifying programmatic aspects of subcontract Did they do the expected work? Responsible for certifying charges on invoice Are they reasonable, valid, etc.? Everyone, with fiscal responsibility, must review summary of budget monthly Spectrum (Peoplesoft) Drilldown Reports Difference between budget year and fiscal year Important to check what has been charged and what has not been charged Subcontract and consultant invoices (PI responsible for ensuring work is completed and expenses appropriate) P-Card Activity Log needs to be reconciled with VISA/Bill statement with receipts Indirect Costs (F&A) not charged on participant support costs, equipment, and subcontracts above $25K Very important expenses are “properly” coded because F&A is collected based on expense code Cost Transfer: Movement of expense(s) between two different university account numbers Charges should be moved within 90 days of initial charge Expenditure review should enable you to catch errors Charges moved after 90 days require PI’s signature No transfers, involving state funds, goes beyond current fiscal year (July 1st) Personnel charges can’t be changed over fiscal years or overlap years No transfers allowed to a sponsored account if expense is more than a year old When error was discovered What the charge was for Why the charge was incorrectly made How it, specifically, relates to the sponsored project account to which it will be transferred Transfer costs on to a project: 1. Are charges Reasonable, Allowable, Allocable, and consistently Treated? 2. Over 90 days requires justification and is a “red flag” to auditors 3. Especially a problem if at end of the grant 4. Dubiously looks as if you are just spending the money$$ Progress Reports Final Report Financial reports PI responsible for the “technical” contents of the report If required, Research Financial Services will file financial report or supply to you the financial information; although you need to request for report Expenditures toward the end of the grant must be reasonable Cost transfers should be minimized Everything needs to balance The Federal government’s auditors are very serious about institutions following the policies Florida International paid $11.5 million in fines UAB paid $3.39 million Northwestern $5.5 million DHHS OIG Work Plan: Effort Reporting Commitments Was the Proposed Effort Met? Are Faculty Overcommitted? Certification Was the Certifier appropriate? Account for “All” activities? DHHS OIG Work Plan: Effort Reporting Allocability Are Payroll Adjustments Appropriate? Do Administrative & Clerical Salaries Appear on Sponsored Projects? Timeliness Why are there Delays in Certifying Effort? Do Delays Indicate Bigger Issues? DHHS OIG Work Plan: Cost Transfers Was the “How & Why that Occurred” documented? Are charges Reasonable, Allowable, Allocable & consistently Treated? Did the PI “certify” the correctness of the new charges to their sponsored project? Are processes changed to prevent future cost transfers? Minimize cost transfers and delays!! Review Green Sheets for initial awards Check project dates Check project salary budget Update PAF as soon as possible – minimize cost transfers Complete Monthly Expenditure Review Questions?