Cost Transfers: How to Make Them Work for You and Not Against You

advertisement

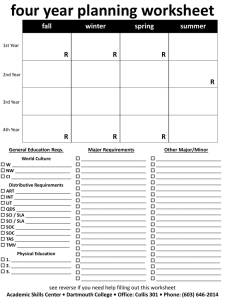

Cost Transfers: How to Make Them Work for You and Not Against You 90 days 60 days 30 days October 2012 Office of Sponsored Projects Rebecca Clogston Aarron Clough Jill Mortali Kathy Page Jody Patten ON TARGET Agenda Background – Regulatory framework, recent developments Dartmouth Policy A133 Audit Metrics – How are we doing? Examples – What hits the target? What doesn’t? Questions? ON TARGET Basic “Textbook” Definition A Cost Transfer is the transfer of an expenditure initially posted to one project and then transferred to another project. Can be: • Salary expenditures: Labor, including salaries, wages, and benefits • Non-salary expenditures: Non-Labor, all costs other than salaries wages, and benefits (e.g., chemicals, lab supplies, equipment, travel, internal service provider charges) The government expects that costs are charged appropriately at the time incurred and that significant adjustments should not be required if adequate financial management practices and policies exist. ON TARGET Basic Principle Institutions have a responsibility to use funds in accordance with applicable law and sponsor terms and conditions. • The federal government scrutinizes cost transfers closely for indications of cost misallocation, and often disallows costs transferred into federal accounts on that basis, or because of non-compliance with timing, documentation, and procedural requirements. • Frequent cost transfers and cost transfers made long after the original cost is incurred (even if valid) raise questions about the reliability of the institution’s accounting system and internal controls. ON TARGET Regulatory & Internal Control Framework Award Budget, Terms, Agency Policy Statement Dartmouth Policies OMB Circular A21 OMB Circular A-133 ON TARGET Charges to Federal Grants Must Benefit the Project AND be Allowable Items not restricted by OMB Circular A-21 or the specific grant Reasonable Goods or services acquired and amount involved reflect an action a prudent person would have taken (Prudent Person Rule). Allocable Chargeable based on the relative benefits received by the project. Treated Consistently Like costs in similar instances need to be treated consistently throughout the Institution. ON TARGET NIH Grants Policy Statement • • • • • • Should be accomplished within 90 days… Supported by documentation that fully explains how the error occurred Certification of the correctness of the new charge by a responsible organizational official of the grantee… An explanation merely stating that the transfer was made “to correct error” to “transfer to correct project” is not sufficient. Transfers of costs from one project to another or from one competitive segment to the next solely to cover cost overruns are not allowable. Grantees must maintain Dartmouth documentation of cost transfers Frequent errors in recording costs may Policies indicate the need for accounting system improvements and/or enhanced internal controls.” NIH Grants Policy Statement OMB Circular A-21 OMB Circular A-133 ON TARGET OMB Circular A-21 “Any costs allocable to a particular sponsored agreement under the standards provided in this Circular may not be shifted to other sponsored agreements in order to meet deficiencies caused by overruns or other fund considerations, to avoid restrictions imposed by law or by terms of the sponsored agreement, or for other reasons of convenience” (OMB Circular A21 Revised, Section C4). “If a cost benefits two or more projects or activities in proportions that can be determined without undue effort or cost, the cost should be allocated to the projects based on the proportional benefit. If a cost benefits two or more projects or activities in proportions that cannot be determined because of the interrelationship of the work involved, … the costs may be allocated or transferred to benefited projects on any reasonable basis” (OMB A-21 Revised, Section C.4.d(3)). ON TARGET Current Regulatory and Audit Climate 1. Increased focus on accountability 2. Concerns over the effectiveness of A133 audits 3. ARRA audits OIG DHHS/NIH Audit Plan for 2013 • NIH—Extramural Construction Grants at NIH Grantees • NIH—Equipment Claims by Grantees • NIH—Colleges’ and Universities’ Compliance With Cost Principles • NIH—Extra Service Compensation Payments Made by Educational Institutions • NIH—Inappropriate Salary Draws From Multiple Universities ON TARGET Audits December 2008 – A leading research university cooperated with a government investigation focusing on charges to awards from over 30 federal agencies from 1999 to 2006. • The government allegations focused on the university: • Utilizing cost transfers to “spend down” available grant funds • Completion of inaccurate and overstated effort reports, resulting in salary overcharges The university acknowledged the charging errors, but disagreed on the nature and extent of errors. • The university paid $7.6 million to the government • The university improved its research compliance administration and infrastructure, including several upgrades to its cost accounting and effort reporting systems and issuance of revised policies and procedures ON TARGET DARTMOUTH REALLOCATION POLICY ON TARGET Dartmouth Sponsored Reallocation of Charges & Cost Transfer Policy Policy Statement: It is the policy of Dartmouth College that costs should be charged to the appropriate sponsored award when first incurred. However, there are circumstances where it may be necessary to transfer expenditures to a sponsored award subsequent to the initial recording of the charge. It is the policy of Dartmouth College that charges to sponsored funds be reviewed on a regular and timely basis to assure appropriateness of charges and to prepare corrections on a timely basis. ON TARGET Purpose of Policy • • • • • • Comply with Circular A-21 Best practices for all sponsored awards Explain and justify the transfer of charges Timeliness and completeness of transfer explanations Transfer of charges closely examined by auditors. Frequent, tardy or unexplained (or inadequately explained) transfers can raise serious questions about the propriety of the transfers and our accounting system and internal controls. ON TARGET Who is Involved? Affected by Policy Dartmouth College administered sponsored awards federal and nonfederal. Aware of Policy Office of Sponsored Projects staff, Departments involved in managing sponsored funds, Principal Investigators and other faculty involved sponsored research and divisional and central financial administrators. Questions? Please direct general questions about this policy to your unit’s administration. If you have questions about policy issues please contact the Director of the Office of Sponsored Projects. If you have questions about process issues please contact your OSP Grant Manager. ON TARGET Definitions Simple Reclassification Option 1 Simple reclassifications are timely reconciliation of transactions (payroll and non-payroll) made within the month following the accounting period of the original GL Transfer Date. Cost Transfer Option 2 Cost transfers are transactions (payroll and non-payroll) that move a previously recorded expense which involves a Sponsored Projects PTA Account. Note: All Simple Reclassifications (SPUD Journals) and Cost Transfers (Cost Transfer Form and Wage Transfer Form) must be approved by OSP before being processed. ON TARGET SIMPLE RECLASSIFICATION Simple Reclassification: Any Dollar Amount if: Transaction for any dollar amount that is being moved to or from a PTA Account Re-class among multi project/task combo within same Award and is within that annual budget period OR Correction made within the month following the accounting period of the original GL Transfer Date OR Re-class within a PTA Account to correct an expenditure type $500 or less OR OR Transaction is UNDER $500 ( * ) Transaction is within the same project/award Transaction is moving from a PTA Account to a G/L Account Correction made within 90 days following the GL Transferred Date of the charge / pay period (**) PROCESS: Non-Compensation: SPUD Journal (CJE) completed by Department Grant Manager or Finance Center (FC), emails Excel file to OSP Grant Manager for approval and upload. Compensation: Wage Transfer form completed and signed by Department Grant Manager or FC, emails signed scanned copy to OSP Grant Manager for approval, OSP Grant Manager emails to appropriate Finance Center for processing. ON TARGET Simple Reclassification • Not considered Cost Transfers • Do not require a PI signature • Corrections such as expenditure type, transposition errors, incorrect account numbers and other input errors • Recharge center input errors must be processed by the originating source (i.e. computer store), refer to the matrix http://www.dartmouth.edu/~control/docs/financialrept/ correct_trans_source.pdf • Transfers within the same project / award may have budget period restrictions. • all transactions under $500 within 90 days of the original charge • (*) Salary of $500 or less (do not include fringe) ON TARGET COST TRANSFER Reallocation of Charges Involving Sponsored Funds Not yet over 90 days and over $500 PROCESS: Non-Comp: Cost Transfer Form completed by Department Grant Manager or FC, PI signs (Department Chair or equivalent can sign if PI is unavailable), Department Grant Manager emails OSP Grant Manager a PDF and Excel version of the Cost Transfer with adequate documentation (examples include copy of transaction report from IRA, copy of invoice, etc.) attached to be approved and processed by OSP. Cost Transfer Comp: Wage Transfer Form completed by Department Grant Manager or FC, PI signs (Department Chair or equivalent can sign if PI is unavailable), the department grant manager emails OSP Grant Manager a PDF version of the form for approval, OSP Grant Manager then emails to appropriate Finance Center for processing. Correction not made in first accounting period, is over 90 days (**) PROCESS: Non-Comp: Cost Transfer Form completed by Department Grant Manager or FC, PI signs (Department Chair or equivalent can sign if PI is unavailable), Department Grant Manager emails OSP Grant Manager a PDF and Excel version of the Cost Transfer with adequate documentation (examples include copy of transaction report from IRA, copy of invoice, etc.) attached to be closely reviewed but may not be approved by OSP depending on the circumstances. Comp: Wage Transfer Form completed by Department Grant Manger or FC, PI signs (Department Chair or equivalent can sign if PI is unavailable), Department Grant Manager emails OSP Grant Manager a PDF version of the form to be reviewed but may not be approved by OSP depending on the circumstances. Cost Transfers are governed by A-21 guidelines which require appropriate signatures and adequate justifications for processing. Any transaction moving charges onto a PTAEO Account 90 days after the original charge will only be approved if there are unusual circumstances. An example would be a sponsored award having a retro start date that goes beyond the 90 day threshold. Before completing transfers that are over 90 days, please talk to your OSP Grant Manager. “Internal” transactions must be processed by originating cost center. (**) see Reallocation / Cost Transfer Calculator (Excel sheet) Cost Transfer Process: Not yet over 90 days and over $500 Non-Comp: • Cost Transfer Form completed by Department Grant Manager or FC, • PI signs (Department Chair or equivalent can sign if PI is unavailable), • Emails OSP Grant Manager a PDF and Excel version • Must include adequate documentation (examples include copy of transaction report from IRA, copy of invoice, etc.) Comp: • Wage Transfer Form completed by Department Grant Manager or FC, • PI signs (Department Chair or equivalent can sign if PI is unavailable), • Emails OSP Grant Manager a PDF version of the form for approval, • OSP Grant Manager then emails to appropriate Finance Center for processing. Cost Transfer Process: Correction not made in first accounting period, is over 90 days Non-Comp: • Cost Transfer Form completed by Department Grant Manager/FC, • PI signs (Department Chair or equivalent if PI unavailable), • Email to OSP Grant Manager (PDF/Excel) • Must have adequate documentation (examples include copy of transaction report from IRA, copy of invoice, etc.) Comp: • Wage Transfer Form completed by Department Grant Manager/ FC • PI signs (Department Chair or equivalent if PI is unavailable) • Email OSP Grant Manager (PDF) APPROVED ONLY UNDER EXTENUATING CIRCUMSTANCES ON TARGET WHAT ARE EXTENUATING CIRCUMSTANCES? • Late issuance of an account for reasons beyond the control of the requestor • Failure of another department to take action, e.g. on a properly submitted payroll distribution change request or Journals to align the allocation of prepaid tuition remission with effort. Please Note: Acceptable extenuating circumstances do not include absences of the PI or administrator, lack of staff or inexperienced staff, or lateness of reconciliations. ON TARGET Sponsored Reallocation of Charges & Cost Transfer Policy Related Documents & Tools: The NIH Grants Policy Statement (REV. 12/03, pp.83-84) http://grants.nih.gov/grants/policy/nihgps_2011/ OMB Circular A-21 http://www.whitehouse.gov/omb/circulars_a021_2004 Cost Transfer Form http://www.dartmouth.edu/~osp/resources/forms.html OSP Policy Website: http://www.dartmouth.edu/~osp/resources/policies/ Quiz Show Question and Answer Samples and Techniques ON TARGET If a transaction is was incurred 64 days ago and totals $499, you do not need PI signature? ON TARGET Which of the following applies to a simple reclassification Expense of any amount under 60 days Any transfer that is needed to closeout the grant Expense under $500 or incurred in the prior month Requires approval of PI All of the above ON TARGET COST TRANSFERS AND THE A-133 AUDIT ON TARGET As part of the annual A-133 audit, the External Auditors (currently KPMG) select a sample of Wage Cost Transfers and Non-Wage Cost Transfers What do the auditors review? • Compliance with the allowability and allocability requirements of OMB Circular A-21 • Are transfers being made timely – within 90 days • Is there a full explanation provided about why the transfers were made? • Is the explanation reasonable about how the error occurred? • Is there adequate documentation attached? • Have all required approvals been obtained? ON TARGET Cost Transfers and the A-133 Audit Potential Findings Insufficient or incomplete documentation for cost transfers Inadequate justification for cost transfers Missing/incomplete authorization for the cost transfer Significant number of late cost transfers (greater than 90 days after original charge) Cost transfers after the grant had closed Department grant managers can make changes without checks and balance Cost transfers to clear overruns Sample Justifications • Reasons why they may not be deemed allowable under audit. • Re-written acceptable justifications. ON TARGET Questionable justification: “Transfer of supplies that were charged to the department in error.” This does justification does not adequately explain: • why the wrong PTAEO was charged • why/how the charge is appropriate to the PTAEO being debited • how the error occurred Acceptable justification: The supplies being transferred were purchased via PCard. The administrative assistant did not review the PCard transactions by the deadline, which caused the transactions to post to the default Pcard account, which is our departmental account. Going forward, the administrative assistant will review all PCard purchases and assign the correct PTAEO number, if applicable, to be charged before the deadline. ON TARGET Questionable justification: “Transfer overage to related project.” This justification does not: • clearly identify which costs are to be shared • the proportions in which the projects will share the costs • a clear indication of how the amount to be shared was determined Acceptable justification: The supplies to be transferred are used on related projects. Supplies should be shared equally on both projects, thus 50% of the cost of the highlighted items is being transferred ON TARGET Questionable justification: “To correct supplies charged due to clerical error.” This justification does not: • why and how the clerical error occurred • why the error was not caught earlier Acceptable justification: The research assistant in the lab who ordered the supplies used a PTAEO number of a project which was terminated. He has been instructed to use the new PTAEO number. In the future, all supply orders will be reviewed and approved by myself or other administrator prior to submission of the order so that such errors can be prevented. ON TARGET Questionable justification “Move charge from department.” This justification does not: • Give the reason for the transfer • The description should be expanded to explain how the charge benefits the grant being charged and why the charge was not originally posted to the grant Acceptable justification: The start date of the grant is December 1. However, the PTAEO number was not established in the accounting system until January 15. The PI needed to purchase some materials to begin work on the project in December, thus they were charged to the department until the PATEO number was established. ON TARGET Examples of typical circumstances in which cost transfers may not be allowed: • Reallocation of expenses because the grant has unexpended funds. • Transfer of after end date expenses to another project. • Transfers which do not explain why the error occurred and how the expense is appropriate to the project which it is being moved to. • Transfer of an expense that was previously transferred. • Late because the department was understaffed. The End