Guiding Student Success through Financial Education

advertisement

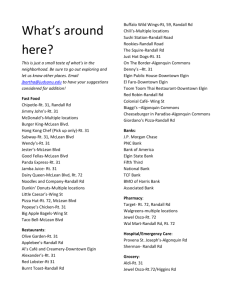

Guiding Student Success through Financial Education Presented to Association of Community College Trustees October 3, 2013 Presenters Eleanor “Ellie” MacKinney, CAS Vice Chair Board of Trustees Community College District 509 David Sam, PhD, JD, LLM President Elgin Community College Kimberly Wagner Managing Director, Student Financial Services Elgin Community College Amy Perrin Director, Financial Aid & Scholarships Elgin Community College Challenges Prior to 2007 Noel Levitz Student Survey Financial Aid Services consultant Compliance issues Student dissatisfaction towards the Financial Aid Office Lack of productivity and customer service to students Transformation Reorganization move to the Business & Finance Division Culture shift to student-centered approach Office-structure change without hiring additional staff ECC Programs Succeed Bringing national recognition to our community 2013 Bellwether Award Alliance for College Readiness 2013 NACUBO Innovation Award ECC Financial Literacy Program Financial Education Is Important Federal loan debt tops $1 trillion 55% of ECC students have the highest amount of need Increase in FAFSA applications, which shows students are searching for resources And… Financial Education Is Important 63% of freshman at two-year colleges indicate they have financial problems that will interfere with their school work 32% of freshman at two-year colleges indicate they have financial problems that are very distracting and troublesome (Source: 2013 Noel Levitz Freshman Attitude Report for Two-Year Colleges) Financial Literacy Program: Background and History 2009-Made available new initiative funds to create a financial literacy program 2009-Purchased online financial literacy module 2010-Spring and fall events, with support from local credit union, held to highlight “Paying for College” 2011-Began one-on-one loan counseling 2012-Collaborated with ECC’s Alliance for College Readiness to expand outreach to parents 2012-Conducted Student Survey 2013-Introduced “How to Win at Life” Program Details Online Module Partnered with Decision Partners Fulfilled TRIO financial literacy requirement Offered in College 101 course Made available to public Interactive 90-minute course Students complete a monthly budget, short- and long-term financial goals and a financial self-assessment Course includes credit card debt, identity theft, moneysavings tips, financial stress, spending habits, and budgetto-actual tracking Events Over 75 Outreach Opportunities!! FAFSA Completion Workshops College Night Parent Summit High School Presentations College Smart Fair Classroom Presentations College Goal Sunday Money Smart Week How to Win at Life Game Transformation of Financial Aid Office Map out financial aid and scholarship process-make the changes Communicate and collaborate with other departments Connect students with scholarship and work study opportunities Early awarding Efficiencies in packaging aid = students are not required to pay out-of-pocket and/or set up a payment plan Loans are not automatically packaged to cover costs Mandatory loan counseling, which is above and beyond the federal requirement Provide individualized exit counseling IMPACT: Number of FAFSAs Received 12,000 10,000 9,299 10,029 10,262 2011-2012 2012-2013 7,571 8,000 6,000 5,291 4,166 4,000 2,000 0 2007-2008 2008-2009 2009-2010 2010-2011 IMPACT: Number of Financial Aid Recipients 8,000 7,111 6,972 2011-2012 2012-2013 7,000 5,769 6,000 5,000 4,734 4,000 3,000 2,000 1,000 0 2009-2010 2010-2011 IMPACT: Uncollected Student Tuition and Fees 1,200,000 1,000,000 $282,605 200,000 $352,500 400,000 $581,789 600,000 $996,576 800,000 FY2010 FY2013 0 FY2006 FY2007 Mandatory One-On-One Loan Counseling Beginning in spring, 2011, students are required to meet with a Financial Aid Loan Advisor before loan is packaged Student’s personal budget is reviewed and discussed Loan amount needed is discussed Loan basics are reviewed (percentage rates, loan types, repayment options, repayment schedule, rights and responsibilities) Obtain cumulative loan balances (from all schools attended) Consequences of default are discussed ECC’s Exit Counseling is Optional (for now) Meet with students in small groups or individually Review repayment options, repayment schedule and their cumulative loan balance Provide contact numbers to loan provider and servicer IMPACT: Amount of Direct Loans Disbursed $7,000,000 $6,399,309 $6,385,830 $6,000,000 $5,000,000 $5,533,059 $5,456,129 2011 - 2012 2012 - 2013 $4,514,076 $4,000,000 $3,000,000 $2,000,000 $1,000,000 $0 2008 - 2009 2009 - 2010 2010 - 2011 IMPACT: Number of Students Borrowing Loans 2,000 1,840 1,800 1,769 1,695 1,573 1,600 1,400 1,342 1,200 1,000 800 600 400 200 0 2008 - 2009 2009 - 2010 2010 - 2011 2011 - 2012 2012 - 2013 Thank you Questions? Kimberly Wagner Managing Director, Student Financial Services Elgin Community College Phone: 847-214-7124 E-mail: kwagner@elgin.edu Amy Perrin Director, Financial Aid & Scholarships Elgin Community College Phone: 847-214-7217 E-mail: aperrin@elgin.edu www.elgin.edu