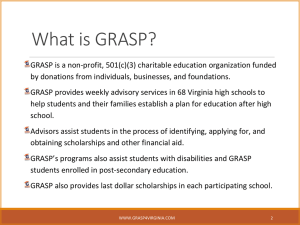

OASFAA Counselor Workshops:

Financial Updates and Training

OASFAA Counselor Workshops, December, 2014

Presented by OASFAA

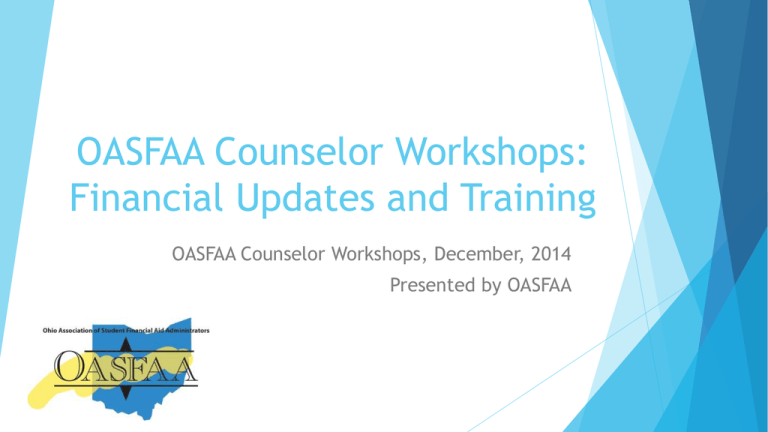

About OASFAA & this presentation

OASFAA is a non-profit organization comprised of volunteer

financial aid professionals.

OASFAA has provided the information today as a free service to

access staff and high school counselors.

You have permission to copy and distribute these materials to

your students and families. Charges may not be assessed for

the material or for the information presented. Permission must

be granted for other use of this information or these materials.

Contact the OASFAA Outreach Chairperson(s) listed on the

OASFAA website, or e-mail the OASFAA Outreach Committee at

outreach@oasfaa.org.

Agenda

FAFSA Updates, including a review of the new same sex

marriage guidelines.

Federal and State Financial Aid updates.

Education policy updates in light of the upcoming

Reauthorization of the Higher Education Act.

A review of the needs analysis formula that determines a

family’s EFC.

A comparison of actual award letters from Ohio Schools so

you can see how families are actually paying for college.

A review of Counselor Resources

FAFSA Updates – Introducing the FSA ID

FSA is adopting the best practice of using a username and password

instead of personal information

The FSA ID (username and password) will replace PIN for students,

parents and borrowers accessing FSA systems starting on April 25, 2015

Users will not be able to access FAFSA by providing last name, SSN and DOB

after implementation

Only change to FAFSA functionality is that FSA ID will replace PIN information

Must use FSA ID to electronically sign or make changes to the FAFSA

No change to customer support

PLEASE NOTE: The original PIN number process will still be in effect

until April 25, 2015.

Students (and parent of dependent students) will still need to obtain a PIN

for FAFSA submission prior to April 25, 2015.

FAFSA Updates – Introducing the FSA ID

The FSA ID:

Requires users to enter less information (2 fields instead of 4)

Provides more secure access to user’s information

Links to PIN information during registration

Offers self–service capability (name change)

New users (Beginning April 25, 2015)

Registration requests the same required information as PIN

New users will be directed to the registration page to create an FSA ID

(username and password) similar to today’s PIN creation page

Current PIN users (Beginning April 25, 2015)

Asked for PIN during account creation

PIN Account will be linked to the FSA ID account if information matches

User who links existing PIN will have access to previous FAFSA submissions

FAFSA Updates – Introducing the FSA ID

Users still click the Sign In button. This directs them to the FSA ID login page. Once they

enter their FSA ID, they are directed back to the application landing page.

Will be updated

Who is

considered

a “parent”

when

completing

the FAFSA?

Parent information on the FAFSA 2 important questions to ask

1.

Who are the student’s legal parents?

2.

Whose information should be provided on the

FAFSA?

The answers to these are not always the same…

Clarification-Who IS considered a

parent?

Who IS considered a legal parent on the FAFSA?

Biological Parents

Adoptive Parents

Stepparents (conditionally)

ONLY if they are married to the student’s biological or adoptive parent and

the student is included in their household size

Only the opposite sex spouse of a legal parent is considered a stepparent for

FAFSA purposes. (But if a same sex partner legally adopts the dependent

student, information from each legal parent would be collected.)

9

Clarification-Who is NOT considered a

parent?

Who is NOT considered a legal parent on the

FAFSA?

Relatives who have not adopted the student

Grandparents, aunts, uncles, older brothers or sisters

Foster parents

Legal guardians who have not adopted the student

Stepparents who have not adopted the student and who

would be the only person providing parental information

Whose information should be provided

on the FAFSA?

Generally speaking:

A dependent student is required to include income and other

information about both of the student’s legal parents (biological

or adoptive) if the parents are living together

REGARDLESS of the parents’ marital status or gender (Unmarried

parents may be of the opposite sex or of the same sex)

Clearly, this does not account for all household types. Let’s

take a look at some different scenarios…

Clarification on marital status

Unmarried and both parents living together (regardless of gender)

Both of your legal parents (biological and/or adoptive) are not married to each other but

live in the same household.

Married/Remarried (regardless of gender)

Does not necessarily mean living together unless your parents’ state of legal residence

recognizes their relationship as a common law marriage.

Consistent with the Supreme Court decision on the Defense of Marriage Act (DOMA),

same-sex couples must report their marital status as “married” if they were legally

married in a state or other jurisdiction (foreign country) that recognizes same-sex

marriage. (even if their state of residence does not recognize it)

Widowed or divorced but has remarried

Choose “married/remarried” and answer the questions about that parent and your

stepparent.

Only the opposite sex spouse of a legal parent is considered a stepparent for FAFSA

purposes. (But if a same sex partner legally adopts the dependent student, information

from each legal parent would be collected.)

Summary of correct parental

information to provide on the FAFSA

Parents' Marital Provide Information for:

Status:

Never Married

and don’t live

together

The parent that you lived with most during the last 12 months. If you

did not live with one parent more than the other, provide information

about the parent who provided more financial support during the last

12 months, or during the most recent year that you actually received

support from a parent.

Unmarried and

both parents

living together

Both of your parents

Married

Both of your parents

Remarried (after Parent and Stepparent

being widowed

or divorced)

Divorced or

Separated

The parent that you lived with most during the last 12 months. If you

did not live with one parent more than the other, provide information

about the parent who provided more financial support during the last

12 months, or during the most recent year that you actually received

support from a parent.

13

Widowed

Your parent

FAFSA Resources

2015-2016 draft paper FAFSA and related documents posted under Forms and

Instructions

− http://www.regulations.gov/#!docketDetail;D=ED-2014-ICCD-0126

The FAFSA Demo site will be available the last Sunday in December, the 28th.

FAFSA Resources – Coming Soon!

3 new infographics coming soon: The

FAFSA Process, “Who’s My Parent,” and

IRS Data Retrieval Process.

Federal Aid Programs, 2014-2015

TEACH

Pell Grant

Campus Based Programs

Direct Loans

16

Sequestration

•Direct Loan origination fees will change each fiscal year

that the Budget Control Act of 2011 is in effect

−Changes effective for loans first disbursed on or after

October 1, 2014

•Direct subsidized and unsubsidized loan fees are

increased from 1.072% to 1.073%

•Direct PLUS loan fees (both parent and graduate

student borrowers) are increased from 4.288% to 4.292%

•Truncate fees to nearest cent – do not round

•Effective for loans first disbursed on or after October 1,

2014

17

TEACH, 2014-2015

Through Sequestration, TEACH Grants that were

first disbursed after 10/1/2014 have been reduced

by 7.3% from the award amount for which the

student would otherwise have been eligible to

receive.

Grant of up to $4,000 per year to students who

intend to teach in a public or private elementary

or secondary school that serves students from

low-income families.

Service requirement upon graduation must be met,

or grant becomes an Unsubsidized Stafford Loan

that must be re-paid!!

18

Federal Pell Grant 2014-2015

•

Maximum award amount

increased slightly for 20142015

•

•

$5,730 maximum award for

full-time enrollment and an

Expected Family

Contribution (EFC) of zero.

Maximum Expected Family

Contribution (EFC) for Pell

eligibility increased to 5157

for 2014-2015. It has not yet

been established for 20152016.

19

Federal Pell Grant 2014-2015

•

Students now have a

maximum number of

terms they can receive

Pell Grant

•

600% of an annual

award amount, or the

equivalent of 12 full

time semesters.

20

Campus Based Programs, 2014-2015

Federal

Supplemental

Education

Opportunity

Grant (SEOG)

Federal

Work

Study

Federal

Perkins

Loan

We are anticipating a reduction in funding for

2015-2016. However, the decrease will vary

from school to school, and exact funding

amounts have yet to be announced.

21

Federal Work Study

•

•

•

•

•

Undergraduate or graduate

students are eligible

Employment can be on or off

campus

FWS wages are excluded

from EFC calculation!!!

Ohio Minimum Wage in 2015

is $8.10/hour

There is a difference

between work study and

“work” or “employment” on

an award letter.

22

Federal Supplemental Educational

Opportunity Grant (FSEOG)

Federal

Undergraduates with exceptional financial need.

SEOG

Pell Eligible students with the lowest EFC

Award ranges from $100 to $4000, depending on when student applies, financial

need, and the funding and policies of school attending.

23

Direct Loans, Undergraduate

2014-2015

Direct Subsidized and Unsubsidized Loans are two separate, unique types of

loans that are awarded separately.

Subsidized

Unsubsidized

Need based

Not based on financial need

Interest is fixed at 4.66% for

new undergraduate loans

disbursed during 2014-15*.

Interest is subsidized while

the student is in school and

during deferment.

Interest is fixed at 4.66% for

all new loans disbursed during

2014-15*. Interest accrues

from time of disbursement of

the funds.

*Interest rates recalculated annually and are effective July 1st based on the 10-year Treasury note index plus 2.05%, capped at 8.25%

Direct Loans, Graduate

2014-2015

Graduate students are only eligible for Unsubsidized Loans (not subsidized).

Unsubsidized

Not based on financial need

Interest is fixed at 6.21% for

all new loans disbursed during

2014-15*. Interest accrues

from time of disbursement of

the funds.

*Interest rates recalculated annually and are effective July 1st based on the 10-year Treasury note index plus 3.60%, capped at 9.5%

Direct Loans, 2014-2015

Class Year

Base Amount

Additional

Unsubsidized

Amount

Freshman

$3,500

$2,000

$5,500

Sophomore

$4,500

$2,000

$6,500

Junior

$5,500

$2,000

$7,500

Senior

$5,500

$2,000

$7,500

Total Available

to Borrow

Independent Students and Dependent Students whose

parents have been denied the PLUS Loan are eligible

for additional Direct Unsubsidized Loans ($4,000 as

Freshmen and Sophomores and $5,000 as Juniors and

Seniors)

26

Direct Loans, 2014-2015

•

Subsidized and Unsubsidized Loans

•

•

1.073% origination fee.*

Parent and Graduate PLUS

•

4.292% origination fee.*

*Adjusted on 10/1/14 based on Sequestration.

27

Direct Loans, 2014-2015

FAFSA

Follow

instructions at

school attending

Entrance

Counseling

MPN

28

Pay As You Earn

•

Available to new Direct loan borrowers (except Parent PLUS) experiencing

financial hardship

•

No loan balance as of October 1, 2007, and

•

Received a Direct loan on or after October 1, 2011

•

Borrower qualifies if annual monthly student loan payments exceed 10% of

“discretionary income”

•

Similar to IBR, borrower’s monthly payment will be determined by a

formula that takes into account family size and adjusted gross

income. Increases in income will impact the required monthly payment

amount

•

Unpaid balance may be forgiven after 20 years of qualifying repayment

(which is a taxable event)

•

Based on Presidential action to further lift the burden of student loan

debt, anticipated final regulations by November 1, 2015

29

Public Service Loan Forgiveness

Under this program, borrowers may qualify for forgiveness

of the remaining balance of their Direct Loans after they

have made 120 qualifying payments on those loans while

employed full time by certain public service employers.

Only loans you received under the William D. Ford Federal

Direct Loan (Direct Loan) Program are eligible for PSLF.

There are many rules that must be followed.

30

Direct Loans, 2014-2015

•

Parent PLUS Loans

•

Loans to parents of dependent students.

•

Loan limits are up to the cost of education less any financial aid received.

•

Interest rate is 7.21% fixed*.

•

Repayment begins within 60 days of full disbursement. Payments may be

deferred while the student is in school.

•

FAFSA completion is required.

*Interest rates recalculated annually and are effective July 1st based on the 10-year Treasury note index plus 4.60%, capped at 10.50%

31

Parent PLUS Loans

New Regulations published October 23, 2014

More Parents and Graduate students expected to be approved based

on new regulations as soon as they are implemented (which will be

asap).

Credit check indicating no adverse credit history will remain valid for

180 instead of 90 days

Required PLUS Loan Counseling

PLUS loan counseling required for borrowers who have adverse credit history

and successfully

−Document extenuating circumstances; OR

−Obtain an endorser with no adverse credit history

Counseling will

−Include information on borrowers’ current loan indebtedness

−Provide estimated loan repayment amounts

−Describe ways to avoid delinquency and default

−Provide additional financial aid literacy information

−Be provided by ED

Voluntary PLUS Loan Counseling

Designed to enhance consumer information for PLUS applicants and will

include

−Calculator that will allow borrowers to estimate future required monthly

payment amounts under various repayment plans

−Tools to assist borrowers in determining how factors such as taking out

additional PLUS loans or deferring repayment affect required monthly

repayment and total amount repaid

Available prior to start of the 2015-2016 academic year

Update on State

Aid Programs

35

Ohio Aid Programs, 2014-2015

•

Ohio College Opportunity Grant (OCOG)

•

National Guard Scholarship

•

•

•

War Orphans Scholarship

Safety Officers Memorial

Nurse Education Assistance Loan Program (NEALP)

•

Choose Ohio First

36

Historical look at need based

Ohio aid

37

Ohio College Opportunity Grant

(OCOG)

•

A student must file the FAFSA, be an Ohio

resident and attend an Ohio public university’s

main campus (not a regional campus or a

community college), or attend an Ohio private,

non-profit college or university, or an Ohio

private, for-profit institution.

•

The Expected Family Contribution (EFC) is the

index number for awarding OCOG

•

EFC eligibility range is from 0000-2190 and a

maximum household income of $75,000.

•

A part-time student will receive a pro-rated

award

•

Available for continuous enrollment (includes

summer)

38

Ohio College Opportunity Grant (OCOG),

2014-2015

Students attending community

colleges and regional campuses are

eligible to receive OCOG if they are

eligible for ETV, as foster youth

students.

From https://www.ohiohighered.org/ocog

39

OCOG, 2015-2016

2015-2016 funding will be

dependent on Ohio Board of

Regents’ Workgroup

recommendation.

There are no known changes

to OCOG, however there is a

statewide committee under

the direction of the

Chancellor that is researching

OCOG. If there are changes,

schools will notify

students/families as the

awarding year begins.

40

War Orphans Scholarship 20142015

•

•

•

•

•

For Ohio dependents of deceased or severely

disabled veterans who served in the armed

forces during a period of declared war or

conflict.

The current annual, full-time award is 77% of

tuition and general fees at all Ohio public

colleges and universities.

Request to fund at 100% based on projected

number of eligible students.

The current annual, full-time award for

students at eligible private colleges and

universities (both non-profit and for-profit) is

$6,994.

Project a 12.5% increase in new students.

41

Ohio National Guard Scholarship 20142015

•

Eligibility determined by the Ohio Adjutant General.

•

The current annual, full-time award is 100% of tuition and

general fees at all Ohio public colleges and universities.

•

The current annual, full-time award for students at

eligible private colleges and universities (both non-profit

and for-profit) is $9,420.

42

Safety Officers Memorial Scholarship

2014-2015

•

For Ohio dependents and spouses of safety

officers killed in the line of duty.

•

The current annual, full-time award is 100%

of tuition and general fees at all Ohio public

colleges and universities.

•

The current annual, full-time award for

students at eligible private colleges and

universities (both non-profit and for-profit)

is $7,494.

43

NEALP, 2014-2015

Loans for RN candidates and

graduate nurse faculty

students

Loans can be

forgiven with 4

to 5 years of

service as a nurse Loans range from

$1,500 to $5,000

or nurse

instructor in Ohio

upon completion

of degree

44

Choose Ohio First, 2014-2015

Various programs with STEM

concentrations

• State funding for these programs

increased slightly for 2013-2014,

and 2014-2015, but individual

awards will vary from school-toschool.

• Partnerships of private/public

schools apply for funding (ex.

Public community college and

private four-year institution.

•

45

Ohio Education and Training Voucher

Program

www.statevoucher.org

•

•

Eligibility requirements:

•

•

•

In foster care on

their 18th birthday

and aged out at

that time.

Adopted from

foster care with

the adoption

finalized after

their 16th birthday

Foster care case

closed between

the ages of 18 and

21.

46

Reauthorization

The 1965 Higher Education Act governs the nation’s student-aid

programs and federal aid to colleges. Part of President Johnson’s

Great Society agenda of domestic programs, it must be

reauthorized every five years. It’s up for renewal again in 2014,

and lawmakers have begun holding hearings and soliciting input to

inform the process.

Many changes in student-aid policy are now being made outside of

the reauthorization process, in spending bills and federal rules.

Reauthorization still significant and some in congress have

referenced putting off major higher education policy changes

until Reauthorization occurs.

No Guarantee that Reauthorization will occur in 2015.

Source: The Chronicle, September 19, 2013 “What You Need to Know About Reauthorization”

Needs Analysis

Need Analysis is the assessment of the difference between a family’s ability

to pay for college (EFC) and the college’s cost of attendance (COA).

As such, Need Analysis is at the core of the financial aid process. Before

awarding any need-based aid, an assessment of family financial resources

must be done.

When a family files the FAFSA form, the federal processor performs separate

calculations from that one form.

There are six different Formulas in the Federal Need Analysis Methodology.

Six Need Analysis Formulas:

Simplified Need Analysis

Regular Need Analysis

1.

Independent Student

1.

Independent Student

2.

Independent w/dependents other

than spouse

2.

Independent w/dependents other

than spouse

3.

Dependent Student

3.

Dependent Student

Assets ARE used in calculation

Does NOT consider assets.

Simplified Need Analysis Qualifications

Students qualify for the simplified EFC formula if BOTH (1) and (2) below are true:

(1)

Anyone included in the household received benefits during previous two years from any of the designated meanstested Federal benefit programs:

•

the SSI Program, the Supplemental Nutrition Assistance Program (SNAP), the Free and Reduced Price School

Lunch Program, the TANF Program, and WIC;

OR

•

the household taxes (student, spouse, parents) all

o

filed or were eligible to file a IRS Form 1040A or 1040EZ, or

o

were not required to file any income tax return; OR

o

the parent, student (or the student’s spouse, if any) is a dislocated worker.

AND

(2) The parents/student’s (and spouse’s) income is $49,999 or less.

• For tax filers, use the parents/student’s (and spouse’s) adjusted gross income

• For non-tax filers, use the income shown on the student’s (and spouse’s) W-2 forms (plus any other earnings

from work not included on the W-2s)

Automatic Zero EFC Qualifications

Some students are eligible for a zero EFC. Requirements the

same as those for the Simplified Need Analysis calculation

except:

•

Income threshold for parents of dependent students

and independent students/spouse with dependents is

$24,000 or less, and

•

Independent students without dependents other than a

spouse are Not Eligible for an automatic zero EFC.

What is Need Analysis

On the income calculations, the federal processor first starts with total

income, taxed and untaxed.

From this are deducted allowances for basic household expenses, taxes, etc.

Of the remaining “available” income, a percentage is assumed to be available

for college.

When reporting assets, the two largest assets for most families (home equity

and retirement plans) are not counted.

For parents, there is also an asset protection allowance that varies according

to parent age.

Finally, of the assets to be considered in the calculation, the assessment rate

is typically around 6 or 7%.

Dependent Case Study – Axel Heck

Axel Heck lives with family in Harmony, Ohio. He is enrolling in college as a

freshman this year, but he’s not sure which college he will attend. He has a

summer job where he earned $9,000 last year, had no tax liability and he has

$600 in a checking account.

His mother, Frankie Heck, and father, Mike Heck, have two other children: Sue

attends college half-time and Brick is still in high school. Last year, Frankie

earned $64,000 and Mike earned $58,000. They have $45,000 in investments

which paid $1,000 in taxable interest income, and contributed $3,000 to a

traditional, tax-deferred IRA for their retirement. They paid $13,200 in federal

income tax last year.

Both Frankie and Mike will turn 45 in 2014.

Dependent Case Study – PARENT INCOME

Parents' Adjusted Gross Income (AGI)

$122,000 income + $1000 interest -$3000 IRA

contribution

Father's income earned from work

Mother's income earned from work

Total parents' income earned from work

Parents' taxable income

Total untaxed income and benefits

Taxable and untaxed income

Total additional financial information

TOTAL INCOME

$120,000

$58,000

$64,000

$122,000

$120,000

$3,000

$123,000

$0

$123,000

Dependent Case Study - ALLOWANCES

Dependent Case Study - Available

Income

Parents’ TOTAL INCOME

$123,000

Parents’ ALLOWANCES

($60,123)

AVAILABLE INCOME

$62,877

Dependent Case Study – PARENT ASSETS

Dependent Case Study – Parent

Contribution

Dependent Case Study – Student Income

Adjusted Gross Income (AGI)

$9,000

Income earned from work

$9,000

Taxable income

$9,000

Total untaxed income and benefits

Taxable and untaxed income

Total additional financial information

TOTAL STUDENT INCOME

$0

$,9000

$0

$9,000

Dependent Case Study – Student

Allowances

Dependent Case Study – Student Available

income and contribution from income

TOTAL STUDENT INCOME

TOTAL ALLOWANCES

Available income

$9,000

($7,218)

$1,782

Assessment of AI (assessment rate)

50%

STUDENT’S CONTRIBUTION FROM

INCOME

$891

Dependent Case Study – Student Assets

Cash, savings, and checking

$600

Net worth of investments

$0

Net worth of business and/or farm

$0

STUDENT NET WORTH

$600

Asset conversion rate

20%

STUDENT'S CONTRIBUTION FROM

ASSETS

$120

Dependent Case Study – EFC

PARENTS' CONTRIBUTION

STUDENT'S CONTRIBUTION FROM

INCOME

STUDENT'S CONTRIBUTION FROM

ASSETS

EXPECTED FAMILY CONTRIBUTION

$12,038

$891

$120

$13,049

Are Recent Headlines Accurate?

L.A. Times: Student debt holds back many would-be home

buyers 4/19/2014

N.Y. Times: It’s Official: The Boomerang Kids Won’t Leave

6/20/2014

U.S. News & World Report: Student Debt Hurts More Than

Your Wallet 08/07/2014

Huffington Post: These 9 Charts Show America's Coming

Student Loan Apocalypse 08/20/2014

Politico: Poll Education second-biggest issue for likely

voters 08/14/2014

What is the Experience of Real Ohio

College Students?

We will compare the actual experience of a $0 EFC

student as well as several $10,000 EFC students as far as

their award letters and how they actually ended up paying

for college at each of:

An Ohio Four Year Public University

An Ohio Four Year Not-For-Profit Private University

Ohio Four Year Public Award Letter $0 EFC

Ohio Four Year Public Award Letter

Budget (COA): $25,758*

EFC: $0

Need: $25,758

Awards

Award Total

Fall

Spring

Pell Grant

$5,730

$2,865

$2,865

SEOG Grant

$ 500

$ 250

$ 250

OCOG

$1,048

$ 524

$ 524

Institutional Grant $4,000

$2,000

$2,000

Work Study

$2,000

$1,000

$1,000

Direct Sub

$3,500

$1,750

$1,750

Direct Unsub

$2,000

$1,000

$1,000

TOTAL

$18,778

*This includes tuition/fees, books, personal expenses, room/board, and transportation.

Ohio Public Four Year University –

Statement of Account

*Note fees

*Also note the Charges are $11,227.60 which is

$22,455.20 for two terms (down from COA of

$25,758). Shows the difference between Direct and

Indirect Costs.

Ohio Four Year Public Award Letter

$10,000 EFC

Ohio Four Year Public Award Letter

$10,000 EFC

Budget (COA): $25,758*

EFC: $10,000

Need: $15,758

Awards

Award Total

Fall

Spring

Direct Sub

$3,500

$1,750

$1,750

Direct Unsub

$2,000

$1,000

$1,000

TOTAL

$5,500

*This includes tuition/fees, books, personal expenses, room/board, and transportation.

Ohio Public Four Year University –

Statement of Account - $10,000 EFC

Note that this school records Tuition

Payment Plan Agreements as “Charges,”

and then posts the payments. This inflates

the “Charges” by 3 x $2,835.20 or

$8,505.60.No

Ohio Private Four Year NFP University –

Award Letter $0 EFC

Budget (COA): $19,963*

EFC: $0

Need: $19,963

Awards

Fall

Merit Scholarship

$4,500

Institutional Grant

$3,080

Pell Grant

$2,865

OCOG

$1,284

Direct Sub

$1,750

Direct Unsub

$1,000

Perkins

$1,250

Work Study

$ 700

Outside Scholarship

$ 200

Addt’l Unsub (PLUS Den.) $2,000

TOTAL

*(Direct Charges: $18,595)

$18,629

Ohio Private Four Year NFP University –

Statement of Account $0 EFC

2014 Fall Semester Billing

Date

Term

Source

Charges

Payments

7/9/14 2014/Fall

Tuition- Full Time

7/9/14 2014/Fall

Technology Fee

$160

7/9/14 2014/Fall

Comprehensive Deposit

$150

7/29/14 2014/Fall

Double- Traditional Hall

$2,225

7/29/14 2014/Fall

Mean Plan

$2,375

9/2/14 2014/Fall

5/8/14 2014/Fall

Late Payment Fee

$13,835

$46

Enroll Deposit (Check)

$150

8/18/14 2014/Fall

Ohio College Opportunity Grant

$1,284

8/18/14 2014/Fall

Federal Pell Grant

$2,865

8/18/14 2014/Fall

Federal Perkins Loan

$1,250

8/18/14 2014/Fall

Institutional Grant

$3,080

8/18/14 2014/Fall

Merit Scholarship

$4,500

8/25/14 2014/Fall

Outside Scholarship

8/18/14 2014/Fall

Subsidized Stafford Loan

8/18/14 2014/Fall

Unsubsidized Stafford Loan

8/18/14 2014/Fall

Additional Unsub Loan (PLUS denial)

9/5/14 2014/Fall

$200

$1,732

$990

$1,979

Credit Card Payment

$761

Total Charges

$18,791

Total Credits

$18,791

$0

Current Balance

Ohio Private Four Year NFP University –

Award Letter $10,000 EFC

Budget (COA): $19,963*

EFC: $10,174

Need: $9,789

Awards

Fall

Institutional Grant

$6,623

Repackage Awd

$1,500

Direct Sub

$1,750

Direct Unsub

$1,000

Perkins

$ 697

Work Study

$ 700

Outside Scholarship

$1,000

TOTAL

$13,270

*Direct Charges: $18,595

Ohio Private Four Year NFP University –

Statement of Account $10,000 EFC

2014 Fall Semester Billing

Date

Term

Source

Amount

7/23/14 2014/Fall

Tutition- Full Time

7/23/14 2014/Fall

Technology Fee

$13,835

7/23/14 2014/Fall

Comprehensive Deposit

7/29/14 2014/Fall

Double- Traditional Hall

$2,225

7/29/14 2014/Fall

Unlimited Mean Plan

$2,375

4/11/14 2014/Fall

Enroll Deposit (Check)

$150

6/17/14 2014/Fall

Semester Payment Plan Payment

$865

7/25/14 2014/Fall

Semester Payment Plan Payment

$865

8/15/14 2014/Fall

Semester Payment Plan Payment

$865

8/18/14 2014/Fall

Federal Perkins Loan

$697

8/18/14 2014/Fall

Institutional Grant

$6,623

8/18/14 2014/Fall

Repackage Award

$1,500

8/18/14 2014/Fall

Subsidized Stafford Loan

$1,732

8/18/14 2014/Fall

Unsubsidized Stafford Loan

8/29/14 2014/Fall

Outside Scholarship

9/15/14 2014/Fall

Semester Payment Plan Payment

$865

10/20/14 2014/Fall

Semester Payment Plan Payment

$865

$160

$150

$990

$1,000

Total Charges

$18,745

Total Credits

$17,017

Current Balance

$1,728

* 2 more monthly payments remain for months of Nov and Dec

Paying for College – Options, After the

Stafford

Reduce Budget (COA)

Books? Personal Expenses? Room & Board? Transportation?

Cash or Credit Cards

Tuition Payment Plan

Independent students have increased Unsubsidized Loan eligibility (an

additional $4,000 for first and second year undergraduate students)

Dependent students’ parents can borrow the Parent PLUS Loan

Students of parents that are denied PLUS Loans can also borrow the additional

unsub of $4,000 for first and second year undergraduate students)

Private Student Loans

Review of Resources for

Counselors

77

Our Contact Information

Email: outreach@oasfaa.org

Web: http://www.oasfaa.org/ (page for counselors)

Request an OASFAA volunteer High School Financial Aid Night presenter.

Register for December Counselor Workshops (we anticipate registration

being live within a week).

Sign up for our email database to be sure you are notified for all events.

College Goal Sunday

•

Sunday, February 8, 2015

•

www.ohiocollegegoalsunday.org

•

Student/Family registration is now

available.

•

Please check the website for

locations near you.

79

Request a Financial Aid Night

Presenter

http://www.oasfaa.org/docs/forms/getting_the_message_Registration.html

80

Ohio School Counselor Resources “Binder”

http://www.oasfaa.org/docs/toc_counselors.html

“Ohio School Counselor Resource Binder Inserts”

2015-2016 UPDATES AVAILABLE JANUARY 2015

81

Financial Aid Toolkit

http://www.financialaidtoolkit.ed.gov/tk/

Consolidates and organizes FSA resources and content into a searchable

online toolkit

For organizations and individuals that

interact with, support, or counsel students

and families on funding a postsecondary

education

Targeted to high school guidance

counselors and college access

professionals

FAAs may use toolkit to support

student outreach efforts

FAAs can also help spread the word about

the toolkit to organizations that work with students and families

Replaces FSA4counselors.ed.gov

70

Studentaid.gov

http://studentaid.gov/

83

COLLEGE SCORECARD

http://www.whitehouse.gov/issues/education/high

84

er-education/college-score-card

FAFSA Completion Tool

http://studentaid.ed.gov/about/data-center/student/application-volume/fafsa-completion-high-school

85

Resources

•

•

Federal Student Aid Information Center (inside cover of “The Guide”)

•

(800)433-3243

•

www.federalstudentaid.ed.gov

Federal Student Aid Publications Website

•

•

Ohio Higher Education Hotline

•

•

www.fsapubs.gov

(800)233-6734

University System of Ohio

•

https://www.ohiohighered.org/

86

Questions/Comments?

Questions

or Comments?

Please complete evaluations.

THANK YOU FOR ATTENDING!

87