Pre-Conference Slides

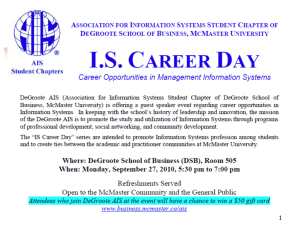

advertisement

Partnerships and Disregarded Entities Howard E. Abrams Professor of Law Biography of Howard E. Abrams Howard E. Abrams, Professor of Law at Emory Law School in Atlanta, GA, is a partnership and corporate tax specialist, receiving his B.A. from the University of California (Irvine) and his J.D. from Harvard University. He has written four books, the BNA Tax Management Portfolio on Disregarded Entities, and more than fifty articles on taxation. Professor Abrams has been at Emory University since 1983, spent the 1999-2000 academic year with the national office of Deloitte Tax as the Director of Real Estate Tax Knowledge, and from January of 2003 through August of 2004 was of counsel to Steptoe & Johnson in Washington, DC. He teaches regularly at Leiden University in the Netherlands and is a member of the American Law Institute and the DC Bar. Prior to joining the Emory faculty, Professor Abrams was a law clerk to Chief Judge Theodore Tannenwald, Jr., of the United States Tax Court and practiced in Los Angeles with the firm of Brobeck, Phleger & Harrison. Professor Abrams has taught as a Visiting Professor at USD, Cornell, Berkeley and Yale Law Schools. Professor Abrams will spend the 2013-14 academic year as a Visiting Professor at Harvard Law School. #AICPA_Banks Topics Regarding a Disregarded Entity Springing and Disappearing Debt Holding a Partnership Interest Through a Disregarded Entity #AICPA_Banks Regarding a Disregarded Entity Overview of Disregarded Entities • Eligible entity • Single owner • No election to be taxed as a corporation When a Disregarded Entity Is Regarded • • • • • • Prior tax obligations Assessment and collection issues TEFRA unified audit procedures FBAR reporting Anti-Conduit financing regulations Gift tax valuation #AICPA_Banks Overview: Eligible Entity Must be a “business entity” • Not an entity formed merely to share expenses - Note: there is no requirement that a business entity have customers or offer goods or services for sale. Madison Gas & Elec. Co. v. Commissioner, 72 T.C. 521 (1979), aff’d, 633 F.2d 512 (5th Cir. 1980). • Not a trust or estate - Note: A trust formed to operate a business, with management vested in one or more trustees and operated for the benefit of one or more beneficiaries, may be classified as a business entity, especially if the trust units are freely transferable. Examples include the Massachusetts Business Trust and the Delaware Statutory Trust. • Not a per se corporation #AICPA_Banks Overview: Single Owner Must have a single owner • An owner who has no interest in profits, losses, or capital will be ignored if the owner is in place only to prevent voluntary bankruptcy. • An owner who has no real risk of loss and whose return is guaranteed or will arise only from tax benefits will not be treated as an owner. • An owner that is itself a disregarded entity (including a QSUB or a Qualified REIT Subsidiary) will be ignored and its interest imputed to its owner. So, for example, a partnership formed by a QSUB and its parent will be treated as having a single owner and so will be a disregarded entity. #AICPA_Banks Overview: No Election to Be Treated as a Corporation A domestic eligible entity defaults to non-corporate classification. A foreign entity defaults to non-corporate classification only if all owners have unlimited liability for the debts of the entity. An entity that is not a per se corporation and that is organized in the US and in a foreign jurisdiction is treated as a domestic entity. #AICPA_Banks A Regarded Entity: Prior Tax Obligations If a disregarded entity was a regarded entity for a prior tax period, the DE will be treated as distinct from its owner with respect to tax obligations arising from the prior period. • Example 1: Regarded T Corp. merges into a DE, owned by P Corp. A redetermination of T’s tax liability for a prior period will cause DE to be treated as regarded for the redetermination. • Example 2: Regarded partnership becomes a DE when all but one partner exits. An audit of DE will cause it to be treated as a regarded entity for the partnership-level audit. #AICPA_Banks A Regarded Entity: Assessment and Collection Issues Certain Excise Taxes Employment Tax Purposes: A disregarded entity is treated as a corporation for employment tax issues and related reporting requirements. • Suppose the owner of DE is also an employee of DE. Is the salary paid by DE to owner treated as self-employment income or employee compensation? Should be self-employment. • Suppose DE is owned by a partnership, and one of the partners is an employee of DE. Can the partner be treated as an employee of DE and thereby receive a W-2? #AICPA_Banks Incentive Partnership Interests P Q DE Q #AICPA_Banks A Regarded Entity: TEFRA Audits The TEFRA unified audit rules do not apply to partnerships having 10 or fewer partners, each of whom is (a) an individual other than a nonresident alien, (b) an estate of a deceased partner, or (c) a C corporation. In Rev. Rul. 2004-88, 2004-2 C.B. 165, the IRS ruled that this small partnership exception does not apply if any of the otherwise-qualifying partners owns the partnership interest through a disregarded entity. This conclusion seems wrong. #AICPA_Banks A Regarded Entity: International Issues FBAR Reporting: Because FBAR reporting requirements are not imposed under the Internal Revenue Code, an otherwise-disregarded entity is regarded for FBAR reporting. Anti-Conduit Financing: For purposes of the anticonduit financing rules in section 881, an entity that is regarded for treaty purposes will be treated as a “person” under the anti-conduit regulations. #AICPA_Banks A Regarded Entity: Gift Tax Valuation In Pierre v. Commissioner, 133 T.C. 24 (2009), the taxpayer created a disregarded entity and then transferred interests in the DE to family members. Held, that the gifts will be treated as gifts of partnership interests rather than undivided interests in the underlying assets, thereby qualifying the transfers for minority and lack of marketability discounts. #AICPA_Banks Disappearing Debt Debt-For-Equity Swaps Distribution/Cancellation of Partnership Debt #AICPA_Banks Debt-For-Equity Swaps: The Partnership Section 108(e)(8): The contribution of partnership indebtedness in exchange for an interest in the venture is treated to the partnership as if the partnership satisfied the obligation with cash equal to the value of the partnership interest received by the creditor. • The partner and partnership can elect to treat the value of the partnership interest as its initial liquidation value. • To minimize the COD income to the partnership, give the creditor significant capital account credit but reduced share of profits going forward. • Note: if the creditor receives a profits interest, do not make the valuation election. #AICPA_Banks Debt-For-Equity Swaps: The Creditor Although the partnership recognizes COD income, the partner is precluded from claiming a bad debt deduction. For the creditor/partner, the transaction is treated as a contribution under section 721. Accordingly, basis in the debt is pushed into the partnership interest. #AICPA_Banks Springing Debt Springing Debt: If a second member joins a disregarded entity when the entity’s assets are encumbered, how is the transaction taxed? Example: X owns a disregarded entity DE and makes equal equity and debt contributions to DE of $100. DE then purchases depreciable property for $200, and after $110 of depreciation has been claimed and the property is worth $150 (though still encumbered by the debt of $100), X sells a 50% interest in the entity to Y for fair market value of $25. X is treated as selling a portion of the property to Y. But what portion of the property is deemed sold? #AICPA_Banks Springing Debt Example Start: X owns property with adjusted basis of $90 and fair market value of $150. End: X owns a note with face value of $100 as well as $25 of cash along with a partnership interest worth $25. Analysis: • Did X sell one half of the property to Y for cash of $25 plus half the debt? If so, gain recognized of $30? • Since Y is out of pocket only $25, did Y purchase $25/$150 (that is, one-sixth) of the asset for $25, producing a gain to X of $10? Or a gain of $25 under Rev. Rul. 84-53? Either way, the debt shift of $50 will be tested under the disguised sales rules. #AICPA_Banks Distribution/Cancellation of Partner Debt Example: In year 1, XYZ loans $1,000 to X. In year 3, XYZ cancels the debt. • Analysis One: COD to X and bad debt deduction to XYZ. • Analysis Two: COD to X and no bad deduction to XYZ. • Analysis Three: Deemed distribution of $1,000 cash to X, followed by deemed repayment by X to XYZ. • Note: If the fair market value of the debt is less than face, then the difference must be COD to X. What if the note was contributed to XYZ? • Under Oden v. Commissioner, T.C. Memo 1981-184, X received no basis credit for the note. • If the contribution is reversed, no income should result. #AICPA_Banks