Fundraising vs. Revenue Income Event

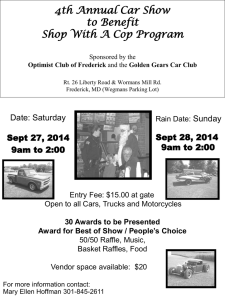

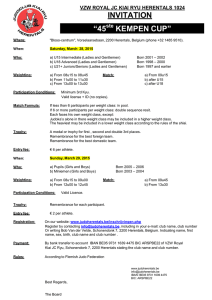

advertisement

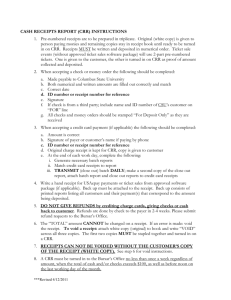

Revenue income event (RIE) (1102): any type of income generated from an event or opportunity where goods and/or services are provided in exchange for monies or payment in kind (quid pro quo) Examples: sale of merchandise, tickets, sponsorship, etc. Fundraising (0392): gift of funds, services, and/or material goods offered without obligation and/or expectation of payment to the donor. Examples: restaurant nights, car wash (by donation only), letter campaign, giving away apparel for free, etc. As a club, you are part of the UREC department, which means you function as a business. We have to track how everything changes hand. Merchandise and equipment counts as money because your club purchased it with your funds. We must have receipts for every single transaction and it must be recorded on your paperwork. We have to make sure we are reconciling all money in and out. Ideally, we should not be off by even a penny, but we understand things happen, so we have allowed a 5 dollar discrepancy. FIVE business days before the start of the event, complete and all necessary forms (see handbook for detailed list of what forms are due when). Complete a Reconciliation Form each time the inventory/fund changes hands and/or when the event is over. Schedule an appointment with Club Sports Admin. for the first business day BEFORE the event to pick up the following items: Cash box Receipt book Check stamp Till fund Meet with Club Sports Admin. to return all documents, inventory (if applicable), and monies for a date no later than one business day after the event has been completed. This meeting is to be set before the RIE. Complete and submit the Revenue Income Results Form Return the following items to the Club Sports Program (if applicable) Cash box Receipt book and receipts (including ticket stubs if applicable) Check stamp Till fund Unsold inventory items (both retail and give-away) and tickets Forms (Reconciliation, Inventory Reservation and Log, Revenue Income Results Forms) Schedule an appointment with the Club Sports Admin. to return all required forms, receipts, donations, remaining inventory, and till fund. This should be scheduled no later than one business day after the fundraiser has been completed. Complete and submit the Fundraising Results Form Return the following items to Club Sports Admin. (if applicable) Cash box Receipt book Give away inventory Till fund Items gifted Forms: reconciliation, inventory give-away log, and fundraising results form Do not mix personal monies with University money (can’t make change with personal money, can’t make change for vending machine) Any gifts (gift cards, food, electronics, etc.) must be noted on the Give- Away Reservation and Log Make checks payable to the University of Arkansas for anything NOT a donation with the club name written on the memo line. All checks for donations should be made payable to the University of Arkansas Foundation. There are certain fields and information that MUST be filled out on check…please see handbook for a picture of everything it must have. All receipts issued must be pre-numbered and issued in sequential order One receipt goes to the Buyer/Donor and the other stays with the club—you will need to turn this in later… don’t lose it! All receipts must contain the following information: Date issued Receipting cashier Name of buyer/donor Amount received Information to identify the specific purpose of the sale(medium shirt, donation, etc.) Form of payment (cash or check) A person buys a $30 t-shirt, gives you 40 dollars and tells you to keep the change… what should you do? Write a receipt for both transactions; the sale of the t-shirt ($30) and another receipt for the donation of $10