*Aflac--2013 PPACA Update* April 12, 2013 Jesse A Patton LUTCF

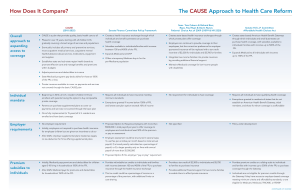

advertisement

Employers’ Council of Iowa Meeting Wednesday, April 24, 2013 PPACA Update Jesse A Patton LUTCF, HIA, MHP, FAHM, HIPAAA, EHBA, PHIAS Health Reform Implementation… This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning. Winston Churchill, November 10, 1942 at the Lord Mayor's Luncheon at Mansion House in London Confused – Implementation overload!! DON’T PANIC YET!! We are at the End of the beginning—7 to 10 years of rule making and changes. Current Status • On March 21, the House passed HR 3590, the bill passed by the Senate on December 24, 2009, with a 219-213 vote. Signed into law on March 23. • The House and Senate have also passed a reconciliation bill, HR 4872, with a packages of “fixes” to the Senate bill • President Obama signed the reconciliation bill. “We have to pass the bill so that you can find out what is in it” …. Speaker Nancy Pelosi Implementation Be forewarned, NAIC, CMS, DOL , Dept. Treasury and DHHS will need to issue continued guidance many issues which will impact our understanding of these measures. There are some questions you have today that cannot be answered. PPACA Cost more than Anticipated • Estimates released by the Congressional Budget Office: 10 year cost March of 2010, just before the law was enacted, cost $950 billion August 2012, CBO estimated PPACA would be $1.165 trillion February 5, 2013, CBO estimated new 10 year cost $1.329 trillion Current Status of Regulations • We now have 20,000 pages of Regulations issued by Government • Stands 7’3” tall • Weighs 300 lbs. Overall Approach & Objective • Require most U.S. citizens to have health insurance • Create American Health Benefit Exchanges with cost sharing credits • Expand Medicaid • Impose new regulations on Health Plans • Require Employers to pay penalties if employees get tax credits Average Annual Premiums for Single and Family Coverage, 1999-2012 $15,745* * Estimate is statistically different from estimate for the previous year shown (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2012. Cumulative Increases in Health Insurance Premiums, Workers’ Contributions to Premiums, Inflation, and Workers’ Earnings, 1999-2012 Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2012. Bureau of Labor Statistics, Consumer Price Index, U.S. City Average of Annual Inflation (April to April), 1999-2012; Bureau of Labor Statistics, Seasonally Adjusted Data from the Current Employment Statistics Survey, 1999-2012 (April to April). Essential Benefits Defined in 2014 Section 1302(b) defines essential health benefits to include: • • • • • • • • • • Ambulatory patient services Emergency services Hospitalization Maternity and newborn care Mental health and Substance use disorder services Prescription drugs Rehabilitative and habilitative services and devices Laboratory Services Preventive and wellness services and chronic disease management Pediatric services, including oral and vision care CBO Analysis of PPACA Premium Costs • Moreover, the CBO makes clear that average premiums would be 27 to 30 percent higher because the law demands greater insurance coverage. The CBO emphasized that those provisions, along with others, “ would have a much greater effect on premiums in the non-group [individual] market than in the small group market, and they would have no measurable effect on premiums in the large group market.” 2014 Unaffordable For Smokers • Health insurers are allowed to charge smokers who purchase an individual policy up to 50% higher premiums. • "60-year-old smoker could wind up paying nearly $5,100 on top of normal premiums. • Government tax credits that will be available to help pay premiums cannot be used to offset the cost of penalties for smokers 2014 – Product Framing Plus catastrophic plan offering for individuals younger than 30/financial hardship The benefit requirements listed above for exchange plans will also apply to Individual and small group fully insured plans sold outside of the exchanges ACA Provisions for Insurance Exchanges, 2014 • Each state must establish an American Health Benefit Exchange and a Small Business Health Options Program (SHOP) Exchange by 2014 for individuals and small employers; states can create single exchange; regional exchanges • If HHS determines in 2013 that a state will not have an exchange operational by 2014, HHS is required to establish and operate an exchange in the state • Individual and small-group markets are not replaced by exchanges, but same market rules apply inside and outside • Non-grandfathered plans to provide essential benefit package inside/outside Marketplaces Small Businesses Up to 100 employees, can buy thru Marketplace 2016 2014-2015 2-50 Employees A web portal “marketplace” for health insurance Individuals (no subsidies for ones offered employer-based coverage, unless that coverage is “unaffordable”) Self-insured plans not eligible to Participate Federal Government • sets criteria for plan participation and purchaser eligibility • provides subsidies for small businesses and individuals • sets up Marketplace if a state fails to ©2010 Steptoe & Johnson LLP States • each sets up own Marketplace • will be involved in premium reasonableness reviews; can approve/reject as provided under state law Flexible Exchange Options for States Premium Tax Credits and Cost-Sharing Protections Under the Affordable Care Act Federal poverty level Income Premium contribution Out-ofActuarial value: as a share of income pocket limits Silver plan <133% S: <$14,484 F: <$29,726 2% (or Medicaid) 133%–149% S: $14,484 – <$16,335 F: $29,726 – <$33,525 3.0%–4.0% 150%–199% S: $16,335 – <$21,780 F: $33,525 – <$44,700 4.0%–6.3% 200%–249% S: $21,780 – <$27,225 F: $44,700 – <$55,875 6.3%–8.05% 250%–299% S: $27,225 – <$32,670 F: $55,875 – <$67,050 8.05%–9.5% 300%–399% S: $32,670 – <$43,560 F: $67,050 – <$89,400 9.5% S: $3,967 F: $7,933 70% 400%+ S: $43,560+ F: $89,400+ — S: $5,950 F: $11,900 — Four levels of cost-sharing: 1st tier (Bronze) actuarial value: 60% 2nd tier (Silver) actuarial value: 70% 3rd tier (Gold) actuarial value: 80% 4th tier (Platinum) actuarial value: 90% 94% S: $1,983 F: $3,967 94% 87% S: $2,975 F: $5,950 73% 70% Catastrophic policy with essential benefits package available to young adults and people who cannot find plan premium <8% of income Notes: FPL refers to federal poverty level; levels are for 2011. Actuarial values are the average percent of medical costs covered by a health plan. Premium and cost-sharing credits are for the Silver plan. Source: Commonwealth Fund Health Reform Resource Center: What’s in the Affordable Care Act? (PL 111-148 and 111-152), http://www.commonwealthfund.org/Health-Reform/Health-Reform-Resource.aspx. 2012 Annual Federal Poverty Guidelines # Family 100% 133% 150% 200% 300% 400% 1 $11,170 $14,856 $16,755 $22,340 $33,510. $44,680 2 $15,130 $20,123 $22,695 $30,260 $45,390 $60,520 3 $19,090 $25,390 $28,635 $38,180 $57,270 $76,360 4 $23,050 $30,657 $34,575 $46,100 $69,150 $92,200 5 $27,010 $35,923 $40,515 $54,020 $81,030 $108,040 6 $30,970 $41,190 $46,455 $61,940 $92,910 $123,880 7 $34,930 $46,457 $52,395 $69,860 $104,790 $139,720 8 $38,890 $51,724 $58,335 $77,780 $116,670 $155,560 Single Person Income and Premium 2012 FPL Min Income Annual Max Income Annual Min Premium Monthly Max Premium Monthly $11,170.00 $14,856.10 $0 $24.76 $14,856.10 $16,755.00 $37.14 $55.82 $16,755.00 $22,340.00 $55.85 $117.29 $22,340.00 $27,925.00 $117.29 $187.33 $27,925.00 $33,510.00 $187.33 $265.29 $33,150.00 $44,680.00 $265.29 $353.72 Family of Four Income and Premiums 2012 FPL Min Income Annual Max Income Annual Min Premium Monthly Max Premium Monthly $23,050.00 $30,656.50 $0 $51.09 $30,656.50 $34,575.00 $76.64 $115.25 $34,575.00 $46,100.00 $115.25 $242.03 $46,100.00 $57,625.00 $242.03 $386.57 $57,625.00 $69,150.00 $386.57 $547.44 $69,150.00 $92,200.00 $547.44 $729.92 Appendix A: List of Questions in the Online Application to Support Eligibility Determinations for Enrollment through the Health Insurance Marketplace and for Medicaid and the Children’s Health Insurance Program Employer Responsibilities Transitional Relief for Non-1/1 Effective Date Plans The transition relief includes the following components: • • If employees who are eligible for employer-sponsored coverage under the terms of the plan in effect on Dec. 27, 2012, are offered affordable, minimum value coverage that starts no later than the first day of the 2014 plan year, the employer will not be assessed a shared responsibility penalty for any of those employees before the 2014 plan year begins. If an employer has at least one quarter of its employees covered under a fiscal year plan (or if the employer offered coverage under the plan to at least one third of its employees during the most recent open enrollment period, before Dec. 27, 2012), the employer will not be subject to shared responsibility payments for any of its full-time employees until the first day of the 2014 plan year, provided that those employees are offered affordable, minimum value coverage no later than the first day of that plan year. Although these regulations are proposed and not final, employers can rely on them until final guidance is issued. Who is a Large Employer under ACA • Any employer with 50+ full-time equivalents • IRC 4980H applies to all common law employers including governmental entities, churches, tax-exempt organizations with at least 50 full-time equivalent employees. • Foreign companies with at least 50 full-time equivalent performing working in the US with US-source compensation Transition Relief for Smaller Employer • Employers can determine whether they are large employers based on a period of six consecutive calendar months as chosen by the employer in the 2013 calendar year, rather than based on the entire 2013 calendar year. The January 1, 2014, compliance deadline is not delayed for smaller employers determined to be large employers based on the six-month calculation. Penalty in 2014 Summary of Potential Employer Penalties under PPACA, Congressional Research Service May 14, 2010 Does Group Coverage Meet the Affordability Test? Federal Poverty Limit FPL 2011 FPL Hourly Rate (40 hr week) 100% (Possibly Medicaid Eligible) $10,890 $5.24/hr 9.5% $86/mo 133%(Possibly Medicaid Eligible) $14.484 $6.96/hr 9.5% $114/mo 150% (Minimum Wage) $16,335 $7.85/hr 9.5% $130/mo 200% $21,780 $10.47/hr 9.5% $172/mo 250% $27,225 $13.09/hr 9.5% $216/mo 300% $32,670 $15.71/hr 9.5% $259/mo 350% $38,115 $18.32/hr 9.5% $302/mo 400% $43,560 $20.94/hr 9.5% $345/mo 9.5% $345/mo since employer only has to use the single rate for lowest tier plan to calculate affordability 400% family of 4 $89,400 $20.94/hr W2 Wage Employee Share of Single Premiums per Mo @ 9.5% income Standard Questions