view the presentation

advertisement

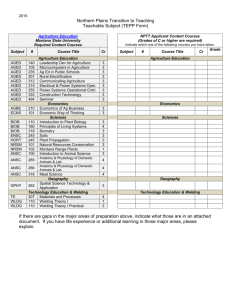

A caring hand helps ease the mind Neil O’Grady and John Walker <Adviser name> is an Authorised Representative of RI Advice Group Pty Ltd Disclaimer Important Notice RI Advice Group Pty Ltd, ABN 23 001 774 125, holds Australian Financial Services Licence Number 238429 and is licensed to provide financial product advice and deal in financial products such as: deposit and payment products, derivatives, life products, managed investment schemes including investor directed portfolio services, securities, superannuation, Retirement Savings Accounts. The information presented in this seminar is of a general nature only and neither represents nor is intended to be specific advice on any particular matter. RI Advice Group strongly suggests that no person should act specifically on the basis of the information contained herein but should obtain appropriate professional advice based on their own circumstances. 1 Clear service offering and value proposition Wealth Living -Private education -New car -Travel -Eating out -Holidays -Investment property Cash Income Growth Where you want to be Lock in your lifestyle - Risk protection - Estate Planning $0 Mortgatge? School fees? Early retirement? Retired? Legacy? Your current situation Surviving - Loss of income - Trauma - Disability - Tragedy - Caring for grandchildren Debt 2 Issues facing the elderly • Personal adjustments • Understanding the options available • What to do with the family home • Costs of aged care and how to pay the fees • Impact on Centrelink benefits • Effects on the estate plan 3 3 Our Seminars - What We Cover • Choices and access to care • The process to enter an aged care facility • The two levels of care • Rules for fees payable • Impact of the former home and strategies to fund fees • How the age pension is impacted • Importance of obtaining advice 4 4 How we can help • Provide advice that will: - Provide a secure cash flow - Maximise Centrelink benefits - Options for funding fees - Preserve estate (the value) • Liaise with your solicitor, accountant & Centrelink • Provide ongoing service 5 How a we can help Tax planning Estate planning Aged care fees & charges Review financial position Family home options Age pension You 6 Client experience process – comprehensive plan • Getting to know you 1 First appointment together 2 Getting all the facts • Discuss the Financial Services Guide • Understand your goals and objectives • Complete a personal and financial profile with you • Determine your tolerance to risk • Develop a clear picture of your financial situation • Letter of engagement 3 Agreeing on the service • Confirm our services • We consider, evaluate and prepare • Discuss services and costs involved 7 Client experience process • Analyse possible strategies and options 4 Advice preparation • Where required, we research legislation and potential products • Prepare recommendations • We present advice – the Statement of Advice (SoA) 5 Advice presentation • Discuss SoA and Product Disclosure Statement • You have considered our recommendations • Should you feel comfortable, you sign the authority to proceed • Implementation of agreed strategy 6 Implementation and ongoing review • Consider portfolio performance and changes • Consider new legislative opportunities and threats • Review of your financial situation, needs and objectives 8 Aged Care Funding Analysis – another service we offer The purpose is to give you an in-depth understanding of: • The facility and the different options available • The cost of care and associated fees • Case study scenarios of your situation • Your ability to cover the ongoing costs of residential care 9 Aged Care Funding Analysis Provides a comparison of funding options to help you decide whether or not to: • Keep the house • Keep the house and rent it out • Sell the house • Sell some of your other investments • Pay a higher bond • Pay by periodic payment • Borrow the funds • Explore other options 10 Aged Care Funding Analysis Why? • It can be complicated • The person making the aged care accommodation decision is often not you 11 Retirement Living Unit Analysis The purpose is to give you an in-depth understanding of: • The facility and the different options available • Case study scenarios of your situation • Your ability to retain your standard of living 12 Case Study ASSETS EXPENSES Bond Deemed investments Other Investments TOTAL $ Option One $220,000 $580,000 $0 $800,000 Basic Daily Care Fee Income Tested Fee Extra Services $38.33 $13.99 $0 $13,990.45 $5,104.69 $0 $40.25 $0 $0 $14,691.25 $0 $0 $52.32 $19,095.14 $40.25 $14,691.25 $329.18 $312.84 $8,558.55 $8,133.80 TOTAL PENSION Asset Test Income Test ANNUAL FINAL AGE PENSION ASSUMPTIONS $ ANNUAL COSTS Option Two /PENSION $700,000 $100,000 $0 $800,000 $729.30 $728.22 $18,961.80 $18,933.80 $X $Y VARIABLES Home sold Home rented Single Other investments Hostel Share of Bond Interest Age Pensioner Rebate retention amount $800,000 Cash Phased resident Married Married and one in Care Both in Care 13 Our credentials • Experienced -Over 30 years experience -Over 80,000 clients -Over $10b under advice • Professional personal advice – Aged Care specialisation • Advice underpinned by quality research and technical teams • Over 150 offices nationwide – 268 advisers • Global company 14 14 Summary – benefits that a financial adviser offers • Give your client and their family peace of mind • Take away the stress and complexity associated with the funding of retirement and aged care living • Provide value added services to UnitingCare Ageing – an extension of your value proposition • Protect your staff (inadvertently providing financial advice) • Enhance the client experience • Share your vision – “Inspired Care…Enriching lives…..together” 15 Thank You