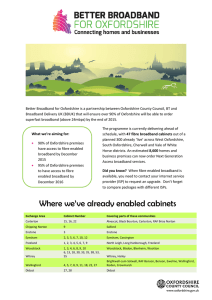

Cotswolds Broadband

advertisement

November 2011 A local initiative to bring high speed fibre access to homes and businesses in West Oxfordshire Independent from national operators, establishes new competitive infrastructure at low cost Current plan - 7,000 premises passed within 18 months 100 Mbps service available New jobs will be created in West Oxfordshire Combined Community, Central Gvmt & local funding model Provides vanguard project for other parts of Oxfordshire and UK The infrastructure challenge of the 21st Century Business needs: Cloud Computing Videoconferencing Dispersed networks Home needs: Video on demand, HD, 3D Live events, sport, concerts Gaming Changing media consumption patterns Community Needs E-learning, telemedicine, telecare Greater speed and capacity required for networking, browsing, video, HD Symmetrical service suffers no bottlenecking Inadequate speed available from other technologies; ADSL, mobile, 4G FTTC deployment will not reach all premises Longevity Future-proof Source: Point Topic November 2011 Current broadband penetration good, but average speed poor (24Mbps)* Customer speed dissatisfaction No other FTTH provider locally Many SoHo workers/small businesses Rural business parks Severe limitations on future high-bandwidth applications * See findings from Oxfordshire Business Broadband Survey Started as a community project under Transition Chipping Norton (TCN) Current plans derived from TCN sponsored study: Sustainable community/economic values Fill in ‘not-spots’ of West Oxfordshire Assist local businesses/residential users Chipping Norton Over Norton, Salford, Southcombe, Heythrop, Chalford Charlbury Spelsbury, Taston, Dean, Chadlington, Shorthampton, Chilson, Leafield Wychwoods Shipton, Milton, Ascott, Lyneham, Bruern, Foscot, Idbury, Fifield Kingham Churchill, Sarsden, Bledington, Daylesford, Oddington, Cornwell Phase Two Enstone Witney Fringe Woodstock, Hanboroughs, Stonesfield, Finstock, North Leigh, Burford Hook Norton Rollright, Swerford, Whichford, Sibfords, Wiggington, Newington South Warks Brailes Shipston, Long Compton, Barton, Wolfords, Toddenham, Cherington, East Gloucs Barringtons Stow, Bourton, Moreton, Rissingtons, Slaughters, Westcotes, Church Enstone, Cleveley, Lidstone, Fulwell, Radford, Assume initial take-up of 35%, growing to 70% in year three Partnering with AFL (Swindon) Use existing power lines to deploy fibre (long/short distance) Aerial or subterranean customer drops Cost effective Proven technology, e.g. Rutland Finance terms available 2 levels of service 40Mbps / 100Mbps Wholesale offering CB carries out install for ISP CB manages fibre infrastructure ISP provides CPE and manages customer VAS available through CB and ISP Marketing activity confined to awareness and stimulation, not direct sales activity Local campaign: DM / parish meetings / door-todoor / local advertising Targets: residential / business / business parks Value Proposition: better, faster, ISP choice (or retention), community benefits Wholesale proposition for ISPs Partnering with CityFibre Holdings (provisioning/billing/customer care) Experience with similar projects: York Dundee Newcastle Bath Essex Limited company (operating co.) wholly owned by PLC (investment vehicle and franchisor) Local people providing local services Emphasis on local recruitment Franchise model could benefit community • Venture Capital • Private Equity • Collateralised obligations • BDUK • OCC Match Funding Equity Public Funding Debt Communit y • High Net Worth Individuals • Local businesses Consistent ARPU derived from wholesale model Relatively low SAC & CPGA due to size of target market Expected churn rates low due to ISP loyalty and 3rd party relationships Low cost of network build-out due to novel technology CPE & Home Drop costs amortised, with menu pricing for customer installs Potential to novate contracts currently relying on OCN to CB and upgrade speed/capacity Assist in meeting OCC obligations & BDUK funding allocation Opportunity to establish proof of concept to extend to other parts of the county. e.g.: Thame Bicester Henley Didcot Improved infrastructure for local businesses and community Direct investment into/by local community rather than national operator Stimulation of demand through new applications Help retain businesses locally Deliver public services locally World-class service Part ownership in local business Future-proof infrastructure Service ubiquitous Retention of existing service provider BDUK allocation Partner Contracts Partner Trials Jul 2013 First Customers Jan 2013 First ‘Dig’ Jul 2012 Jan 2012 Demand Shareholder Assessment Prospectus Novate OCC Contracts How this project could work within Oxfordshire’s Broadband Strategy: Market Demand Assessment required Feeds into & informs Oxfordshire Broadband Strategy Supplements Broadband Survey (August 2011) Addresses residential & business customers Community engagement/demand stimulation programme Investigate novation potential of OCC contracts Thank You