Ziggo Annual General Meeting 2014 1 Minutes of the Annual

advertisement

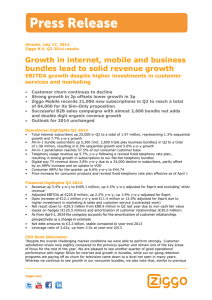

Minutes of the Annual General Meeting of Ziggo N.V. held on 17 april 2014 Chairman: A. Sukawaty General remarks These minutes of the Annual General Meeting of Ziggo N.V. ("Ziggo" or "the Company"), held on April 17, 2014, are intended purely for information purposes and are not intended to be complete. They contain a report of the Annual General Meeting of April 17, 2014, and do not deal with events after April 17, 2014. These minutes should be read in conjunction with the agenda and the explanatory notes to the agenda for this meeting and the 2013 statutory Annual Report. 1. Opening The Chairman introduced himself, opened the Annual General Meeting of Ziggo and welcomed all those present on behalf of the Supervisory Board and the Management Board. The members of the Management Board present were introduced as René Obermann and Bert Groenewegen. The members of the Supervisory Board were introduced as David Barker, Joseph Schull, Dirk Jan van den Berg, Anne Willem Kist, Pamela Boumeester and Rob Ruijter. The Chairman explained that Paul Hendriks, who is also a Management Board member, is absent but on his way to the meeting. Finally, Jan Pieter Witsen Elias was appointed as secretary of this meeting. The Chairman furthermore welcomed Ziggo's external auditor Frank Blenderman of Ernst & Young accountants as well the Company's civil law notary Manon Cremers. The Chairman established that all legal requirements regarding the convocation of this meeting were met, so legally valid resolutions can be adopted at this meeting. The Chairman subsequently addressed the other agenda items. 2. Annual Report The Chairman gave the floor to Mr René Obermann, the CEO, and after his presentation in turn to Mr Bert Groenewegen, who provided an explanation of the Annual Report's financial side in 2013 and the results. After these presentations, Mr Frank Blenderman provided an explanation on behalf of Ernst & Young, the Company's auditor. The presentations are attached to these minutes as a separate annex. The Chairman thanked the three gentlemen for their presentations, and pointed out that the Annual Report can also be found on the website which offers more details on many of the topics that were brought up. The Chairman then gave those present an opportunity to ask questions with respect to the Annual Report. Mr. Jorna representative of the Vereniging van Effectenbezitters (VEB) complimented the elaborate explanations that were given, announced to have a few questions and then asked the following questions. The first question is whether the external auditor has researched the possibility of fraud at the level of the subsidiaries of Ziggo. Mr. Blenderman answered that the possibility of fraud the subsidiaries were included in the audit. Mr. Jorna subsequently asked whether the recommendations made in last year's management letter were followed. Ziggo Annual General Meeting 2014 1 Mr. Blenderman confirmed that the pointers in the management letter were picked up adequately. Mr. Jorna subsequently inquired to the valuation of pre and post take-over customers, which Mr. Blenderman elaborated upon. Mr. Jorna subsequently asked whether this valuation method is being discussed with UPC. Mr. Blenderman responded not to be aware of this. Ms. Elsenga of PGGM Investments asked a question with respect to the discussions with the AFM with respect to Ziggo's accounting method. Mr. Blenderman indicated that to be aware of the discussion with the AFM and to follow these discussion. Mr. Blenderman informed the meeting that in the opinion of EY, Ziggo's annual accounts meet the standards of IFRS. The Chairman then opened the floor to ask questions to Mr. Obermann en Mr. Groenewegen on both the Annual Report and the financial performance, either first quarter or last year. Mr. Jorna asked whether the recommendation to the shareholders to accept Liberty Global's bid on Ziggo was made under certain resolutive conditions (ontbindende voorwaarden). The Chairman indicated that he will be very limited in its answers to questions relating to the bid, because there is an extraordinary meeting coming up where he will be prepared to go into everything in as much detail as people need. The Chairman confirmed that the recommendation was made under certain conditions, and that all information that could be disclosed on the day of the meeting is laid out in the merger protocol document that has been published. Mr. Jorna indicated that this answered sufficed for him and asked whether Ziggo would prefer the European Commission to approve Liberty Global's bid rather than the Dutch ACM. The Chairman indicated that Ziggo is only on the receiving end of a decision. Mr. Obermann informed the meeting that Brussels will announce whether or not they will handle the case in Brussels on the eighth or ninth of May. Mr. Jorna inquired again to a preference. The Chairman responded not to be able to say anything about Ziggo's preferences relative to regulatory opinions. Mr. Jorna inquired to the opinion of Ziggo relating to the mandatory opening up of its cable network as a condition for regulatory approval. The Chairman indicated that this would be technically problematic, and repeated not to be able to express an opinion or try to pre-empt anything that is discussed relative to the potential merger. Mr. Jorna inquired to planned investments in hardware, and how hard or easy it will be to combine that hardware with UPC's network. Mr. Groenewegen responded that the integration is expected not be easy, and to take time and money. Mr. Jorna asked whether it would be wise to liaise with UPC before investing in hardware. Mr. Groenewegen stated that today, Ziggo is an independent company, and doesn't anticipate on the merger. Also, these are investments that were initiated a while back. It's too early to anticipate on a new joint platform. Ziggo Annual General Meeting 2014 2 Mr. Jorna asked whether the investment is in the interest of the customers. Mr. Groenewegen confirmed this. Mr. Jorna inquired to the ambitions in the B2B market. Mr. Groenewegen indicated that the goal is growth in the B2B market, but it is hard to predict what the limit to this growth will be. Mr. Jorna asked whether growth in B2B market is part of the remuneration targets. Mr. Groenewegen responded that only total turnover performance is part of the targets. Ms. Reijme of the VBDO inquired to Ziggo’s activities in the circular economy? Mr. Obermann responded that Ziggo still has a long way to go there.. Ms. Reijme inquired how many data centers Ziggo has in the Netherlands and how many of those could be renovated to reduce the amount of energy Ziggo uses. Mr. Obermann responded that Ziggo has three hundred and seventy-three (373) data centres, and stated that it is Ziggo's policy to have these data centers refurbished only when they need refurbishment replacement. At that time, or when we have new or additional data centers, they need to meet the Breeam criteria because of environmental friendliness and environmental consciousness, and also cost efficiency. Ms. Reijme asked whether sustainable criteria are part of the remuneration targets, and whether they would be in the future Mr. Obermann responded that they are currently not, and it is not possible for him to say whether they will be in the future. Ms. Reijme then asked how Ziggo will protect the privacy of the Dutch customers in a post-merger situation. Mr. Obermann responded that this is certainly a high priority in Ziggo's agenda. Ms. Reijme expressed the hope that gender diversity gets more attention in the future. The Chairman responded that although the Supervisory Board looks for the best person for the job, it is supportive of diversity in general and expects to work hard in the future to try to do better on that front. Mr. Obermann subscribed to this point of view, and stated that Ziggo is increasing diversity over time by filling the talent pipelines so that it can have talents to choose from for its very senior positions. Mr. Jorna asked why Ziggo invests in derivatives. Mr. Groenewegen answered that short-term-rent loans are hedged with long-term ones. On the long term if the derivative results are negative, the balance would still be neutral. The Chairman then asked Ms. Cremers to report on the number of shares represented at the meeting. Ms. Cremers informed the meeting that 127,868,139 shares are present or represented, which equals 63.39% of the total issued capital; this means all resolutions can be adopted with an absolute majority of votes, meaning more than half of the votes. 3. Remuneration policy Ziggo Annual General Meeting 2014 3 The Chairman introduced Ms. Pamela Boumeester, the Chairman of the Selection Appointment and Remuneration Committee, to discuss the remuneration policy in accordance with article 2:135 paragraph 5a of the Dutch Civil Code. Ms. Boumeester informed the meeting that this agenda item relates to how Ziggo's remuneration policy has been applied in the year 2013. She referred to Ziggo's Annual Report 2013 for details on the policy and elaborated on how Mr. Obermann's appointment as CEO of Ziggo was established. She informed the meeting that an individual remuneration package was agreed with Mr. Obermann tailored to fit the specific circumstances of Mr. Obermann's transfer and appointment as CEO of Ziggo. The Chairman opened the floor for questions on the remuneration policy. Ms. Elsenga of PGGM Investments noted that PGGM does not favor signing bonuses and asked whether the signing bonus awarded to Mr. Obermann will be paid out in the event of a change of control. The Chairman explained that in the opinion of the supervisory board, the remuneration is appropriate, given Mr. Obermann's unique stature. He explained that Mr. Obermann bonus consists of a termination fee, a signing bonus and a cash bonus in the event of a change of control, which are guaranteed, meaning they will indeed be paid in the event of a change of control. Ms. Elsenga asks whether it was decided to pay the signing bonus in the event of a change of control at the moment the contract with Mr. Obermann was entered into. The Chairman confirmed this. Ms. Elsenga asked why the signing bonus wasn't constructed to be paid out pro rata continued employment, conditional for three year, given that the public offer on Ziggo was already pending. The Chairman responded that while there was speculation in the market, there were absolutely no discussions going on for LGI to step in. Therefore Ziggo didn’t award the bonus presupposing that the bid was going to happen. Mr. Jorna indicated that he would have subscribed to the idea of a pro rata limitation of the signing bonus. He subsequently asked why Mr. Nijhoff is paid a year's salary when he chose to resign himself. Then he asked whether Mr. De Groot will also be paid a bonus in the event of a change of control. The Chairman asked Pamela Boumeester to respond. Ms. Boumeester explained that Ziggo and Mr. Nijhoff parted with mutual agreement. The supervisory board chose to award a bonus as a sign of appreciation for Mr. Nijhoff's contributions. Mr. Jorna asked whether that means he was actually fired. Ms. Boumeester repeated that this is not the case. After having discussed the future, the decision was made mutually. Mr. Jorna asked whether ordinary middle management employees that become redundant due to the merger can also count on an extra year's salary. Ms. Boumeester responded by saying that this is not something that is up to the supervisory board. Mr. Jorna redirected his question to the management board. Mr. Obermann responded that there are different levels of protections, but there is no generic answer to this question. Ms. Boumeester subsequently informed the meeting that the agreement with Mr. De Groot does not contain a bonus upon change of control. Ziggo Annual General Meeting 2014 4 Mr. Jorna asked whether it would have been possible to delay the appointment of Mr. De Groot until after the merger. Ms. Boumeester explained that this would have been possible, but Ziggo deems it important to show who's in charge of the company at all times. Mr. Jorna asked whether this would not have been possible from Mr. De Groot's present management position, rather than from a seat in the management board. Ms. Boumeester responded that Ziggo thinks it's important to have a strong management board, and avoid an exterior image of a shrinking management board. The Chairman subscribed to Ms. Boumeesters explanation, and reiterated that if the transaction with LGI doesn't take place, Mr. Obermann and Mr. De Groot will continue to be on the management board, which has to be a strong management board going forward. Chairman informed the meeting that Mr. Obermann would like to speak specifically around the point of what happens post the LGI transaction as far as he personally is concerned. Mr. Obermann explained that he chose Ziggo in the Netherlands for good reasons. He stated that the company is agile, it is independent, separately listed and that was what I was looking for. He explained there is another reason why he intend to not continue after the merger has closed, namely that he has a non-compete condition with his ex-employer and therefore he cannot stay given the timing of the close-up. 4. Adoption of the Annual Accounts 2013 The Chairman announced that the next item, the adoption of the annual accounts, is a voting item, and asked Jan Pieter Witsen Elias to provide an explanation on the voting system. De heer Witsen Elias explained and tested the voting system, which appeared to work. The Chairman put forward the proposal to adopt the Annual Accounts for the financial year 2013, which are reflected on page 61 up to and including 113 of the Annual Report. The Chairman referred to the previous discussion and asked whether any shareholders wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Votes against Abstentions 127,846,401 63.92% 127,542,882 303,519 21,738 The Chairman announced that agenda item 4. has been adopted. He then moved on to item 5 on the agenda. 5. Dividend 5.a. Dividend Policy The Chairman refered to the full text of the dividend policy, included in the Annual Report on page 27 and he gave the opportunity to ask questions on the dividend policy. Mr. Jorna asked whether there is a possibility that there won't be a dividend distribution over financial year 2014. Ziggo Annual General Meeting 2014 5 The Chairman responded that in connection with the possible public offer it was agreed that no dividend payment will be made for eighteen months, which is customary. It is not possible to say whether dividend will be paid after those eighteen months. 5.b. Appropriation of profit The Chairman put forward the proposal to establish the interim dividend as the final dividend over 2013 payable out of the net profit 2013. The Chairman referred to the previous discussion and asked whether any shareholder wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Votes against Abstentions 127,846,426 63.92% 127,730,009 116,417 21,713 The Chairman announced that agenda item 5b. had been adopted. He then moved on to item 6 on the agenda. 6. Discharge members of the Management Board The Chairman asked whether there were any questions with respect to the discharge of the members of the Management Board for their functioning throughout the financial year 2013. Ms. Elsenga indicated to want to use the opportunity to express concern with respect to the contemplated legal construction that would circumvent regular minority shareholder protection, and ensure a completion of acquisition of 100% of the shares by Liberty Global when at least 80% of the shareholders offer their shares. The Chairman responded that this is a topic that should be discussed at the EGM. The Chairman put forward the proposal to discharge the members of the Management Board. The Chairman referred to the previous discussion and asked whether any shareholders wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Votes against Abstentions 127,844,403 63.92% 126,800,462 1,043,941 23,736 The Chairman announced that agenda item 6. had been adopted. He then moved on to item 7 on the agenda. 7. Discharge members of the Supervisory Board The Chairman asked whether there were any questions with respect to the discharge of the members of the Supervisory Board for their functioning throughout the financial year 2013. The Chairman put forward the proposal to discharge of the members of the Supervisory Board. The Chairman referred to the previous discussion and asked whether any shareholder wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Ziggo Annual General Meeting 2014 6 Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Votes against Abstentions 127,844,423 63.92% 126,796,291 1,048,132 23,716 The Chairman announced that agenda item 7 had been adopted. He then moved on to item 8 on the agenda. 8. Vacancy Management Board The Chairman asked whether anyone present had any questions with respect to the contemplated appointment of Mr. Hendrik de Groot by the Supervisory Board for a period of two years. Mr. Jorna asked why the appointment is only for two years, and asked whether this relates to the possible merger. The Chairman answered that the post-merger compostion of the management board is currently unknown. Ms. Boumeester added that it is indeed the current special circumstances that have prompted the two year period rather than a four year period. 9. Appointment of external auditor The Chairman put forward the proposal to grant the audit of the financial statements for 2014 to EY Accountants. The Chairman referred to the previous discussion and asked whether any shareholder wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Votes against Abstentions 127,764,017 63.88% 126,925,954 838,063 104,122 The Chairman announced that agenda item 9. had been adopted. He then moved on to item 10 on the agenda. 10. Extension of the authority of the Management Board to repurchase shares The Chairman put forward the proposal to extend the authorisation of the Management Board to acquire shares in the capital of the company to a maximum of ten per cent (10%) of the number of issued shares at the time of acquisition, for the price and in the manner as further described in the explanatory notes to the agenda. The Chairman referred to the previous discussion and asked whether any shareholder wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Ziggo Annual General Meeting 2014 7 Votes against Abstentions 127,842,601 63.92% 127,732,183 110,418 25,538 The Chairman announced that agenda item 10. had been adopted. He then moved on to item 11 on the agenda. 11. Extension of the authority of the Management Board to issue shares (including the grant of rights to subscribe for shares) and to limit or exclude pre-emptive rights The Chairman asked whether anyone present has any questions with respect to the proposed extention of the authority of the Management Board as the body authorised, subject to the prior approval of the Supervisory Board, to issue shares or to grant rights to subscribe for shares, up to ten percent (10%) of the number of issued shares at the time of the issue, which ten percent (10%) can be used for general purposes, including but not limited to the financing of mergers and acquisitions for a period of eighteen months, until 17 October 2015. Ms. Elsenga asked whether the previously granted authority would end by granting this new one. Chairman confirmed this. 11.a. Extension of the authority of the Management Board to issue shares (including the grant of rights to subscribe for shares)* The Chairman put forward the proposal to extend the authority of the Management Board as the body authorised, subject to the prior approval of the Supervisory Board, to issue shares or to grant rights to subscribe for shares, up to ten per cent (10%) of the number of issued shares at the time of the issue. The Chairman referred to the previous discussion and asked whether any shareholder wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Votes against Abstentions 127,846,676 63.92% 120,705,344 7,141,332 21,463 The Chairman announced that agenda item 11a had been adopted. He then moved on to item 11b on the agenda. 11.b. Extension of the authority of the Management Board to limit or exclude the pre-emptive rights The Chairman put forward the proposal to resolve to limit or exclude the pre-emptive rights in relation to the issue of shares (or the grant of rights to subscribe for shares) which can be issued (or granted) pursuant to the authority as mentioned under (12)(a) above. This extension of the authority is requested for a period of eighteen months, until 17 October 2015. The Chairman referred to the previous discussion and asked whether any shareholders wished to ask questions. Since no questions came up, the proposal was put to the vote. The result of the vote was as follows: Total number of shares for which votes were validly cast Percentage of the issued capital Votes in favor Votes against Abstentions 127,846,677 63.92% 119,473,404 8,373,273 21,462 Ziggo Annual General Meeting 2014 8 The Chairman announced that agenda item 11b. had been adopted. He then moved on to item 12 on the agenda. 12. Any other business The Chairman asked whether there was any other business anyone from the floor wanted to raise for this meeting. 13. Close Since no other business came up, the Chairman thanked those present, and closed the meeting. Ziggo Annual General Meeting 2014 9