CHAPTER

12

Bailment and

Insurance Law

Microsoft® PowerPoint® Presentation Prepared By

Gail McKay, LLB, Thompson Rivers University

© 2008 McGraw-Hill Ryerson Ltd.

Ltd., All Rights Reserved.

OBJECTIVES

1. To explore the nature of bailment and its

effect on risk allocation in business

2. To examine various forms of bailment

3. To survey various forms of insurance and

their uses in business risk management

4. To examine the nature of insurance and the

concept of indemnity for loss, and to identify

the parties to insurance contracts

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-1

NATURE OF BAILMENT

A bailment is an express or implied

contractual arrangement having three parts:

1. Delivery of goods by the bailor to the bailee

2. Possession of the goods by the bailee for a

specific purpose

3. An understanding that the goods will be

returned to the bailor at a future time, or

the delivery of the goods according to the

bailor’s directions

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-2

BAILOR - BAILEE RELATIONSHIP

Delivery of goods to the bailee may be

either a physical or a constructive (implied by

conduct) transfer of possession

Only possession of the goods is transferred,

not title; however a bailee can sue anyone who

wrongfully interferes with the bailor’s goods

The bailee has a duty either to return the exact

goods (or interchangeable commodities) or to

follow instructions for disposition of the goods

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-3

SUB BAILMENT

A sub bailment generally requires the

previous express agreement of the bailor if

there will be a bailment of the goods on the

part of the bailee to a sub bailee

An exception to the consent requirement arises

if it is the routine custom of the trade to sub

contract to another bailee

A bailee arranging for a sub bailment must

ensure consistency with the terms of the

original bailment to avoid breaching it

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-4

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-5

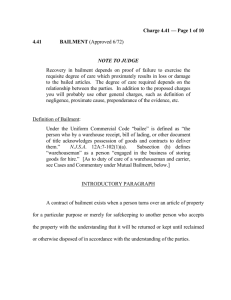

LIABILITY FOR LOSS OR DAMAGE

The standard of care depends on the type of

bailment arrangement, but if goods are lost,

damaged or not returned, the onus shifts to

the bailee since he or she is in the position of

being most likely to know what actually

happened to the goods

To meet this onus, the bailee must

demonstrate that he or she met and

maintained the appropriate standard of care,

and that the harm to or loss of the goods was

not a result of the bailee’s negligence

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-6

TYPES OF BAILMENT

In a gratuitous bailment, the bailee takes

the goods at no charge and liability depends on

who benefits: if for the benefit of the bailor,

low liability; if for the benefit of the bailee, the

highest liability; if for the benefit of both,

moderate liability

In a bailment for reward, the bailee receives a

fee for holding or handling the goods

In the storage of goods, possession and control

of goods passes to the proprietor of the facility

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-7

WAREHOUSE STORAGE

A warehouse operator is expected to meet

the reasonable standard of care expected of a

skilled storekeeper, protecting the goods from

all foreseeable risk

A warehouse receipt allows the person who

presents it to claim the bailed goods and,

similarly, a bill of lading (used by carriers)

represents title to the goods

Statutory liens allow a bailee to retain goods

until he or she is paid or, after notice to the

bailor, auction them off

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-8

PARKING LOTS

Transfer of possession is the key element

that distinguishes a bailment from mere rental

of a parking space – a licence arrangement

If the lot operator either takes the keys and

parks the vehicle, or if the vehicle owner is

directed where to park and then the lot

operator requests the keys, a bailment occurs

Exemption clauses on tickets must be brought

to the attention of the bailor before or at the

time of bailment, or be visible on large signs

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-9

BAILMENT FOR REPAIR OR SERVICE

Bailment of a chattel left for service or

repair, even though no specific charge is made

for the bailment, nevertheless is viewed as a

bailment for reward creating reasonable

liability for the proprietor

A bailee who professes to have a particular skill

will be held to the standard of care for that skill

A bailee has a common law right of lien against

a chattel owner who does not pay for service

or repair, including the right to auction the

chattel after notice to the bailor

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-10

RENTAL OF A CHATTEL

When a bailor rents a chattel to a bailee, it

is the temporary possession in exchange for

payment that creates a bailment

The bailee must not use the chattel for any

purposes other than those intended and must

not sub bail the goods without permission

Bailors must ensure the goods provided are fit

for the purpose described by the bailee, are

free from defects and, if the chattel is

inherently dangerous, that appropriate

warnings are provided

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-11

CARRIAGE OF GOODS

A common carrier is a specialist in the

business of transporting goods for reward and

is therefore held to a high standard of care –

since essentially the company is an insurer of

the goods totally within its care and control for

the duration of the bailment

An act of God, or a bailor’s improper packing or

labelling, would preclude liability of a carrier

A private carrier may transport goods and

must exercise reasonable care over them, but

is not in the business of the carriage of goods

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-12

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-13

PLEDGE OF PERSONAL PROPERTY

If a debtor delivers personal property to a

creditor to be held as security for a loan (a

transfer to the creditor which is called a

pledge), a bailment is created

Temporary possession by the bailee is what is

anticipated; but if there is a default on the

loan, the security (usually bonds, share

certificates or life insurance policies) may be

sold – with payment of any surplus to the

debtor

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-14

INNKEEPERS

Governed by provincial and territorial

statutes, an inn is defined as an establishment

that offers both food and lodging to guests

The statutes require that the liability section of

the legislation be posted in guests’ rooms and

in public areas since it restricts the liability of

the innkeeper for loss or damage to guest

property to between $40 and $100, depending

on the jurisdiction

If valuables are placed in the innkeeper’s vault,

a bailment occurs and the innkeeper is liable

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-15

FORMS OF INSURANCE

Insurance is an contractual undertaking

by an insurance company (the insurer) to

indemnify a person or business (the insured)

for an agreed consideration from loss or

liability which arises from an event or events,

the occurrence of which is uncertain

It is a form of risk management which shifts

the risk of loss to the insurer for events such

as employee dishonesty, business interruption,

fire, accidents, theft or the death of key

personnel

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-16

FIRE INSURANCE

The purpose of fire insurance is the

indemnification of any person with an interest

in property for damage or loss that arises as a

result of fire

The scope of loss includes damage to buildings,

equipment, and chattels

The cause of the damage may include the fire

itself as well as smoke, water damage, and

sometimes lightning

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-17

LIFE INSURANCE

The purpose of life insurance is the

protection of beneficiaries by insuring either

one’s own life or the life of another person in

whom one has an insurable interest

The application for insurance is an utmost good

faith document which allows the insurer to

assess the risk of insuring the potential insured

and to determine how much the premium for

the policy should be

Statements discovered to be fraudulent allow

the insurer to avoid payment under the policy

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-18

OTHER FORMS OF INSURANCE

Sickness and accident insurance has the

purpose of reducing income loss that arises

from illness or accident and may be provided

as part of a benefits package by an employer

Liability and negligence insurance is intended

to indemnify a business or person for claims

made by others about the performance of their

work, including professional errors and

omissions, environmental accidents, occupiers’

liability, manufacturers’ product liability and

automobile accident liability

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-19

THE NATURE OF AN INSURANCE POLICY

Changes in standard form contracts of

insurance are made by means of either a rider

or additional clause added at the time the

contract is created, or alternatively by means

of an endorsement - a change to an existing

contract which saves rewriting the original one

An insurable interest is defined as a financial

interest that would result in a loss to the

insured on the occurrence of some event, but

excludes a wilfull act on the part of the insured

against themselves or an insured interest

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-20

NATURE OF POLICY, continued

An insurable interest must exist both at the

time the contract of insurance is made and

when the event occurs that causes the loss

The one exception to this rule is a contract for

life insurance

There is also one exception to the full

disclosure rule for utmost good faith insurance

contracts: innocent misrepresentation (or

innocent non disclosure)

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-21

CHANGE OF RISK

Notification is required from the insured to

the insurer if there is to be a substantial

change in the property itself or to the type of

business carried on there

The notification allows the insured to decide if

it still wishes to provide coverage for the

business, and if so, what the change in the

amount of the premium should be

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-22

THE CONCEPT OF INDEMNITY FOR LOSS

Indemnity permits an insured business to be

placed in the position it would have been in

prior to the loss, but not to make a profit

An insurer has 3 rights respecting the insured’s

losses: salvage, if the insurer has paid the

insured the value of the goods; subrogation, if

the insurer has compensated the insured for

loss and wishes to sue the third party who

caused it; and contribution, if there are 2

policies covering the same loss, the insurers

have the right to share indemnification for the

loss between themselves

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-23

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-24

PARTIES ASSOCIATED WITH INSURANCE

Agents of the insurer negotiate insurance

contracts and are liable to insurers; if an

insured relies on an agent’s word that a risk is

covered, he or she can sue the agent if it is not

Brokers, who may work for either party,

determine risks and complex insurance needs

and seek insurers who will provide coverage

Insurance adjusters investigate reported losses

on behalf of the insurer and then assess the

extent of the loss; insurers use this amount to

make an offer to settle the claim

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-25

SUMMARY

Bailment is the temporary transfer of

possession, but not title, to goods - either

gratuitously or for reward

Bailment for reward includes storage, carriage

of goods, deposit of goods for repair, rental of

goods, and the pledge of securities for a loan

Insurance is used to indemnify an insured with

an insurable interest at the time of contract

formation and the time of the event causing

the loss; after indemnification, the insurer has

salvage, subrogation and contribution rights

Fundamentals of Canadian Business Law, Second Edition

© 2008 McGraw-Hill Ryerson Ltd. All Rights Reserved.

12-26