REFERENCE COMMITTEE I - American College of Radiology

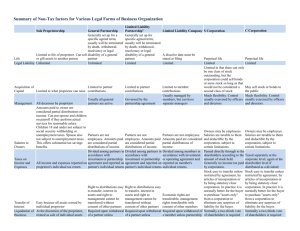

advertisement

The “ABC’s” of Accounting A Special Thank You to: Dr. David M. Yousem, M.D., M.B.A. Professor, Department of Radiology Vice Chairman of Program Development Director of Neuroradiology Johns Hopkins Hospital for allowing the use of his material/content in this presentation Dr. Yousem’s online lecture series can be viewed at: http://webcast.jhu.edu/mediasite/Catalog/pages/catalog.aspx?catalogId =7e18b7d5-9c63-487e-aaf1-77a86f83b011 Dr. Yousem’s project was funded through an RSNA Educational Grant Accounting Overview • • • • • • • Regulatory Agencies The Balance Sheet Income Statement Statement of Cash Flows Budgets Accounting Entities Insurance REGULATORY AUTHORITIES • Financial Accounting – Financial Accounting Standards Board (FASB) • Tax Accounting – Internal Revenue Service (IRS) Financial Accounting Standards Board (FASB) • Has authority to set financial accounting standards – Recognized by: • Securities & Exchange Commission (SEC) • American Institute of Certified Public Accountants (AICPA) • Standards = Generally Acceptable Accounting Principles (GAAP) GAAP Hierarchy • A. Statement of Financial Accounting Standards (FASB) – Greatest authority • B. Technical Bulletins (FASB) • C. Consensus Position. Emerging Issues Task Force (FASB) • D. Accounting Interpretations (FASB) • E. Statement of Financial Accounting Concepts – Least authority Bookkeeping ≠ Accounting • Bookkeeping – Chronological documentation of economic events for later use by an accountant. • Accounting – Integrating and “making sense” of bookkeeping information and preparation of various financial reports to assess financial performance. THE BALANCE SHEET • = Statement of financial condition • Composed of two columns that balance and equal each other: Assets = Liabilities + Retained Earnings • Assets and Liabilities are each divided into two sections: – Current • “An asset or liability that can be liquidated or will come due in the next 12 months.” – Noncurrent • Same as current, except ranges past the next 12 months. Importance of Ratios • Working Capital = Current Assets ÷ Current Liabilities – Ideally a ratio of 2:1 or higher is sought – Measure of how liquid a company is… • The more money and less liability ~ the better off the company Assets (Cash + Accounts Receivable + Inventory) • Quick Assets Ratio (Asset Test Ratio) = (Current Assets-Inventories) ÷ Current Liabilities – Important ratio when a company has a lot of inventory included on the balance sheet – Inventory is the least liquid current asset • Accounts Receivable – Amounts due from patients/insurance companies • Other assets – Deferred: Payments now for next year’s expenses – Intangible Assets – Fixed Assets: Property, plant, and equipment Liabilities • Debt + Accounts Payable + Accrued Expenses + Stockholders Equity – Debt • Typically, real estate and equipment purchases in radiology practices – Accounts Payable • Amounts owed to vendors/suppliers – Accrued Expenses • Items expensed but not yet paid for. – e.g. Taxes, Salaries, Legal Fees INCOME STATEMENT • Summary of income and expense items for a given period of time – Contrary to Balance Sheet, which looks at a specific date • Bottom Line (Profit) = (Income – Expenses) – Other names: • EBT (Earnings before taxes) • EBITDA (Earnings before interest, taxes, depreciation, & amortization) STATEMENT OF CASH FLOW • Summary of inflow and outflow during a specified period • Critical to assessing the immediate needs of the company – Primarily relating to liquid assets • Balance Sheet + Income Statement + Statement of Cash Flow – Basic components to financially evaluate a business BUDGETS • Important to establish benchmarks for a company to compare actual performance • “Variances” = deviations in the budget • “Red Flags” = Large deviations/fluctuations • Budgeting for internal use only • Need both annual and long-term budgets – Useful models: • Rolling forecasts- prior year plus percentage increase – Allow performance evaluation of different segments within the company BUDGETS • Profit Margin = Operating Income ÷ Revenues • Most budgets forecast to operating income (profit) – Also called EBIT (Earnings before interest and taxes) • Revenue is proportional to volume • Variable expenses change in proportion to revenue – Fixed expenses to be considered: – Rent, Salaries, Benefits, Insurance • Depreciation – Must be incorporated in budget, with a tax benefit if deducted on accelerated basis – Based on IRS general depreciation systems ACCOUNTING ENTITIES • Three entities in radiology private practice – C corporation – Partnership/pass-through entity • Partnership • S corporation • Limited liability company (LLC) – Sole proprietorship C Corporation • Regular corporation – File annual income tax – Pay tax on taxable income • Note: THE STOCKHOLDERS PAY ANOTHER TAX ON DIVIDEND DISTRIBUTIONS (Double Taxation) Partnership/Pass-through Entities • File annual tax returns, but do NOT pay income taxes • Each return issues a Form K-1 to each investor – Reports the percentage share of each income & deduction for each investor • Investors report their share of income and deductions on their respective tax returns • Essentially, taxation only at investor level S Corporation • Must meet certain criteria – Can only have a single class of stock (no common or preferred stock) – 75 or less stockholders – Shareholders have limited liability • Only their investment is at risk • If sued, the assets of the corporation, not the investors’, are available for collection. Partnership • Similar to S Corporation • Any number and types of partners • General Partnership – All partners are general and all are fully liable for partnership debts • Partners may have to contribute additional assets to satisfy debts • Limited Partnership – One general partner and numerous limited partners • Limited partners liable for debt only up to their investment LLC – Limited Liability Companies • Hybrid of C corporation & partnership • Can be taxed as either C corp or partnership if >1 partner • If one member only, can be taxed as C corp or as “disregarded entity” – Report income and deductions on personal tax return • No Form K-1 • Members liable only for their extent of their investment – Similar to S corp • No requirement that member has general liability for LLC debts State-dependent restrictions • In many states, professional practices not allowed to organize as LLC’s, partnerships, or C corporations – Separate entities • Professional Associations (PA) • Professional Corporations (PC) • Professional Limited Liability Companies (PLLCs) – Must be licensed by state authority (medical board) – Taxed like C corporation or pass through entity – Can protect each investor from the liability of the other members malpractice INSURANCE • In addition to malpractice insurance…. – Umbrella Policy – Disability Insurance – Key-man Insurance • Can fund any buyouts in multi-partner practices • Life insurance is paid out to the practice, which is then used to purchase the deceased doctor’s interest in the practice from the heirs Personal Life Insurance • Consider establishing an Irrevocable Life Insurance Trust (ILIT) – Usually insurance benefits pass tax-free to beneficiaries, but proceeds are included in your gross estate, thus subject to income tax – If policy purchased and owned by ILIT, insurance proceeds should not be included in your estate, thus not taxed • Also, deducting disability insurance premiums is generally not recommended, despite their short-term tax savings – If they are not deducted, upon payment they will not be taxed Additional Resources/Reading • ACR Residents & Fellow Section on Dollars & Sense http://rfs.acr.org/dollars_sense/ • Radiology Business Practice: How to Succeed. Ed. David M. Yousem & Normal Beauchamp, Jr. Saunders/Elsevier 2008. Credit and Additional Resource • All information herein is based on the book, “Radiology Business Practice: How to Succeed” (Ed. David M. Yousem & Norman J. Beauchamp, Jr)