ODR, SDR, GDR

advertisement

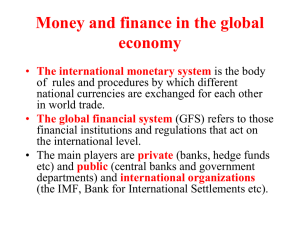

ORDINARY DRAWING RIGHTS SPECIAL DRAWING RIGHTS & GLOBAL DEPOSITORY RECEIPTS Presented by: Saad Ahmed Khan Mohammad Saad Habib Source: www.imf.org ORDINARY DRAWING RIGHTS (ODR) Source: www.imf.org SPECIAL DRAWING RIGHTS (SDR) Definitions: o SDRs are defined in terms of a basket of major currencies used in international trade and finance, namely: US dollar, Japanese Yen, Euro, and Pound sterling. o SDRs are potential claims on the freely usable currencies of IMF members. o SDRs have the ISO 4217 currency code XDR. Source: www.imf.org SDR continues…. The amounts of each currency making up one SDR are chosen in accordance with the relative importance of the currency in international trade and finance. The determination of the currencies in the SDR basket and their amounts is made by the IMF Executive Board every five years. The next review will take place in 2010. The exact amounts of each currency in the basket, and their approximate relative contributions to the value of an SDR, in the past were and currently are shown in the next slide. Source: www.imf.org Composition of basket (Value of 1 XDR) Source: www.imf.org PURPOSES OF SDRs SDRs are used as a unit of account by the IMF and several other international organizations. SDRs were basically created to replace ‘Gold’ in large international transactions. It is used as foreign exchange reserves by central banks of many countries today. Source: www.imf.org DETERMINATION OF SDR VALUE The value of one SDR in terms of United States dollars is determined by the IMF, based on the exchange rates of the currencies making up the basket, as quoted at noon at the London market. If London market is closed, New York market rates are used; if both markets are closed, European Central Bank reference rates are used. Source: www.imf.org According to IMF SDR Definition: The SDR is an international reserve asset, created by the IMF in 1969 to supplement the existing official reserves of member countries. SDRs are allocated to member countries in proportion to their IMF quotas. The SDR also serves as the unit of account of the IMF and some other international organizations. Its value is based on a basket of key international currencies. Source: www.imf.org BRETTON WOODS SYSTEM The value of the SDR was initially defined as equivalent to 0.888671 grams of fine gold – which, at the time, was also equivalent to one US dollar. It is known as Bretton Woods system because the meeting was held at Bretton Woods – A state of United states. Source: www.imf.org SDR Valuation After the collapse of Bretton Woods system in 1973, the SDR was redefined as a basket of currencies. The U.S. dollar value of the SDR is posted daily on IMF’s website. Today, it is calculated as the sum of specific amounts of the four currencies valued in U.S. dollars, on the basis of exchange rates quoted at noon each day in the London market. Source: www.imf.org SDR Allocations Under Articles of Agreement The IMF may allocate SDRs to members in proportion to their IMF quotas. If a member’s SDR holdings rise above its allocation, it earns interest on the excess and vice versa. The agreement also allows the cancellation of SDRs, but this provision has never been used! In addition, the IMF cannot allocate SDRs to itself. Source: www.imf.org Source: www.imf.org Source: www.imf.org INTRODUCTION TO GLOBAL DEPOSITORY RECEIPTS (GDR) Source: www.imf.org GLOBAL DEPOSITORY RECEIPTS Definition: A Global Depository Receipt or Global Depositary Receipt (GDR) is a certificate issued by a depository bank, which purchases shares of foreign companies and deposits it on the account. GDRs represent ownership of an underlying number of shares. Source: www.imf.org What do GDRs do? Global Depository Receipts (GDRs) provide investors an opportunity to reach beyond the geographical confines of their parent country. Recent years have seen a growing number of emerging market countries opting to raise capital from international investors through issues of depository receipts. Source: www.imf.org Forms of GDRs Issuance Sponsored GDRs: It is defined as the issuance of GDRs by the company itself against its own shares in any foreign market to attract investors. It could be a set of 1 GDR = 10 Shares Unsponsored GDRs: It is defined as the issuance of GDRs by any other individual or a company for instance against the shares of any other company in foreign market. Source: www.imf.org Pakistanis Entering GDR Market Pakistan had entered the GDR market in 1994 when Pakistan Telecom., Hub Power Company ltd, and Pakistan Cement Limited issued their GDRs in the American market. Later on, In line with global trends, Pakistan saw a revival of GDR issues during 2006, after a gap of more than 10 years. So far MCB, (OGDC), and United Bank Limited (UBL) have successfully launched GDRs amounting to a total sum of US$1.5 billion at the London Stock Exchange. Source: www.imf.org LAST BUT NOT THE LEAST… Q/A Session Source: www.imf.org