LET 4, Graded Ex, NEFE Lesson 4, Investing, Making Your Money

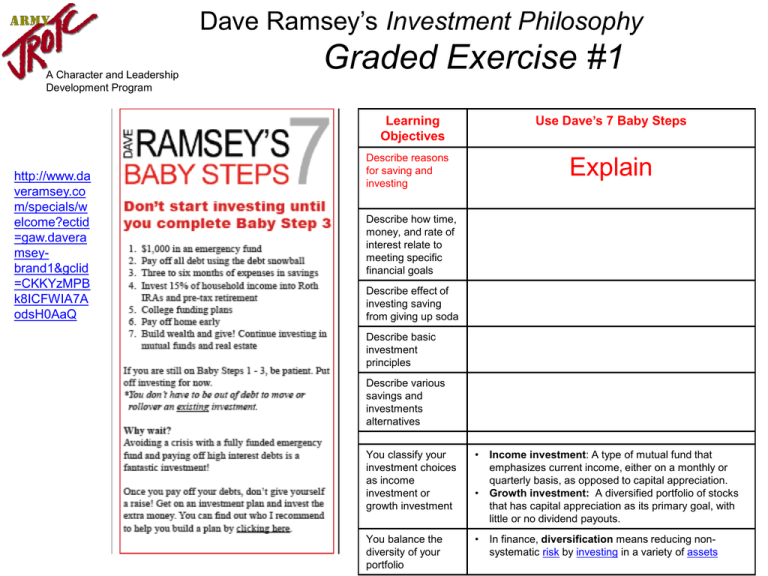

advertisement

Dave Ramsey’s Investment Philosophy A Character and Leadership Development Program Graded Exercise #1 Use Dave’s 7 Baby Steps Learning Objectives http://www.da veramsey.co m/specials/w elcome?ectid =gaw.davera mseybrand1&gclid =CKKYzMPB k8ICFWIA7A odsH0AaQ Describe reasons for saving and investing Explain Describe how time, money, and rate of interest relate to meeting specific financial goals Describe effect of investing saving from giving up soda Describe basic investment principles Describe various savings and investments alternatives You classify your investment choices as income investment or growth investment • You balance the diversity of your portfolio • • Income investment: A type of mutual fund that emphasizes current income, either on a monthly or quarterly basis, as opposed to capital appreciation. Growth investment: A diversified portfolio of stocks that has capital appreciation as its primary goal, with little or no dividend payouts. In finance, diversification means reducing nonsystematic risk by investing in a variety of assets Dave Ramsey’s Investment Philosophy A Character and Leadership Development Program http://www.daveramsey.com/special s/welcome?ectid=gaw.daveramseybrand1&gclid=CKKYzMPBk8ICFWI A7AodsH0AaQ Graded Exercise #1 Use Dave’s Investing Calculator Learning Objectives Describe reasons for saving and investing Describe how time, money, and rate of interest relate to meeting specific financial goals Explain Describe effect of investing saving from giving up soda Explain Describe basic investment principles Describe various savings and investments alternatives You classify your investment choices as income investment or growth investment • You balance the diversity of your portfolio • • Income investment: A type of mutual fund that emphasizes current income, either on a monthly or quarterly basis, as opposed to capital appreciation. Growth investment: A diversified portfolio of stocks that has capital appreciation as its primary goal, with little or no dividend payouts. In finance, diversification means reducing nonsystematic risk by investing in a variety of assets Dave Ramsey’s Investment Philosophy A Character and Leadership Development Program Graded Exercise #1 Use Dave’s 7 Baby Steps Learning Objectives Describe reasons for saving and investing http://www.daver amsey.com/spe cials/welcome?e ctid=gaw.davera mseybrand1&gclid=C KKYzMPBk8ICF WIA7AodsH0Aa Q Describe how time, money, and rate of interest relate to meeting specific financial goals Describe effect of investing saving from giving up soda Describe basic investment principles Explain Describe various savings and investments alternatives You classify your investment choices as income investment or growth investment • You balance the diversity of your portfolio • • Income investment: A type of mutual fund that emphasizes current income, either on a monthly or quarterly basis, as opposed to capital appreciation. Growth investment: A diversified portfolio of stocks that has capital appreciation as its primary goal, with little or no dividend payouts. In finance, diversification means reducing nonsystematic risk by investing in a variety of assets Dave Ramsey’s Investment Philosophy A Character and Leadership Development Program http://www.daveramsey.com/special s/welcome?ectid=gaw.daveramseybrand1&gclid=CKKYzMPBk8ICFWI A7AodsH0AaQ Graded Exercise #1 Use Dave’s Advice Learning Objectives Describe reasons for saving and investing Describe how time, money, and rate of interest relate to meeting specific financial goals Describe effect of investing saving from giving up soda Describe basic investment principles Describe various savings and investments alternatives Explain You classify your investment choices as income investment or growth investment • You balance the diversity of your portfolio • • Income investment: A type of mutual fund that emphasizes current income, either on a monthly or quarterly basis, as opposed to capital appreciation. Growth investment: A diversified portfolio of stocks that has capital appreciation as its primary goal, with little or no dividend payouts. In finance, diversification means reducing nonsystematic risk by investing in a variety of assets Personal Investment Plan Graded Exercise #2 A Character and Leadership Development Program My Personal Budget Percent My realistic take home monthly income Monthly Budget Charity 10% Savings/ Investments 10% Housing 25% $375 Utilities 5% $75 $1,500 10% $150 Clothing Medical/ Health 1. $150 2. Food Transportation Criteria $150 Forecast Personal Savings & Investments 3. 4. 5. 6. 7% $105 7. Personal Recreation Debts - New Car Insurance Total My Investment Plan A Character and Leadership Development Program Personal Investment Plan Graded Exercise #2 Criteria My Investment Plan 1. You select at least five products for your investment plan 1. 2. 3. 4. 5. 2. You outline your investment strategy (amount to invest, how often, and when to invest) Give one example: • $____ = Starting balance • %___ = Rate of return • $____ = Monthly contribution • 3-years = Years plan to contribute 3. You predict the potential value of your investments three years from now Use above example: 4. You classify for investment choices as income investment or growth investment See criteria #1, it clearly classifies my investment choices as: • Income investment and/or • Growth investment 5. You balance the diversity of your investments See criteria #1, it clearly demonstrates that I balance the diversity of my investments 6. Your plan is realistic for your near-term and intermediate-term goals Explain near-term goal: 7. You explain how your investing plan aligns with your intermediate-term and long-term financial goals Explain intermediate-term (3-12 months) goal: $____ How much investment will be worth Explain intermediate-term goal: Explain long-term (1-year and beyond) goal: