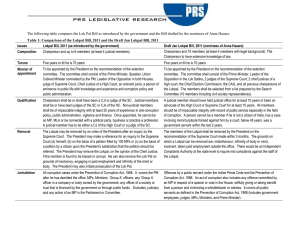

Disclosure of Assets by Govt. Servant as per Lokpal & Lokayukta Act

advertisement

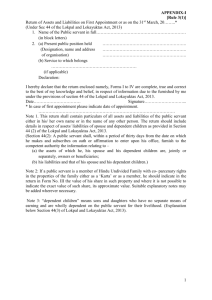

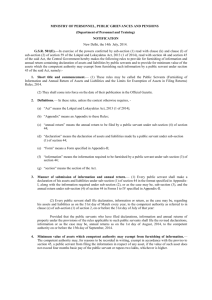

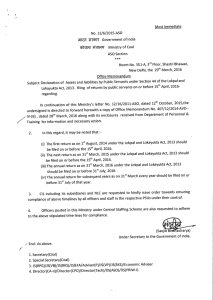

Disclosure of Assets by Govt. Servant as per Lokpal & Lokayukta Act,2013 Kashi Nath Jha DG, NICF, New Delhi Brief of Presentation • Brief about Lokapal and Lokayuktas Act, 2013 • Public Servants (Furnishing of Information and Annual Return of Assets and Liabilities and the Limits for Exemption of Assets in Filing Returns) Rules, 2014 • DoPT Letter dtd. 23rd July 2014 • DoPT OM dtd. 25th August 2014 • DoT communication • How to fill up the return ? About Lokapal and Lokayuktas Act, 2013 • An Act to provide for the establishment of a body of Lokpal for the union and Lokayukta for States to inquire into allegations of corruption against certain public functionaries and for matters connected therewith or incidental thereto. Background • India has ratified the United Nations convention against Corruption • Government’s commitment to clean and responsive governance • Public demonstration and demand, Mass movement • For prompt and fair investigation and prosecution in case of corruption Lokpal • One Chairperson and Members (Max – 8) • Not less than 50% of the Members shall be from SC/ST/OBC/Minorities and Women • Term of 5 Years or attaining the age of 70 Years whichever is earlier • Secretary to the Lokpal = Secy to GoI • Director of Inquiry = Not below the rank of Adl. Secretary to GoI • Director of Prosecution = Not below the rank of Adl. Secretary to GoI Jurisdiction of Lokpal • Including Prime Minister, Ministers, Members of Parliament • Group ‘A’ and ‘B’ officers of Central Government • Group ‘C’ and ‘D’ officials of Central Government • Any Body, Corporation, Authority, Company, Society, Trust, Autonomous Body etc. established by an act of Parliament or wholly or partially financed by the Central Govt. or controlled by it. • Inquiry Wing – Headed by Dir. of Inquiry • Prosecution Wing – Headed by Director of Prosecution • Every Preliminary Inquiry shall ordinarily be completed within a period of 90 days and for reason to be recorded in writing, within a further period of 90 days from the date of receipt of complaint. Powers of Lokpal • For the purpose of inquiry the Lokpal shall have powers of Civil court under the Code of Civil Procedure (CPC),1908 – Summoning and enforcing the attendance of any person and examining him on oath – Requisitioning of any document – Receiving evidence on affidavits – Issuing commissions for the examination of witnesses or documents – Such other matter as may be prescribed • Proceeding before the Lokpal shall be deemed to be a judicial proceeding under sec. 193 of IPC. Chapter XIII Declaration of Assets • Sec. 44 (1) Every public servant shall make a declaration of his assets and liabilities in the manner as provided by or under this Act. (2) A public servant shall within a period of 30 days from the date on which he makes and subscribes an oath or affirmation to enter upon his office, furnish to the competent authority the information relating to – a) The assets of which he, his spouse and his dependent children are, jointly or severally, owners or beneficiaries b) His liabilities and that of his spouse and his dependent children Section - 44 (4) Every public servant shall file with the competent authority, on or before the 31st July of every year, an annual return of such assets and liabilities, as referred to in subsection (2), as on the 31st March of that year. (6) Ministry/Deptt. Shall ensure publication of all such statements on their website by 31st August of that year. Section - 45 • If any public servant willfully or for reasons which are not justifiable, fails to – A) to declare his assets ; or – B) gives misleading information in respect of such assets and is found to be in possession of assets not disclosed or in respect of which misleading information was furnished, then, such assets shall, unless otherwise proved, be presumed to belong to the public servant and shall be presumed to be assets acquired by corrupt means Prosecution for false complaint • Sec. 46(1) Notwithstanding anything contained in this Act, whoever makes any false and frivolous or vexatious complaint under this Act shall on conviction, be punished with imprisonment for a term which may extend to one year and with fine which may extend to one lakh rupees. • 46(5) In case of conviction of a person, for having made a false complaint under this Act, such person whall be liable to pay compensation to the public servant against whom he made the false complaint in addition of legal expenses. • 46(6) Nothing contained in this section shall apply in case of complaint made in good faith. • Section 53 – The Lokpal shall not inquire or investigate into any complaint, if the complaint is made after the expiry of a period of seven year from the date on which the offence mentioned in such complaint is alleged to have been committed. • Sec. 59(2) (k) – the form of annual return to be filed by a public servant under sub-section(5) of section 44 (The Central Govt. may by notification in the official Gazette make rules to carry out the provision of this Act.) Establishment of Lokayukta • Sec. 63 – Every State shall establish a body to be known as the Lokayukta for the state, if not so established, constituted or appointed, by a law made by the State Legislature, to deal with complaints relating to corruption against certain public functionaries, within a period of one year from the date of commencement of this Act. Gazette Notification dtd 14th July,2014 • General Statutory Rule (GSR) 501(E) Rules to provide for furnishing of information and annual return containing declaration of assets and liabilities by public servant. • These rules may be called the Public Servant (Furnishing of Information and Annual Return of Assets and Liabilities and the Limits for Exemption of Assets in Filing Returns) Rules, 2014. Manner of submission of information and annual return • Every public servant shall make a declaration of his assets and liabilities under sub-section(1) of Section 44 in the format specified in Appendix-I -------- and in Form I to IV specified in Appendix – II • Every Public Servant shall file declaration, information or return, as the case may be, regarding his assets and liabilities as on the 31st day of March every year, to the competent authority as referred to ------- on or before 31st July of that year. • Provided that the public servants who have filed declarations, information and annual returns of property under the provisions of the rules applicable to such public servants shall file the revised declarations, infromation or as the case may be , annual returns as on the 1st day of August, 2014, to the competent authority on or before the 15th day of September, 2014. • Appendix – I :- declaration about return • Footnotes are important • Appendix – II – Form No. 1 : - Details of Family – From No. 2 : - Statement of Movable property – Form No. 3 : - Statement of Immovable propery • DoPT Lr. Dtd. 23rd July – It may also be noted that the definition of public servant covers all central government servants (Gr. A,B and C). This is an important difference from the Central Civil Services (Conduct) Rules 1964 and may kindly be noted. • Revised declaration of annual returns as on the 1st August 2014 shall be filed by 15th Sept.2014. • This information should be placed in public domain on the website of the Min./Deptt. • DoPT OM dtd. 25.8.2014 reiterates that the definition of public servant covers all Gr.’A’, B and C employees. • How to file return ? • Bone of content – how much gold / silver your spouse have ? • Meaning of cash in hand • Whether Daughter/Son is liability ? • Any other issue Thank You