Uploaded by

Abigail Ejiro Obukohwo

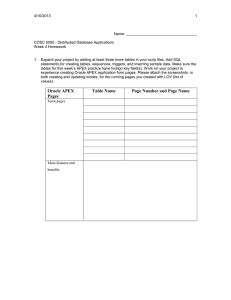

Performance Management Course Material: Syllabus & Introduction

advertisement