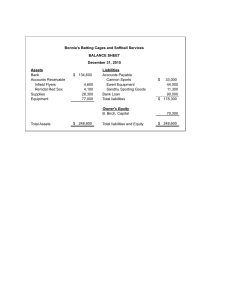

Introduction (Welch, Chapter 01) LEE, Dong Wook Korea University Business School FALL 2024 Finance How to allocate money Guidance: Value ≡ What something is worth Thus, finance is about making good financial decisions – i.e., allocating money in a way that value is maximized. In this course, we will be discussing financial decisions mostly in the context of corporation. (Note: The same concepts and techniques are applicable to individuals’ financial decision making.) Value Valuation (finding the value of something) Extremely important yet Awfully difficult One useful approach, mentioned in ch 1 of the textbook, is relative valuation. It is based on the law of one price -- self-explanatory. 동질적인 재화이면 같은 가치(가격)을 갖는다 To use this method, one needs (to be able) to find a comparable, alternative, peer, etc. (will return to this concept later) Let’s try Q 1.1. = similar한거 찾을 수 있느냐 easy /market에서 tade하기 때문에 difficult difficult city - there are building, can add up valuation but there are subjective things ->hard to value relatively easy hard to value Some more terms Cash flows: flows of money Project: a certain set of cash flows in/out ㄴ value of project: net cash flows Company or Firm: a set of projects So, we will look at a company/firm as a collection of cash flows. company/firm as a collection of cash flows That is, Entire Firm = all current & future cash inflows – all current & future cash outflows = all current & future net cash flows = all current & future net earnings Our class focuses on: ▪ How to value cash flows ▪ What increases/decreases the value of cash flows IN & OUT is just one way of categorizing cash flows. ㄴ 소스??? Another way is to see where they come from. income : own money(owner’s money) + source money(liabilities) ▪ Cash flows are generated by assets. ▪ Assets are funded by owners’ money and others’ money. ▪ That is, equities (stocks) and debts (liabilities). (Each is a “project” with both cash inflows and cash outflows.) So, Entire firm = all stocks + all liabilities own borrowing money Let’s try Q 1.2 and 1.3. cash flows = actual cost + opportunity cost Yes. Foregone salary is a cost that you are bearing. benefit: not paying rent fee valuation is hard Inflows: value of implicit rent. Capital gain if house appreciates Outflows: Maintenance costs. Transaction costs.Mortgage costs. Real estate tax etc.. This class will discuss value, value maximization, value-maximizing financial / corporate decisions, assuming that the market is perfect. Later in the semester, we move to market imperfections and their implications for us. Corporate (social) responsibilities are part of the discussions of market imperfections. Under market perfection assumptions, we begin with: corporations are set up to maximize the wealth of their owners. It is the government’s job to create rules that constrain corporations to do so only within ethically appropriate boundaries (p.6) Of course, this is debatable. For example, compare: ✓ Business Roundtable 2019 ✓ Council of Institutional Investors So, who owns the company? Who should own the company? Any thoughts? stock holders wnwn Let’s try Q 1.4, 1.5, 1.7, 1.8. yes. ‘law of one price’ is one way to put a value. -> only in certain situation 1) 확실성 2) 선수취 bond is less risky because the amount of interest rate is garunteed it’s the same Assets Liabilities traded in the market = can see valuation in the market place = 증권 company ▪ Valuing equities ▪ Value debts Tahemei > 따함 영 vvm " Y Those financial stakes in a company are typically in the form of a security. Imagine you become an equity-holder or a (partial) owner of a company. You will probably be doing so by buying a security that represents a fractional ownership in a company. If there is similarity within the security, then the equity YOU have and the equity OTHERS have would be valued the same – LOOP! If any of them is traded and thus have a price tag, then you can value the entire equity part.

![FORM 0-12 [See rule of Schedule III]](http://s2.studylib.net/store/data/016947431_1-7cec8d25909fd4c03ae79ab6cc412f8e-300x300.png)