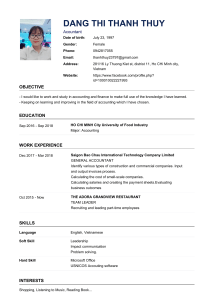

CASE STUDY: BUYING OR RENTING A HOUSE The Minh & Lan family Minh and Lan are a young couple who have been married for 2 years. Minh is 30 years old and Lan is 28 years old. Both husband and wife were students at the University of Economics and now both have stable jobs and incomes. Minh is currently working at a commercial joint stock bank in Ho Chi Minh City, as an assistant manager, with a monthly salary of VND38 million. Lan is currently working as an accountant for a joint venture company, with a monthly salary of VND25million. The couple's income is credited to a joint account used for family’s spending. . Both have a payment account in OCB bank account, average balance is VND50 million, a 1-month savings deposit of VND100 million, interest rate 5%/year, a 3-month savings deposit of VND200 million, interest rate 6%/year. Minh participates in securities investment and currently holds 10,000 shares of Saigon Thuong Tin Company, currently market price is VND18.000 per share , dividend in 2017 received is 14%/year and 20,000 shares of ABC Commercial Joint Stock Bank, currently market price is VND25.000 per share, dividend in 2017 received is 10%/year. Lan bought a 3-month deposit certificate of BIDV bank, total face value is VND80million, interest rate 7%/year. Minh is using an Apple laptop, VND32 million, used for 2 years, depreciated about 40% of its original value. Both have a desktop computer worth VND20 million, used for 2 years, depreciated about 30% of its original value. Lan has some jewelry worth about VND50 million VND. Both of them go to work by motorbike. Minh owns a motorbike worth VND40 million, Lan owns a motorbike worth VND50 million. Both of them are using a Toyota car bought on installments for 5 years, worth VND530 million, and Minh often drives on vacations or back to their hometown on weekends. The car has been paid in installments for 2 years, the remaining principal debt is VND326 million, the interest rate is 13% per year, the principal and interest are paid monthly is VND12 million, the remaining value of the car to be 80%. They are currently living with Minh's parents in a small townhouse in Binh Thanh District, Ho Chi Minh City, worth VND3.8 billion. The value of the interior of the house is VND300 million. Because the parents' house is a bit cramped and they want to create a private life, the two plan to move out. Minh's parents also promised to give them VND1 billion when they buy a house. Minh and Lan are considering to buy an apartment near their parents ' house. However, the price is currently quite high, and if they buy a house, they will have to borrow more from the bank. Lan has just found out that she is pregnant and will give birth in 8 months. Minh's parents are very happy and told Minh and Lan to stay with them so that they can help take care of the baby while they both go to work. Minh also thought about the option of staying with his grandparents, then saving up and buying a house later. However, Lan wants to have her own apartment, spacious and modern when she has a baby so that her daily activities can be more convenient and independent. Minh and Lan's average monthly expenses in 2017 are as follows: Food expenses: 10 million VND Clothing cost: 2 million VND Electricity bill: 1.2 million VND (shared with parents) Water bill: 0.3 million VND (shared with parents) Phone cost: 0.8 million VND Travel expenses: 1 million VND (gas, car repairs) Medical examination and treatment costs: 1 million VND Entertainment and travel expenses: 3 million VND Gift: 1 million VND Others: 0.5 million VND Minh and Lan both have credit cards with a limit of VND100 million each. They both know how to spend reasonably, try to maintain monthly debt payments on time, and spend about VND6 million on both credit cards. I. Prepare balance sheet and cash flow statement of Minh and Lan. II. Based on the calculation formulas learned in chapters 5,6,7 of the text book - Analyze the proportion of liquid assets and investment assets to total assets. Comment on whether the savings and investment levels are reasonable? - Analysis of the ratio of short-term and long-term debt payable to total capital. The ratio of total debt to surplus assets and comments on debt repayment ability. - Analysis of the ratio of networth to total assets 1. Comments and analysis of Minh and Lan's cash flow statements - Analyze the stability of main sources of income - Analyze the proportion of variable and fixed costs in total costs. Comment on whether monthly expenses are reasonable? - Analyze the ratio of total monthly debt to monthly income and comment on the surplus or deficit in monthly expenses. III. Problem solving and making decision 1. Buying an apartment After analyzing the balance sheet and the current cash flow statement, Minh and Lan realized that they could afford to buy an apartment for about VND4 billion in installments. The couple's long-term goal is also to own an apartment and move out. They both went to find information about apartments in Binh Thanh District near their parents' house, getting information about bank loan interest rates: - Found an apartment with an area of 120m2, 1 living room, 2 bedrooms at Nguyen Ngoc Phuong apartment, Binh Thanh District, priced at 3.8 billion VND. - If they borrow from the bank to buy a house in installments within 10 years, the bank will lend up to 70% of the house value. Minh and Lan must have 30% down payment. The loan term is 15 years and the loan average interest rate is 12%/year, interest calculated on decreasing balance. - If renting a similar apartment, the monthly rent is VND15million. 2. Options There are 3 options given to Minh and Lan. a. Getting bank loan to buy house in installments b. Rent an apartment for 2-3 years and save up to buy a house. c. Live with parents for 2-3 years and save up to buy a house 3. Requirements Minh and Lan need to plan their personal finances to solve the housing problem, deciding whether to buy a house, rent a house or continue living with their parents. Help them to prepare a personal balance sheet (expected) and a cash flow statement (expected) for Minh and Lan for each of the above options. Assume that Minh and Lan's jobs do not change and their income is stable. Savings and investment items remain unchanged. Regarding monthly expenses, Minh and Lan cut their credit card spending from 5 million to 3 million, to save for expenses arising from having a baby. Expenses for the baby such as milk, clothes, diapers, hiring a maid, etc. are planned at 15million/month. Analyze each option and make a decision on which of the three options to choose. The selected option must ensure optimal short-term financial resources, as well as achieve short-term and long-term financial goals.