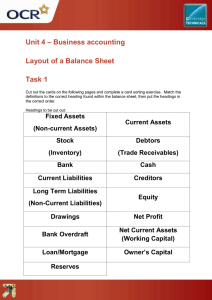

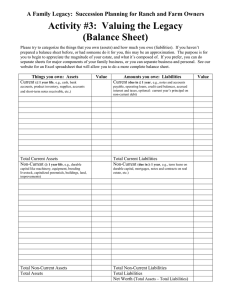

19/02/2025 Chapter 33 Finance Key TERMS: 1. Asset-An item of monetary value that is owned by a business. 2. Cost of sales: The direct cost of goods that were sold during the financial year. 3. Current assets: Assets that are either cash or likely to be turned into cash within 12 months. 4. Current liabilities: These are debts that have to be paid by the business within a year. 5. Depreciation: The decline in estimated value of a non-current asset. 6. Dividends: The share of the business’s profits that have to be paid to shareholders. 7. Expenses: The overhead costs that arise in operating the business, which are deducted from gross profit to calculate profit from operations. 8. Gross profit: This is the amount obtained after deducting cost of sales from revenue. 9. High quality profit: Profit that can be repeated and sustained. 10. Intangible assets: These are items of value that do not have a physical presence such as trademarks and copyrights. 11. Intellectual property or capital: The intangible capital of a business that includes human capital, such as skilled labour, structural capital such as databases and relational capital like good links with suppliers. 12. Liability: A financial obligation of a business that is required to pay in the future. 13. Low quality profit: This is a once off profit that cannot easily be repeated or sustained. 14. Net book value: The current statement of financial position value of a non-current asset= original cost less accumulated depreciation. 15. Net current assets: The amount of capital needed for day to day activities, it is also referred to as working capital(= current assets-current liabilities). 16. Net realisable value: The amount for which inventory can be sold minus the cost of selling it. 17. Non-current assets: These are assets kept and used by the business for more than one year. 18. Non-current liabilities: The value of debts of the business that are payable after more than a year. 19. Profit for the year (profit after tax): This is profit before tax less profit (corporation) tax. 20. Profit from operations (operating profit): Gross profit less overheads/ expenses. 21. Reserves: Accumulated retained profits and capital reserves from re-valuation of non-current assets. 22. Retained earnings: Profit after tax in a company rather than paid out to shareholders as dividends. 23. Share capital: The total value of capital raised from shareholders by the issue of shares. 24. Shareholders’ equity: The total value off assets less total value of liabilities. 25. Statement of financial position: A financial statement that records the value of a business’s assets, liabilities and shareholder’s equity at one point in time, also known as a balance sheet. 26. Statement of profit or loss: A financial statement that records the revenue, costs and profit (or loss) of a business over a given period of time also known as income statement. 27. Straight line depreciation: A constant amount of depreciation is subtracted from the value of an asset each year. 28. Trade accounts receivables (debtors): The value of payments to be received from customers who have bought goods on credit. 29. Trade accounts payables (creditors): The value of debts for goods bought on credit payable to suppliers.