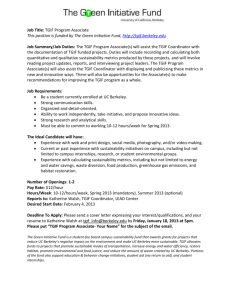

Trading Daily Review: Technical Analysis & Market Structure

advertisement

Friday January 24,2025 - Daily Review - Daily Chart On th! daily chart : Th! market Trad! up from th! +OB & overtak! th! -FVG to trad! to th! Rejection Block. What day does this happen ? Wednesday. What can w! expect for today’s trading ? W! hav! an expansion to th! upsid! all th! Week. That can b! a Good Friday to se! a TGIF Setup tak! place. TGIF Clarication It’s not every Friday ! W! need som! conditions to se! a TGIF Heppen : - • W" need to se" a HTF Premium or Discount Level Hit • Unilateral Week 60m Chart & Th" fact that this High Hit Th" Rejection Block on Th" Daily Chart & This Happen On Wednesday I don’t want to se" this High Taken Out & Trap traders on th" breackout They don’t trust this down mov! after this - * Trap Traders On Th" Breackout B B On th! 60min Chart now : What resting abov! this Old High ? Buystops ES at th! sam! tim! form a Higher High And What’s Happened befor! th! mov! that go to th! Buystops ? Let’s tak" a closer look : Th" market fall rst and eliminates th" Sell Stops, why does it do this rst ? This is inducing short… So it generates liquidity even through w" know it’s going to fall, it consolidates so w" lik" thes" types of moves Th" market goes down, Sell Stops, other traders will also go short, so th" pric" goes up ag#inst thes" traders And ag#inst thos" who ar" already short by going abov" th" STH, th" algorithm will attack this Buy Stops Liquidity Pool and that will also punish new buyers. Whenever a signicant pric" drop is expected always anticipat" som" measur" of Stop Run, BuyStops, STH and vic" versa when w" look for Higher Prices - & - & 15m Chart A Body Tell You What Her! ? & 2022 Model - Shift In Market Structure - Measuring Gap REQL’s - Ther! is a lot of orders resting abov! this Old High in a form of BuyStops Look How Smooth This Highs Are… «Smooth Edges Tend To B! Mad! Jagged» Th! body tell you her! a good story, they hav! run th! BuyStops and at th! sam! tim! ES form a Higher High BUT how is th! body on ES ? Higher -> Body SMT · W! hav! a Shift In Market Strcut"r! so w! hav! now a good conrmation that th! market start moving for lower price, Buysid! Enga$ed -> Shift In Market Structur! -> Displacement (-FVG) -> Bearish Bias - HTF PD Array - BuyStops = - & 2022 Model - Sellstops 09.30am Openi%g Bell Trad! on Prop Firm Account Swing is a fak! run that tricks peopl! into chasing it Juda Swing - Aso Juda they ar! out of th! game, this goes to a very specic PD Array Médium & High Impact News Tend To Creat! Th! Juda Swing 3 Driv! Pattern Abov! Liquidity Pool Insid! HTF PDA Equals Highs W! Open At 09.30am With a Small Premium Openi%g Rang! Gap Th! Market start to mov! lower and lled th! Openi%g Rang! Gap Drop Insid! Midnight Openi%g Rang! (It’s also th! sam! rang! as th! Daily V.I. Algorithmic Referenc! Points W! start to mov! higher after touching th! Midpoint or Equilibrium of th! Midnight Openi%g Range. Why Midpoint or EQ ? It’s a rang! measur! with candl! not a Ineciencie. Midnight Open W! hav! a shift in market structur! and start to mov! higher in th! direction of th! EQH’s on th! HTF chart (Previous Daily High) What happened abov! th! Buysid! & At th! 60m Rejection Block ? W! hav! a 3 Driv! Reversal Pattern -> It’s not always a reversal that can b! just a temporary retracement befor! a trend continuation but in our cas! here, w! hav! th! Friday TGIF environment. When th! market go below th! 2nd Low (Green Circle) that’s wher! w! can start to look for entry. # Personal Funds Execution - Full TGIF & Weekly Chart With TGIF FIBO Th! Entry : My entry is based on : • W" performed th" Juda Swing With Th" High Impact News 3 • W" hit th" Rejection Block 60m • Just befor" hit this Rejection Block a 3D Pattern was form • I Had th" conrmation following th" break of th" 2nd Low • -IFVG - Why I’m anticipat! th! TGIF start during th! AM Session and not during th! Lunch Hour or PM Session ? - Becaus! Wednesday form th! High of th! week & not friday i don’t want to se! an expansion start during th! AM Session If ther! had not been this Juda Swing at 09.30am when th! market opened, in other words if w! had continued to ris! without reversing then i would expect a Lunch Hour or between 1.30pm / 2.0pm for a reversal. My exit on 0.30% of th! Weekly Rang! & agre! with th! PDL Sellsid! Liquidity Homework For You : Study this execution in depth