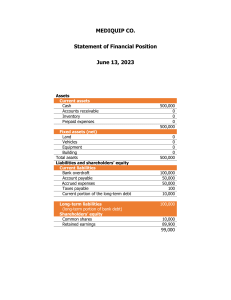

Finance – Financial Management ANNUAL REPORT: The annual report is issued annually to its stockholders, containing two types of information or divided into two parts, the first one is a verbal section, that describes management analysis of the firm's operating results during the past year along with developments and operations that will affect future operations, and the second one is a quantitative section that provides and represents 4 basic financial statements, that are closely related to one another and collectively provide an accounting picture of the firm’s operations and financial position. Both parts are equally important, financial statements report what has happened to its assets, earnings, and dividends, whereas the verbal part explains why things turned out the way they did and some estimated future predictions based on current scenarios and situations. Four Basic Financial Statements: 1. Balance Sheet: Snapshot of a firm’s financial position, at s specific point in time. It shows what assets the company owes (assets on the left side) and who has claims on these assets as of a given date (liabilities and stockholder’s equity on the right side). On the left-hand side, assets on the right are further divided into two main categories: current assets and non-current/fixed/long-term assets. Current assets are the assets that can be converted into cash within one year, including cash and cash equivalents, accounts receivables, and inventories. Non-current/long-term assets are expected to be used for more than one year, including plant, land building, tools and equipment, and machinery in addition to intellectual property like patents and copyrights, whereas plant and equipment are generally reported net of accumulated depreciation. On the right-hand side, claims against assets are of two basic types: liabilities (money that a company owes to a third party) and stockholder’s equity (money that a company owes to its owners/shareholders). Liabilities on the right-hand side are divided into two categories: current liabilities, the claims that must be paid off within one year, including accounts payable, accruals (accrued wages and accrued taxes), and notes payable to banks and other lenders, due within one year, whereas, non-current/long-term liabilities include long term debts and bonds payables and other long term financings on credits and loans with maturity for more than one year (accounting period). Stockholder’s equity, the owner’s claim in business can be thought of in two ways, firstly, it’s the amount that stockholders paid to the company when they bought shares of the company to raise its capital, and secondly, it’s all of the earnings the company has retained over the years. Retained earnings are just not the earnings the company has retained in the last year, it’s the cumulative total of all of the earnings the company has earned and retained its life. Assets, as well as liabilities on the balance sheet, are listed, by the length of time before they will be converted to cash or, in the order in which they must be paid off. In assets, current assets will be at the top, and among all current assets first would be cash and cash equivalent, on second and third accounts receivables and inventories and other current assets, and lastly, under the non-current assets all the fixed assets with more than one year life will be listed. Similarly in liabilities, current liabilities will be at the top, and among all of the current liabilities accounts payable will be listed first as they will be paid within a few days, on second there will be accruals as they will be paid promptly on the third note payables to banks and other lender will be listed as they must be paid within one year, and lastly, under the non-current liabilities, all the long term debts and bonds payable will be listed. Some additional important points in the balance sheet are: i. Only cash and cash equivalents represent actual spendable money or cash in hand, whereas among other current assets, accounts receivables represent credit sales that have not been collected yet, and inventories represent the cost of raw material, work-in-process, and finished goods, and no-current/fixed assets represent costs of buildings, land, tools and equipment, and machinery used in operations minus depreciation that has been taken on these assets. Non-cash assets do generate cash over time but do not represent the total amount of cash in hand. And the cash these would bring in if they were sold today could be higher or lower than the values reported on the balance sheet. ii. Current assets are often called working capital because these assets turn over, that is, they are used and then replaced throughout the year. When a company buys inventory items on credit, its suppliers, in effect, lend it the money used to finance the inventory items. A company could have borrowed from its bank or sold stock to obtain the money, but it received the funds from its suppliers. These loans are shown as accounts payable and are typically free in the sense that they do not bear interest. Similarly, the company pays its labor every two weeks, and pays taxes quarterly, so allied labor forces and tax authorities provide it with loan/liability in terms of accrued wages and taxes payable, these are collectively termed accruals. In addition to these free sources of credit, a company borrows some money from banks on a short-term basis, but unlikely to other liabilities company must have to pay a certain amount of interest and the maturity of these borrowings would be less than or equal to one year, these are called notes payables, and these are as well can be signed with other lenders. These all collectively represent current liabilities and by subtracting current liabilities from current assets we will get Net Working Capital or Working Capital. iii. Net Operating Working Capital (NOWC) differs from Net Working Capital (NWC) in two ways: First NOWC makes a distinction between current assets by subtracting the excess cash that is being held for other/financing purposes from the cash that is used for operating expense, giving the operating current assets, and on second NOWC makes a distinction between current liabilities by subtracting the interest-bearing current liabilities that are generally treated as financing cost (notes payables) from the free liabilities that are generally treated as operating cost (accounts payables, accruals and other operating liabilities), giving operating current liabilities and by subtracting operating current liabilities from operating current assets we will get Net Operating Working Capital. iv. Most companies finance their assets with a combination of short-term debt, long-term debt, and common equity. Some companies also use hybrid securities such as preferred stock, convertible bonds, and long-term leases. Preferred stock is a hybrid between common stock and debt, while convertible bonds are debt securities that give a bondholder an option to exchange their bonds for shares of common stock. In the event of bankruptcy, debt is paid off first, and then preferred stock and common stock are last in receiving the payments only when something remains after the debt and preferred stock are paid off. v. Most companies prepare two sets of financial statements one is based on Internal Revenue Service (IRS)/other state tax rules and is used to calculate taxes, and the other is based on GAAP/IFRS and is used for reporting to investors. Firms often used accelerated depreciation for tax purposes but straight-line depreciation for stockholder reporting. vi. Companies generally use GAAP/IFRS to determine the values reported on their balance sheets, and in most cases, these reported values of assets (book values) differ from the amount at which assets would be sold in the market and that amount is called market value. Under accounting standards, the company must record and report the value of an asset at its historical cost less accumulated depreciation. vii. The balance sheet is a snapshot of the firm’s financial position at a point in time. Therefore, the balance sheet values change now and then and are only finalized at the year's end. viii. Inventories can be valued by several different methods chosen can affect both the balance sheet value and the cost of goods sold and net income in the income statement as all four financial statements are interlinked. ix. Few firms use preferred stock, it can take several different forms, but it is generally like debt because it pays a fixed amount each year. However, it is also like common stock because a failure to pay the preferred dividends doesn’t expose the firm to bankruptcy. If a firm does use preferred stock, it is shown on the balance sheet between total debt and common stock. There is no set rule on how preferred stock should be treated when financial ratios are calculated, it could be considered as debt or as equity. Bondholders often think of it as equity, while stockholders think of it as debt because it has a fixed charge. 2. Income Statement: reports a firm’s revenue, expenses, and profit/loss during a reporting period of a company. Net sales are shown at the top of the statement, and then operating costs, interest, and taxes are subtracted to obtain net income available to common stockholders. Earnings and dividend per share, in addition to some other data. Earnings per share is often called the bottom line denoting that of all items on the income statement, EPS is most important to stockholders. A typical stockholder focuses on the reported EPS, but professional security analysts and managers differentiate between operating and non-operating income. Operating income is derived from the firm’s regular core businesses. It is an earnings from operations before interest and tax (EBIT). And can be calculated by subtracting operating costs from sales revenue/service revenue/net sales/net revenue. Different firms have different amounts of debts, different tax carrybacks, and carry-forwards, and different nonoperating assets such as marketable securities. These differences cause two companies with identical operations to report significantly different net incomes. For example, two companies have identical sales, operating costs, and assets, however, one company uses debt, and the other company uses only common equity, despite the similar operations, sales, and assets, a company with no debt and interest-bearing expense will have higher net income. Similarly, if two companies are being compared based on their operating performances then it is best to focus on their operating income. Operating income is considerably important as managers are generally compensated on the performance of the units they manage. A division manager can control their division’s performance but not the firm’s capital policy or the corporate decisions, and if one firm is considering acquiring another it will be interested in the value of the target firm’s operations and that value is determined by the target firm's operating income. Operating income is more stable than total income, as total income is heavily influenced by write-offs of bonds backed by mortgages and the like, therefore analysts focus on operating income for long-run stock values. In income statements depreciation and amortization are important components of operating costs, depreciation is an annual charge against income that reflects the estimated dollar cost of the capital equipment and other tangible assets that were depleted in the production process, and amortization amounts the same thing except that it represents the decline in value of intangible assets such as patents, copyrights, trademarks, and goodwill, as amortization and depreciation are similar they are generally lumped together and even thou they are reported as costs in an income statement, but they are not cash expenses so managers, analysts, officers and who are concerned with the amount of a cash a company is generating often calculate earnings before interest, tax, depreciation, and amortization EBITDA. As the balance sheet represents the snapshot of the company’s financial position (its assets and claims on those assets) in time, the income statement represents or reports operations over time. Most importantly income statement is tied to the balance sheet through the retained earnings account on the balance sheet. Net income as reported on the income statement less dividends paid is the retained earnings for the year. Those retained earnings are added to the cumulative retained earnings from prior years to obtain the current year-end balance for retained earnings. The retained earnings for the year are also reported in the statement of stockholders’ equity. 3. Statement of Cash Flows: this is a report/financial statement that shows how much cash is being produced or generated by the company through its operating, investing, and financing activities. Net income on an income statement is not cash, and in finance cash is king. Management’s goal is to maximize the price of the firm’s stock and the value of any asset under its ownership, including a share of stock, is based on the cash flows the asset is expected to produce. Therefore managers strive to maximize the cash flows available to investors. This statement is divided into 4 parts: I. Operating Activities: this section deals with items that occur as part of normal ongoing operations. These operations include net income; if all sales were cash, if all costs required immediate cash payments, and if the firm were in a static situation net income would equal cash from operations, however, these conditions do not hold so net income is not equal to cash from operations and needed few adjustments, depreciation and amortization, increase/decrease in inventory, increase/decrease in accounts receivables and payables, and many more operating activities that affect inflow and outflow of cash by as a result of doing business operations, must be included in this section. Collectively these all will provide net cash from operating activities. II. Investing Activities: all activities including long-term assets, and the purchase and sale of short-term investments and marketable securities, other than trading securities and bonds and lending and collecting on notes receivables and other investing activities affecting the cash flows of the company will also be added. Collectively these all will provide net cash from investing activities. III. Financing Activities: this section outlines the inflow and outflow of cash used to fund the business for a given period. These activities include the issuance and repayment of equity (issuance of stock), payments of dividends, issuance and repayment of debt, capital lease obligations, and increase and decrease in notes and bonds payables (short and long-term interest-bearing liabilities), and other financing activities that fund the business affecting the cash flow must be included as well. Collectively these activities provide net cash from financing activities. IV. Summary: This section summarizes the changes in cash and cash equivalent over a year or accounting period and gives the net balance of cash and cash equivalent. And, when the net balances of these four sections are added it will provide the net cash flow balance (either positive or negative). 4. Statement of Stockholders’ Equity: this statement shows, how much a firm’s equity changed during the year and why this change occurred. Retained earnings represent a claim against assets. Stockholders allow management to retain earnings and reinvest them in business. Thus retained earnings as reported on the balance sheet do not represent cash and are not available for dividends or anything else. Uses and Limitations of Financial Statements: Uses of Financial Statements Limitations of Financial Statements Performance Evaluation: Financial statements provide insights into the financial performance of an organization, enabling stakeholders to assess profitability and efficiency. Financial Position Analysis: Balance sheets give a snapshot of the company’s financial position at a specific point in time, including assets, liabilities, and equity. Investment Decisions: Investors use financial statements to make informed decisions about buying, holding, or selling equity in a company. Credit Decisions: Creditors and lenders analyze financial statements to determine a company’s creditworthiness and ability to repay loans. Regulatory Compliance: Companies use financial statements to comply with statutory requirements and regulatory bodies’ mandates. Tax Assessment: Tax authorities use financial statements to assess the tax liabilities of an organization. Historical Nature: Financial statements primarily reflect past performance and may not accurately predict future performance. Limited Scope: Financial statements do not capture non-financial factors such as market conditions, management quality, and brand value. Potential Bias: Management has some discretion in selecting accounting policies and estimates, which can introduce bias or manipulation. Valuation Methods: Different accounting methods (e.g., LIFO vs. FIFO) can significantly impact reported financial results. Historical Costs: Assets are often recorded at historical cost, which may not reflect their current market value. Non-Cash Items: Financial statements include non-cash items like depreciation and amortization, which may not reflect current cash flow realities. Comparative Analysis: Financial statements allow for comparison Complexity and Understandability: Financial statements can be between different periods and with other companies in the industry. complex and difficult for non-experts to understand without proper analysis. Strategic Planning: Management uses financial statements for strategic Timeliness: Financial statements are often prepared and published after planning, budgeting, and forecasting future financial performance. the reporting period, leading to delays in obtaining current information. Merger and Acquisition Analysis: Potential acquirers review financial statements to evaluate the financial health and value of a target company. Dividend Policy Decisions: Financial statements help determine the capacity of the company to pay dividends to its shareholders. Fraud and Errors: Financial statements are subject to fraud and errors, which can mislead stakeholders. Omissions: Some significant information, like the impact of inflation and economic conditions, may not be fully captured in the financial statements. Free Cash Flow: Free cash flow is the amount of cash that could be withdrawn without harming a firm’s ability to operate and produce future cash flows. Accounting statements are designed to be used by creditors, investors, tax officers, and other external users, and are not for managers and stock analysts, for corporate users these statements are often modified to meet their needs. The positive FCF indicates that the firm is generating more than enough cash to finance current investments in fixed assets and working capital. By contrast, negative FCF indicates that the company doesn’t have sufficient internal funds to finance investments in fixed assets and working capital, and there will be a need to raise new money in capital markets to pay for investments. Market Value Added (MVA) & Economic Value Added (EVA): Items reported on financial statements reflect historical values (past values), not the current market values, and there is always a substantial difference between these two. Changes in interest rate and inflation rate affect the market values of the company’s assets and liabilities but often do not affect the corresponding book values reported in statements. Perhaps more importantly the market’s assessment of value takes into account its ongoing assessment of current operations as well as future opportunities. The accounting statements do not reflect market values, so they are not sufficient for evaluating managers’ performances. For this reason, analysts have developed two additional performance measures, the first is MVA market value-added, the excess of the market value of equity over its book value, and it simply is the difference between the market value of equity and book value of equity. The higher the MVA the better the job management is doing for the firm’s shareholders, still most firm's stock price rises in a rising stock market, so a positive MVA may not be entirely attributable to the performance of management. Thus the second measure is EVA economic market value, the excess of non-operating profit after tax over capital costs. Companies create value and realize positive EVA if the benefits of their investments exceed the cost of raising capital. EVA is an estimate of a business’s true economic profit for a given year and it often differs sharply from net income, and the main reason is that accounting income takes into account the cost of debt (the company’s interest expense), it does not deduct for the cost of equity capital, whereas, EVA takes into account the total dollar cost of all capital, which includes both the cost of debt and equity capital. If EVA is positive then after-tax operating income exceeds the cost of capital needed to produce that income, and management’s actions are adding value for stockholders. Positive EVA on an annual basis will help ensure that MVA is also positive. Where MVA applies to the entire firm, EVA can be determined for divisions as well as for the company as a whole, so it is a useful guide to reasonable compensation for divisional as well as top corporate managers. Income Taxes: Individuals and corporations pay out a significant portion of their income as taxes, individuals pay taxes on wages and salaries, on investment income (dividends, interest, and profits from the sale of securities), and profit of proprietorship and partnership. Taxable income is defined as a gross income less a set of exemptions and deductions. The progressive tax system is where the tax rate is higher on higher incomes and lower on lower incomes. When filing a tax return (individual tax rate) in the current year for the previous year, taxpayers receive an exemption of some amount which reduces the taxable income. However, this exemption is indexed to rise with inflation and exemption is phased out or taken away for high-income taxpayers. Certain expenses including mortgage interest paid, state and local income tax paid, and charitable contributions can be deducted and thus used to reduce the taxable income but again high-income taxpayers lose most of these deductions. The marginal tax rate is defined as the tax rate on the last dollar of income. The average tax rate is taxes paid divided by taxable income. Note that interest income received by individuals from corporate securities is added to other income and thus is taxed at federal rates. Capital gain and losses on the other hand are treated differently. Assets such as stocks, bonds, and real estate are defined as capital assets and when you buy capital assets and later sell it for more than you paid you might earn a profit (capital gain) or loss (capital gain). If you held the asset for a year or less you will have a short-term capital gain or less, while if you held it for more than a year, you will have a long-term capital gain or loss. Depending on how long you hold the stock you will have a short-term or long-term capital gain or loss. A short-term capital gain is taxed at the same rate as ordinary income, however, long-term capital gains are taxed differently. Because corporations pay dividends out of earnings that have already been taxed, there is double taxation of corporate income, income is first taxed at the corporate rate then what is left is paid out as dividends and it is taxed again. The corporate tax structure is relatively simpler than above mentioned individual tax structure. Corporations earn most of their income from operations, but they may also own securities, bonds, and stocks and receive interest and dividend income. Interest income received by a corporation is taxed as ordinary income at the regular corporation tax rate. However, dividends are taxed more favorably. When a corporation receives dividends and then pays out its after-tax income as dividends to its stockholders, the dividends received are subjected to triple taxation. A firm can finance its operations with either debt or stock, if a firm uses stock it is expected to pay dividends and if a firm uses debt it must pay interest. Interest paid can be deducted from operating income to obtain taxable income but dividends paid cannot be deducted. It is generally not possible to finance exclusively with debt and the risk of doing so would offset the benefits of the higher expected income, still, interest (deductible expense) has a profound effect on the way businesses are financed, the corporate tax system favors debt financing over equity financing. Ordinary corporate operating losses can be carried backward for years and carried forward for 20 years to offset taxable income in a given year. A consolidated tax return is a corporate income tax return of an affiliated group of corporations that elect to report their combined tax liability on a single return. This tax return allows for corporations that run their business through many legal affiliates to be viewed as one single entity. Common items that are consolidated include capital gains, net losses, and certain deductions, such as charitable contributions or net operating losses. If a corporation owns more of another corporation's stock, it can aggregate income and file one consolidated tax return. This allows the losses of one company to be used to offset the profits of another. No business wants to incur losses, but tax offsets make it more feasible for large, multidivisional corporations to undertake risky view ventures or ventures that will suffer losses during a developmental period. Tax allows small businesses that meet certain conditions to be set up as corporations and thus receive the benefits of the corporate form of organization, especially limited liability yet still be taxed as proprietorships or partnerships rather than as corporations. These corporations are called S corporations (regular corporations are c corporations), a small corporation that under subchapter S of the Internal Revenue Code, elects to be taxed as a proprietorship or a partnership yet retains limited liability and other benefits of the corporate form of organization. Because the income is taxed only once, this is an important benefit to owners, this is an important benefit to the owners of small corporations in which all or most of the income earned each year is distributed as dividends similar to LLCs (A limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. As with corporations, the LLC legally exists as a separate entity from its owners. Therefore, owners cannot typically be held personally responsible for the LLC's debts and liabilities.). LLCs and S corps have much in common: Limited liability protection. The owners of LLCs and S corporations are not personally responsible for business debts and liabilities. Instead, the LLC or the S corporation, as the owner of the business, is responsible for its debts and liabilities. S corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on corporate income. S corporations are responsible for tax on certain built-in gains and passive income at the entity level. To qualify for S corporation status, the corporation must meet the following requirements, be a domestic corporation. Have only allowable shareholders. May be individuals, certain trusts, and estates, and it may not be partnerships, corporations, or non-resident alien shareholders. Have no more than 100 shareholders. Have only one class of stock. Not be an ineligible corporation (i.e. certain financial institutions, insurance companies, and domestic international sales corporations). Depreciation also plays an important role in income tax calculations, the larger the depreciation, the lower the taxable income, the lower the taxable bills, and therefore the higher the operating cash flows.