Global Semiconductor & Electronic Parts Manufacturing Report 2024

advertisement

Global Manufacturing • C2524-GL

Global Semiconductor &

Electronic Parts

Manufacturing

Demand intensifies: for semiconductor manufacturers, the only thing faster

than innovation is the race to keep up with it.

Evan Jozkowski

Published December 2024

2024 IBISWorld. All Rights Reserved

www.ibisworld.com

About

IBISWorld specializes in industry research with coverage on

thousands of global industries. Our comprehensive data and indepth analysis help businesses of all types gain quick and

actionable insights on industries around the world. Busy

professionals can spend less time researching and preparing for

meetings, and more time focused on making strategic business

decisions

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Table of Contents

Standard Report

1. About

........................................................................................................

1

International Trade

.................................................................................

16

Definition

......................................................................................................

1

Imports

.......................................................................................................

16

............................................................................................................

1

Exports

........................................................................................................ 17

.........................................................................................

1

5. Geographic Breakdown

...................................................................................................

1

Key Takeaways

.....................................................................................

1

Business Locations

............................................................................................

2

6. Competitive Forces

Codes

What's Included

Companies

Related Industries

Related Terms

Additional Resources

19

19

................................................................................

Key Takeaways

........................................................................................

Concentration

..........................................................................................

21

...................................................................................................

3

Barriers to Entry

.....................................................................................

22

..............................................................................................

23

3

Substitutes

...........................................................................

3

Buyer & Supplier Power

Key External Drivers

...............................................................................

3

..........................................................................................

...........................................................................................................

4

8. External Environment

Key Takeaways

............................................................................................

Industry Structure

...................................................................................

Executive Summary

......................................................................

24

7. Companies

..........................................................................................

26

3

Key Takeaways

.......................................................................................

26

4

Companies

...............................................................................................

32

.......................................................................................

32

.................................................................................................

32

................................................................................

4

Key Takeaways

........................................................................................

5

Highlights

Key Takeaways

..........................................................................................

5

External Drivers

5

Regulation & Policy

Performance Snapshot

..........................................................................

Current Performance

.....................................................................................

..............................................................................

...............................................................................

7

Assistance

Volatility

......................................................................................................

9

9. Financial Benchmarks

Outlook

...............................................................................................

.......................................................................................

36

.................................................................................................

36

10

Key Takeaways

11

Highlights

4. Products and Markets

....................................................................

13

Cost Structure

.........................................................................................

13

Key Ratios

..................................................................................................

13

10. Key Statistics

..........................................................................

13

Industry Data

..........................................................................................

15

11. Key Success Factors

Major Markets

34

36

......................................................................................................

Products and Services

32

33

...................................................................

Life Cycle ....................................................................................................

Key Takeaways

26

....................................................................

3. Performance

3

21

2

3

Products and Services

Highlights

21

..............................................................................

Major Players

SWOT

19

.........................................................................

...........................................................................................

2. At a Glance

Highlights

.................................................................

........................................................................................

........................................................................................

................................................................................................

36

37

..................................................................................

39

..........................................................................................

39

......................................................................

41

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

About This Industry

Definition

This industry manufactures electronic components, which are typically packaged in a discrete form with two or more connecting leads or

metallic pads. Connecting these parts by soldering them to a printed circuit board creates an electronic circuit. A semiconductor device is an

electronic component made with semiconductor material, such as silicon.

Codes

What's Included

• Semiconductor manufacturing

• Bare printed circuit board and printed circuit assembly manufacturing

• Capacitor manufacturing

• Coil, transformer and other inductor (electronic) manufacturing

• Connector manufacturing

• Electron tube and part manufacturing

• Liquid Crystal Display unit screens manufacturing

• Resistor manufacturing

• Transistor manufacturing

• Other electronic component manufacturing

Companies

• Taiwan Semiconductor Manufacturing

Company

• Intel

• Samsung

• Qualcomm

• Broadcom

• SK Hynix

• Micron Technology

Related Industries

Domestic industries

Competitors

Complementors

• Global Consumer Electronics Manufacturing

• Global Household Cooking & Appliance Manufacturing

• Global Computer Hardware Manufacturing

• Global Automobile Engine & Parts Manufacturing

International industries

• Semiconductor & Circuit Manufacturing in the US

• Circuit Board & Electronic Component Manufacturing in the US

• Semiconductor & Other Electronic Component Manufacturing in Canada

• Audio Visual Electronic Equipment Manufacturing in Australia

• Electronic Component Manufacturing in the UK

• Loaded Electronic Board Manufacturing in the UK

• Semiconductor Manufacturing in China

• Integrated Circuit Manufacturing in China

• Printed Circuit Board Manufacturing in China

1

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Related Terms

INTEGRATED CIRCUIT

A miniaturized electronic circuit (consisting of semiconductor devices and passive components that has been manufactured in the surface of a

thin substrate of semiconductor material.

MICROPROCESSOR

The central processing unit (CPU) of a computer system, microprocessors process system data and controls other devices in the system.

PRINTED CIRCUIT BOARD (PCB)

An electrically insulated board onto which electrical components are assembled and wired together.

PASSIVE ELECTRONIC COMPONENTS

Used to store, filter or regulate electric energy, and include capacitors, resistors and inductors. These components do not require power to

operate.

SEMICONDUCTOR

A material, such as silicon, that has an electrical resistivity between that of a conductor and an insulator.

DYNAMIC RAM

Most common kind of random access memory for personal computers, the PC processor can access any part of the memory directly and its

storage cells must be refreshed every few milliseconds.

LIGHT-EMITTING DIODE

A semiconductor device that emits visible light when an electric current passes through it

DIODE

A device that conducts current in only one direction, and only when the cathode voltage is positive relative to the anode voltage by a specified

amount.

DOPING

A process that introduces impurities into an extremely pure semiconductor for the purpose of modulating its electrical properties.

NAND MEMORY

Also known as flash memory, it is a nonvolatile computer storage chip that can be electrically erased and reprogrammed.

Additional Resources

• Semiconductor Industry Association

• World Semiconductor Trade Statistics

• IHS Markit

• IPC - Association Connecting Electronics Industries

• US Census Bureau

2

www.ibisworld.com

December 2024

Global Manufacturing •

Global Semiconductor & Electronic Parts Manufacturing

At a Glance

Revenue

$1.0tr

Employees

’18-’23

4.7 %

’23-’28

4.1 %

’18-’23

11.3 %

Profit

$181.2bn

2m

Businesses

’18-’23

1.6 %

’23-’28

2.9 %

’18-’23

7.8 pp

Profit Margin

17.9%

20,880

’18-’23

3.2 %

’23-’28

1.6 %

’18-’23

4.0 %

Wages

$145.4bn

’23-’28 3.5 %

Five-year growth rates display historic and forecast CAGRs

Major Players

Company

Key External Drivers

Revenue

Market Share

Taiwan Semiconductor

Manufacturing

Company

$69.1bn

6.8%

Intel

$40.7bn

4.0%

Samsung

$39.7bn

3.9%

Qualcomm

$35.8bn

3.5%

Other Companies

$826.8bn

81.7%

Impact

Global aggregate private investment

Positive

Total value of world trade

Positive

Global internet usage

Positive

Global research and development funding

Positive

World GDP

Positive

Key Takeaways

Products and Services

3

Key External Drivers

Performance

Item

Revenue

Market Share

Printed circuit

assembly

$211.5bn

20.9%

Logic semiconductors

$181.2bn

17.9%

Memory

semiconductors

$93.1bn

9.2%

Analog semiconductors

$82.0bn

8.1%

Electronic connectors

and inductors

$57.7bn

5.7%

Bare printed circuit

boards

$42.5bn

4.2%

Other semiconductors

$177.1bn

17.5%

• 5nm and 3nm process nodes have boosted chip performance.

Manufacturers have enhanced device capabilities and energy

efficiency without significantly changing the physical size of

chips.

• Downstream innovation has driven growth. Semiconductor and

electronic parts manufacturers have worked closely with

automakers, consumer electronics manufacturers, AI

companies and other manufacturers to produce cutting-edge

technology.

• Companies must navigate an increasingly complex regulatory

environment. As tensions between the West and China heat up,

companies are fleeing Chinese markets.

External Environment

• Manufacturers face heavy global regulations. Trade tensions

between China and the United States have influenced the

industry, causing significant upheaval.

• Many governments are readily investing in new semiconductor

foundries. For example, the United States, European Union,

China and Malaysia have set policies to encourage foreign

investment.

www.ibisworld.com

December 2024

Global Manufacturing •

Global Semiconductor & Electronic Parts Manufacturing

SWOT

Strengths

Executive Summary

Demand intensifies: for semiconductor manufacturers,

the only thing faster than innovation is the race to keep

up with it.

High Profit vs. Sector Average

Low Customer Class Concentration

Low Product/Service Concentration

High Revenue per Employee

Weaknesses

High Capital Requirements

Opportunities

High Revenue Growth (2018-2023)

High Revenue Growth (2023-2028)

High Performance Drivers

Threats

Low Outlier Growth

Industry Structure

Characteristic

Level

Concentration

Low

Barriers To Entry

High

Steady

Moderate

Increasing

Regulation and Policy

Life Cycle

Revenue Volatility

4

Trend

Mature

High

Assistance

Moderate

Increasing

Competition

Very High

Increasing

Innovation

Very High

Global semiconductor manufacturers are experiencing rising

demand from downstream consumer electronic, automobile,

computer and industrial machinery companies as digital platform

adoption and AI development have increased. Competition is

rising globally, as the United States and Europe have made

significant investments to catch up to Asian nations who lead in

developing advanced 5nm and 3nm nodes. Despite the

continuous increase in the need for chips, trade conflicts between

the West and China, combined with economic disruptions, have

led to supply chain inefficiencies, causing revenue to shrink at an

expected CAGR of 1.1% to $1.1 trillion through the current period. A

significant drop of 13.4% during 2023 stemmed from economic

slowdowns in regions such as the UK and in 2024, revenue

returned to growth, surging 3.3%. Profit will total 22.9% of revenue

in 2024, declining due to the costly nature of developing smaller

nodes.

The commodity-like nature of semiconductors has fueled the

industry's hectic growth pattern. As process nodes shrink,

manufacturing has become increasingly more complex and

challenging. Architects continuously adjust designs to

accommodate miniaturization requirements while thermal

management innovation is also becoming crucial.

Through the outlook period, companies will develop more

powerful semiconductors and bolster revenue. In particular,

manufacturers will strive to meet smaller, more functional product

requirements. The continued rise of the Internet of Things (IoT)

systems and autonomous vehicles will strengthen demand for

semiconductors and electrical parts. Revenue will swell at an

expected CAGR of 3.7% to $1.3 trillion through 2029. Governments

worldwide will continue to prioritize capacity investment,

integrating AI and new manufacturing approaches into operations,

especially as 2nm and sub-2nm node technology emerge.

Potential conflicts with China threaten the stability of the industry

however, as a full-scale invasion of Taiwan could lead to a

collapse in the market.

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Performance

Key Takeaways

5nm and 3nm process nodes have boosted chip performance. Manufacturers have enhanced device capabilities and energy

efficiency without significantly changing the physical size of chips.

Downstream innovation has driven growth. Semiconductor and electronic parts manufacturers have worked closely with automakers,

consumer electronics manufacturers, AI companies and other manufacturers to produce cutting-edge technology.

Companies must navigate an increasingly complex regulatory environment. As tensions between the West and China heat up,

companies are fleeing Chinese markets.

Performance Snapshot

Revenue

Total value ($) and annual change from 2010 – 2028. Includes 5-year outlook.

1.5

24%

Forecasted

Revenue

1.2

16%

$1.0tr

0.9

8%

0.6

0%

0.3

-8%

0

-16%

’18-’23

4.7 %

’23-’28

4.1 %

2023 Revenue Growth

13.8 %

Decreasing

Revenue Volatility

2010

2012

2014

2016

2018

2020

Annual Revenue ($tr)

2022

2024

2026

High

2028

Change (%)

Source: IBISWorld

5

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Employees

Total number of employees and annual change from 2010 – 2028. Includes 5-year outlook.

3,000,000

24%

Forecasted

2,400,000

16%

1,800,000

8%

1,200,000

0%

600,000

-8%

Employees

2m

’18-’23

1.6 %

’23-’28

2.9 %

Employees per Business

104

’18-’23

1.6 %

’23-’28

1.3 %

Revenue per Employee

0

-16%

2010

2012

2014

2016

2018

Annual Employees

2020

2022

2024

2026

2028

$468k

’18-’23

3.1 %

’23-’28

1.2 %

’18-’23

3.2 %

’23-’28

1.6 %

Change (%)

Source: IBISWorld

Businesses

20,880

Employees per Business

104

’18-’23

1.6 %

’23-’28

1.3 %

’18-’23

1.5 %

Revenue per Business

$48.5m

6

www.ibisworld.com

’23-’28 2.5 %

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Profit Margin

Total profit margin (%) and annual change from 2010 – 2028

40%

45pp

32%

30pp

24%

15pp

16%

0pp

8%

-15pp

0%

-30pp

Total Profit

$181.2bn

’18-’23

11.3 %

Profit Margin

2010

2012

2014

2016

Profit Margin (%)

2018

2020

17.9%

’18-’23 7.8 pp

Profit per Business

$8.7m

2022

Change (pp)

Source: IBISWorld

Current Performance

2018-23 Revenue CAGR -4.7%

What's driving current industry performance?

Manufacturers introduce a series of innovations as demand grows

• The need for passive electronic components like capacitors, resistors, connectors and inductors is rising as they store, filter and regulate

electric energy across various industries. Automotive, medical, aerospace and defense sectors have increasingly adopted these

components. Meanwhile expanding networks and digital entertainment in telecommunications and consumer electronics markets have also

increased demand for multilayer semiconductors.

• The shift to 5nm and 3nm process nodes has enhanced chip power, efficiency, and compactness, which is crucial for AI and 5G. These

advances improve device capabilities and energy efficiency without notably altering physical size constraints. Since 2020, TSMC's N5 5nm

nodes supply companies like Apple, while its 3nm nodes, produced since 2022, assist AMD and NVIDIA in boosting next-generation chip

performance.

• As process node sizes shrink, chip design complexity has grown. Architects are experimenting with multi-core and heterogeneous

computing, combining diverse cores for optimal workloads, alongside specialized accelerators like GPUs and AI chips. Advanced

packaging, including 3D stacking and chiplets, has boosted performance by integrating components without shrinking individual transistors,

maximizing smaller nodes' potential without altering sizes.

• Managing heat and power efficiency in chips has become increasingly challenging. Innovations in thermal management, such as advanced

cooling technologies and power systems, have become crucial to preventing overheating. Manufacturers like Intel and AMD have developed

solutions like liquid cooling and vapor chamber technologies to ensure optimal chip performance without excessive heat buildup.

Asian nations continue to dominate the market while Western countries seek to boost capacity

• Despite the pandemic leading to global shortages and supply-chain inefficiencies, low-wage Asian countries such as China, Singapore and

Taiwan continue to lead as major semiconductor exporters. Many downstream consumer electronics, computer and automotive

manufacturers have factories in the Asia-Pacific region; the industry's manufacturers have moved close to buyers, enabling greater

collaboration and creating stronger partnerships.

• To counteract declines in global chip-making capacity, the $52 billion CHIPS and Science Act, passed in the US in 2022, has encouraged

investment in domestic foundries. Similarly, the European Chips Act, valued at $47 billion, has supported similar initiatives. Post-pandemic,

Western nations are boosting domestic fab production to mitigate supply chain vulnerabilities and enhance competition with Asian markets.

• According to the Semiconductor Industry Association, US FAB capacity reached 10% as of 2022 and avoided a drop to 8% because of the

legislation. In 2022, semiconductor sales from the Americas increased by 16%, while Chinese semiconductor sales decreased by 6%.

7

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Patent conflicts and geopolitical tensions with China have altered trade conditions

• Companies in various countries have accused China of stealing patent information. In particular, ASML, the only manufacturer in the world

making extreme ultraviolet (EUV) photolithography machines, used to turn wafers into semiconductors, has alleged that Chinese workers

stole confidential information. This conflict has led to sanctions on Chinese products.

• In 2022, the United States took decisive steps to distance itself from China's semiconductor sector. After signing the CHIPS Act, the US

banned the sale of advanced computer chips used in AI and supercomputers to China, highlighting a significant shift in tech policy.

• The Netherlands and Japan have also restricted exports of advanced chips to China, while Taiwan has banned Chinese companies, such as

Huawei, from contracting its chip manufacturers. As tensions increase, companies have relocated production from China to Vietnam,

Malaysia, Singapore and the US. These measures have curbed China's technological advancement in chip-making and hindered its

integration into international supply chains.

• With the global semiconductor market increasingly taking action against the country, the Chinese government fired back in May of 2023,

announcing a ban on products from Micron, a US-based semiconductor company, citing undisclosed national security issues.

Consolidation has increased in recent years

• Companies have actively consolidated, acquiring strategic competitors. The deals often focus on acquiring new technology or patents.

Most of the industry's consolidation has occurred between leading players and smaller companies as they seek new methods to gain market

share and solidify positions in niche technology.

• SK Hynix's acquisition of Intel's NAND memory business in 2020 and Renesas Electronics’ purchase of Dialog Semiconductor for $5.9 billion

highlight the ongoing industry trend toward consolidation and expansion. In 2022, Amkor Technology completed the acquisition of the

remaining shares of J-Devices, a major outsourced semiconductor assembly and test (OSAT) provider in Japan, to fully integrate it into its

operations.

• Manufacturers relating to autonomous and electric vehicles have also been active in M&A markets. In 2021, Qualcomm boosted its presence

in autonomous vehicle technology by acquiring Arriver, the driving assistance software platform from Veoneer. This acquisition sought to

enhance Qualcomm's Snapdragon Ride platform, providing a comprehensive solution for autonomous driving systems and strengthening its

competitive position in the rapidly evolving market.

8

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Volatility

High

What influences industry volatility?

Semiconductors are highly commoditized

• Some areas of semiconductor devices, especially within random access memory markets, like dynamic random access memory (DRAM),

random access memory (RAM) and static random access memory (SRAM) sales, face heavy exposure to price fluctuations, acting akin to

commodities and dictating industry trends.

• The consumer electronics and computer markets freely shift alongside consumer sentiment. As more people gain internet access and

consumer spending rises, these markets will exhibit increased stability, limiting volatility.

Yearly innovation can ripple through the market

• Many products, especially logic chips, undergo yearly releases, creating a fast-paced, unpredictable market. Companies that lag on

innovation will endure heavy volatility. This trend is especially true as electronics go through faster update cycles.

• For example, Intel, NVIDIA and AMD release yearly graphics processing units (GPUs) and central processing units (CPUs), primarily relying

on contract manufacturers, to jockey for market share. Recently, Intel's releases have performed poorly against AMD, causing Intel's revenue

to plummet. Intel's latest 13th-generation GPU represents yet another volatile innovation cycle.

Specialized manufacturers face downturns

• Many manufacturers specialize in a single product or market, making them susceptible to shifts in demand or disruptive new products. For

example, SK Hynix's new partnership with NVIDIA to produce HBM3 DRAM has vaulted the company past traditional memory market leader

Samsung.

• Many companies invest heavily in making chips for autonomous vehicles. These semiconductor manufacturers will struggle if automakers

scrap these projects or face setbacks. For example, an Uber self-driving car hit a pedestrian in 2018, leading to suspended testing and

creating a semiconductor production backlog.

• Many companies also produce logic chips for artificial intelligence (AI) computing. Many governments are floating AI restrictions and

regulations that could stifle manufacturers' growth. This technology is in its infancy, but the US government has already drafted regulations

pertaining to AI development and self-sufficiency.

9

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Hazardous

High

Roller

Coaster

Stagnant

Blue Chip

Volatility

Hazardous

Low

Industry volatility vs. revenue growth (2018-2024 CAGR)

Below GDP growth

Above GDP growth

Revenue Growth

Source: IBISWorld

Key Success Factors

How do successful businesses overcome volatility?

Adapt quickly to changing regulations

Manufacturers must adhere to a varying array of regulations globally. Companies must rapidly adapt to shifting labor and environmental

regulations and the latest trade war between the US and China alongside China's Micron ban are examples of rapidly changing regulations.

Have a well-defined strategy

Manufacturers must develop clear strategies and focus on core competencies to remain competitive. Rapid innovation creates an

environment where competitors can quickly overtake others, requiring a directed and well-thought-out strategy.

Outlook

2023-28 Revenue CAGR +4.1%

What's driving the industry outlook?

Governments will continue to invest in manufacturing expansion as competition increaseses globally

• Driven by the CHIPS and Science Act, between 2022 and 2032, the United States is on pace to achieve a 203% increase in chip fabrication

plant production capacity, while the EU aims to double its global market share to 20% by 2030. Canada lags in investment, though it is likely

to pursue a chip partnership with the United States in the years ahead.

• Japan will invest $7.5 billion to boost its semiconductor industry and reduce its reliance on imports. A new chip plant in Kumamoto with

TSMC will focus on automotive and industrial applications. Similarly, South Korea's "K-chips Act" will offer tax credits and the country will

develop a $350 billion semiconductor mega-cluster near Seoul.

• In its pursuit of technological self-reliance, China will invest over $100 billion in firms like SMIC to advance next-generation semiconductor

nodes. By 2025, the goal is for 70% of its semiconductor needs to be met domestically. Investment in raw material operations and fabrication

equipment innovation will also increase, as the country aims to establish a fully integrated domestic supply chain.

Next generation product offerings will rapidly emerge

• Building on 3nm technology, manufacturers will invest heavily in developing 2nm nodes in the years ahead. Manufacturers will face

challenges continuously innovating using traditional silicon design methods and will need to leverage new classes of ultraviolet lithography

10

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

(EUVL) machines. Though extremely challenging to develop, 2nm and sub-2nm nodes will be crucial for high-performance computing

applications, AI software and data centers moving forward.

• As the premier chip developer in the market, TSMC is at the forefront of developing 2nm process nodes and plans to begin mass production

after 2024. Meanwhile, Samsung targets production of 2nm nodes by 2025 and aims for sub-2nm nodes by 2027.

• As manufacturing activity advances to producing 2nm and sub-2nm nodes, resource consumption will surge. . To address this, fabs will

integrate 6D BIM to simulate energy use, optimize facility layouts and enhance resource efficiency. Retrofitting older plants with green

technologies and building new greenfield sites will yield environmental benefits amid rising demands for sustainable practices.

• Due to the complexity and costs of smaller monolithic chips, many companies will turn to chiplets, dividing processors into smaller

interconnected dies to cut costs and risks. Despite their advantages, chiplet adoption will face short-term limitations because of supply

chain complexities and fragmentation challenges, according to the Wall Street Journal. This suggests a gradual adoption rate in the

industry.

AI will shape manufacturing processes moving forward

• Advanced AI tools are set to significantly alter semiconductor manufacturing operations in the future. Deloitte reports that 70% of

executives view generative AI as a transformative business tool. Among these leaders, 28% believe AI's role in enhancing operations and

equipment performance will offer the most value. Meanwhile, 18% consider AI-driven predictive maintenance and diagnostic solutions to be

crucial as well.

• In the coming years, companies like Siemens and IBM will also invest in integrated database systems to unify data across business units and

vast supply chains. Deloitte reports that data modernization, unified platforms and advanced analytics will be paramount. Incorporating

next-gen SaaS will ensure data accuracy, optimizing AI and machine learning to enhance operational efficiency and drive future growth.

• As automation advances, identifying key skills for supervising sophisticated machinery will become essential. Companies will increasingly

focus on specialized training in robotics programming and data analysis for machine oversight. The industry will continue to evaluate areas

where human involvement can be safely diminished in fab operations, enabling more fully automated processes to boost production

efficiency and operational resilience.

China's reunification ambitions with Taiwan pose a threat to the industry's stability

• In an evolving geopolitical landscape, China's reunification ambitions regarding Taiwan heighten fears of an invasion. Disruption of Taiwan

Semiconductor Manufacturing Company (TSMC), a pivotal global player, poses significant risks. According to the economist, Taiwan has a

68% global market share of semiconductor production and produces 90% of the world's most advanced chips.

• A Chinese takeover of Taiwan could lead to potential semiconductor shortages of all types, which would escalate production costs and

delay technological advancements. As companies navigate these challenges, strategic supply chain diversification and investment in

domestic semiconductor capabilities will become critical.

• Even if China fails to reunify with Taiwan, a potential conflict between the United States and coalition forces in the South China Sea in the

future would significantly disrupt maritime trade routes. This scenario would delay not only semiconductor fulfillment orders but also the

delivery of rare earth elements like silicon, cobalt, and lithium, which are crucial for chip production.

Life Cycle

Mature

Why is the industry mature?

Contribution to GDP

Despite declining sharply following the pandemic, the Global Semiconductor and Electrical Parts Manufacturing industry provides an

indispensable product with complete market acceptance.

Market Saturation

The industry is highly fragmented since each product line has specific standards, requiring intensive research and development (R&D) and

unique production methods. For example, Intel and AMD dominate the central processing unit (CPU) market, leaving little room for entrants.

Start-up costs are also extensive, limiting saturation.

Innovation

Product and manufacturing technologies change rapidly in this industry, driven by competition and innovation. Most manufacturers devote

much of their revenue to R&D. R&D expenditures enable the creation of high-tech advancements, driving demand.

Consolidation

11

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Companies have readily consolidated. Many manufacturers target smaller companies with cutting-edge technology. For example, Intel acquired

Tower Semiconductors, and AMD acquired Xilinx in the industry's largest deal ever in 2022. Similarly, SK Hynix has acquired part of Intel's

memory business.

Technology & Systems

The semiconductor fabrication process is a multistep sequence of photographic- and chemical-processing steps during which companies

gradually create electronic circuits on a wafer made of pure semiconducting material. Companies invest in cutting-edge lithographic and other

fabrication machines for more precise and efficient production. Many companies have enlisted help from artificial intelligence and automation

to streamline design and production.

Life Cycle

Indication of the industry’s stage in its life cycle compared to similar industries

Life cycle stage

Quantity Growth

Quality Growth

Maturity

Annual Revenue

Decline

*Growth is based on change in share of economy combined with change in establishment numbers

Source: IBISWorld

12

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Products and Markets

Key Takeaways

Companies rely on innovation. Many manufacturers produce new variations of processors and memory cores to meet customers' needs

and remain ahead of the competition.

Desktop, laptops and phones drive semiconductor sales, but industrial, government and commercial buyers are starting to

order more chips yearly. These electronics find uses in civil projects, defense contracts, vehicles, satellites and other operations.

Demand from communications and consumer electronics manufacturers has skyrocketed. As the usage of digital platforms

accelerates, these markets have bolstered semiconductor and electric parts demand.

Largest Market

$211.5bn

Product Innovation

Very High

Printed circuit assembly

Products and Services

How are the industry’s products and services performing?

Rapid innovation spurs the logic semiconductors segment

• Buyers use logic chips to control the operations of digital devices

by processing digital data. In particular, logic semiconductors

include central processors (CPUs) and graphics processing units

(GPUS), commonly used in consumer electronics and PCs.

• The demand for logic semiconductors has surged because of

advancements in AI and machine learning. Industries are

increasingly integrating AI capabilities into devices, necessitating

powerful processing units like GPUs and specialized logic chips.

Self-driving vehicles rely on GPUs and CPUs, and companies have

developed data processing units (DPUs) to offload intensive tasks

from the CPU.

• SIA reports that logic chip sales increased 1.1% over 2023 (latest

data). Rising competition from Advanced Micro Devices (AMD) and

Taiwan Semiconductors (TSMC), which produces Apple and

NVIDIA processors, has led to rapid technological innovation,

encouraging consumers to upgrade electronics and spurring

demand for logic semiconductors.

Memory semiconductors benefit from steady innovation

• Manufacturers design memory chips capable of holding data and

programs temporarily or permanently, depending on function.

These chips include random access memory (RAM) and solid-state

drives (SSDs). This segment doesn't include memory protection

units (MPUs) and memory management units (MMUs).

• Most RAMs are volatile memory, deleting all data when powered

down; most SSDs are nonvolatile storage and keep data over a

device's lifetime. Since RAM is replaceable and upgradeable on

personal computers, many consumers and businesses have

purchased RAM upgrades over the past five years.

• The rise in cloud storage and services has fueled demand for

memory semiconductors, driven by the need for efficient, highperformance storage solutions. Innovations in memory

technologies, like higher density and energy efficiency in DRAM

13

and NAND flash memory, stem from efforts to create smaller, more

efficient consumer devices.

• Even so, SIA reports that memory chip sales declined 28.9% over

2023 (latest data). The commodity-like nature of semiconductors

can dramatically change yearly and quarterly product breakdowns.

For example, logic semiconductors overtook memory in 2022 as

Intel's new 13th-generation processors hit the market.

Analog semiconductors remain a vital part of audio transmission

• Companies use analog semiconductors in power systems. It

includes two-terminal semiconductors that convert or rectify

alternating current (AC) into direct current (DC). Integrated circuits

(ICs) are microelectronics semiconductor devices comprising many

interconnected transistors and other components.

• The proliferation of Internet of Things (IoT) devices and smart

technology has driven demand for analog semiconductors,

essential for translating physical parameters into electrical signals.

The rise in EV production has increased the need for power

management and conversion systems, leading to greater demand

for analog semiconductors.

• Companies widely use analog semiconductors for voice and music

systems, like public address systems, speakers and amplifiers.

However, in many cases, buyers are replacing analog chips with

their digital counterparts. As a result, SIA reports that analog

semiconductor sales decreased 8.8% in 2023 (latest data

available).

Other semiconductors provide a wide variety of uses

• Semiconductors and related products include semiconductors,

microprocessors, photovoltaic cells, microcircuits and other

electrical components. This segment includes discrete, MCU, MPU,

MMU, sensor and digital signal processor (DSP) semiconductors

and optoelectronics.

• Discrete semiconductors are components that typically perform a

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

single function. Optoelectronics are hardware devices that convert

electrical signals into photon (or light) signals and vice versa.

According to SIA, sensor, DSP, MCU, discrete and opto

semiconductor sales have all risen through the current period.

Printed circuit assembly remains concentrated in high-tech

countries

• The printed circuit assembly segment includes computer and

peripheral printed board assemblies, communications printing

board assemblies, industrial process control board assemblies,

instrumentation printed board assemblies for industrial processing

and printed board assemblies for consumer electronics.

product capabilities, driving growth in tailored PCB solutions.

• Other electronic components serve a massive array of consumer

and industrial needs. For example, manufacturers sell electronic

connectors (e.g. fiber optic connectors), cathode ray tubes and

liquid crystal displays (LCDs) to downstream manufacturers for

many consumer electronics.

Products & Services Segmentation

Industry revenue in 2023 broken down by key product and service

lines.

• Printed circuit assembly requires extremely strict quality control

protocols. Companies require skilled, high-wage workers to

manage quality assurance and design, so technologically

advanced nations, like the United States, Taiwan and South Korea,

dominate this market.

• Automation in manufacturing processes, including printed circuit

assembly, has increased, leading to more efficient production lines

and higher-quality electronic components. To speed up production

and reduce costs, there is a trend towards standardizing

components across different platforms and devices.

Other passive and interconnecting electronic components remain a

stable revenue source

• Bare printed circuit boards (PCBs) include those without mounted

electronic components involving print, perforate, plate, screen,

etch or photo print interconnecting pathways for electric current on

laminates. Bare PCBs require less skilled labor for design and

production, meaning many production facilities are in low-wage

countries, such as China and Malaysia.

• Demand for customized printed circuit boards (PCBs) is increasing

as industries look for greater flexibility in electronics applications.

This trend spans from consumer electronics to industrial machines.

Companies aim to adapt quicker to market needs and enhance

Printed circuit assembly ($211.5bn)

Logic semiconductors ($181.2bn)

20.9%

17.9%

Memory semiconductors ($93.1bn)

9.2%

Analog semiconductors ($82.0bn)

8.1%

Electronic connectors and inductors ($57.7bn)

Bare printed circuit boards ($42.5bn)

Other semiconductors ($177.1bn)

17.5%

Other electronic components ($167.0bn)

What are innovations in industry products and services?

5.7%

4.2%

16.5%

Source: IBISWorld

Very High

Advanced process technologies and chiplets

• Companies have advanced their manufacturing processes beyond 5nm to 3nm nodes and are exploring smaller dimensions, enabling more

powerful and energy-efficient chips. The evolution toward 2nm and sub-2nm node semiconductor manufacturing involves numerous

technological challenges and advancements in lithography, materials and design.

• Samsung has announced its initiative to produce 2nm chips, utilizing its proprietary GAA transistor technology, Multi-Bridge-Channel FET

(MBCFET). Meanwhile, TSMC plans to utilize its EUV lithography and advanced transistor architectures to produce 2nm and sub-2nm chips.

• Chiplet technology has also matured as manufacturers look for opportunities to become more flexible. This allows different processing and

memory functions to be integrated into a single package, improving performance and scalability while reducing costs.

AI optimizes production

• Many companies have integrated artificial intelligence (AI) programs to support production, ranging from design to quality control.

Companies have also partnered with leading AI innovators to create more powerful chips to run more complex programs, creating new

growth opportunities.

• AI can streamline tedious design processes, giving engineers more research and development time. Similarly, AI can read sensor data more

efficiently, improving product quality and reducing production downtime.

14

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Key Success Factors

What products or services do successful businesses offer?

Be an early adopter of new technologies

This industry produces products incorporating a high level of technology, which advances rapidly. In addition, production processes can

involve a high level of technology. Access to the latest technology is essential.

Develop new products

Manufacturers develop, produce and supply complex components often incorporated into complex end products. Production of these

components often requires complex production technologies and highly skilled staff.

Major Markets

What’s influencing demand from the industry’s markets?

Computer and peripheral equipment manufacturers benefit from

growing global internet connectivity

• The computer and peripheral equipment manufacturers segment

includes companies that manufacture computers, laptops, servers,

monitors and other computer-related devices. Computer

manufacturers use semiconductors, namely central processing

units (CPUs), graphics processing units (GPUs) and memory chips,

alongside LED-related products and other electronic components.

• The economy's shift to digital platforms has boosted revenue for

this segment through the second half of the current period, driven

partially by a shift of the global workforce to remote operations.

Rising global internet usage and consumer spending have

encouraged consumers to buy new computers.

5G network implementation bolsters demand from communications

and network equipment manufacturers

• Communication and network equipment manufacturers create

communications and network equipment, including cell phones,

smartphones, routers and modems. The increasing prevalence of

mobile devices and rising internet connectivity worldwide has

facilitated increased demand from this segment.

• Demand from network equipment manufacturers has started to

slow because most developed economies already have network

infrastructure in place, causing this segment to contract slowly.

• Still, introducing fifth-generation (5G) wireless technologies will

buoy industry sales to this market segment over the coming years,

with many of the most advanced economies already accelerating

their 5G rollout.

The transportation sector faces chip shortages following the

pandemic

• The rising number of electric vehicle (EV) sales has increased

demand from automotive manufacturers for semiconductor and

electrical component companies. Many automakers have

implemented more luxurious and intuitive driving and assistance

systems to entice new customers. This trend has required complex

electronic components and semiconductors, particularly for

semiautonomous and autonomous driving programs.

• Many manufacturers will partner with transportation companies to

15

fulfill particular needs and develop new, effective self-driving

systems. For example, General Motors announced a strategic

partnership with Wolfspeed, a growing American semiconductor

company, for new EVs.

• In 2020, this segment fell as supply chain inefficiencies related to

the pandemic led to a sharp drop in automobile sales.

Manufacturers shifted to supply more chips to other downstream

markets, like consumer electronics manufacturing. The automotive

sector's rapid recovery following the pandemic led to a major chip

shortage, causing car prices worldwide to skyrocket.

Consumer electronics manufacturers develop advanced and

interconnected products

• Increased use of internet-enabled devices has led to rising demand

for products embedded with chips and sensors. This segment has

expanded as many consumers in developed nations adopt smart

home technology. Many consumer products, such as thermostats

and lights, increasingly contain chips as the technological

complexity and functionalities of these products become more

comprehensive.

• Semiconductors and electronic components used in computers,

communications and networking equipment are often more

advanced and expensive. In comparison, products in this market

are less expensive because downstream consumers are often more

price-sensitive when buying household appliances.

Manufacturers serve a wide variety of other markets

• Other sources of demand include general industrial markets and

military and government clients. This segment comprises

electronic equipment manufacturers but also focuses on particular

machinery uses.

• Most of these products are used in major infrastructure projects,

defense applications and industrial production, including the

mining and energy sectors. For example, demand from healthcare

machinery manufacturers has increased as more hospitals adopt

advanced products, namely robotic surgery equipment or

monitoring devices.

• Demand from the defense sector can be particularly volatile,

especially if companies have foundries in non-allied nations. For

example, China has recently banned Micron, citing a national

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

security risk.

Major Markets Segmentation

Industry revenue in 2023 broken down by key markets

Communications and network equipment manufacturers ($302.6bn)

29.9%

Computer and peripheral equipment manufacturers ($295.5bn)

Transportation sector ($142.7bn)

Consumer electronics manufacturers ($137.7bn)

Other ($133.6bn)

29.2%

14.1%

13.6%

13.2%

Source: IBISWorld

International Trade

Imports

Moderate

Increasing

What are the industry’s import trends?

China attempts to reduce dependency on foreign semiconductors

• China lacks foundries to produce advanced chips for AI, defense and other cutting-edge technologies. The country relies on Taiwanese

semiconductors for most of these chips; however, in recent years, the US has stepped in with export controls to control China's access to

cutting-edge semiconductor technology.

• After ASML accused Chinese employees of stealing chip and technology data for its lithographic machines, China is now restricted from

importing advanced lithography machines made by Dutch companies such as ASML. Japan has also implemented export controls on

chipmaking technologies and materials, aligning with the US and Netherlands' efforts.

• To maintain its supply of advanced semiconductors, China has significantly increased investment in its domestic semiconductor industry,

aiming to enhance self-sufficiency through government funding and initiatives like the Made in China 2025 plan. The country has also

threatened to invade Taiwan which would ultimately lead to the country taking over its semiconductor industry.

• In May of 2023, the Chinese government banned imports from US chip maker Micron. The Cyberspace Administration of China cited Micron's

failure to pass a security review, although the specific security risks were not detailed publicly.

US policy pushes manufacturers to open foundries in the United States

• Following the passing of the CHIPS and Science Act in the United States, TSMC and Samsung have opened or announced new facilities,

signaling the country's intention to reduce its reliance on foreign products after semiconductor shortages damaged post-pandemic

economic recovery.

• In 2023, ON Semiconductor Corporation opened a new $1.3 billion semiconductor fabrication plant in upstate New York, reflecting a trend of

manufacturers locating near downstream partners. This move aims to streamline production and efficiency, potentially reducing trade

complexities.

• Additional projects aimed to reduce the US' reliance on imports include Texas Instrument's $30 billion project to expand its capabilities in

Texas and Intel's plan to build a new $20 billion manufacturing complex in Ohio.

16

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

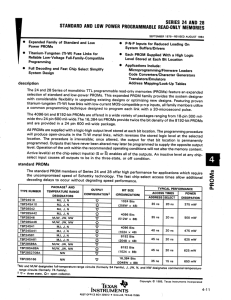

International Trade: Imports

Concentration of imports and exports from each country based on industry revenue:

Total Imports

$222.6bn

’18-’23

6.0 %

’23-’28

2.4 %

’18-’23

6.0 %

’23-’28

2.4 %

Total Exports

$222.6bn

Trade Balance

Balanced

: $0

Value

$0bn

$12kbn $24…

$36…

$48…

$60…

$72kbn

Source: IBISWorld

Exports

Moderate

Increasing

What are the industry’s export trends?

Asian countries dominate production

• China, South Korea and Taiwan are the leading global exporters of semiconductors. These Asian countries play critical roles in the

electronics supply chain and contribute significantly to technological advancements.

• As the demand for advanced technologies such as 5G, AI and IoT grows, the demand for advanced semiconductors has increased

significantly. This has led to increased exports of high-tech chips capable of supporting these technologies, primarily from Taiwan and

South Korea.

• Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung, leading semiconductor manufacturers, are headquartered in Taiwan

and South Korea, respectively. While Samsung operates in China, its focus is on-chip assembly and testing rather than wafer fabrication. It

emphasizes the latter stages of production, including packaging and verification processes.

US and China tensions affect export trends

• After years of rising tensions between the two countries, the US banned the export of advanced computer chips essential for AI and

supercomputers to China in 2022. This strategic move marked a significant change in US tech policy and is aimed at limiting China's access

to critical technology.

• US-China trade tensions have led to shifts in supply chain strategies, with companies diversifying their manufacturing bases to minimize

risks. This has resulted in increased investments and exports from countries like Vietnam and India, which are becoming important nodes in

the semiconductor and electronics industry.

17

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

International Trade: Exports

Concentration of imports and exports from each country based on industry revenue:

Total Imports

$222.6bn

’18-’23

6.0 %

’23-’28

2.4 %

’18-’23

6.0 %

’23-’28

2.4 %

Total Exports

$222.6bn

Trade Balance

Balanced

: $0

Value

$0bn

$25kbn

$50kbn

$75kbn

$100kbn

$125kbn

Source: IBISWorld

18

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Geographic Breakdown

Key Takeaways

Most manufacturers have moved production plants to Asia. Many Asian countries, like Malaysia, China and Singapore, have fewer

regulations, enabling companies to cut back on wage costs.

Many companies have started to return to North America. The United States has implemented favorable policies, encouraging

semiconductor investment throughout the country.

Business Locations

Where are industry businesses located?

Many companies keep headquarters in North America and Europe

• Most of the electronics sector has offshored its manufacturing

operations to developing countries. The world's largest electronic

component companies often have headquarters in developed

countries, principally the United States, Japan, South Korea, Taiwan

and the Netherlands. In fact, the SIA reports that USheadquartered manufacturers own 48.0% of foreign foundries.

• Most of these companies have established manufacturing facilities

in low-cost countries, including China and Malaysia, sometimes as

joint ventures.

• Favorable policy in the United States has encouraged many

companies to return to North America. In particular, TSMC and Intel

have announced new facilities in Arizona, increasing this region's

share of establishments. Many European countries have followed

America's example, creating new funding opportunities for tech

companies.

• Many companies have moved production to low-cost nations,

including Malaysia, Singapore and Vietnam. Foundries in these

regions often save on labor costs for low-skill positions.

• Also, many downstream electronics manufacturers have production

facilities in these regions, enabling semiconductor and electronic

component manufacturers to cut transportation costs and facilitate

purchasing contracts.

• Also, increasing political tensions with China, especially regarding

weak of patent protection and ongoing trade wars, have

encouraged many companies to set up facilities across Malaysia,

Vietnam and other low-cost manufacturing nations. Even so, the

United States has started pressuring Vietnam to improve

workplace standards, which could lead to higher wage costs. The

growing relationship between the US and Vietnam may lead to

more establishments in the country.

Share of Revenue (%) vs. share of population (%)

60%

Companies move production to North Asia

15%

Southeast Asian nations provide low-cost labor

19

st

As

ia

ic

a

So

ut

h

Ea

Am

ce

a

er

ni

a

h

So

ut

ia

O

or

th

As

ic

a

N

or

th

Am

er

lA

en

tra

C

In

di

a

&

N

a

si

e

Eu

ro

p

M

id

dl

e

Ea

st

0%

&

• For example, Chinese companies are building multiple new

production facilities in China because of increased government

funding. In addition, companies have recruited skilled

semiconductor engineers from other countries with high salaries.

30%

ca

• There is a strong likelihood that North Asia will increase its share of

production through the outlook period as recent trade spats with

the United States have pushed China to accelerate development of

its domestic semiconductor industry.

45%

Af

ri

• The production of final electronics products has largely shifted

from developed countries, like Japan, Germany and the United

States, to low-cost countries mainly located in Asia.

Revenue

Population

Source: IBISWorld

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Key Success Factors

How do businesses use location to their advantage?

Having contacts within key markets

Manufacturers must develop contacts and strong relationships with customers in key markets where end products are manufactured.

Be willing to outsource when appropriate

Outsourcing can reduce capital costs and enable companies to focus on core capabilities. More semiconductor companies that design and

supply chips have chosen to outsource fabrication.

20

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Competitive Forces

Key Takeaways

Price is essential for widely available general-purpose chips. Manufacturers primarily compete on product quality, reliability, selling

price, customer service, product range and innovation and timely delivery.

Many buyers design electronics around using a specific chip. If that unit is unavailable, switching to a competitor is expensive and

time-consuming.

High barriers, particularly access to labor and start-up costs, prevent most entrants from succeeding. Companies must also

navigate extensive patent law, leading to lower saturation.

Concentration

Low

What impacts the industry’s market share concentration?

Companies face high barriers to entry

• High barriers to entry lead to a concentrated market share in the

industry globally. Companies like Intel, Samsung and TSMC hold a

significant market share because of substantial capital

requirements, advanced technological expertise and established

distribution networks. New entrants face high costs for R&D and

infrastructure, making it hard to compete.

• These industry giants invest heavily in innovation and maintain

strong relationships with key clients, further solidifying their market

position. Economies of scale also give them a cost advantage,

keeping prices competitive while maintaining profits.

Manufacturers explore new partnerships

• Semiconductor manufacturers form joint ventures and strategic

alliances for manufacturing and R&D, often partnering with

automakers to align with market demands. Notable collaborations

include Intel with BMW, Samsung with Audi and Nvidia with Tesla,

showcasing a trend of tech companies teaming up with automakers

to advance automotive technology.

range of high-tech products and market segments. High upfront

costs and ongoing research and development investments deter

companies from easily transitioning between niches, like memory

to GPUs, because of the significant financial burdens spanning

multiple specialized areas within the industry.

• For example, Samsung and SK Hynix have a near-duopoly on high

bandwidth memory (HBM), controlling over 90.0% of the

addressable market. SK Hynix's recent deal to be the primary

supplier of NVIDIA's next-generation DRAM solidifies the

company's position in this market.

• SK Hynix has steadily built up its position in memory markets,

acquiring Intel's NAND and SSD businesses. This acquisition

represents a trend of manufacturers solidifying current niches

rather than expanding into new territory.

Market Share Concentration

Combined market share of the four largest companies in this industry

50%

40%

• Companies have also readily acquired smaller competitors,

accessing new technology and intellectual property alongside

increasing their market share. Innovative manufacturers in AI and

automotive spaces have become attractive targets for leading

manufacturers.

• In recent years, major semiconductor and electronic manufacturers

have aggressively acquired smaller competitors to expand market

share and access new technologies. Notable examples include

Samsung Electronics' purchase of Harman to boost its automotive

and connected technologies and Intel's buyout of Habana Labs to

expand its AI capabilities.

30%

20%

10%

0%

2018

2020

Market share of the four largest companies (%)

Manufacturers often dominate specific niches

2022

Sector average (%)

Source: IBISWorld

• Semiconductor and electronic parts manufacturing encompasses a

21

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Key Success Factors

How do successful businesses handle concentration?

Economies of scale

Large-scale manufacturing plants often achieve lower unit costs than smaller ones. Larger companies can negotiate effectively with

suppliers and spread research, development and marketing expenses over a broader sales base, enhancing their competitive advantage.

Willingness to outsource

Outsourcing fabrication can lower capital costs for semiconductor companies, allowing them to concentrate on core competencies.

Increasingly, chip designers and suppliers are opting for this model to optimize efficiency and stay competitive in the industry.

Barriers to Entry

High

Steady

What challenges do potential industry entrants face?

Legal

• Manufacturers confront diverse regulations: EU and North American companies adhere to stringent environmental and workplace laws,

while Asian companies face fewer restrictions. Input sourcing and quality standards are pressured by US-China trade tensions, which may

lead to product bans.

Differentiation

• Established manufacturers maintain dominance by securing supply contracts with large customers, reinforcing their market position. Their

strong reputations make customers hesitant to switch to new suppliers and technologies, entrenching the established companies'

competitive edge.

Start-up Costs

• The semiconductor industry faces high capital demands, especially in certain segments. Constant machinery upgrades and expensive

fabrication plants add to investment risks. Rapid innovation, product obsolescence, price volatility and the need for specialized machinery

complicate the landscape.

Capital Expenses

• Companies struggle to attract skilled employees because of the limited availability and intense competition. Sophisticated and rapidly

changing technology demands expertise in R&D, production and sales. Manufacturers face high costs for ASML's lithographic machines and

deal with input scarcity.

Key Success Factors

How can potential entrants overcome barriers to entry?

Secure the latest and most efficient technologies and techniques

This industry rapidly advances by integrating highly sophisticated technology into its products and production processes. Given the swift

pace of technological advancements, staying competitive depends on access to cutting-edge technology, which is crucial.

Secure a highly skilled workforce

Manufacturers develop, produce and supply complex components, often incorporated into complex end products. The production of these

components often requires complex production technologies and highly skilled staff.

Economies of scale

Large-scale manufacturing plants often achieve lower unit costs than smaller ones. They negotiate better with suppliers and distribute

research, development and marketing costs over a wider sales base. This efficiency enhances their competitive edge in the market.

22

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Substitutes

Low

Steady

What are substitutes for industry services?

No competition

• Semiconductors and electrical components play a crucial, irreplaceable role in data storage and electricity transmission. These

technologies ensure efficient processing and handling of information and energy. Their significance in modern infrastructure highlights the

limitations other products face, emphasizing their unique contribution to technological advancement and reliability.

• The processing power of semiconductors and electronic components is unmatched. They enable rapid computation and efficient energy

consumption, pivotal to modern electronics and critical infrastructure. Overall, these products remain the backbone of innovations in

computing, telecommunications and automation.

Key Success Factors

How do successful businesses compete with substitutes?

Establish an efficient funding structure and efficient, cost-effective distribution channels

Outsourcing cuts capital costs and lets companies concentrate on core capabilities. Many semiconductor firms that design and supply

chips are increasingly opting to outsource fabrication, highlighting a strategic shift in the industry's operational approach.

Develop strong technical product knowledge

Manufacturers must continually innovate with new value-added products and robust technical expertise to remain competitive. Those

lagging in innovation are swiftly outpaced by competitors, risking replacement in an industry where staying ahead is crucial.

23

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Buyer & Supplier Power

Suppliers

Buyers

1st tier

Global Mining and Oil and

Gas Field Equipment

Manufacturing

Global Alumina and

Aluminum Production and

Processing

Global Copper, Nickel,

Lead and Zinc Mining

Global Glass and Glass

Products Manufacturing

Global Semiconductor & Electronic Parts

Manufacturing

_

2nd tier

1st tier

2nd tier

Global Computer Hardware

Manufacturing

Global Consumer

Electronics Manufacturing

Auto Parts mfg

Car and Truck mfg

Trucks mfg

Source: IBISWorld

What power do buyers and suppliers have over the industry?

Moderate

Steady

Buyers: semiconductors and electrical components are essential products

• Semiconductors and electrical components are essential for manufacturing consumer electronics, computers and vehicles. Companies like

Apple and Tesla depend heavily on these for their tech-driven products. These components are critical in enabling advanced features and

maintaining competitive advantages in their respective industries.

• Even so, heavy competition and rapid product innovation mean companies must price competitively, limiting their power over buyers.

Regardless, some markets run as effective monopolies or duopolies, meaning buyers must pay premiums to acquire necessary niche

products.

High

Increasing

Suppliers: companies require specialized machinery

• The semiconductor and electrical component industry faces significant expenses because of highly specialized machinery. ASML, a Dutch

company, uniquely manufactures lithographic presses essential for specific semiconductors. This specialization produces strong supplier

power, as these machines are built to precise specifications for individual products.

• Companies face challenges purchasing oxides and rare earth metals, with only a few mines globally providing access to specific elements,

leading to increased supplier power. Many of these mines are in China and as sanctions against the nation strengthen, companies may need

to source rare earth metals from other countries.

24

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Key Success Factors

How do successful businesses manage buyer & supplier power?

Secure the latest and most efficient technologies and techniques

The industry rapidly advances with high-tech products and processes requiring cutting-edge technology. Staying updated is crucial, as

access to the latest advancements directly affects production efficiency and competitiveness.

Having contacts within key markets

Manufacturers must focus on cultivating robust connections with customers in major markets where end products are made. Strong

relationships can enhance market presence and open opportunities for collaboration and growth in these strategic locations.

25

www.ibisworld.com

December 2024

Global Manufacturing • C2524-GL

Global Semiconductor & Electronic Parts Manufacturing

Companies

Key Takeaways

The industry’s fragmented nature prevents one company

from gaining significant market share. Even so, companies like

Major Players

Intel or Samsung often dominate specific verticals like logic or

Company

Revenue

Market Share

memory chip manufacturing.

Taiwan Semiconductor

Manufacturing

Company

$69.1bn

6.8%

Intel

$40.7bn

4.0%

Samsung

$39.7bn

3.9%

Many companies contract other foundries to produce chips.

TSMC is the most prominent producer of “fabless” companies,

supplying products for tech giants, including Apple, Tesla, NVIDIA,

AMD and Sony.

Qualcomm

$35.8bn

3.5%

Other Companies

$826.8bn

81.7%

Companies

Market Share (%)

Revenue ($m)

Profit ($m)

Profit Margin (%)

Company

2023

2023

2023

2023

Taiwan Semiconductor Manufacturing

Company

6.8