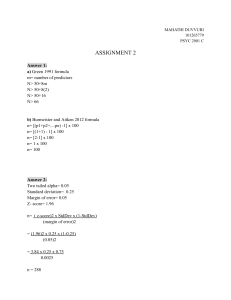

The text and our Scrums 1.7.3 Agile Methods Modality: The explanation of Agile roles: The Scrum Master as a coach and facilitator, the Developers as executors of the project scope, the Product Owner as the formal authority on “go-no go” acceptance/rejection, the customer and the Product Backlog. 2.1.1 Strategic Planning Overview Modality: The Palm Project: Sheikh Muhammad bin Rasheed Al Maktoum’s strategic plan to mitigate the forecasted shortage of gas/oil by 2016 Modality: The plan to cut the 15-year project delivery time to just 4 years in order to speed Return on Investment (ROI) Analyzing the Business Case Modality: 3 project options, the Viper, the Warthog and the Strike Eagle employing Net Present Value (Discount Rate, Cash Flows and Years-to-Delivery) Modality: Return on Investment (ROI), Years, Future Value FV = PV (1 + r) n 1 The text and our Scrums 3.1.1, 3.1.2 The Project Triangle (Scope (Quality), Time and Cost Modality: Using Earned Value Management, examining the impact of lacking Earned Value performance (Scope) on the project schedule (Time) Modality: Stakeholders and Reporting Scrum, 5 scenarios concerning reporting 3.4.1, Calculating the Critical Path Modality: Demonstrated the Forward Pass, starting with a hypothetical duration of 4 days, calculated the Earliest Start and Earliest Finish; determining the Critical Path, the longest chain of duration activities, was in fact 36 fays 3.5.1, Monitoring and Controlling Techniques Modality: Calculating Earned Value Management (EVM), examining the impact of lacking Earned Value performance (Scope) on the project schedule (Time) 3.6.1, Reporting Modality: Stakeholders and Reporting Scrum, 5 scenarios concerning reporting 2 The text and our Scrums Your company is evaluating the Business Case of 3 projects; all three projects support profitability in your company’s portfolio, designed to give your company a strategic advantage approximately 7 years from now. Each Sprint considers the Business Case on the basis of Net Present Value (NPV), Future Value and Return on Investment (ROI). Your project sponsor, due to time and stakeholder constraints, asks your team to exclude one of the Business Case constructs above in your evaluations. Which Business Case construct would you exclude and why? 3 Stakeholders & Reporting A project is planned to take 8 months. At the end of the 4th months, the records of the project controlling show the following observed cumulative indicators: Actual Cost (AC) 120K Earned Value (EV) 90K Planned Value (PV) 100K Budget at Completion (BAC) 200K Your sponsor’s most influential stakeholder likes all reporting constructs expressed as a percentage (if possible). Your Project Sponsor reports to key stakeholders today and he anticipates a few key metrics and approaches you with the following questions. How much higher is the Actual Cost given spending expectations? How would you express the status of Earned Value? 4 Stakeholders & Reporting A project is planned to take 8 months. At the end of the 4th months, the records of the project controlling show the following observed cumulative indicators: Actual Cost (AC) 120 Earned Value (EV) 90 Planned Value (PV) 100 Budget at Completion (BAC) 200 Your sponsor’s most influential stakeholder likes all reporting constructs expressed as a percentage (if possible). Your Project Sponsor reports to key stakeholders today. He anticipates a few key metrics and approaches you with the following questions. If this spending performance persists, how would you compute and characterize (express the status to key stakeholders based on their needs/limits) the project’s total cost at closing? 5 Stakeholders & Reporting A project is planned to take 8 months. At the end of the 4th months, the records of the project controlling show the following observed cumulative indicators: Actual Cost (AC) 120 Earned Value (EV) 90 Planned Value (PV) 100 Budget at Completion (BAC) 200 You learn that your sponsor’s boss is not satisfied with the metrics reported. She demands that the remaining work be done according to planned spending standards. If her spending demands become reality how much will your project cost the organization when done? 6