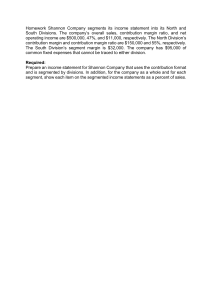

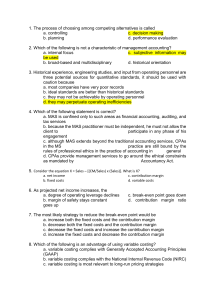

Managerial Accounting 202 Study Guide Unit Exam TWO Chapters 5, 6, 7 David Weaver – Instructor Chapter 5: 1. When variable cost decrease, what happens to contribution margin? 2. 3. How do we calculate break-even point in units? 4. 5. How to calculate degree of operating leverage 6. 7. How are fixed cost per unit calculated? If the number units go up or down, what happens to fixed costs? 8. 9. What happens when contribution margin does not cover the fixed cost? 10. A LOSS OCCURS 11. Formula for calculating dollar sales necessary to achieve a desired level of profit. 12. 13. Calculate net operating income when the number of units sold changes from the initial level given. 14. BY % multiply unit total, by # use new total and cost per unit to change sales number 15. Calculate the total contribution margin. 16. Refer to 1 17. Calculate net operating income when the contribution margin ratios, fixed cost and sales are known. 18. Calculate break even in monthly sales dollars 19. 20. Calculate sales in units when we know the target profit. (Here is the formula: 1. Find contribution margin per unit (BE = fixed exp. / unit CM to get CM per unit) then (target profit + fixed expenses) / unit contribution margin to get sales in units 21. 22. Contribution margin per unit= CM/units sold 23. Calculate a contribution margin ratio Chapter 6: 1. Does absorption accounting treat all manufacturing cost as product or period cost? 2. Absorption: Products cost, Variable : Period cost 3. How to calculate segment margin 4. segment revenue minus segment expenses 5. Formula to calculate break even point for a company using a segmented income statement 6. Is fixed manufacturing cost in variable costing a product or period cost? 7. What cost would be considered a product cost in both variable and absorption accounting? 8. Calculate the absorption unit product cost 9. Calculate absorption costing unit product cost 10. Calculate the variable cost per unit 11. Calculate the total gross margin under absorption costing 12. Calculate the break even in dollars for a segment 13. Calculate the contribution margin of a segment 14. Calculate the segment margin Chapter 7: 1. Activity based accounting (ABC) is designed to accomplish what? 2. Which is easier to set up, variable or ABC or a traditional cost accounting system? 3. Should employees be consulted in how to set up 1st stage allocations in ABC Systems 4. What is accomplished in 2nd stage allocations? 5. In ABC costing, the activity rate cost pool is computed by what formula 6. Calculate an activity rate per product design hour 7. Calculate how much supervisory wages should be assigned to products and how much should not be. 8. Calculate an activity rate per machine hour 9. Calculate the activity rate for a given cost pool 10. What is the formula to calculate the activity rate. Practice test answers 13. Unit product cost under absorption costing = 51 + 12 + 2 + (441,000/7,000) = 128 -- -- -The contribution margin ratio of Mountain Corporation's only product is 52%. The company's monthly fixed expense is $296,400 and the company's monthly target profit is $7,000. The dollar sales to attain that target profit is closest to: -To obtain the dollar sales volume necessary to attain a given target profit, which of the following formulas should be used? A: (Fixed expenses + Target net profit) ÷ Contribution margin ratio -- -An activity-based costing system that is designed for internal decision-making will not conform to generally accepted accounting principles because: A: under activity-based costing some manufacturing costs (i.e., the costs of idle capacity and organization-sustaining costs) will not be assigned to products. --(end of pract test) Obrien corp(CASE 6-29) Absorption based costing -CASE 5-32 Pittman Company is a small but growing manufacturer of telecommunications equipment. The company has no sales force of its own; rather, it relies on independent sales agents to market its products. These agents are paid a sales commission of 15% for all items sold. -Diego Company manufactures one product that is sold for $79 per unit in two geographic regions—East and West. The following information pertains to the company’s first year of operations in which it produced 50,000 units and sold 45,000 units. -- -- -Engberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: -Mauro Products sells a woven basket for $19 per unit. Its variable expense is $13 per unit and the company’s monthly fixed expense is $13,200.