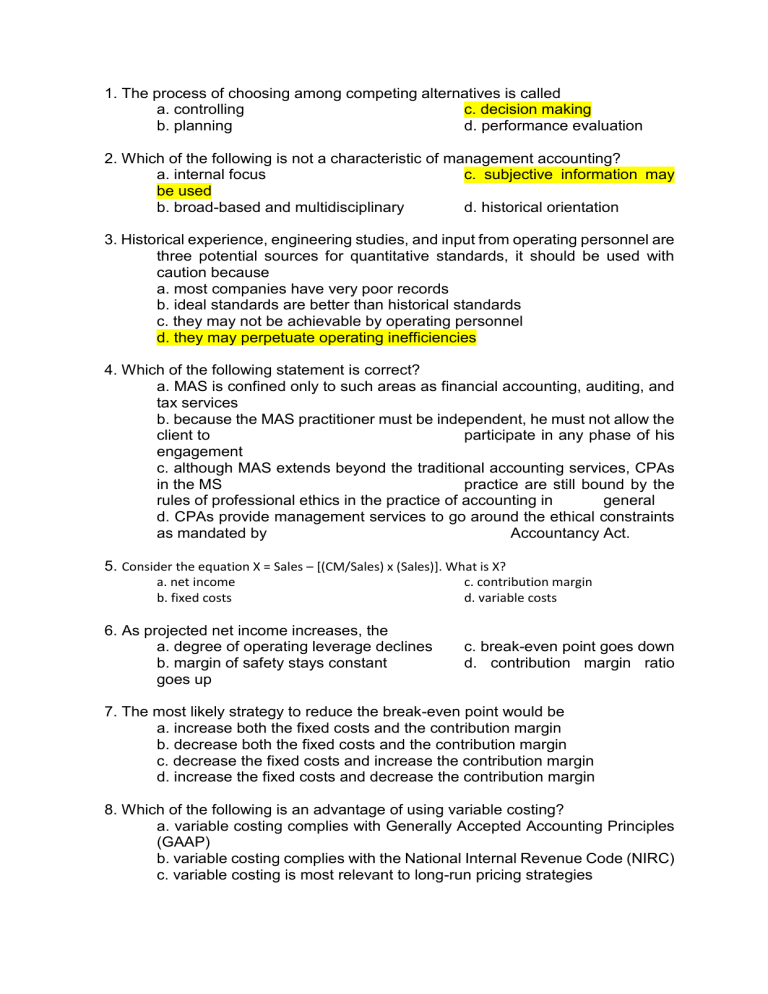

1. The process of choosing among competing alternatives is called a. controlling c. decision making b. planning d. performance evaluation 2. Which of the following is not a characteristic of management accounting? a. internal focus c. subjective information may be used b. broad-based and multidisciplinary d. historical orientation 3. Historical experience, engineering studies, and input from operating personnel are three potential sources for quantitative standards, it should be used with caution because a. most companies have very poor records b. ideal standards are better than historical standards c. they may not be achievable by operating personnel d. they may perpetuate operating inefficiencies 4. Which of the following statement is correct? a. MAS is confined only to such areas as financial accounting, auditing, and tax services b. because the MAS practitioner must be independent, he must not allow the client to participate in any phase of his engagement c. although MAS extends beyond the traditional accounting services, CPAs in the MS practice are still bound by the rules of professional ethics in the practice of accounting in general d. CPAs provide management services to go around the ethical constraints as mandated by Accountancy Act. 5. Consider the equation X = Sales – [(CM/Sales) x (Sales)]. What is X? a. net income b. fixed costs 6. As projected net income increases, the a. degree of operating leverage declines b. margin of safety stays constant goes up c. contribution margin d. variable costs c. break-even point goes down d. contribution margin ratio 7. The most likely strategy to reduce the break-even point would be a. increase both the fixed costs and the contribution margin b. decrease both the fixed costs and the contribution margin c. decrease the fixed costs and increase the contribution margin d. increase the fixed costs and decrease the contribution margin 8. Which of the following is an advantage of using variable costing? a. variable costing complies with Generally Accepted Accounting Principles (GAAP) b. variable costing complies with the National Internal Revenue Code (NIRC) c. variable costing is most relevant to long-run pricing strategies d. variable costing makes cost-volume-profit relationships more easily apparent