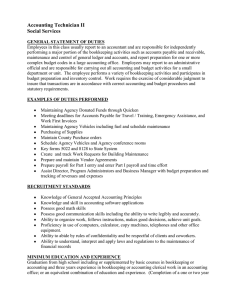

The Importance of Bookkeeping and Accounting for MNCs Why Bookkeeping and Accounting Are Vital for Multinational Corporations Bookkeeping and accounting are the lifelines of any business, especially for multinational corporations (MNCs). These practices ensure financial clarity, compliance, and growth. Without proper accounting systems, MNCs risk operational inefficiencies and potential legal complications. Enhancing Financial Transparency Financial transparency is crucial for MNCs operating across multiple jurisdictions. Accurate bookkeeping helps track income, expenses, and assets. It allows businesses to assess their financial health regularly. Reliable financial data also enables stakeholders to make informed decisions, fostering trust and confidence. Ensuring Compliance with International Regulations MNCs must adhere to various international accounting standards and tax laws. Proper accounting ensures compliance, reducing the risk of penalties or reputational damage. For instance, meticulous bookkeeping helps prepare timely financial statements, which are often mandatory in many countries. Facilitating Strategic Decision-Making Strategic decisions rely on precise financial insights. Bookkeeping provides the necessary data to identify profitable ventures and cut losses. This information aids in budget allocation, cost control, and financial forecasting. With accurate records, MNCs can adapt quickly to market changes and maintain competitiveness. Streamlining Financial Operations Efficient accounting systems streamline financial operations across different branches. By integrating bookkeeping software, MNCs can automate repetitive tasks and improve accuracy. This integration reduces human error and enhances productivity. Centralized financial data also simplifies inter-branch transactions and consolidations. Improving Cash Flow Management Cash flow management is essential for sustaining daily operations. Bookkeeping tracks receivables and payables, ensuring timely payments and collections. It helps prevent cash shortages and supports long-term financial planning. Healthy cash flow boosts liquidity and facilitates investment opportunities. Supporting Business Expansion As MNCs expand, their financial complexity increases. Proper accounting systems support scalability by maintaining organized records. They help navigate currency fluctuations, tax structures, and legal requirements in new markets. Accurate bookkeeping lays a solid foundation for sustainable growth. Minimizing Fraud and Errors Robust accounting practices minimize the risk of fraud and errors. Regular audits and reconciliations detect discrepancies early. By implementing internal controls, MNCs can safeguard their assets and maintain financial integrity. Boosting Investor Confidence Investors prioritize transparency and reliability. Detailed financial records demonstrate a company’s stability and growth potential. This transparency attracts more investors and secures funding for future projects. Accurate accounting builds trust, a critical factor in investor relations. Adopting Advanced Technology Modern bookkeeping tools enhance efficiency and accuracy. MNCs can use cloud-based platforms for real-time data access. These tools simplify compliance reporting and improve decision-making. Automation reduces workload and allows accounting teams to focus on strategic tasks. Conclusion Bookkeeping and accounting are indispensable for MNCs aiming to thrive in a competitive global market. They provide financial clarity, ensure compliance, and support strategic growth. By prioritizing robust accounting systems, MNCs can achieve long-term success and maintain their market position.