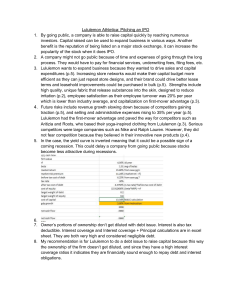

A MARKETING REPORT ON LULULEMON Adeen Momin 300213840 Jasmine Kaur 300218104 Armaan Dhillon Himmat Sangha Sukhman Gill 110 Contents Introduction ........................................................................................................................... 2 SWOT Analysis ..................................................................................................................... 4 Strengths ........................................................................................................................... 4 Weaknesses ...................................................................................................................... 4 Implications on Internal analysis .................................................................................... 4 Opportunities ..................................................................................................................... 5 Threats .............................................................................................................................. 5 Implications of External Factors ..................................................................................... 5 Articles .................................................................................................................................. 6 Article 1 ............................................................................................................................. 6 Article 2 ............................................................................................................................. 7 Article 3 ............................................................................................................................. 8 TARGET MARKET ................................................................................................................ 9 PSYCHOGRAPHICS......................................................................................................... 9 DEMOGRAPHICS ............................................................................................................. 9 GEOGRAPHY ................................................................................................................... 9 BEHAVIOR ........................................................................................................................ 9 PRODUCT TYPE ................................................................................................................ 10 PRODUCT AND PLACE IN THE PRODUCT LIFE CYCLE .............................................. 10 Channels of Distribution ...................................................................................................... 11 Communication With Target Market .................................................................................... 13 Socially Responsible Behaviour .......................................................................................... 16 Marketing Recommendations.............................................................................................. 18 Section A ......................................................................................................................... 18 Section B ......................................................................................................................... 20 Section C......................................................................................................................... 21 REFERENCES ................................................................................................................... 23 Appendix ............................................................................................................................. 25 Page 1 of 25 Introduction Lululemon Athletica is a Canadian athletic apparel retailer known for its yoga/athletic-focused clothing and gear. Founded in 1998 by Chip Wilson in Vancouver, British Columbia, the company has grown into a global brand with a focus on technical athletic apparel for yoga, running, training, and other activities. Lululemon's marketing emphasizes the relaxed lifestyle of the West Coast, focusing on being healthy, mindful, and building a community. This brand has become famous worldwide, changing how we think about sportswear. Over the years, Lululemon has expanded its offerings to include men’s and women’s clothing for various athletic activities. They offer leggings, tops, shorts, jackets, and accessories such as yoga mats, water bottles, and bags. Lululemon is also committed to sustainability, incorporating recycled materials into its products, and setting ambitious goals to reduce its environmental impact, such as striving for 100% renewable energy in its operations. It started with a goal to make great yoga/active clothes that look good and work well, and they succeeded. Lululemon has become the top choice for high-quality workout clothing. From opening their first-ever small store in Vancouver in 2000 to becoming a global company, Lululemon's success has come from being innovative and growing smartly. They've stayed true to their roots, keeping a strong focus on quality, new ideas, and community involvement. Lululemon focuses on being innovative, such as introducing new fabrics and versatile, multiuse products, which helps it maintain its competitive edge and attract a broad customer base. Going public in 2007 was a significant step forward for them. Lululemon's growth over the years is impressive. They have over 710 stores worldwide, with 19 of them in British Columbia. Financially, they're doing great as well, making billions in sales every year because people love their clothes and they're good at advertising. Lululemon’s strong community engagement through in-store events, free yoga classes, and partnerships with other fitness companies fosters a loyal customer base. Their sales have consistently shown strong growth, with revenue reaching $9.6 billion in 2024, demonstrating the brand's popularity and market success. For me, Lululemon isn't just a brand; it's a lifestyle. As someone who enjoys working out and staying active, their clothes are essential. They care about making quality products that help you perform better during workouts, which aligns with my values and motivates me to do my best. They also have a great return policy, which makes shopping with them even better and easier. Page 2 of 25 In conclusion, Lululemon Athletica's journey from a small start to worldwide fame shows what happens when you mix innovation, community focus, and staying true to yourself. They've changed the game for sportswear, and as they continue to grow, they're inspiring fitness enthusiasts everywhere. Page 3 of 25 SWOT Analysis Strengths 1) Omni Channel model: The company’s omni channel model enables it to serve their customers efficiently and effectively. Lululemon continues to integrate its online channels to create more interactions with its customers and provide and enhanced omni channel experience. 2) Strong brand value: Lululemon is widely known for the high-quality, innovative and stylish athletic apparel. It is a premium brand in the athletic apparel market. 3) Diverse product range: Lululemon is regarded as one of the leading designer and distributor of athletic apparel. It has various designs for men and women ranging from jackets to yoga pants with different designs which gives customer a lot of choices. 4) Strong product development: Lululemon is known for its product development and innovation. Their focus on and development has led to the unique fabrics such as Luon and Nulu. Weaknesses 1) High product pricing: Lululemon's products are usually priced higher than its competitors, it caters to high end market segments. The high prices attract the middleand high-income customers and not the low-income customers. 2) Over dependence on North American market: Majority of lululemon's revenue generate from the North American market. depending on a single market makes it vulnerable to any economic changes and fluctuation in the market. 3) Reliance on Vendors: Lulelemon currently works with 45 vendors to who produces its products and over 60 suppliers to who provides the fabric for its products. Any delays or cost in supply of fabric or manufacture can have a notable effect on meeting the customer’s demand. 4) Supply chain risks: Lululemon’s reliance on overseas manufacturing exposes its risks such as geopolitical tensions, trade disputes and disruptions in the supply chain. Implications on Internal analysis Lululemon’s internal analysis highlights strengths such as omni channel model, a strong brand value, a diverse product range and a great amount of focus on product development. However, it faces challenges including high product pricing, dependence on north American market, reliance on vendors and supply chain risks. To eradicate these weaknesses and leverage their Page 4 of 25 strengths, they should focus on diversifying their market presence globally, optimize relationships with vendors for reliability, to increase their supply chain resilience and to neglect trade related risks. Opportunities Lululemon has several promising opportunities to enhance its market presence and drive growth. One significant opportunity is the expansion into new international markets, particularly in Europe and Asia, where there is a growing middle class and increasing disposable incomes (McKinsey & Company, 2020). Additionally, the men's activewear segment remains underdeveloped but exhibits strong growth potential, providing a profitable area for Lululemon to explore. The global trend towards health and wellness further creates a favourable environment for Lululemon’s product offerings, as more consumers seek active and healthy lifestyles. Furthermore, by leveraging e-commerce and digital sales channels, Lululemon can broaden its customer reach and engagement, benefiting from the ongoing shift towards online shopping (Statista, 2023). Threats Despite the opportunities, lululemon faces substantial threats that could impact its performance. The activewear market is highly competitive, with major brands like Nike and Adidas posing significant challenges that could weaken Lululemon's market share. Supply chain disruptions and rising raw material costs are also critical threats, potentially affecting the company's operational efficiency and profit margins (IBISWorld, 2022). Economic downturns represent another risk, as they can lead to reduced consumer spending, particularly on premium-priced products like those offered by Lululemon. Additionally, the company could face backlash over its high prices and ethical concerns related to its manufacturing practices, which could harm its reputation and customer loyalty (Deloitte, 2021). Implications of External Factors Given these external factors, Lululemon should prioritize expanding into new geographical markets and strengthening its digital sales channels to capitalize on the growing health and wellness trend. However, the company must also enhance its supply chain resilience and address pricing strategies to alleviate competitive and economic threats. Page 5 of 25 Articles Article 1 June 5,2024 Tara Deschamps The Canadian Press In this article, Lululemon Athletica Inc.'s CEO, Calvin McDonald, reflects on the company's first-quarter performance, highlighting a slower start despite increased profits and revenues. The company faced challenges such as consumer hesitancy due to inflation and interest rate hikes, as well as inventory issues in its women's and bag categories, particularly with limited colour palettes and stockouts in smaller sizes. Despite these hurdles, McDonald remains optimistic about addressing these issues in the second half of the year through innovation and addressing consumer demands, notably for smaller sizes and a wider colour selection. However, Lululemon faces intensified competition from brands like Alo and Vuori, prompting analysts to recommend a focus on expanding into newer sporting categories like golf to counteract potential market saturation and maintain growth. While international revenue surged, the modest growth in the Americas suggests possible market maturity and increased competition, urging Lululemon to strategize further to sustain its momentum. Page 6 of 25 Article 2 October 16,2023 Chibuike Oguh Reuters This article reports on Lululemon Athletica's significant stock surge, rising over 10% to nearly a two-year high following its inclusion in the S&P 500 index, effective mid-October. The announcement prompted a surge in demand from institutional investors and mutual fund managers who track the index, driving the stock price to reach $416.01, its highest since December 2021. This surge reflects investor confidence in Lululemon's growth prospects and market value, particularly buoyed by recent strategic agreements, such as its deal with Peloton Interactive to become its primary athletic-apparel maker. Despite a historically lower price-toearnings ratio compared to its five-year average, analysts remain bullish on Lululemon's stock, with a median price target of $450 and a "buy" recommendation. This development underscores Lululemon's growing stature in the market and its continued momentum in the athletic apparel industry. Page 7 of 25 Article 3 November 9,2022 Cara Salpini Retail Dive This article explores Lululemon's pivotal role in popularizing athleisure, a category of clothing that seamlessly blends athletic wear with casual, everyday apparel. It highlights how Lululemon's influence has transcended the athletics space, revolutionizing the broader apparel industry. With references to SEC filings indicating the widespread adoption and recognition of the term "athleisure" among retailers, the article suggests that Lululemon played a significant role in shaping this trend. It also discusses the evolution of athleisure from a niche segment to a mainstream fashion phenomenon, citing examples from industry experts such as Matt Powell and Shawn Grain Carter. Overall, the article underscores Lululemon's transformative impact on the apparel landscape, positioning it as a trailblazer in defining and popularizing athleisure as a cultural and fashion staple. Page 8 of 25 TARGET MARKET Lululemon’s target market can be measured based on various customer demographics such as psychographics, demographics, geography, and behaviour. PSYCHOGRAPHICS Based on their psychographics, Lululemon’s customers are mainly yoga and fitness loving individuals. The target is primarily sport loving individuals who strive to maintain a healthy life amid a busy work life. They are passionate about traveling, leisure, fitness, and work life balance at large (Zacks Equity Research, 2024). The goal is to supply them with state of the art yoga sports and fitness attire. DEMOGRAPHICS Lululemon’s customers are primarily young people in their teens to thirties. The business targets the young because they are active in sports and its products are sport oriented. For gender, Lululemon seeks to be a “dual gender brand” serving both men and women. Even then, women still make a great part of the company sales amounting to $4.2 billion (67.74%) sales compared to men’s $1.5 billion (24.19%) sales. The rest $0.55 billion (8%) came from “other gender” (Zacks Equity Research, 2024). Despite women being such a huge market, the company continues to focus on men to bring a gender balance with the segment making 30% Compound Annual Growth (CAGR) in 2021 compared to women’s only 15% CAGR. Demographics can also be measured based on income where Lululemon targets a high-end market with customers being comfortable and willing to pay high prices for the company’s products (Zacks Equity Research, 2024). GEOGRAPHY For geography, North America (the United States and Canada) by far remains the largest market but Lululemon still has a focus on the market in other parts of the World. In regard, Lululemon has the largest market in the United States making 70% of sales in 2021, Canada 15%, and 15% from the rest of the world combined (Manuel, 2022). BEHAVIOR Lululemon customers are technologically proficient individuals preferring both online ordering as well as the physical shopping experience. The company estimates a 50-50 split between physical store shopping and online shopping. These customers take physical fitness and mental wellbeing as their identity (Zacks Equity Research, 2024). Page 9 of 25 PRODUCT TYPE Lululemon seeks to offer a tangible product to its customers. The company specializes in yoga and sports attire. Its major product lines include fitness pants, shorts, tops, and jackets all meant for yoga. Lululemon also sells a range of fitness related products that include bags, socks, and yoga mats. The products are categorized as consumer flexible. This means that, more of the products will be demanded in high quantities when the target consumer income is high and the economy is growing. To ensure competitiveness and meet customer specific needs, Lululemon closely engages its customers to gain insights and relay feedback. The product offering is seasonal ensuring that the product suits the season of the year and consumer needs. It is also intended to correct fluctuations in demand based on the weather and seasonal conditions while still ensuring constant yoga and sports based theme. With the product being predominantly attire, the company pays close attention to trends and emerging issues in the fashion industry (Soni, 2014). The company can as such be said to be innovative and dynamic in as far as its products are concerned. It attributes its success to new, beautiful, and greatly technical products courtesy of engagement with the market. PRODUCT AND PLACE IN THE PRODUCT LIFE CYCLE A product that Lululemon offers is the Align pant which falls in the legging’s product category amongst many others the company sells. This product is among the highest demanded products for Lululeom as of 2023. The pants were launched in 2015 in line with Lululemon’s innovative strategy (Lululemon, 2024). We seek to understand Lululemon’s Align pants based on the product life cycle (PLC). PLC contains five stages namely: Development, introduction, growth, maturity, and decline. At development, a new product is designed and stakeholders are shown the designs and unique features. Marketing proceeds to create awareness by creating content and inbound logistics. The product begins to pick in the market. The product then enters market growth where customers embrace the product and demand increases. At the time, a seller can increase product prices or discriminate without hurting demand significantly and make huge profits. Eventually, the product enters the maturity stage, and sales level off. A marketer may need to lower prices and differentiate their product to stay competitive at this stage. The final stage is the decline stage where a product is fast becoming outdated or has fallen out of favor with customers. A manufacturer will need to call off a product at the stage and deploy a wholly new one that suits the market (Udokporo, 2021). Page 10 of 25 Channels of Distribution To make sure that their high-quality products reach the customers, Lululemon Athletica, which is a well-known brand in sportswear, has come up with an elaborate supply chain. From production to sales, this supply chain supports all processes involved in getting the final product into the hands of the consumers. The next part of this report will look at how Lululemon uses distribution channels such as sourcing, manufacturing, warehousing and logistics. Most of its raw materials are sourced from different suppliers worldwide mainly involving highperformance fabrics that can meet their right quality standards. Key materials include: Silver scent: A fabric infused with silver fibres to stop bacterial growth and reduce Odor. Nulu, and Everlux: Other proprietary fabrics designed for specific performance. Luon: A fabric made from a blend of nylon and Lycra, providing stretch and moisture properties. The raw materials come from specialized textile manufacturers in countries such as Taiwan, South Korea, and China where the technology to manufacture these sophisticated textiles exists. Manufacturing: Once sourced, the raw materials are transported to various manufacturing plants. Its production is outsourced by Lululemon to contract manufacturers mainly situated in Asia namely Vietnam, Cambodia and Bangladesh. These facilities are chosen based on their ability to adhere with Lululemon’s quality standards and ethical practices of production. Ownership and Timing: Lululemon does maintain strict control over its supply chain process that guarantees quality and timely delivery of products to customers. This involves intensive monitoring of manufacturing timetables, frequent quality assurance tests as well as compliance with labour standards. The timing here is crucial as Lululemon operates on a seasonal product release cycle implying that market demand requires precise coordination. Warehousing and Transportation: After manufacturing takes place, the products are shipped to Lululemon’s distribution centers. The company has various distribution centres across the globe like in North America Vancouver, Toronto, Columbus (key) and Europe Netherlands. In this respect, these locations ensure efficiency in the transportation process while minimizing time taken for delivery. Warehousing: The distribution centres work as the central hubs of inventory control. This is done with the help of advanced storage techniques such as automated sorting systems and realPage 11 of 25 time inventory tracking to enhance precision and speed. They store goods until they are prepared for transportation to retail outlets or directly to clients. Transportation: Lululemon uses a combination of transportation modes to get products from manufacturing facilities to distribution centres and ultimately, retail stores or customers. These include Ocean Freight for bulk transportation from Asia to North America and Europe, Air Freight is used in case of urgent shipments especially for restocking inventory or meeting high demands during peak seasons, and Truck and Rail which are used in land transportation from ports to distribution centres and between regional distribution hubs. Lululemon reaches its customers through several sales channels with: Retail Stores: Physical stores located in major urban centres as well as busy shopping areas. These outlets provide an opportunity for consumers who want to see the items firsthand besides getting personal assistance. Wholesale Partnerships: This entails limited affiliations with few chosen partners like luxury departmental stores to make them more accessible. E-Commerce: The company’s online store has a complete range of products available at the convenience of being shipped directly home. The e-commerce platform is linked with the distribution centres so that it can speed up order fulfilment. Showrooms & Pop-Up Shops: Temporary spaces where brands can increase their visibility or check out new locations with less commitment over time. Lululemon’s distribution strategy is its way of showing that it values quality, efficiency, and customer satisfaction. Lululemon ensures that it meets high standards for its products and delivers them to customers on time by taking care of each stage beginning with the procurement of raw material to the last mile. Therefore, a well-established supply chain supported by advanced logistics as well as strategic alliances is important for upholding the brand’s place in the market as well as achieving growth within this sports apparel industry which has become competitive over time. Page 12 of 25 Communication With Target Market Demographics Lululemon has a smart way of connecting with its target audience in British Columbia's Lower Mainland, a region known for its active and health-conscious residents. Lululemon's target market has broadened significantly over recent years. Originally focused on women aged 2545, the brand now draws a nearly equal mix of men (48%) and women (52%) as of 2023 (Retail Dive). The age range has also expanded to include younger individuals aged 18-35, driven by the rising popularity of athleisure and a growing emphasis on fitness among millennials and Gen Z. Website and Style Changes Lululemon has also revamped and improved its website and product styles to attract younger customers. The website is sleek, easy to navigate, and emphasizes digital interaction. Models on the site come from diverse backgrounds, showcasing a variety of styles and body types, including those with tattoos and piercings, reflecting the inclusive values important to both younger and older customers. Prices and Economic Status As a premium brand in the activewear market, Lululemon targets middle to upper-middle-class individuals willing to pay more for high-quality, durable clothing. With leggings priced around $98 and sports bras/T-shirts about $58 (Lululemon, 2023), the brand appeals to customers who prioritize health, wellness, and performance. Geographic Focus Lululemon targets urban areas in North America, Europe, and Asia, such as New York, Los Angeles, London, and Shanghai. These cities are home to many fitness-minded customers with substantial disposable income, aligning with the brand’s focus on active lifestyles and fashionforward customers. Lululemon customers typically lead active, health-focused lives, seeking clothing that is both functional and fashionable. They view their purchases as investments in a lifestyle that promotes physical well-being and community. Lululemon supports this with local events, yoga classes, and running clubs, fostering a sense of community and belonging. The brand uses social media influencers and ambassadors who embody the active, aspirational Page 13 of 25 lifestyle their audience desires, a strategy particularly effective with younger customers on platforms like Instagram and TikTok (Business Insider, 2023). Inclusivity and Diversity Lululemon emphasizes inclusivity and diversity in its branding. It offers a wide range of sizes and ensures marketing materials feature diverse body types, ethnicities, and gender identities. This approach resonates with socially conscious customers who prefer brands reflecting their values. Loyalty and Community Engagement Lululemon promotes customer loyalty and community engagement through initiatives like the Lululemon Collective and Lululemon Like New. These programs offer exclusive events, early product access, and discounts, encouraging repeat purchases and fostering a personal connection to the brand. Engagement Strategies in the Lower Mainland In British Columbia's Lower Mainland, Lululemon focuses heavily on community involvement through local events and partnerships, often hosting yoga classes, running clubs, and wellness workshops in collaboration with local fitness studios and instructors. These events not only promote a healthy lifestyle but also create a direct bond with their customers, boosting brand loyalty and making Lululemon a key part of the community's fitness culture. Lululemon also maintains a strong digital and social media presence on platforms like Facebook, Instagram, and YouTube, sharing content that aligns with their customers' interests and values. From workout tips and mindfulness practices to product launches and customer stories, their social media strategy is designed to engage and inspire. They use Facebook to inform customers about new products, events, sales, and community stories. They engage with people in the comments and messages to make them feel included and foster conversation. On Instagram, they share their newest releases, upcoming special deals, workout tips, and ideas for a healthy lifestyle. They team up with famous athletes such as DK Metcalf, Hunter Woodhall, and Connor Bedard to make their posts more relatable and to attract more attention to their brand. Twitter is where they share quick news and interact directly with customers, helping them with questions and feedback promptly. They make videos on YouTube showing workouts, new clothes, and behind-the-scenes content. They send emails to customers with special offers and news based Page 14 of 25 on their interests. Their website functions as an extensive online store where customers can shop, find out about events, and learn more about the brand. Product Attraction Lululemon attracts customers with their clothing by using high-quality materials, designs, and stylish aesthetics tailored to different seasons. For summer, they offer lightweight, sweat-proof apparel in bright colors and trendy patterns, while their winter collections feature insulated, thermal wear with water-resistant and windproof fabrics. Their versatile designs are great for both athletic and casual wearers, enhancing their products' attractiveness. Conclusion In conclusion, Lululemon’s promotional strategies in the Lower Mainland are rooted in community engagement, influencer marketing, and a strong digital presence. By hosting local events, collaborating with fitness influencers, and leveraging social media platforms, Lululemon effectively communicates with their target market. These strategies not only promote their products but also strengthen their brand identity as a leader in the athletic apparel industry, successfully connecting with and inspiring their audience while fostering a loyal and active community. Page 15 of 25 Socially Responsible Behaviour The firm has witnessed a significant transformation in its business model with respect to integration of social responsibility as Lululemon Athletica, a key factor in the sportswear industry. The company’s approach exhibits a commitment to sustainability, ethical manufacturing, community engagement, and employee well-being. Thus, this review sheds light on the socially responsible behaviour of Lululemon. Sustainability Initiatives: Lululemon focuses on reducing its ecological footprint through various sustainability efforts: Sustainable Sourcing: Lululemon has adopted the use of materials which are sustainable, for example recycled polyester and organic cotton. The company is also looking into the possibility of developing new fabrics such as plant-based fibres and agreed by 2025 to source one hundred percent of its cotton from sustainable sources. Reducing Carbon Footprint: Lululemon intends to minimize carbon emissions throughout its operations. The company has committed itself to a science-based target seeking to reduce carbon emissions by sixty percent by 2030. This means optimizing energy usage in stores and distribution centres, increasing renewable energy application, and reducing transportation. Circular Economy: To address textile waste, Lululemon came up with initiatives such as “Like New” resale program where customers could trade in their gently used Lululemon products for store credits. This program supports product reuse while also reducing amounts of clothes that go into dumping sites. Ethical Manufacturing: Due to Lululemon's ethical manufacturing procedures, fair working conditions and high labour standards are maintained: Vendor Code of Ethics: To maintain its high labor standards, Lululemon has put in place a vendor code of ethics to show requirements concerning workers’ rights, wages fairness and safe working conditions. Thus, through several audits conducted regularly on its suppliers, it makes sure that these expectations are met. Fair Labor Association: Lululemon is one of the members of Fair Labor Association (FLA) which helps it in monitoring and improving labour practices within its supply chain. Membership to such an organization thus indicates Lululemon’s compliance with international labor standards. Page 16 of 25 Supplier Training Programs: The company offers training programs for its suppliers to improve their practices related to health and safety, worker rights, and environmental management. The aim of these programmes is to entrench sustainable long-term relationships with suppliers. Community Engagement: Lululemon is involved in the community in a variety of initiatives: Here to Be Program: This global initiative operates on a community level to support non-profits focused on using yoga and mindfulness to promote positive social change. Through offering grants, donations, and volunteers to local organizations this program supports mental and physical well-being within communities. Ambassador Program: Lululemon works with its Ambassador Program for local athletes, trainers and community leaders. These ambassadors are reflective of health and wellness which is a major focus by the company as they endorse healthy living while encouraging involvement with communities. Employee Well-being: Lululemon is investing in its employee’s well-being through some important policies: Employee Development: Among them are development programs which are extensive and include leadership training programs as well as career growth opportunities. This emphasis on personal and professional development contributes to a positive and driven staff. Workplace Wellness: Lululemon offers its workforce various wellness perks including fitness reimbursements, mental health resources, and flex hours. These benefits promote employee’s wellbeing thus encouraging a good work-life balance. The commitment of Lululemon Athletica to social responsibility is evident through its efforts to promote sustainability, ethical manufacturing, community outreach and employee wellbeing. The company’s use of sustainable materials, carbon reduction targets and circular economy programs underscore its commitment to environmental stewardship. Commendable labor practices that are directed towards suppliers and training programs in the community like “Here to Be” as well as Ambassador Program enhance social well-being. In addition, through investment in employee development and wellness schemes, Lululemon demonstrates a approach to corporate responsibility. These initiatives have positioned Lululemon as a leader among sportswear industry enterprises practicing responsible business concerning society. Page 17 of 25 Marketing Recommendations Section A This marketing plan outlines specific initiatives that lululemon should focus on the next 2 years including expansion of market presence, leveraging digital channels and addressing operational weaknesses. Increase Market Share in International Markets Lululemon should expand market share in Europe and Asia by 5% within the next 2 years. With a growing middle-class engagement and increasing disposable incomes in these regions, Lululemon has the potential to attract new customers. The following strategies could be applied to gain popularity among the masses. • Market Entry and Expansion: Lululemon should aim to open 50 new stores across major European and Asian cities. • Localized Marketing Campaigns: It can invest $100 million in localized marketing campaigns tailored to regional preferences and cultural nuances. Boost E-commerce Sales Lululemon should aim to increase e-commerce sales by 30% annually over the next 2 years. Leveraging the ongoing shift towards online shopping can help Lululemon reach a broader audience other than following the below strategies. • Website Optimization: Enhancing the user experience on Lululemon’s website and mobile app by integrating more personalized shopping experiences and AI-driven recommendations can boost e-commerce sales. • Digital Marketing: Allocating $150 million towards digital advertising, including social media, SEO, and PPC campaigns to drive online traffic could be quite beneficial. Expand Men’s Activewear Segment Lululemon should plan to increase men’s activewear segment revenue by 50% over the next 2 years. Although the men’s activewear market is underdeveloped, it shows a strong potential of growth if the following strategies are applied. Page 18 of 25 • Product Line Expansion: Lululemon can introduce new products specifically designed for men, such as sports-specific apparel and accessories. • Targeted Marketing: It can also invest $80 million in marketing campaigns targeting male consumers, highlighting the functionality and style of Lululemon’s men’s line. By focusing on these specific objectives and implementing targeted strategies, Lululemon can strengthen its market position, drive growth, and mitigate potential risks. This comprehensive marketing plan leverages Lululemon’s strengths, addresses its weaknesses, and capitalizes on available opportunities while countering external threats. Page 19 of 25 Section B MARKET PENETRATION: Enhance Lululemon's digital presence by implementing AI driven personalized shopping experiences and AR virtual try Ons to improve customer interaction and satisfaction. Increase social media engagement by collaborating with fitness influencers and encouraging user generated content to enhance reach and authenticity. Strengthen local community ties by hosting fitness events, workshops, and wellness programs. Create loyalty programs that offer exclusive discounts with pre orders on new products, creating closer relationships with the customer base and repeat traffic (Goeyardi et al., 2022). This way, market penetration will be solid and assure Lululemon's position in the market as a leading brand in activewear. MARKET DEVELOPMENT: Expand operation across Europe and Asia by doing complete research on the market to understand consumer behaviours and preferences in each local area. The main agendas will have to make the marketing strategies as per the regional variation while building up the company's localized approach. New stores or pop up shops can open to test the market's response and to get a starting point. This localized strategy will guide Lululemon to properly penetrate new markets, attract diverse customer bases, and help reduce dependency on the North American market. PRODUCT DEVELOPMENT: The product line should be more diversified with more inclusive sizing and further integrate the men's activewear segment. Regarding the advertising message, sustainability is needed through new eco friendly products (Kruachottikul et al., 2023). Partner with designers or celebrities for limited collections to give new customers reasons to shop and create a buzz that can attract in more customers. DIVERSIFICATION: Introduce new categories of products in line with the current health and wellness trend, such as wellness or fitness products and accessories. Research potential partnerships with tech firms to design future proof fitness products (Horvat et al., 2019). JUSTIFICATION: Lululemon's substantial brand value provides a solid foundation for these strategies. Going global and broadening the product line will reduce risks originating from the North American market and overpricing their products. A strengthened digital engagement and community involvement will drive customer loyalty and greater market penetration while focusing on sustainability and inclusivity. Page 20 of 25 Section C For developing an effective strategy for lululemon in pricing, promotion, product and distribution in regarding the SWOT analysis done by our group it is also essential to consider the current situation. Pricing Strategy 1. Tiered Pricing Models: Lululemon should create a tiered pricing system to cater different market segments. While maintaining the premium segment and consider a slightly lower-priced line to attract middle-income customers. 2. Value Based Promotions: Offering limited and timely promotions to loyal customers during special occasions. This will help remaining the high-end customers while attracting new ones. 3. Subscription models: Implementing subscription model for essential items like leggings and sports bras. This can create a good revenue stream and provide better value for regular customers. Promotion Strategy 1. Localized Marketing Campaigns: Developing targeted marketing campaigns for new international markets, highlighting lululemon’s commitment to quality through local culture relevance. 2. Digital Engagement: Enhance digital marketing campaigns with personalized advertising, social media engagement and influencer partnerships to expand the and reach the new customers. 3. Sustainability Campaigns: Promoting lululemon’s sustainability initiatives through social media and emphasizing eco-friendly practices which can strengthen brand reputation and appeal to environmentally conscious customers. Product Strategy 1. Men’s Activewear Expansion: Through targeted marketing strategies, maximize the basic men's division by launching various products designed primarily for men. 2. Innovative Product Lines: Expand on the features of Lululemon’s products, for example comfort, sustainability, and performance. Also, expand on the unique designs and types of fabrics Page 21 of 25 3. Customization Options: Introduce product customization, providing customers to create their unique activewear, which can increase engagement and brand loyalty in the long run Distribution Strategy 1. International Expansion: Expand the business into international markets, mainly Europe and Asia. Create marketing strategies and product offerings according to the world-wide market. 2. Enhanced E-Commerce Platform: Expand the business through an e-commerce platform to offer features like virtual try-ons, detailed product videos, and AI-powered recommendations. 3. Strategic Partnerships: Develop strong partnerships with high-end department stores and online retailers to increase brand visibility and accessibility. Page 22 of 25 REFERENCES Bhasin, H. (2023, May 3). SWOT Analysis of Lululemon 2023. Marketing91. https://www.marketing91.com/swot-of-lululemon/ Deloitte. (2021). Global Powers of Retailing 2021: Resilience despite challenges. Retrieved from https://www2.deloitte.com/global/en/pages/consumer-business/articles/global-powersof-retailing.html Goeyardi, G. M., Ramadhasari, D. R., & Alimudin, A. (2022). Market penetration strategy Horvat, A., Granato, G., Fogliano, V., & Luning, P. A. (2019). Understanding consumer data use https://globalnews.ca/news/10027580/lululemon-stock-sp-500-inclusion/ IBISWorld. (2022). Athletic & Sporting Goods Manufacturing in the US - Market Research Report. Retrieved from https://www.ibisworld.com/united-states/market-researchreports/athletic-sporting-goods-manufacturing-industry/ in new product development and the product life cycle in European food firms – An empirical study. Food Quality and Preference, 76, 20–32. https://doi.org/10.1016/j.foodqual.2019.03.008 Kruachottikul, P., Dumrongvute, P., Tea-makorn, P., Kittikowit, S., & Amrapala, A. (2023). New Lululemon Athletica Inc Revenue 2010-2024 | LULU. (n.d.). MacroTrends. https://www.macrotrends.net/stocks/charts/LULU/lululemon-athleticainc/revenue#:~:text=Lululemon%20%20Athletica%20%20Inc%20annual%20%20revenue,a %2042.14%25%20%20increase%20%20from%202021 Lululemon Ethics & Sustainability Report. (2020, May 3). Issuu. https://issuu.com/amberpullinger1/docs/final_lululemnon_ethics___sustainability_report_ LULULEMON, & CEO. (2021). LULULEMON 2021 IMPACT REPORT. https://corporate.lululemon.com/~/media/Files/L/Lululemon/our-impact/reporting-anddisclosure/2021-lululemon-impact-report.pdf LULULEMON, & CEO. (2021b). LULULEMON 2021 IMPACT REPORT. https://corporate.lululemon.com/~/media/Files/L/Lululemon/our-impact/reporting-anddisclosure/2021-lululemon-impact-report.pdf Lululemon. (2024). Women's Bestsellers. https://shop.lululemon.com/c/bestsellers/_/N1z0xcuuZ1z0xbcfZ8td. Manuel, L. (2022). Global Marketing in a Digital World. ON Ontario, Fanshawe. Page 23 of 25 McDonald, C. (2022). Impact Report 2022. https://corporate.lululemon.com/~/media/Files/L/Lululemon/our-impact/reporting-anddisclosure/lululemon-2022-impact-report.pdf McKinsey & Company. (2020). The State of Fashion 2020. Retrieved from https://www.mckinsey.com/industries/retail/our-insights/the-state-of-fashion Our journey. (n.d.). https://corporate.lululemon.com/about-us/inclusion-for-all/our-journey Pereira, D. (2024, May 30). Lululemon business model - How Lululemon makes money? Business Model Analyst. https://businessmodelanalyst.com/lululemon-business-model/ product development process and case studies for deep-tech academic research to commercialization. Journal of Innovation and Entrepreneurship, 12(1). https://doi.org/10.1186/s13731-023-00311-1 Reuters. (2023, October 16). Lululemon stock hits nearly two-year high on plans to join S&P 500. Global News. Salpini, C. (2022, November 9). Lululemon didn’t change activewear, it changed apparel. Retail Dive. https://www.retaildive.com/news/lululemon-changed-apparel-activewearfashion-trends/633757/ Soni, P. (Dec. 15th, 2014). Overview: Lululemon’s Target Market and Product Assortment. Yahoo Finance. https://finance.yahoo.com/news/overview-lululemon-target-market-product193745711.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&g uce_referrer_sig=AQAAAAoS4RWsMkdqks9R6bYLDeGroDdXHQ7f8bQ6Pp0QkNojPaDgd9fDIlFVNd4w0841T_2J6Ho0cYX3TcNoLmW7LusRDHLpvrwE8SkdC3h9ogObu 8YpOv8whLHVH22LcNiCVJM2wDWknTDqhWSPFKvZ16W7oRVEAneUmyZ0rdmhvMs. Statista. (2023). Sportswear market value worldwide from 2018 to 2023. Retrieved from https://www.statista.com/statistics/875786/global-sportswear-market-value/ Tara Deschamps, The Canadian Press. (2024, June 5). Lululemon sees Q1 net income hit $321M, revenues up 10%. Pique Newsmagazine. https://www.piquenewsmagazine.com/national-business/lululemon-sees-q1-net-income-hit321m-revenues-up-10-8995280 Thangavelu, P. (2023, December 20). Understanding Lululemon's Business Model (LULU). Investopedia. https://www.investopedia.com/articles/investing/052715/understandinglululemons-business-model.asp through social media marketing to create Consumer Loyalty. IJEBD (International Journal of Entrepreneurship and Business Development), 5(6), 1148–1156. https://doi.org/10.29138/ijebd.v5i6.2065 Udokporo, C. K. (2021). Understanding the Stages of the Product Life Cycle. In Product Life Cycle-Opportunities for Digital and Sustainable Transformation. IntechOpen. Zacks Equity Research (Jan. 22nd, 2024). Lululemon (LULU) on Track with Growth Strategies: Stock to Gain. Nasdaq. https://www.nasdaq.com/articles/lululemon-lulu-on-trackwith-growth-strategies:-stock-to-gain. Page 24 of 25 Appendix Page 25 of 25