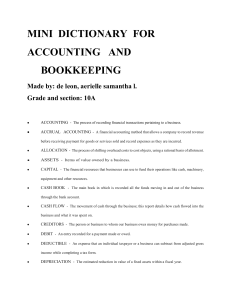

Professional Bookkeeping Service Provider in Ontario: A Smart Choice for Your Business Running a business, whether small or large, involves handling many complex financial tasks. One of the most critical areas is bookkeeping. Bookkeeping is the process of recording, organizing, and maintaining financial transactions, which helps ensure that businesses stay compliant with tax laws and regulations. For many business owners in Ontario, managing this aspect of their business can be overwhelming. This is where a professional bookkeeping service provider in Ontario can make all the difference. Why You Need Professional Bookkeeping Services ● Accurate Financial Records One of the most important reasons to hire a professional bookkeeping service provider in Ontario is the accuracy they bring to your financial records. Bookkeeping requires attention to detail, and mistakes can lead to incorrect financial reports, which can harm your business. A professional will ensure that all your financial transactions are recorded accurately and on time. ● Compliance With Tax Laws In Ontario, businesses must comply with various tax regulations. A professional bookkeeping service provider in Ontario is knowledgeable about tax laws and ensures that your business adheres to them. They will keep track of your expenses and revenues and prepare reports that meet the requirements of the Canada Revenue Agency (CRA). By doing so, you reduce the risk of tax penalties or audits How to Choose the Right Professional Bookkeeping Service Provider in Ontario 1. Experience and Expertise Look for a bookkeeping service provider with experience in your industry. They should be familiar with the specific financial challenges and tax requirements that businesses like yours face. Check their qualifications and certifications to ensure they have the necessary expertise. 2. Reputation A good reputation is crucial when selecting a bookkeeping service provider. Check online reviews and ask for references from other business owners. A trustworthy professional will have a history of providing excellent service and reliable financial support. 3. Technology and Tools The bookkeeping process has evolved with advancements in technology. Many professional bookkeeping service providers in Ontario now use cloud-based software that allows for real-time updates and easy access to financial data. Choose a provider who uses modern tools that ensure efficiency and accuracy. The Benefits of Outsourcing Bookkeeping in Ontario 1. Focus on Core Business Activities Outsourcing your bookkeeping allows you to concentrate on the core aspects of your business. You won’t have to worry about managing accounts or dealing with tax filings. Instead, you can focus on growing your business and providing excellent customer service. 2. Increased Efficiency Professional bookkeepers are trained to handle financial tasks efficiently. They are skilled at managing large amounts of data and ensuring everything is organized. This efficiency leads to more accurate financial reporting, which in turn helps in making better business decisions. 3. Reduced Risk of Errors Human error is common when handling complex financial data. By outsourcing to a professional bookkeeping service, you reduce the likelihood of making mistakes that could negatively impact your business’s finances. Professional bookkeepers are trained to spot potential issues and correct them before they become significant problems. Conclusion Bookkeeping is an essential part of any business, and hiring a professional bookkeeping service provider in Ontario can ensure that your business’s financial records are accurate, compliant, and well-maintained. Whether you're a small business owner or a large company, outsourcing your bookkeeping needs can save you time, reduce the risk of errors, and provide valuable financial insights. With the right service provider, you can focus on growing your business while leaving the financial management to the experts. Source blog: RCSPL CANADA INC.