A Guide to Finding Reliable Cash Buyers for Flats in Manchester

advertisement

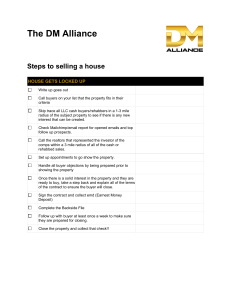

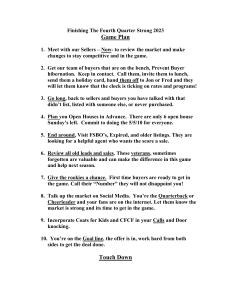

A Guide to Finding Reliable Cash Buyers for Flats in Manchester Selling a flat in Manchester can be an exciting yet challenging endeavor. If you’re seeking a quick sale, finding a reliable cash buyer can streamline the process and offer peace of mind. Cash buyers often eliminate the complexities of traditional sales, such as lengthy mortgage approvals or property chains. However, locating a trustworthy buyer requires careful consideration. Here’s a comprehensive guide to ensure a smooth and secure transaction. Understanding the Benefits of Cash Buyers Before diving into the search, it’s crucial to understand why cash buyers for flats Manchester are advantageous. These buyers offer flexibility and speed, often completing transactions within weeks. Since they aren’t reliant on mortgages, the risk of delays or sales falling through is significantly reduced. Additionally, cash buyers are ideal for sellers facing tight deadlines or those with properties requiring significant renovations, as they typically purchase flats in any condition. Conduct Thorough Research Thorough research is the foundation of a successful sale. Start by understanding the local property market in Manchester. Review recent sales of similar flats in your area to gauge realistic pricing. Familiarize yourself with current trends, such as demand for certain neighborhoods or property types. With this knowledge, you’ll be better equipped to negotiate and identify genuine offers. Next, research potential cash buyers for flats Manchester. Look for individuals or companies with a proven track record in buying properties quickly and ethically. Check online reviews, testimonials, and forums to assess their credibility. Reliable buyers are often transparent about their processes and willing to provide references upon request. Verify Financial Capability Ensuring a cash buyer has the financial resources to complete the purchase is paramount. Ask for proof of funds, such as bank statements or letters from financial institutions. Genuine buyers will readily provide documentation to confirm their ability to pay the agreed amount. This step not only safeguards your sale but also minimizes the risk of delays. Seek Recommendations Word of mouth is a powerful tool in the property market. Reach out to friends, family, or colleagues who have sold flats in Manchester for recommendations. They may have firsthand experience with reliable cash buyers and can offer valuable insights. Consulting local property professionals, such as estate agents or solicitors, can help you identify reputable buyers. These experts often have connections and a deep understanding of the market. Consider Direct Marketing If you want to take a proactive approach, consider marketing your flat directly to cash buyers. Advertise your sale on online property platforms, social media, and community boards. Highlight key features of your flat, such as its location, size, and unique attributes. Including a clear statement that you’re seeking cash buyers can attract the right audience and streamline inquiries. Engage a Property Solicitor Engaging a property solicitor is crucial once you’ve identified a potential buyer. A solicitor ensures all legal aspects of the sale are handled correctly, from drafting contracts to verifying the buyer’s legitimacy. They’ll also help you navigate the complexities of property transactions, giving you confidence and clarity throughout the process. Stay Vigilant Against Scams While most cash buyers for flats Manchester are genuine, it’s essential to remain cautious. Be wary of buyers who pressure you into making hasty decisions or those who refuse to provide clear documentation. Avoid buyers who offer unrealistic prices, as this may be a tactic to lower the offer later. Trust your instincts and seek professional advice if anything seems amiss. Finding a reliable cash buyer for your flat in Manchester doesn’t have to be overwhelming. By conducting thorough research, verifying financial credentials, and seeking professional guidance, you can ensure a seamless and positive selling experience. Whether moving on to new opportunities or simplifying your property portfolio, the right buyer can make the process efficient and rewarding.