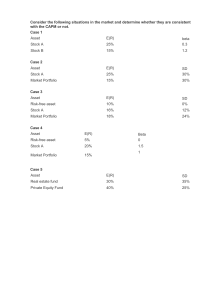

13 Return, Risk, the Security Market Line and CAPM McGraw-Hill/Irwin Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved. Chapter Outline Expected Returns and Variances Portfolios Risk: Systematic and Unsystematic Diversification and Portfolio Risk Systematic Risk and Beta The Security Market Line The Capital Asset Pricing Model (CAPM) 13-1 Expected Returns and Variances Expected returns are based on the probabilities of possible outcomes n E ( R ) pi Ri i 1 Variance & Standard deviation (STD) measure the volatility of returns Measure total risk n 2 2 σ pi (Ri E(R)) i 1 13-2 Expected Returns and Variances Suppose you have predicted the following returns for stocks C and T in three possible states of nature. What are the expected returns, variance and STD? State Boom Normal Recession Probability 0.3 0.5 ? C (%) 15 10 2 T (%) 25 20 1 RC = .3(15) + .5(10) + .2(2) = 9.9% RT = .3(25) + .5(20) + .2(1) = 17.7% 2(C) = .3(15-9.9)2 + .5(10-9.9)2 + .2(2-9.9)2 =20.29 = 4.5 CV(C) = / RT = 4.5/9.9 = 0.45 2(T) = .3(25-17.7)2 +.5(20-17.7)2 +.2(1-17.7)2 =74.41 13-3 = 8.63 CV(T) = / RT = 8.63/17.7 = 0.48 Risk Analysis Expected value E(Ai) n E ( Ai ) ( R ij * P j ) j 1 Standard deviation: is a measure of the dispersion of a set of data from its expected value E(Ai) Coefficient of variation (CV) is the ratio of the standard deviation to the mean. n ( Ai ) (Rij E( Ai ))2 * Pj j 1 CV is a standardized measure of risk that shows the risk per unit of return. CV ( Ai ) E ( Ai ) The higher the coefficient of variation, the greater the level of dispersion around the mean 13-4 Higher risk! Another Example Consider the following information: State Boom Normal Slowdown Recession Probability .25 .50 .15 .10 ABC, Inc. (%) 15 8 4 -3 What is the expected return? E(R) = … What is the variance? Variance = … What is the standard deviation? STD = … 13-5 Portfolios A portfolio is a collection of assets The expected return of a portfolio: is the weighted average of the expected returns of the respective assets in the portfolio. m E (RP ) w j E (R j ) j 1 You can also find the expected return by finding the portfolio return in each possible state and computing the expected value as we did with individual securities 13-6 Portfolio Variance Portfolio Variance / Standard deviation: • Compute the portfolio return for each state RP = w1R1 + w2R2 + … + wmRm • Compute the expected portfolio return • Compute the portfolio variance and standard deviation using the same formulas as for an individual asset 2 n σ p pi ( R p E ( R p )) 2 i 1 13-7 Example: Portfolio Variance Consider the following information Invest 50% of your money in Asset A, 50% in B. State Probability Boom Bust .4 .6 A 30% -10% B -5% 25% Portfolio 12.5% 7.5% What are the expected return and STD for each asset? What are the expected return and STD for the portfolio? Ans: A: 6%,19.6%; B: 13%, 14.7%; Portfolio: 9.5% & 2.45% CV(A) = 3.2; CV(B) = 1.1; CV(P) = 0.2 Difference in return & STD between each stock and portfolio? 13-8 Portfolio Variance Portfolio Variance / Standard deviation: n 2 σ p pi ( R p E ( R p )) 2 i 1 n σ X ,Y pi [ Xi E( X )][Yi E(Y )] i 1 σ 2p w 12 σ 12 w 22 σ 22 2w 1 w 2 σ 1 σ 2 ρ 1,2 . w 12 σ 12 w 22 σ 22 2w 1 w 2 σ 1,2 Với: w1 là trọng số tài sản 1 1,2 là correlation coefficient 1,2 là covariance 13-9 Another Example Consider the following information State Boom Normal Recession Probability .25 .60 .15 X 15% 10% 5% Z 10% 9% 10% What are the expected return and standard deviation for a portfolio with an investment of $6,000 in asset X and $4,000 in asset Z? Expected return = … Standard deviation = … COV(X,Z) = … 13-10 Expected return - Risk Expected return 4 2 3 1 Variance or STD • (2) vs. (1): …? • (2) vs. (3): …? • (4) vs. (3): …? 13-11 Returns Total Return = expected return + unexpected return Unexpected return = systematic portion + unsystematic portion Therefore, total return can be expressed as follows: Total Return = expected return + systematic portion + unsystematic portion 13-12 Systematic Risk Risk factors that affect a large number of assets. Also known as non-diversifiable risk or market risk. Includes such things as changes in GDP, inflation, interest rates, etc. 13-13 Unsystematic Risk Risk factors that affect a limited number of assets Also known as unique risk and asset-specific risk (diversifiable risk) Includes such things as labor strikes, part shortages, etc. 13-14 What risk should be priced? Total risk = Systematic risk + Unsystematic risk Relationship between Diversification and Risk 13-15 Diversification Portfolio diversification is the investment in several different asset classes or sectors Diversification is not just holding a lot of assets For example, if you own 50 Internet stocks, you are not diversified However, if you own 50 stocks that span 20 different industries, then you are diversified 13-16 Diversification & Risk Diversification can substantially reduce the variability of returns (risk) without an equivalent reduction in expected returns This reduction in risk arises because worse than expected returns from one asset are offset by better than expected returns from another However, there is a minimum level of risk that cannot be diversified away and that is the systematic portion 13-17 Table 13.7 13-18 Figure 13.1 13-19 Total Risk Total risk = Systematic risk + Unsystematic risk The standard deviation of returns is a measure of total risk For well-diversified portfolios, unsystematic risk is very small Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk 13-20 Systematic Risk Principle There is a reward for bearing risk There is not a reward for bearing risk unnecessarily The expected return on a risky asset depends only on that asset’s systematic risk since unsystematic risk can be diversified away 13-21 Measuring Systematic Risk How do we measure systematic risk? We use the beta coefficient to measure systematic risk What does beta tell us? A beta of 1 implies the asset has the same systematic risk as the overall market A beta < 1 implies the asset has less systematic risk than the overall market A beta > 1 implies the asset has more systematic risk than the overall market 13-22 Total versus Systematic Risk Consider the following information: Standard Deviation Security C Security K 20% 30% Beta 1.25 0.95 Which security has more total risk? Which security has more systematic risk? Which security should have the higher expected return? 13-23 Example: Portfolio Betas Consider the previous example with the following four securities Security DCLK KO INTC KEI Weight .133 .2 .267 .4 What is the portfolio beta? Beta 2.685 0.195 2.161 2.434 m beta P w jbeta j j1 Beta(p) = .133(2.685) + .2(.195) + .267(2.161) + .4(2.434) = 1.947 13-24 Beta and the Risk Premium Risk premium = Expected return – Risk-free rate The higher the beta, the greater the risk premium should be Can we define the relationship between the risk premium and beta so that we can estimate the expected return? YES! 13-25 Example: Portfolio Expected Returns and Betas 30% Expected Return 25% E(RA) 20% 15% 10% Slope = (E(RA) – Rf) / A =Reward-to-Risk ratio Rf 5% 0% 0 0.5 1 1.5 A 2 2.5 3 Beta 13-26 Reward-to-Risk Ratio: Definition and Example The reward-to-risk ratio is the slope of the line illustrated in the previous example Slope = (E(RA) – Rf) / (A – 0) Reward-to-risk ratio for previous example = (20 – 8) / (1.6 – 0) = 7.5 What if an asset has a reward-to-risk ratio of 8 (implying that the asset plots above the line)? What if an asset has a reward-to-risk ratio of 7 (implying that the asset plots below the line)? 13-27 Market Equilibrium In equilibrium, all assets and portfolios must have the same reward-to-risk ratio and they all must equal the reward-to-risk ratio for the market E(RA ) Rf A E(RM Rf ) M Rf: Risk-free rate RM: Market return RA: Return of asset A A: Systematic risk of A M: Systematic risk of market (=1) 13-28 Security Market Line The security market line (SML) is the representation of market equilibrium The slope of the SML is the reward-to-risk ratio: (E(RM) – Rf) / M But since the beta for the market is ALWAYS equal to one (M =1), the slope can be rewritten: Slope = E(RM) – Rf Slope = E(RM) – Rf = market risk premium 13-29 Figure 13.4 13-30 The Capital Asset Pricing Model (CAPM) The capital asset pricing model defines the relationship between risk and return: E(RA) = Rf + A(E(RM) – Rf) If we know an asset’s systematic risk, we can use the CAPM to determine its expected return This is true whether we are talking about financial assets or physical assets 13-31 Factors Affecting Expected Return Pure time value of money – measured by the risk-free rate Reward for bearing systematic risk – measured by the market risk premium Amount of systematic risk – measured by beta () 13-32 Example - CAPM Consider the betas for each of the assets given earlier. If the risk-free rate is 2.13% and the market risk premium is 8.6%, what is the expected return for each? Security DCLK KO INTC KEI Beta 2.685 0.195 2.161 2.434 Expected Return 2.13 + 2.685(8.6) = 25.22% 2.13 + 0.195(8.6) = 3.81% 2.13 + 2.161(8.6) = 20.71% 2.13 + 2.434(8.6) = 23.06% 13-33 13 End of chapter McGraw-Hill/Irwin Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.