Finance Reflection Notes: Returns, Risk, and Portfolio Management

advertisement

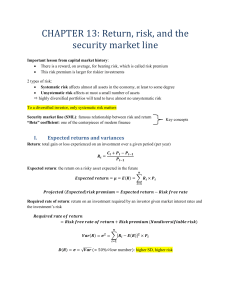

Reflection week 11 1. Expected returns - Based on the probabilities of possible outcomes - The average if the process is repeated multiple times Can be solved using the formula : Given a Stock A, you follow the procedure : Bloom A(probability 1) + normal A(probability 2) + recession A(probability 3)=expected returnA% 2. Variance and standard deviation - Measures the volatility of returns - Uses unequal probabilities for entire range of possibilities - Variance is the weighted average of squared deviations Variance can be solved using the formula : And the standard deviation can be solved by taking the square root of the variance Given a Stock A, you follow the procedure : Probability 1(Bloom A - Expected return A)^2 + probability 2(Normal A - Expected return A)^2 + probability 3 (recession A - Expected return A)^2 = variance Then you square root the variance for the standard deviation 3. Portfolio weights - Can be found by taking the portfolio weight and dividing it by the invested amount For security ABC, you take 2000, the portfolio weight, and divide it by 15,000, the invested amount for 0.133 4. To calculate the expected return of an entire portfolio Can be solved using the formula : Where you take the calculated weight and multiply it by the corresponding expected return For example : = 0.1333(0.1965) + 0.20(0.0896) + 0.267(0.0967) + 0.4(0.0813) = 10.24% 5. Correlation coefficient Can be solved using the formula : For example : “What is the correlation of the following stocks if the standard deviation of stock X is 0.08 and the stock Y is 0.007 and covariance of the two stocks are 0.0002” Covariance = 0.0002 , Stock X = 0.08 , Stock Y = 0.007 Correlation = 0.0002/(0.08*0.007) = 0.36 6. Systematic vs unsystematic risk Systematic/non diversifiable risk - Risk factors that affect a large number of asserts - Non diversifiable risk is also known as market risk - Includes such things as changes in GDP, inflation, interest rates, etc - A stock price will systematically go up and down with the overall market Unsystematic/diversifiable risk - Risk factors that affect a limited number of assets - Can be reduced by diversification - Unique risk or asset specific risk Idiosyncratic individual company risk Includes such things as labor strikes shortages etc, A stock will trade on its own merits (growth, profitability) not related to systematically moving with the overall market 7. Return formulas and risk Total return = Expected return + unexpected return Unexpected return = systematic portion + unsystematic portion Therefore, total return can be expressed as follows Total return = expected return + (systematic portion + unsystematic portion) Total risk = systematic risk + unsystematic risk 8. Beta rules, or measuring systematic risk 9. The capital asset pricing model (CAPM) - which defines the relationship between risk and return Can be calculated using the formula : And the variables defined as :