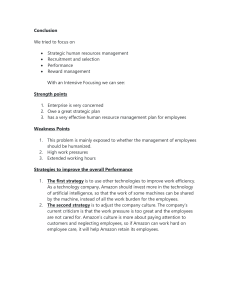

Group 3 – Amazon Vs Walmart! Briefings Overview Amazon prime – subscription model effectiveness, Wide range of products available at amazon Amazon go and fresh – brick and mortar stores, new technology – focus more? possible problems – stealing? 23 stores across the US, 8 stores closed last year – didn’t live up to the company’s vision!! High cost and complex to operate – high operating costs for software and people, hard to autopilot, Barnes and nobles and wholefoods. Walmart – Low-cost leadership Widespread presence – low prices and wide coverage of products!! Matrix structure of leadership Similar mission statements of low prices, convenience and customer service. Vision statement – amazon – customer centric and convenience – wide range of products to customers Walmart – providing value to customers by keeping the prices low. Strategies of Walmart and amazon – Walmart – lower prices – information technology utilized by both the companies. Low cost advertising implemented by Walmart. Customers preferring online retail channel. Walmart – investing in to system – interface built up Strength – amazon(leading product search engine) Whole foods barnes and nobles- not doing too much good in terms Questions Q.1 Should they continue to develop capabilities in each other traditional domains or focus on their core strengths while offering complementary services? Yes For amazon – they should white label more essential products (such as low ticket goods such as pens, notebooks, keyboards etc) and market on their platform, implementing Ai in their e-commerce for data analysis and estimation of product demand. Since it would be extremely difficult to excel in brick-and-mortar stores going in to the market with low cost leadership, they should expand on their whole foods strategy with high price, high quality and providing goods and services which are not offered by Walmart. 2. what strategies should they adopt to address the distinct customer bases and product categories best suited for online and offline retail? Walmart – focus on essential and staple products while improving their omnichannel division for quickly filling up the order and reduce the delivery times for essential groceries, this can be done by training omni-channel employees, testing different techniques to fulfill order quickly. Incentives for customers to sign up for the online delivery services to boost the initial customer acquisition and lower the subscription fees. For amazon – onboard official companies such as nike, adidas to offer their products on amazon directly to clear out dead inventory, which would benefit both companies to boost more sales since amazon is a leading search engine for products. 3. If Walmart and amazon continue investing in their competitor’s business models, how can they capture the opposition’s target market?? Amazon can capture the brick-and-mortar space by their successful whole foods location focus less on expansion of amazon go where cashless experience is not as popular due to lack of customer service touch. Walmart should invest more to promote their online presence selling a variety of goods from groceries, stationaries, and electronic products with same day delivery. The same day delivery can be implemented with effective omni-channel and logistics since they have 10,000 stores across United States. Swot Amazon S– Brand recognition prime membership, fulfillment network W– High operational cost – logistic and marketing, third party sellers O– Global expansion Technological advancements T Intense competition Cybersecurity threats Walmart S Market leadership – largest retailer Economies of scale W– Thin profit margins Public perception issue Dependence on us markets OGlobal expansion Threats Intense competition Industry analysis – US market 6.3 trillion us market cap for ecommerce 72% of the sales will be conducted in brick-and-mortar stores – of what products.??????? Same day delivery – most important for Walmart!!!! 33% of consumers purchased shoes through e-commerce. Possible solution for amazon – onboard Nike to sell directly!! Competitors – Target – leading retail – 1900 stores Costco – warehouse (for wholesale product market) – amazon for small businesses to provide at wholesale prices. Temu – for online ecommerce Walmart – 10,000 stores!! Brick and mortar presence Amazon – retail stores – revenue from aws services Walmart - highest revenue company in the world Amazon – active in investments PPE – intellectual property!! Walmart is conservative in debt issuance – pays quarterly dividends while amazon does not.