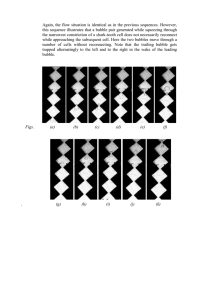

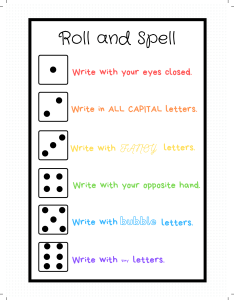

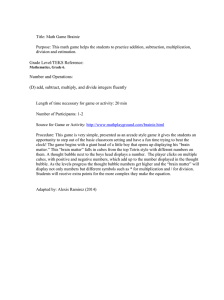

The Quarterly Review of Economics and Finance 52 (2012) 243–255 Contents lists available at SciVerse ScienceDirect The Quarterly Review of Economics and Finance journal homepage: www.elsevier.com/locate/qref Value relevance and the dot-com bubble of the 1990s夽 John J. Morris a,∗ , Pervaiz Alam b a b Kansas State University, Department of Accounting, 109 Calvin Hall, Manhattan, KS 66506-0502, United States Department of Accounting, College of Business Administration, Kent State University, P.O. Box 5190, Kent, OH 44242, United States a r t i c l e i n f o Article history: Received 30 November 2010 Received in revised form 31 January 2012 Accepted 5 April 2012 Available online 17 April 2012 Keywords: New economy Value relevance Capital markets Equity valuation Earnings quality Analyst forecast a b s t r a c t During the dot-com bubble of the 1990s, equity market valuation was a popular topic for investors, financial analysts and academics. Some questioned whether traditional accounting and financial information had lost its value relevance, as stocks traded at multiples of earnings well in excess of historic levels, leading Alan Greenspan to caution against “irrational exuberance.” This study examines the relation between market valuation and traditional accounting/financial information before, during and after the bubble. We confirm previous research that documents a decline in the relation between market value and traditional accounting information leading up to the bubble period. However, we also document that after the collapse of the bubble in 2000 this trend reverses. We also examine two related metrics that may provide a rational explanation for this phenomenon, including the quality of earnings, and the aggressiveness of financial analysts’ forecasts, finding some support that earnings quality may contribute to the changes in value relevance, but not the aggressiveness of analyst forecasts. © 2012 The Board of Trustees of the University of Illinois. Published by Elsevier B.V. All rights reserved. 1. Introduction During the dot-com bubble of the 1990s, many questioned the value of fundamental financial information for investment decision-making purposes. Stocks were trading at record multiples of earnings. In fact many companies with no earnings at all, experienced significant increases in their stock prices during the latter half of the 1990s. A number of academic studies documented a decline in the linear relationship between earnings and stock returns (e.g., Brown, Lo, & Lys, 1999; Ely & Waymire, 1999; Francis & Schipper, 1999; Lev & Zarowin, 1999). Investors called for additional information beyond the traditional financial statements based on Generally Accepted Accounting Principles (GAAP). Some argued that earnings no longer mattered and that other metrics such as number of clicks or page views were more appropriate in the new economy (Penman, 2003). Others argued that bad accounting and poor accounting standards contributed to the 1990s bull market (Krugman, 2004; Stiglitz, 2003). In response to these demands, companies began releasing so called “pro-forma” financial information that presented what the company’s financial statements would look like if they did not have to follow current 夽 Data availability: Data used in this study are available from public sources. ∗ Corresponding author. Tel.: +1 785 532 6185; fax: +1 785 532 5959. E-mail addresses: jjmorris@ksu.edu (J.J. Morris), palam@kent.edu (P. Alam). accounting guidelines. Amazon.com Inc. started the trend in the second quarter of 1998 by excluding amortization expenses on intangible assets, and was quickly followed by Yahoo! Inc. and others. By the middle of 2001, the majority of S&P 500 companies excluded some GAAP expenses when reporting financial performance in their press releases (Best, 2006). The practice became such a concern to the SEC that on December 4, 2001 it issued an advisory statement that cautioned public companies not to mislead investors, providing five propositions for guidance on the dissemination of pro-forma information (SEC, 2001).1 Penman (2003) describes the bubble period of the 1990s as a pyramiding chain letter where momentum investing displaced fundamental investing. The mood was perhaps best described by Alan Greenspan, Chairman of the Federal Reserve Board, when he cautioned against irrational exuberance in a speech at The American Enterprise Institute for Public Policy Research on December 5, 1996 (Greenspan, 1996). These prophetic words have been the subject of many discussions since, and they motivate our investigation of this bubble and its subsequent collapse. 1 The propositions include: (1) antifraud provisions apply to pro-forma, (2) differences from GAAP and pro-forma should be clearly spelled out, (3) materiality of omitted information is important consideration, (4) companies should follow guidelines developed by the Financial Executives International and the National Investors Relations Institute for pro-forma style, and (5) investors are encouraged to compare pro-forma results to GAAP-based results. 1062-9769/$ – see front matter © 2012 The Board of Trustees of the University of Illinois. Published by Elsevier B.V. All rights reserved. http://dx.doi.org/10.1016/j.qref.2012.04.001 244 J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 Specifically, we examine the value relevance of accounting and financial information during the period of time surrounding the dot-com bubble, from 1995 to 2000. This period of time is referred to as the new economy period (NEP) by several researchers, who examine trends in value relevance leading up to this time period (e.g., Core, Guay, & Van Buskirk, 2003; Demers & Lev, 2001; Trueman, Wong, & Zhang, 2003). Our study extends these prior studies into the post dot-com bubble period by examining a broad cross-section of firm-year observations from 1989 through 2006 and a sub-sample of firms in high technology industries that are thought to be more representative of the so called “new economy firms.” We find that value relevance as measured by regression R2 decreased during the bubble period, from 1995 to 2000, consistent with prior research, but increased after the collapse of the bubble in 2000. We find similar results for both high technology and low technology sub-samples. We also examine two related metrics as possible explanations for this phenomenon. First, we use a proxy for perceived earnings quality and find no significant difference in perceived earnings quality occurs during the dot-com bubble period, suggesting that the decline in value relevance cannot be explained by a perceived decline in the quality of financial reporting for the overall sample. However, when we split the sample between high technology and low technology firms, we find that the perception of earnings quality for high technology firms declined during the dot-com bubble period, and remained low for the next four years after the bubble collapsed. In contrast our low-tech sample reflects no change during the bubble period and improved quality perceptions following the bust, suggesting that the investing public was still apprehensive about the quality of financial reporting for the high-tech segment of the economy, but not the low-tech segment. Therefore, the overall value relevance trend, which declines during the bubble period then increases following the bursting of the bubble, can only be explained, in part, by perceived earnings quality. We also examine whether financial analysts may have contributed to the decline in value relevance during the dot-com bubble period by being overly aggressive with their forecasts. We find no evidence, of increased aggressiveness in forecasting during the bubble period. However, we do find a significant decline in aggressiveness following the bubble bursting. The results of our study are likely to be of interest to academics, accountants, financial professionals, investors, and regulators for a number of reasons. First, the general decline in value relevance identified by the academic community in prior research appears to have stopped and reversed in the post bubble period, which to our knowledge has not been previously documented. For accounting and financial professionals, the decline in value relevance and perceived earnings quality during the dot-com bubble period followed by an increase in value relevance after the collapse should serve to encourage continued improvement in the quality of financial reporting. From the investor perspective, the results indicate that reliance on traditional accounting and financial information for investment decision making still has merit. For accounting regulators, the results provide support for resisting any call to reduce reporting standards just because certain interest groups argue that a “new economy” requires new or different information. The remainder of the paper is organized as follows: Section 2 reviews prior research and develops our hypotheses, Section 3 discusses research methods and models used in the study, Section 4 summarizes the sample selection process, Section 5 presents the empirical results, and Section 6 summarizes results and offers some conclusions and opportunities for future research. 2. Prior research and hypotheses development 2.1. Prior research The demand for additional information by investors during the 1990s motivated a number of academic studies that demonstrate a decline in the linear relationship between earnings and stock returns (e.g., Brown et al., 1999; Ely & Waymire, 1999; Francis & Schipper, 1999; Lev & Zarowin, 1999). These value relevance studies typically use regressions of returns on earnings, finding that the slope coefficients and R2 s decline over time. Ryan and Zarowin (2003) investigate two explanations for this decline, lag and asymmetry, finding that annual earnings reflect news with a lag relative to stock prices, and that earnings reflect good and bad news in an asymmetric fashion. Sinha and Watts (2001) use an analytical model to argue that an increase in alternate sources of information, either indirectly through financial analysts or directly from companies due to increased pressure from regulators, may be contributing to the decline in relevance of financial reports. Core et al. (2003) study a broad sample of firms from 1975 to 1999 to explore whether, and to what extent, traditional proxies for future cash flows are relevant for explaining equity values of firms operating in the so called “new economy period.” They find mixed support for their hypothesis that the new economy period is characterized by significant changes in the relation between equity values and traditional explanatory variables. A growing literature also examines the role of Internet companies during the 1996–2000 stock market bubble. Keating, Lys, and Magee (2003) investigate the decline in value of Internet firms in the spring of 2000 and conclude that stock prices during the period are explained more by revised investor assessments of annual report data than by any new information. Lewellen (2003), in a discussion of the Keating et al. (2003) paper, argues that the results tell more about investor perceptions or misperceptions than they tell about the underlying economics of Internet firms. He argues that the market was irrational at that time, and offers evidence that prices were too high. In another new economy study that focused on anomalous stock returns around earnings announcements by Internet firms, Trueman et al. (2003) find little evidence to suggest that returns can be explained either by earnings news disclosed or by risk changes, suggesting some level of irrationality in the pricing of Internet stocks. Ofek and Richardson (2003) demonstrate that the market valuation of Internet companies was higher during the bubble period because of the market’s limited ability to short Internet stocks. Cooper, Khorana, Osobov, Patel, and Rau (2005) find that internet-related firms that change their name by adding a dot-com during the boom and removing it after the bust experience large gains in shareholder wealth. Pastor and Veronesi (2006) argue that the Internet Nasdaq bubble during the late 1990s was not irrational but it was a result of high volatility of stock prices due to uncertainty about average future firm profitability. Bharath and Viswanathan (2006) report that U.S. publicly traded Internet firms lost nearly $428 billion during the March–December 2000 period as a result of the bubble burst. These studies suggest the importance and contribution of Internet firms to the stock market bubble of the 1990s. More recent research examines other issues related to bubbles. For instance, Leger and Leone (2008) find departures from fundamental pricing during the bubble in the UK and that consumer confidence is a strong explanatory variable in the pre-bubble period. Louis and Eldomiaty (2010) use the Dow Jones and NASDAQ indices to test the robustness of Binswanger’s (2004a,b,c) findings that US stock price movements after the 1982 debt crisis are mainly governed by non-fundamental shocks. They conclude that US stock prices are mostly governed by speculative bubbles or irrational J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 245 exuberance. Anderson, Brooks, and Katsaris (2010) find that the bubble of the 1990s was not confined to the information technology sector, but included financials and general industry segments as well. to the decline in value relevance, we would expect to see a pattern similar to value relevance, with a decrease in quality during the bubble followed by an increase in quality after. This leads to our next hypothesis: 2.2. Value relevance hypothesis H2. The quality of financial reporting as measured by perceived earnings quality will decline during the dot-com bubble period, and increase following the collapse of the bubble. Although there has been a significant amount of research related to bubbles, as discussed in the prior section, to our knowledge no one has examined whether the value relevance findings leading into the dot-com bubble period continue to hold in the post-bubble period. The previous studies, in one way or another, raise the possibility that the markets are not always rational. In fact, a somewhat controversial line of research in the finance field argues that markets may be driven more by human behavior characteristics than by the efficient market theory. For instance, Jegadeesh and Titman (1993, 2001) develop and test behavioral models, including the concept of momentum strategies, finding evidence that investors tend to overreact to momentum. In other words, when markets are going up they tend to buy beyond the point where they should, and likewise on the downside tend to hold on and not sell when they should. Assuming behavioral finance academics are at least partially correct that the market does from time to time react irrationally, we posit that one of those times was during the dot-com bubble of the 1990s. Irrationality would explain why researchers would struggle in reconciling their results with an efficient market theory. Irrationality would also help explain why traditional accounting measures would reflect a decline in value relevance as discovered by Collins, Maydew, and Wiess (1997), Francis and Schipper (1999), Brown et al. (1999), Core et al. (2003) and others. Aharon, Gavious, and Yosef (2010) study the effects of the stock market bubble on mergers and acquisitions, concluding that investors seem to experience a learning process in terms of the type of variables preferred and are more cautious after the bursting of the bubble. Therefore, we further posit that if irrationality contributed to the decline in value relevance during the bubble period, then after the bubble bursts, investors will return to a more fundamental (rational) approach to market valuation, which leads to our first hypothesis: 2.4. Forecast accuracy hypothesis Another rational explanation for the decline in value relevance may be related to the influence of financial analysts. One of the groups that Healy and Palepu (2003) single out for contributing to the dot-com bubble is the financial analyst community. They point out that many investors rely on financial analysts to interpret the financial information provided by management and to assess company strategy and management strengths and to forecast the performance of the companies that they track. Armed with this information, individual investors then make the final buy, sell, or hold decisions. They note that following the collapse of the bubble, investigators found evidence of conflicts of interest with analysts providing “puffed up” prospects for companies that were also IPO clients of their firm. Liu and Song (2001) examined analysts’ forecasts of earnings for Internet companies surrounding the market crash in March 2000. They reported that analysts were more optimistic before than after the March 2000 period suggesting that analysts’ optimism may have caused the stock market bubble. Similarly, O’Brien and Tian (2006) conclude that analysts were more optimistic in their recommendation for Internet companies than for non-Internet companies during the 1990s bubble period. Glaum and Friedrich (2006) find that following the collapse of the bubble analysts have changed their focus from revenue-oriented measures towards an assessment of profitability and cash flow generation. Given this situation, we expect to see a trend in analyst forecast accuracy that is similar to the trend in value relevance of financial information and the trend in earnings quality. In other words, if financial analysts were overly optimistic during the bubble period, the collapse of the bubble and the subsequent regulatory response should mitigate that behavior, which leads to our next hypothesis: H1. The value relevance of traditional accounting information, which declined during the dot-com bubble period, will increase in the period following the collapse of the bubble. H3. Earnings forecasts by financial analysts will be more aggressive during the dot-com bubble period, and less aggressive following the collapse of the bubble. 2.3. Earnings quality hypothesis 3. Research models One rational explanation for the decline in value relevance may be related to a decline in the quality of financial information provided to investors. Healy and Palepu (2003) argue that in addition to “irrational exuberance,” other forces were at work during the bubble that led to the collapse. They point to a number of high profile business failures including Enron, WorldCom, Tyco, and Global Crossing who misrepresented their financial condition, and blame auditors, financial analysts, and mutual fund managers for ignoring fundamental analysis and contributing to the “herd mentality.” They point out that as a result of the finger pointing that followed the scandals, and the market collapse, regulators and legislators stepped in to change the way these professions function. An example is the oversight provided by the Sarbanes-Oxley Act (SOX), which was quickly rushed through the US Congress. Jenkins, Kane, and Velury (2006) find a significant increase in the magnitude of discretionary accruals and a significant decrease in the earnings response coefficient (ERC) during the period 1997–1999, relative to the period 1990–1996, suggesting an overall decrease in earnings quality. Assuming poor quality financial reporting did contribute 3.1. Value relevance model The exact start of the new economy period is uncertain. However, Core et al. (2003, p. 54) point out that the term “new economy” shows up as early as 1994, and that “comments from the Vice Chairman of the Federal Reserve Board suggest that the economic factors denoting an NEP significantly accelerated around the year 1995.” Therefore, we use 1995 as the first year of the new economy period and the start of the related dot-com bubble period. The end of the bubble is easier to select because the stock market collapsed in 2000. Therefore, we assume that the year 2000 is the last year of the bubble period. To test our value relevance hypothesis (H1), we look for a valuation regression model that relates equity value to various accounting and financial variables. Ohlson (1995) was one of the first to model the market value of equity (price) as a function of current book value plus the present value of future earnings. Subsequent researchers have modified this basic model to examine various issues related to the association between equity values and 246 J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 accounting information (Brown et al., 1999; Collins et al., 1997; Core et al., 2003; Francis & Schipper, 1999; Lev & Thiagarijan, 1993). We use the formulation developed by Core et al. (2003), which has been widely cited in subsequent research (Armstrong, Davila, Foster, & Hand, 2011; Ashton, 2005; Balachandran & Mohanram, 2011; Bonson, Cortijo, & Escobar, 2008; Hao, Jin, & Zhang, 2011; Henderson, Kobelsky, & Richardson, 2010; Jeon & Kim, 2011; Kothari & Shanken, 2003; Maines et al., 2003; Murgulov & Bornholt, 2009; Shah & Akbar, 2008; Simpson, 2008; Skinner, 2008; Wang & Alam, 2007; Xu, Magnan, & Andre, 2008). Core et al. (2003) extend their research through 1999, just prior to the bubble bursting, which gives us a reference point for comparison purposes. Their formulation is also appropriate for our study because it includes more detailed accounting data points than other models. Our objective, like Core et al. (2003), is to select accounting variables that theoretically and empirically explain cross-sectional variation in stock prices, and are expected to be robust over time. Our objective is not to maximize the fit of any particular model therefore we do not test it against other models. Core et al. (2003) regress the market value of equity on the book value of equity, current earnings, and proxies for expected earnings growth. Following Core et al. (2003), we use income before extraordinary items as the measure of current earnings, and a variable for loss years because prior literature documents differences in the valuation of losses and profits (e.g., Basu, 1997; Collins et al., 1997; Hayn, 1995). The loss-year variable is set equal to income before extraordinary items for firm-years with losses (the negative value), and zero for firm-years with profits. Proxies for growth include: advertising expenditures, research and development expenditures, capital expenditures, and sales growth over the previous year. Brown et al. (1999) caution researchers that the use of per share or firm level data can provide misleading results when comparing R2 values from different samples unless they control for the scale factor effect on the estimated coefficients. In fact, they show that in two prior studies that had concluded that R2 was increasing (Collins et al., 1997; Francis & Schipper, 1999), after controlling for the coefficient of variation, the values decreased. Brown et al. (1999) recommend two approaches to control for this effect. The first is to include a proxy for the coefficient of variation of scale, and the second is to deflate individual observations by a proxy for scale. To be consistent with Core et al. (2003), we follow the second recommendation and use a scaled version of the model, deflated by the book value of equity, which they suggest is consistent with several other valuation studies in the new economy period, such as Rajgopal, Kothari, and Venkatachalam (2000) and Trueman, Wong, and Zhang (2000). Following is our valuation regression model: (MVEi,t+4m /BVEi,t ) = ˛0 + ˛1 (1/BVE)i,t + ˛2 (IBX/BVE)i,t + ˛3 (NEG IBX/BVE)i,t + ˛4 (RND/BVE)i,t + ˛5 (ADVERT/BVE)i,t + ˛6 (CAP EX/BVE)i,t + ˛7 (SALES GR/BVE)i,t + ε (1) where MVEi,t+4m = market value of equity for firm i four months after fiscal-year end t (Compustat MKVALM)2 ; BVEi,t = Book value of equity for firm i at fiscal-year end t (Compustat #216); IBXi,t = net income before extraordinary items for firm i for fiscal-year t (Compustat #18); NEG IBXi,t = net income before extraordinary items for firm i for fiscal-year t if < 0, otherwise = 0; RNDi,t = R&D expenditures for firm i for fiscal-year t (Compustat #46); ADVERTi,t = advertising expenditures for firm i for fiscal-year 2 The four month lag is common practice in accounting research to allow the market to incorporate results of the prior fiscal year financial reports. t (Compustat #45); CAP EXi,t = capital expenditures for firm i for fiscal-year t (Compustat #30); SALES GRi,t = 1 year change in sales for firm i for fiscal-year t (Compustat #12 change). Based on prior research, we expect a positive coefficient on each of the variables except the variable for negative income (NEG IBX), which both Core et al. (2003) and Collins et al. (1997) found to be negative, indicating that stock prices reflect expectations of investors that large losses precede higher future cash flows. 3.2. Earnings quality model To test our earnings quality hypothesis (H2), we use the methodology developed by Ecker, Francis, Kim, Olsson, and Schipper (2006) to measure perceived earnings quality by adding a variable for accrual quality (AQfactor), to the standard CAPM asset pricing regression model3 as follows: Rj,t − RF,t = ˛j,t + ˇj,T (RM,t − RF,t ) + ej,T AQfactort + εj,t (2) where t = index for the number of trading days in year T; Rj,t = firm j’s return on day t; RF,t = the risk free rate on day t; RM,t = the market return on day t; AQfactort = accrual quality factor on day t. AQfactors are daily measures of accrual quality developed by Ecker et al. (2006) using a model first developed by Dechow and Dichev (2002) as modified by McNichols (2002), which measures accrual quality as the residuals from firm-specific regressions of changes in working capital on past, present, and future operating cash flows. It is a time specific, not firm specific, measure developed using a dynamic portfolio technique with industry cross-sections for each of the Fama and French (1997) industries. Ecker et al. (2006), show that AQfactor can be correlated with the returns of any firm to determine its exposure to poor quality because it is timespecific and not firm-specific. See Appendix A for a more detailed explanation of how AQfactor is constructed. The coefficient on the AQfactor variable, referred to as the eloading by Ecker et al. (2006), is a returns-based representation of earnings quality. Similar to the way the CAPM beta captures exposure to market risk, e-loading captures investor perceptions of the firm’s earnings quality exposure in year t. Ecker et al. (2006) show that e-loadings exhibit predictably positive correlations with most other proxies used to represent earnings quality. They also show that firms with higher e-loadings have lower earnings response coefficients and more dispersed and less accurate analysts’ forecasts. They argue that this characteristic is consistent with market participants perceiving that higher e-loading firms have noisier earnings signals compared to lower e-loading firms. They also find a decline in the magnitude of e-loadings and an increase in autocorrelation over time, as firms mature. In a final test, they find that e-loadings are highest during years containing restatement announcements, lawsuit filings, and bankruptcies, all events that are indicative of poor earnings quality. Based on this prior work, we believe e-loadings represent a reasonable proxy for earnings quality for our study. A larger e-loading coefficient implies greater sensitivity to poor earnings quality; therefore we expect this coefficient to be higher during the dot-com bubble period and lower before and after the bubble period. 3 In addition to the CAPM model, Ecker et al. (2006) use the 3-factor Fama and French model which includes variables for SMB (small-minus-big) and HML (highminus-low) portfolios. We also used this model, but only report the results from the primary CAPM model because they lead to similar conclusions. J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 247 Table 1 Three digit SIC codes used to identify Hi-Tech sub-sample. Code Description 283 357 360 361 362 363 364 365 366 368 481 737 873 Drugs Computer and office equipment Electrical machinery and equipment, excluding computers Electrical transmission and distribution equipment Electrical industrial apparatus Household appliances Electrical lighting and wiring Household audio, video equipment, audio receiving Communications equipment Computer hardware Telephone communications Computer programming, software, data processing Research, development, testing services 3.3. Forecast accuracy Abarbanell and Bushee (1997, 1998) find that accounting fundamentals are associated with analysts forecast revision. Therefore, we predict that analysts forecast accuracy will decline in the bubble period if analysts contributed to the bubble. In particular, we expected to see that decline in analysts forecast accuracy more in the Hi-Tech sector than in the Lo-tech sector during the bubble period. To test our forecast accuracy hypothesis (H3), we use an equation that measures the accuracy of the one-year-ahead analysts’ forecast of earnings per share (EPS) as a ratio of forecasted earnings per share to actual earnings per share as follows: Analysts forecast accuracy ratio = forecasted EPS actual EPS (3) Based on our hypothesis, we expect the analysts’ forecast accuracy ratio to reflect more aggressively optimistic earnings during the dot-com bubble period than during the period before and after the bubble period. We use the median analysts’ forecast of one year ahead EPS from Institutional Broker’s Estimate System (IBES). 3.4. Test of significance model To measure the significance of the changes in R2 , e-loadings, and forecast ratios between the periods, we regress each of the three factors on dummy variables representing the periods before and after the dot-com bubble period using the following model: Factor = ˇ0 + ˇ1 (BEFORE) + ˇ2 (AFTER) + ε (4) where Factor = the adjusted R2 from the year-by-year regressions from Eq. (1), or the e-loadings from the year-by-year regressions from Eq. (2), or the forecast accuracy ratios for each year from Eq. (3); BEFORE = dummy variable is equal to 1 before the dot-com bubble period, otherwise 0; AFTER = dummy variable is equal to 1 after the dot-com bubble period, otherwise 0. In this model, using OLS regression, the coefficient on the intercept represents the mean value during the dot-com bubble period. The coefficients on the BEFORE (AFTER) variables represent the differences or change from the intercept (the bubble period) to the period before (after) the bubble. We report our results using auto regression with the Yule–Walker method and lag of 2, which adjust the coefficients and the related t-statistics for autocorrelation. 4. Sample data selection Fig. 1. Comparison of adjusted R2 over time. Services (WRDS) system. We define a firm-year consistent with Compustat data conventions. For example, the year 1999 corresponds to firms with fiscal years ending between June 1999 and May 2000. Although Core et al. (2003) collected data for years beginning in 1975, our data are only collected for years 1989–2006, since our intent is not to replicate their study, but rather to use their model for the years leading up to the dot-com bubble and extending it into the post-bubble period. Since the bubble period lasted for six years (1995–2000), we used six years before and six years after for our pre- and post-bubble periods. Following Core et al. (2003), and Morck, Shleifer, and Vishney (1998), we set R&D, advertising, and capital expenditures equal to zero when their values are missing. We start with an initial sample of 147,344 total firm-years from the Compustat database. Following prior studies (Brown et al., 1999; Collins et al., 1997; Core et al., 2003), we exclude observations for all financial institutions,4 observations with negative or missing book values and/or market values, and observations with other missing data. Also, consistent with prior studies, in order to mitigate the effect of extreme values, we delete observations in the top and bottom one-half percent of market-to-book value ratios each year, which leaves a final sample of 68,298 firm-year observations. To address outliers in the independent variables, we winsorize all values at the 1 percent and 99 percent levels by year. Because many of the firms in high technology industries were the ones that argued for using non-traditional financial measures for market valuations, we divide the sample into two sub-samples: (1) observations from Hi-Tech firms and (2) the remaining observations referred to as Lo-Tech firms. Following Core et al. (2003), we select the sub-sample of Hi-Tech firms by using the same classification scheme used by Francis and Schipper (1999), which is based on whether firms in the industry are likely to have significant unrecorded intangible assets. Examples of these industries 4.1. Value relevance data We begin by selecting data from the Compustat database for all active US companies (CS Active) using the Wharton Research Data 4 Financial institutions (SIC codes 6000–6999) are excluded because they have significantly different disclosure requirements and accounting rules. 248 J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 Table 2 Comparison of adjusted R2 values. Total Hi-Tech Lo-Tech Panel A: Mean values by year 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 0.446 0.403 0.347 0.442 0.329 0.318 0.277 0.271 0.285 0.244 0.245 0.245 0.312 0.391 0.430 0.376 0.383 0.402 0.544 0.465 0.352 0.399 0.220 0.239 0.257 0.250 0.276 0.217 0.206 0.173 0.313 0.405 0.451 0.434 0.429 0.529 0.435 0.393 0.342 0.485 0.373 0.350 0.272 0.273 0.301 0.279 0.257 0.319 0.332 0.428 0.422 0.336 0.347 0.304 Panel B: Mean values by period Pre-bubble period (1989–1994) Bubble period (1995–2000) Post-bubble period (2001–2006) 0.381 0.261 0.382 0.370 0.230 0.427 0.397 0.284 0.361 Sign Panel C: Test of significance (+) Intercept (+) BEFORE AFTER (+) Observations Total R2 Coef. p-Value Coef. p-Value Coef. p-Value 0.255 0.127 0.128 18 0.723 <0.001 <0.001 <0.001 0.238 0.133 0.190 18 0.618 <0.001 0.042 0.007 0.280 0.116 0.086 18 0.610 <0.001 <0.001 0.001 Values in bold represent highest and lowest values for each column. Adjusted R2 results are from the following regression model: (MVEi,t+4m /BVEi,t ) = ˛0 + ˛1 (1/BVE)i,t + ˛2 (IBX/BVE)i,t + ˛3 (NEG IBX/BVE)i,t + ˛4 (RND/BVE)i,t + ˛5 (ADVERT/BVE)i,t + ˛6 (CAP EX/BVE)i,t + ˛7 (SALES GR/BVE)i,t + ε where MVEi,t+4m = market value of equity for firm i four months after fiscal-year end t (Compustat MKVALM); BVEi,t = book value of equity for firm i at fiscal-year end t (Compustat #216); IBXi,t = net income before extraordinary items for firm i at fiscal-year end t (Compustat #18); NEG IBXi,t = net income before extraordinary items for firm i at fiscal-year end t if < 0, otherwise = 0; RNDi,t = R&D expenditures for firm i at fiscal-year end t (Compustat #46); ADVERTi,t = advertising expenditures for firm i at fiscal-year end t (Compustat #45); CAP EXi,t = capital expenditures for firm i at fiscal-year end t (Compustat #30); SALES GRi,t = 1 year change in sales for firm i at fiscal-year end t (Compustat #12 change). Test of significance is based on auto regressions of year-by-year adjusted R2 s using SAS PROC AUTOREG with the Yule–Walker method and lag of 2 with the following model: Adjusted R2 = ˇ0 + ˇ1 (BEFORE) + ˇ2 (AFTER) + ε where Intercept = mean value during the bubble period (1995–2000); BEFORE = dummy variable is equal to 1 before the dot-com bubble (1989–1994), otherwise is equal to 0; AFTER = dummy variable is equal to 1 after the dot-com bubble (2001–2006). include: computer hardware and software, pharmaceuticals, electronic equipment and telecommunications. This selection process resulted in a sub-sample of 20,679 Hi-Tech and 47,619 Lo-Tech firm-year observations over the 18 year time period. Table 1 provides a listing of the three-digit SIC codes used to select the Hi-Tech sub-sample. by eliminating the top and bottom 1 percent of daily returns each year leaving a sample of 23,116,343 daily observations. We also follow Ecker et al. (2006) and exclude any firm-year regressions with less than 100 daily observations, resulting in a total of 97,176 firmyear regressions. We use the same approach to segment the sample into Hi-Tech and Lo-Tech that we used for the value relevance data. 4.2. Earnings quality data 4.3. Analysts’ forecast accuracy data We use 4288 observations of market index returns (RM ), risk free rates (Rf ), and accruals quality index returns (AQfactor) for the period January 1, 1989 through December 31, 2005.5 We then extract from the Center for Research in Securities Prices (CRSP) database the daily returns for all firms listed during the same period (1/1/1989 to 12/31/2005). We eliminate observations with missing returns and for all financial institutions. We address outliers 5 We thank Jennifer Francis for making this data available to us. In this section, our analysis is limited to the time period ending 12/31/2005, which is the time period for the data provided on the Francis website. For the forecast accuracy data, we begin by selecting all firms for which one-year ahead forecast earnings per share (EPS) data are available in the Thomson Financial I/B/E/S database from 1989 through 2006. We exclude those observations for which SIC codes were not available and all financial institutions leaving a sample of 50,004 firm-year observations. We use the median forecast rather than the mean forecast in order to accommodate the impact that a small number of analysts following each firm may have on the mean value. We then use the same approach to segment the sample into Hi-Tech and Lo-Tech that we used for the value relevance data. J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 249 Table 3 Regression of MVE/BVE by time period. Pre-bubble Panel A: All firms Intercept 1/BVE IBX/BVE NEG IBX/BVE RND/BVE ADVERT/BVE CAP EX/B/BVE SALES GR/BVE Observations Adjusted R2 Panel B: Hi-Tech Intercept 1/BVE IBX/BVE NEG IBX/BVE RND/BVE ADVERT/BVE CAP EX/B/BVE SALES GR/BVE Observations Adjusted R2 Panel C: Lo-Tech Intercept 1/BVE IBX/BVE NEG IBX/BVE RND/BVE ADVERT/BVE CAP EX/B/BVE SALES GR/BVE Observations Adjusted R2 Bubble period Post-bubble Estimate (t-stat) Estimate (t-stat) Estimate (t-stat) 0.425 4.822 10.935 −13.295 6.058 1.819 1.112 0.514 13,360 0.348 3.82*** 8.09*** 15.44*** −17.96*** 9.76*** 2.48** 4.05*** 4.61*** 0.740 4.459 12.153 −14.020 9.278 0.950 2.383 0.618 23,972 0.218 5.31*** 8.40*** 16.01*** −16.67*** 14.12*** 0.82 5.50*** 5.92*** 0.471 5.396 9.202 −10.933 4.418 3.940 4.184 0.924 30,966 0.334 4.20*** 12.27*** 13.94*** −15.71*** 9.29*** 3.14*** 7.18*** 8.05*** 0.393 5.565 11.078 −13.894 5.465 −1.400 1.667 0.864 3,255 .328 1.55 7.07*** 9.64*** −10.27*** 6.20*** −0.58 1.47 3.37*** 1.680 4.970 12.321 −13.632 8.360 −0.436 5.138 1.047 7,375 .169 5.26 4.68*** 7.33*** −7.74*** 9.56 −0.10 3.67*** 3.94*** 1.038 5.685 5.718 −7.075 4.217 2.463 5.262 1.616 10,049 .346 6.62*** 7.66*** 6.25*** −7.07*** 7.58*** 0.71 3.38*** 7.29*** 0.448 4.661 10.892 −13.086 5.599 2.354 1.085 0.431 10,105 0.354 3.64*** 6.19*** 12.53*** −14.89*** 5.45*** 3.11*** 4.12*** 3.47*** 0.359 4.157 12.419 −14.772 8.383 1.788 1.935 0.485 16,597 0.254 2.63*** 6.79*** 15.75*** −15.86*** 6.68*** 1.79*** 4.99*** 4.60*** 0.158 5.142 11.044 −13.146 5.486 4.324 3.966 0.598 20,917 0.334 1.07 9.44*** 12.94*** −14.45*** 4.60*** 3.45*** 7.19*** 4.69*** (MVEi,t+4m /BVEi,t ) = ˛0 + ˛1 (1/BVE)i,t + ˛2 (IBX/BVE)i,t + ˛3 (NEG IBX/BVE)i,t + ˛4 (RND/BVE)i,t + ˛5 (ADVERT/BVE)i,t + ˛6 (CAP EX/BVE)i,t + ˛7 (SALES GR/BVE)i,t + ε where MVE = market value of equity for firm i four months after fiscal-year end t (Compustat MKVALM); BVE = book value of equity for firm i at fiscal-year end t (Compustat #216); IBX = net income before extraordinary items for firm i at fiscal-year end t (Compustat #18); NEG IBX = net income before extraordinary items for firm i at fiscal-year end t if < 0, otherwise = 0; RND = R&D expenditures for firm i at fiscal-year end t (Compustat #46); ADVERT = advertising expenditures for firm i at fiscal-year end t (Compustat #45); CAP EX = capital expenditures for firm i at fiscal-year end t (Compustat #30); SALES GR = 1 year change in sales for firm i at fiscal-year end t (Compustat #12 change). Note: t-stats are adjusted for heteroscedasticity using the White method. ** p < 0.05. *** p < 0.01. 5. Empirical results 5.1. Value relevance results (H1) Following prior valuation studies, we use adjusted R2 to measure value relevance (Brown et al., 1999; Collins et al., 1997; Hand, 2005; Ryan & Zarowin, 2003). Fig. 1 provides a graphical overview of the annual change in value relevance that has taken place from 1989 to 2006 based on the adjusted R2 results from our regression model #1. The adjusted R2 values from the annual regressions trend downward for all three sub-groups from 1989 to 2000, consistent with prior research that finds a decline in value relevance over time. However, notice that all three of the lines turn sharply upward following the collapse of the dot-com bubble in 2000 forming a U shaped curve, which is consistent with our expectations.6 Table 2 provides a listing of the annual adjusted R2 results by year in Panel A, with the highest and lowest values for each column set in bold face type. For instance in the total sample column, the highest adjusted R2 is recorded in the pre-bubble period 6 Untabulated results show that when we extend our analysis to 2010, we find a repeat of the U pattern, turning back up after the market collapse of 2008–2009. (1989: 0.446) and the lowest during the bubble period (1998: 0.244). Similar results are found for the Hi-Tech and Lo-Tech subsamples, where the highest adjusted R2 values are found during the pre-bubble period (Hi-Tech = 1989: 0.544 and Lo-Tech = 1992: 0.485) and lowest during the bubble period (Hi-Tech = 2000: 0.173 and Lo-Tech = 1999: 0.257). These univariate statistics support the graphic display in Fig. 1, which reflects a reversal of the downward trend in value relevance. The rows in Panel B present the mean values of the annual R2 s for each of the three time periods: (1) prebubble, (2) bubble and (3) post-bubble. Note that the mean of the adjusted R2 s for the total sample goes from 0.381 before the bubble to 0.261 during the bubble back up to 0.382 after the bubble. The test of significance for the total sample in Panel C shows that the coefficients for both the BEFORE and AFTER variables are highly significantly positive (p < 0.01), indicating that the explanatory power of the regression model is statistically lower during the dot-com period than either the period before or after, which is further support for our first hypothesis (H1). Similarly, the mean adjusted R2 of the Hi-Tech sample goes from 0.370 to 0.230 to 0.427 and the mean of the Lo-Tech sample goes from 0.397 to 0.284 to 0.361, all consistent with our expectations. Panel C confirms that these differences are also significant providing additional support for our hypothesis H1. 250 J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 Table 4 Auto regression of MVE/BVE and the bubble interaction variables. All Firms Intercept 1/BVE IBX/BVE NEG IBX/BVE RND/BVE ADVERT/BVE CAP EX/B/BVE SALES GR/BVE BUB Lo-Tech Estimate(t-stat) Estimate(t-stat) Estimate(t-stat) Estimate(t-stat) Estimate(t-stat) Estimate(t-stat) 0.347 (7.56) 5.135 (66.66) 10.421 (48.57) −12.228 (−53.92) 5.931 (48.84) 2.370 (6.95) 2.755 (24.25) 0.759 (28.30) 0.720 (11.88) 0.476 (9.58) 5.314 (62.65) 9.676 (37.61) −11.508 (−42.56) 4.547 (31.57) 3.187 (7.71) 2.940 (19.98) 0.833 (25.68) 0.272 (3.11) −0.854 (−4.24) 2.484 (5.34) −2.511 (−5.05) 4.549 (17.08) −2.289 (−3.14) −0.486 (−2.10) −0.213 (−3.69) 68,298 0.291 0.560 (5.29) 5.466 (32.65) 8.145 (16.23) −9.526 (−18.18) 5.31 (27.62) 0.402 (0.42) 4.671 (14.19) 1.39 (21.69) 2.013 (14.14) 0.946 (8.29) 5.670 (30.66) 6.371 (10.47) −7.827 (−12.36) 4.363 (18.50) 1.549 (1.33) 4.176 (9.41) 1.497 (19.74) 0.751 (3.76) −0.735 (−1.68) 5.907 (5.49) −5.730 (−5.04) 3.968 (8.90) −2.662 (−1.28) 1.117 (1.68) −0.450 (−3.17) 20,679 0.271 0.246 (5.38) 4.873 (59.80) 11.669 (53.30) −13.875 (−59.39) 6.338 (32.77) 2.898 (8.89) 2.392 (21.94) 0.517 (19.17) 0.117 (1.99) 0.238 (4.73) 5.029 (56.03) 11.300 (43.19) −13.501 (−48.60) 5.398 (23.19) 3.459 (8.73) 2.678 (19.07) 0.548 (16.60) 0.122 (1.38) −0.871 (−4.06) 1.109 (2.32) −1.258 (−2.44) 2.975 (7.11) −1.679 (−2.41) −0.736 (−3.29) −0.063 (−1.09) 47,619 0.309 (1/BVE) * BUB (IBX/BVE) * BUB (NEG IBX/BVE) * BUB (RND/BVE) * BUB (ADVERT/BVE) * BUB (CAP EX/BVE) * BUB (SALES GR/BE) * BUB Observations Total R2 Hi-Tech 68,298 0.287 20,679 0.267 47,619 0.308 Auto regression of (MVEi,t+4m /BVEi,t ) on the following variables and with interaction on BUB. MVE = market value of equity for firm i four months after fiscal-year end t (Compustat MKVALM); BVE = book value of equity for firm i at fiscal-year end t (Compustat #216); IBX = net income before extraordinary items for firm i at fiscal-year end t (Compustat #18); NEG IBX = net income before extraordinary items for firm i at fiscal-year end t if < 0, otherwise = 0; RND = R&D expenditures for firm i at fiscal-year end t (Compustat #46); ADVERT = advertising expenditures for firm i at fiscal-year end t (Compustat #45); CAP EX = capital expenditures for firm i at fiscal-year end t (Compustat #30); SALES GR = 1 year change in sales for firm i at fiscal-year end t (Compustat #12 change); BUB = dummy variable is equal to 1 during the dot-com bubble (1995–2000), otherwise is equal to 0. t-Statistics adjusted for autocorrelation using the Yule–Walker method with lag of 2. We further test our first hypothesis by using two alternatives to the annual regressions. First, we divide our sample into six year blocks that represent the six years before, during, and after the bubble period. We then run separate regressions for these blocks of time using the same regression model that we used for annual regressions. The results are summarized in Table 3, and reflect a similar pattern for the adjusted R2 values, with lower values during the bubble period than before or after. The table also shows the coefficient estimates and t-statistics from the regressions indicating that most of the variables are statistically significant at the .01 level in all three time periods. To address possible heteroscedasticity we adjust the t-statistics using the White method. Although the adjusted R2 results in both Table 2 and Table 3 indicate that the model explains less of the variation in market value during the bubble period than before or after, the contribution of the coefficients are more difficult to measure because most of them are highly significant. To examine this impact, we modify our model to add a variable to represent the bubble period (BUB), which we set equal to (1) for observations during the bubble period and (0) for all other observations. We then run an auto regression using SAS PROC AUTOREG on the entire sample, and an expanded model with interaction terms for the interaction of the independent variables with the bubble variable. Our expectation is that if the coefficient is less relevant during the bubble period, the interaction coefficient will be negative. Table 4 provides the results of these regressions for the total sample and both the HiTech and Lo-Tech sub-samples. In the total sample, we find that five out of our seven interaction terms have the expected significant (p < 0.05) negative coefficients: the reciprocal of book value, negative income indicator, advertising, capital expenditures, and sales growth. However, contrary to our expectations, the coefficients on the interaction with income and R&D expenditures are significantly positive. The results for our Lo-Tech sample are similar to the total sample, only the sales growth coefficient is no longer significant. Our Hi-Tech sample however, has only two of the interaction terms with significant negative coefficients: negative income and sales growth and one (reciprocal of book value) that is only marginally significant (p < 0.10). Advertising is not significant and capital expenditures are marginally significant with a positive sign. Income and R&D expenses remain significantly positive. Although these results are not in themselves conclusive, taken as a whole with the R2 analysis in Tables 2 and 3, they strengthen our argument that the value relevance of accounting information to market value did decline during the dot-com bubble period, but reversed course and increased following the collapse of the bubble. J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 251 Table 5 Comparison of e-loading factors. Total Hi-Tech Lo-Tech Panel A: Mean values by year 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 0.277 0.261 0.234 0.255 0.252 0.292 0.229 0.327 0.322 0.354 0.204 0.303 0.261 0.294 0.294 0.258 0.107 0.342 0.298 0.322 0.394 0.379 0.371 0.371 0.522 0.485 0.448 0.404 0.600 0.505 0.584 0.544 0.524 0.223 0.259 0.251 0.207 0.211 0.214 0.267 0.180 0.256 0.257 0.314 0.123 0.151 0.119 0.134 0.165 0.120 0.049 Panel B: Mean values by period Pre-bubble period (1990–1994) Bubble period (1995–2000) Post-bubble period (2001–2003) 0.262 0.290 0.243 0.351 0.472 0.476 0.235 0.214 0.118 Exp Total Sign Coef. p-Value Coef. p-Value Coef. p-Value 0.295 −0.036 −0.049 17 0.179 <0.001 0.226 0.130 0.474 −0.124 0.008 17 .328 <0.001 0.042 0.894 0.219 0.014 −0.106 69589 0.014 <0.001 0.612 0.003 Panel C: Test of significance (+) Intercept (−) BEFORE (−) AFTER Observations 2 Total R Hi-Tech Lo-Tech Values in bold represent highest and lowest values for each column. e-Loading factors are the coefficients on AQfactor from the following CAPM regression model: Rj,t − RF,t = ˛j,t + ˇj,T (RM,t − RF,t ) + ej,T AQfactort + εj,t where T = index for the number of trading days in year T; Rj,t = firm j’s return on day t; RF,t = the risk free rate on day t; RM,t = the market return on day t; AQfactort = accrual quality factor on day t. Test of significance is based on auto regression of e-loading factors using SAS PROC AUTOREG with the Yule–Walker method and lag of 2 with the following model: e-Loading = ˇ0 + ˇ1 (BEFORE) + ˇ2 (AFTER) + ε where Intercept = mean value during the bubble period; BEFORE = dummy variable is equal to 1 before the dot-com bubble, otherwise is equal to 0; AFTER = dummy variable is equal to 1 after the dot-com bubble, otherwise is equal to 0. 5.2. Earnings quality results (H2) Fig. 2 provides an overview of the change in earnings quality that has taken place from 1989 to 2005 using the e-loading factor as a proxy. We expect the pattern here to be the inverse of the value relevance graphic with an inverted U shape because a higher e-loading value is an indication that investors perceive lower earnings quality. Therefore, if investors are using earnings quality as a rational explanation for the declining value relevance of accounting information, then this factor should be highest during the bubble period, when value relevance is the lowest. The total sample does not reflect the expected pattern, remaining relatively flat across all three time periods. Lo-Tech results show relatively little change from the pre-bubble to the bubble period, but decrease sharply in 1999 and remain low through 2005, indicating higher perceived earnings quality. The Hi-Tech results increase during the bubble period as expected, but remain high even after the collapse, indicating that the market may have continued to perceive poor earnings quality for that segment, at least through 2004. Table 5 Panel A provides e-loading factors by year, showing that the highest value for the total sample occurs during the bubble period (1998: 0.354); and lowest during the post-bubble period (2005: 0.107) indicating that perceived earnings quality was lower during the bubble period, and that it improves in the post-bubble period. Panel B shows that the mean values during each of the periods for the total sample follows the expected pattern, with the highest value in the bubble period (0.290 bubble vs. 0.262 prebubble and 0.243 post-bubble), however as indicated in Panel C, the change is not significant. Hi-Tech firms have their highest e-loading during the bubble period (2000: 0.600) and their lowest value is in the post-bubble period (2005: 0.223). Panel B shows that Hi-Tech firms reflect an increase in the mean e-loading factors during the bubble period from 0.351 to 0.472 (p = 0.042), consistent with our expectations, but they remain high after the collapse. In fact, the mean values actually increase again from 0.472 to 0.476 between the bubble and post-bubble periods, although the change is not significant (p = 0.894). An interesting pattern is presented for Lo-Tech firms, where the highest e-loading factor occurs during the bubble period (1998: 0.314) and the lowest occurs in the post-bubble period (2005: 0.049), consistent with the other two samples. However, the mean value decreases from the pre-bubble period to the bubble period (0.235–0.214) although the amount of change is not significant 252 J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 Fig. 3. Comparison of forecast accuracy over time. Fig. 2. Comparison of e-Loadings over time. Table 6 Comparison of forecast accuracy ratios. Total Hi-Tech Lo-Tech Panel A: Mean values by year 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 1.122 1.195 1.348 1.247 1.035 1.065 1.014 1.159 1.042 1.146 1.055 1.045 1.063 0.984 0.906 0.920 0.981 1.024 1.198 0.978 1.332 1.226 1.007 1.010 0.871 1.110 1.020 0.957 1.002 0.822 0.940 0.864 0.777 0.919 0.923 0.904 1.101 1.255 1.352 1.253 1.044 1.083 1.061 1.176 1.051 1.225 1.077 1.147 1.128 1.046 0.969 0.921 1.009 1.078 Panel B: Mean values by period Pre-bubble period (1990–1994) Bubble period (1995–2000) Post-bubble period (2001–2003) 1.169 1.077 0.980 1.125 0.964 0.888 1.181 1.123 1.025 Exp Total Sign Coef. p-Value Coef. p-Value Coef. p-Value 1.066 0.117 −0.090 18 0.633 <0.001 0.015 0.050 0.964 0.171 −0.086 18 0.562 <0.001 0.003 0.093 1.118 0.071 −0.096 18 0.461 <0.001 0.187 0.083 Panel C: Test of significance Intercept (+) BEFORE (−) (−) AFTER Observations 2 Total R Hi-Tech Lo-Tech Values in bold represent highest and lowest values for each column. Forecast accuracy is based on the following: median analyst forecast earnings per share/actual earnings per share. Test of significance is based on auto regression of forecast accuracy ratios using SAS PROC AUTOREG with the Yule–Walker method and lag of 2 with the following model: Forecast accuracy ratio = ˇ0 + ˇ1 (BEFORE) + ˇ2 (AFTER) + ε where Intercept = mean value during the bubble period; BEFORE = dummy variable is equal to 1 before the dot-com bubble, otherwise is equal to 0; AFTER = dummy variable is equal to 1 after the dot-com bubble, otherwise is equal to 0. J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 (p = 0.612) but the change is significant following the collapse of the bubble, decreasing to 0.118 (p = 0.003). These results provide some support for our alternative explanation that the decrease in value relevance may be a rational reaction of the market to a decline in earnings quality; therefore hypothesis H2 is partially supported. Overall the results document a decline in perceived earnings quality for Hi-Tech firms during the dot-com bubble, which remained low through 2004. They also suggest that the perceived quality of earnings for Lo-Tech firms improved after the collapse. 5.3. Forecast accuracy results (H3) Fig. 3 shows that all three of the forecast accuracy ratios for each of three samples were higher in the pre-bubble period than the bubble period or the post-bubble period. In fact, the ratios for Hi-Tech firms reflect a much less aggressive pattern in the bubble period, dropping below 1.0 for three of the years. If financial analysts were contributing to the irrational exuberance, by ignoring basic fundamentals as suggested by Healy and Palepu (2003), we would expect an increase in this ratio during the bubble period. In fact, we would expect to see the same inverted U pattern that we expected in the earnings quality graphic, with the most aggressive forecasts (ratios greater than 1.0) appearing during the bubble period and more conservative forecasts (ratios closer to or less than 1.0) before and after the bubble period. This is not the pattern we see in Fig. 3. Instead we see a downward trend, with the most aggressive forecasts before the bubble and the least aggressive after the bubble for each of the samples. Table 6 Panel A provides the year by year mean values reflected in the graph. Notice that the highest forecast accuracy ratios occur in the pre-bubble period (1991) for all three groups: total (1.348), Hi-Tech (1.332), and Lo-Tech (1.352). The lowest ratios occur in the post-bubble period for all three groups; total (2003: 0.906), Hi-Tech (2003: 0.777), and Lo-Tech (2004: 0.921). The mean values in Panel B reflect similar results with the highest ratios in the pre-bubble period and the lowest in the post-bubble period. The decrease from the pre-bubble to the bubble period is significant for the total sample (p = 0.015) and the Hi-Tech sample (p = 0.003), but not for the Lo-Tech sample (p = 0.187). Panel C shows that the decrease from the bubble period to the post-bubble period is significant for the total sample (p = 0.050), and marginally significant for the other two sub-samples (Hi-Tech: p = 0.093) and (Lo-Tech: p = 0.083). Therefore, our third hypothesis H3 is not supported, indicating that overly aggressive analyst forecasts do not provide a more rational explanation for the decline in value relevance of accounting information for those firms. 6. Conclusions During the dot-com bubble of the 1990s, there was talk about traditional accounting and financial information losing its value relevance with respect to serving as a proxy for expected future cash flow. As a result, some called for changes in the way that accounting information was reported. Others argued that we were entering into a new economy period, and that non-accounting factors were more important in value estimation than traditional accounting measures. This study provides evidence that during the dot-com bubble period, the value relevance of accounting information as measured by adjusted R2 values from a valuation regression model was significantly lower than for the previous six years, consistent with prior research. However, we also document that in the six years after the dot-com bubble collapsed, the adjusted R2 values are significantly higher than during the dot-com bubble period, and are 253 comparable to the period leading up to the bubble. This trend occurred in a broad cross-section of all firms during that period as well as for a sub-sample of high technology firms that were considered to be typical of the “new economy” firms. These results tend to support the argument that during the dot-com bubble period the market may have behaved in a less rational manner than it did before or after. We examine two alternative explanations for the decline in value relevance. The first is that the decline may have been due in part to a decline in the quality of financial reporting. Using a proxy for perceived earnings quality, we find that the perception of earnings quality has not changed significantly during the dot-com bubble period for a broad cross section of firms. However, we did find a significant decline in perceived earnings quality between the pre-bubble and bubble period for Hi-Tech firms but not for Lo-Tech firms and that after the collapse of the bubble only the perceived quality of Lo-Tech firms has improved significantly. In fact, the perceived quality of earnings for Hi-Tech firms continued to be low, suggesting that the investing public may still have been apprehensive about the quality of financial reporting by these firms. Therefore, we conclude that a decline in earnings quality can only explain part of the decline in value relevance. We also examine whether the decline in value relevance may be due to over-aggressive forecast estimates by financial analysts. We show that prior to and during the dot-com bubble period, analysts’ forecasts consistently exceeded actual results, and that after the collapse, forecasted EPS have been lower than actual EPS, especially for Hi-Tech firms. However, contrary to our expectations, the forecast accuracy ratios during the bubble period are not higher than the pre-bubble or post-bubble periods. Therefore, our results do not support an alternative suggestion that overly aggressive analyst forecasts may have contributed to the decline in value relevance. Our results are also contrary to prior research that finds financial analysts were partly to blame for the dot-com bubble (Liu & Song, 2001; O’Brien & Tian, 2006). Our findings, on the other hand, show that analysts’ forecasts were fairly close to actual earning numbers during the bubble period. Given the mixed results between prior studies and our findings, we recommend future studies should further investigate the role of financial analysts during the dot-com period. One avenue of future research could be the investigation of the stock recommendations of sell-side analysts during the dotcom period. In summary, we found only some support for the earnings quality explanation and no support for the aggressive analyst forecast explanation, which leaves open the possibility that irrational exuberance is responsible for the decline in value relevance. Although the lack of support for our alternative explanations does not in itself provide support for the irrational exuberance explanation, we cannot exclude it as a possibility. Finally, our results show that whatever caused the decline in value relevance, the trend reversed following the collapse and fundamental accounting measures regained most of the value relevance they had prior to the dot-com bubble period. These results have implications for at least four groups: academics, financial professionals, investors, and regulators. For academics, it confirms prior research on the decline in value relevance of accounting and financial information that was taking place in the 1990s, and it documents a reversal in this trend following the collapse of the bubble. To our knowledge, no other study had documented this reversal. Our study also explores various explanations as to what may have contributed to the decline, other than “irrational exuberance.” Future behavioral and earnings quality research may be useful in providing additional insights into this phenomenon. 254 J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 For financial professionals such as auditors, financial analysts, mutual fund managers and corporate accountants, these results suggest that investors do value the financial information provided to them, especially during non-bubble times. As for investors, these results suggest that the long history of using fundamental accounting and financial information for investment decision-making has merit. Additionally, our findings provide warning signs to help the investor spot future bubbles in that when the relation between fundamental accounting variables and stock prices begin to reach levels never before seen, a red flag should be raised. Finally, for regulators and other standard setters, this study confirms that GAAP and other reporting regulations serve a purpose in the process of communicating between publicly traded corporations and the investing public. They should proceed with caution when pressure mounts to replace the historical accounting model with “modern” approaches to financial reporting. Appendix A. Construction of AQfactor from http://faculty.fuqua.duke.edu/∼fecker/EFKOS 2006.htm A Returns-Based Representation of Earnings Quality Ecker, Francis, Kim, Olsson and Schipper (The Accounting Review, July 2006) Construction of AQfactor The construction of AQfactor starts with identifying all firms with the necessary data to estimate the underlying accruals quality metric, developed by Dechow and Dichev (2002) and modified by McNichols (2002). Requiring a minimum of 20 firms per industryyear, we run annual cross-sectional regressions of total current accruals on past, present and future cash flows from operations, as well as on gross property, plant and equipment and the change in sales revenues, separately for each of the 48 Fama–French (1997) industries. Accruals quality at the end of year T (AQ) is the standard deviation of the five firm- and year-specific residuals obtained from the regressions in Years T-5 to T-1. Lagging AQ by one year accounts for the fact that the industry regressions contain the leading cash flow from operations. We assign firms to AQ deciles using a dynamic portfolio technique that allows for differences in firms’ fiscal year ends as well as over-time changes in accruals quality. Specifically, we further lag the AQ metric by three months after fiscal year end to ensure public availability of the accounting data and then form deciles on the first day of each month based on the firm’s most recent value of AQ. If the AQ signal for the following fiscal year is missing due to insufficient data, the firm is excluded from this portfolio formation after twelve months (but allowed to re-enter the portfolio later). Finally, AQfactor is defined as the equal-weighted daily return of the four deciles of firms with the highest (=poorest) AQ less the equal-weighted daily return of the four deciles of firms with the lowest (=best) AQ. The file ‘AQfactor 1970–2003.xls’ contains the 8586 daily portfolio returns from 1970 to 2003. For a more detailed description about the procedure, including Compustat variable numbers, etc., please refer to the published article. Note: In addition to the file described above, an updated file is also available from the site, “AQfactor 1970-2005.xls” which has 9,090 daily portfolio returns from 1970 to 2005. This is the data used in this paper. References Abarbanell, J., & Bushee, B. (1997). Fundamental analysis, future earnings, and stock prices. Journal of Accounting Research, 35, 1–24. Abarbanell, J., & Bushee, B. (1998). Abnormal returns to a fundamental analysis strategy. The Accounting Review, 73, 19–45. Aharon, D. Y., Gavious, I., & Yosef, R. (2010). Stock market bubble effects on mergers and acquisitions. The Quarterly Review of Economics and Finance, 50, 456–470. Anderson, K., Brooks, C., & Katsaris, A. (2010). Speculative bubbles in the S&P 500: Was the tech bubble confined to the tech sector? Journal of Empirical Finance, 17, 345–361. Armstrong, C., Davila, A., Foster, G., & Hand, J. R. M. (2011). Market-to-revenue multiples in public and private capital markets. Australian Journal of Management, 36, 15–57. Ashton, R. (2005). Intellectual capital and value creation: A review. Journal of Accounting Literature, 24, 53–134. Balachandran, S., & Mohanram, P. (2011). Is the decline in the value relevance of accounting driven by increased conservatism? Review of Accounting Studies, 16, 272–301. Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting & Economics, 24, 3–37. Best, B. (2006). Financial statements in the new economy. In an essay extracted from: http://www.benbest.com/business/newecon.html (21.02.06). Bharath, T. S., & Viswanathan, S. (2006). Is the internet bubble consistent with rationality? University of Michigan and University of Maryland. (Working paper) Binswanger, M. (2004a). How do stock prices respond to fundamental shocks? Finance Research Letters, 1, 90–99. Binswanger, M. (2004b). How important are fundamentals? Evidence from a structural VAR model for the stock markets in the US, Japan and Europe. Journal of International Financial Markets, Institutions and Money, 14, 185–201. Binswanger, M. (2004c). Stock returns and real activity in the G-7 countries: Did the relationship change in the early 1980? The Quarterly Review of Economics and Finance, 44, 237–252. Bonson, E., Cortijo, V., & Escobar, T. (2008). The role of XBRL in enhanced business reporting (EBR). Journal of Emerging Technologies in Accounting, 5, 161–173. Brown, S., Lo, K., & Lys, T. (1999). Use of R2 in accounting research: Measuring changes in value relevance over the last four decades. Journal of Accounting & Economics, 28, 83–115. Collins, D. W., Maydew, E. L., & Wiess, I. S. (1997). Changes in the value-relevance of earnings and equity book values over the past forty years. Journal of Accounting & Economics, 24, 39–67. Cooper, M., Khorana, A., Osobov, I., Patel, A., & Rau, R. (2005). Managerial actions in response to a market downturn: Valuation effects of name changes in the dot.com decline. Journal of Corporate Finance, 11, 319–335. Core, J. E., Guay, W. R., & Van Buskirk, A. (2003). Market valuations in the New Economy: An investigation of what has changed. Journal of Accounting & Economics, 34, 43–67. Dechow, P., & Dichev, I. (2002). The quality of accruals and earnings: The role of accural estimation errors. The Accounting Review, 77, 35–59. Demers, E., & Lev, B. (2001). A rude awakening: Internet shakeout in 2000. Review of Accounting Studies, 6, 331–359. Ecker, F., Francis, J., Kim, I., Olsson, P., & Schipper, K. (2006). A returns-based representation of earnings quality. The Accounting Review, 81, 749–780. Ely, K., & Waymire, G. (1999). Accounting standard-setting organizations and earnings relevance: Longitudinal evidence from NYSE common stocks, 1927–93. Journal of Accounting Research, 37, 293–318. Fama, E. F., & French, K. R. (1997). Industry costs of equity. Journal of Financial Economics, 43, 153–193. Francis, J., & Schipper, K. (1999). Have financial statements lost their relevance? Journal of Accounting & Economics, 39, 295–327. Glaum, M., & Friedrich, N. (2006). After the bubble: Valuation of telecommunications companies by financial analysts. Journal of International Financial Management and Accounting, 17, 160–174. Greenspan, A. (1996). The challenge of central banking in a democratic society. In a speech before the American Enterprise Institute for Public Policy Research. Washington, DC. Available from: http://www.federalreserve.gov/boarddocs/speeches/1996/19961205.htm (2006). Hand, J. R. M. (2005). The value relevance of financial statements. The Accounting Review, 80, 613–648. Hao, S., Jin, Q., & Zhang, G. (2011). Investment growth and the relation between equity value, earnings, and equity book value. The Accounting Review, 86, 605–635. Hayn, C. (1995). The information content of losses. Journal of Accounting & Economics, 20 Healy, P. M., & Palepu, K. G. (2003). How the quest for efficiency corroded the market. Harvard Business Review, 81, 75–85. Henderson, B., Kobelsky, K., & Richardson, V. J. (2010). The relevance of information technology expenditures. Journal of Information Systems, 24, 39–77. Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48, 65–91. Jegadeesh, N., & Titman, S. (2001). Profitability of momentum strategies: An evaluation of alternative explanations. The Journal of Finance, 56, 699–720. Jenkins, D. S., Kane, G. D., & Velury, U. (2006). Earnings quality decline and the effect of industry specialist auditors: An analysis of the late 1990. Journal of Accounting and Public Policy, 25, 71–90. Jeon, S., & Kim, J. (2011). The role of R&D on the faluation of IPO firms. Journal of International Business Research, 10, 39–57. Keating, E. K., Lys, T., & Magee, R. P. (2003). Internet downturn: Finding valuation factors in spring 2000. Journal of Accounting & Economics, 34, 189–236. J.J. Morris, P. Alam / The Quarterly Review of Economics and Finance 52 (2012) 243–255 Kothari, S. P., & Shanken, J. (2003). Time-series coefficient variation in valuerelevance regressions: A discussion of Core, Guay, and Van Buskirk and new evidence. Journal of Accounting & Economics, 34, 69–87. Krugman, P. (2004). The great unraveling: Losing our way in the new century. New York, NY. Leger, L., & Leone, V. (2008). Changes in the risk structure of stock returns: Consumer confidence and the dotcom bubble. Review of Financial Economics, 17, 228–244. Lev, B., & Thiagarijan, R. (1993). Fundamental information analysis. Journal of Accounting Research, 31, 190–215. Lev, B., & Zarowin, P. A. (1999). The boundaries of financial reporting and how to extend them. Journal of Accounting Research, 37, 353–385. Lewellen, J. (2003). Discussion of the internet downturn: Finding valuation factors in spring 2000. Journal of Accounting & Economics, 34, 237–247. Liu, Q., & Song, F. (2001). The rise and fall of Internet stocks: Should financial analysts be blamed? School of Economics, University of Hong Kong. (Working paper). Louis, R. J., & Eldomiaty, T. (2010). How do stock prices respond to fundamental shocks in the case of the United States? Evidence from NASDAQ and DJIA. The Quarterly Review of Economics and Finance, 50, 310–322. Maines, L., Bartov, E., Fairfield, P., Hirst, D. E., Iannaconi, T., Mallett, R., et al. (2003). Implications of accounting research for the FASB’s initiatives on disclosure of information about intagible assets. Accounting Horizons, 17, 175–185. McNichols, M. (2002). Discussion of: The quality of accruals and earnings: The role of accrual estimation earros. The Accounting Review, 77, 61–69. Morck, R., Shleifer, S., & Vishney, R. (1998). Management ownership and market valuation, an empirical analysis. Journal of Financial Economics, 20. Murgulov, Z., & Bornholt, G. (2009). Seasoned equity offerings by new economy companies in Australia. Accounting Accountability and Performance, 15, 1–32. O’Brien, P., & Tian, Y. (2006). Financial analysts’ role in the 1996–2000 internet bubble. University of Waterloo. (Working paper). Ofek, E., & Richardson, M. (2003). Dotcom mania: The rise and fall of internet stock prices. Journal of Finance, 58, 1113–1137. 255 Ohlson, J. A. (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research, 11, 661–687. Pastor, L., & Veronesi, P. (2006). Was there a NASDAQ bubble in the late 1990? Journal of Financial Economics, 81. Penman, S. H. (2003). The quality of financial statements: Perspectives from the recent stock market bubble. Accounting Horizons, 17, 77–96. Rajgopal, S., Kothari, S. P., & Venkatachalam, M. (2000). The relevance of web traffic for internet stock prices. University of Washington. (Working paper). Ryan, S. G., & Zarowin, P. A. (2003). Why has the contemporaneous linear returnsearnings relation declined? The Accounting Review, 78, 523–553. SEC. (2001). Cautionary advice regarding the use of pro-forma financial information in earnings releases. Release 33-8039, 34-45124, FR-59, December 4, 2001. Shah, S., & Akbar, S. (2008). Value relevance of advertising expenditure: A reveiw of the literature. International Journal of Management Reviews, 10, 301–325. Simpson, A. (2008). Voluntary disclosure of advertising expenditures. Journal of Accounting Auditing and Finance, 23, 403–436. Sinha, N., & Watts, J. (2001). Economic consequences of the declining relevance of financial reports. Journal of Accounting Research, 39, 663–681. Skinner, D. (2008). Accounting for intangibles – A critical review of policy recommendations. Accounting and Business Research, 38, 191–204. Stiglitz, J. (2003). The roaring nineties: A history of the world’s most prosperous decade. New York, NY. Trueman, B., Wong, M. H. F., & Zhang, X. J. (2000). The eyeballs have it: Searching for the value in internet stocks. Journal of Accounting Research, 38, 137–162. Trueman, B., Wong, M. H. F., & Zhang, X. J. (2003). Anomalous stock returns around internet firms’ earnings announcements. Journal of Accounting & Economics, 34, 249–271. Wang, L., & Alam, P. (2007). Information technology capability: Firm valuation, earnings uncertainty, and forecast accuracy. Journal of Information Systems, 21, 27–48. Xu, B., Magnan, M., & Andre, P. (2008). The stock market valuation of R&D information in biotech firms. Contemporary Accounting Research, 24, 1291–1318.