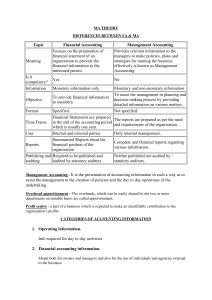

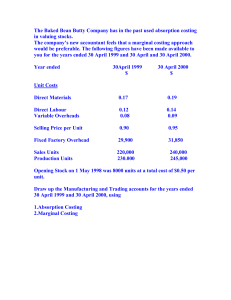

MANAGEMENT ACCOUNTING Module Guide Copyright© 2019 MANAGEMENT COLLEGE OF SOUTHERN AFRICA All rights reserved, no part of this book may be reproduced in any form or by any means, including photocopying machines, without the written permission of the publisher. Please report all errors and omissions to the following email address: modulefeedback@mancosa.co.za This Module Guide, Management Accounting (NQF level 6), will be used across the following programmes: • Bachelor of Business Administration • Bachelor of Commerce in Information and Technology Management • Bachelor of Commerce in Supply Chain Management • Bachelor of Commerce in Marketing Management • Bachelor of Commerce in Retail Management • Bachelor of Commerce in Entrepreneurship • Bachelor Commerce Project Management Management Accounting MANAGEMENT ACCOUNTING Preface........................................................................................................................................................... 1 Unit 1: Management Accounting – An Introduction ..................................................................................... 6 Unit 2: Classification of Costs ..................................................................................................................... 12 Unit 3: Materials .......................................................................................................................................... 21 Unit 4: Labour .............................................................................................................................................. 35 Unit 5: Absorption Costing and Marginal Costing ..................................................................................... 55 Unit 6: Cost-Volume-Profit Analysis ........................................................................................................... 69 Unit 7: Budgets and Budgetary Control...................................................................................................... 99 Unit 8: Standard Costing........................................................................................................................... 123 Unit 9: Capital Investment Appraisal ........................................................................................................ 144 Bibliography ............................................................................................................................................... 173 i Management Accounting Preface A. Welcome Dear Student It is a great pleasure to welcome you to Management Accounting (MA6). To make sure that you share our passion about this area of study, we encourage you to read this overview thoroughly. Refer to it as often as you need to since it will certainly be making studying this module a lot easier. The intention of this module is to develop both your confidence and proficiency in this module. The field of Accounting is extremely dynamic and challenging. The learning content, activities and selfstudy questions contained in this guide will therefore provide you with opportunities to explore the latest developments in this field and help you to discover the field of Accounting as it is practiced today. This is a distance-learning module. Since you do not have a tutor standing next to you while you study, you need to apply self-discipline. You will have the opportunity to collaborate with each other via social media tools. Your study skills will include self-direction and responsibility. However, you will gain a lot from the experience! These study skills will contribute to your life skills, which will help you to succeed in all areas of life. The module is a 15 credit module at NQF level 6 We hope you enjoy the module. 1 MANCOSA Management Accounting B. Learning Outcomes and Associated Assessment Criteria of this Module Module Outcomes At the end of this module, students will be able to: • Explain the need for pre-determined costs and management accounting systems; • Distinguish between direct and indirect costs and fixed and variable costs; • Calculate the value of stock using different valuation methods; • Explain Absorption Costing; • Explain Marginal Costing and Breakeven Analysis; • Determine the optimal costing methods (Absorption Costing Vs Marginal Costing); Associated Assessment Criteria • Explain the principles of effective budgeting; • Apply Cost control using Standard Costing methods; • Apply techniques of Investment Appraisal. • Complete the relevant module activities, and self-reflection questions and think points Complete and pass the formative and summative assessments • The student needs to: C. How to Use this Module This Module Guide was compiled to help you work through your units and textbook for this module, by breaking your studies into manageable parts. The Module Guide gives you extra theory and explanations where necessary, and so enables you to get the most from your module. The purpose of the Module Guide is to allow you the opportunity to integrate the theoretical concepts from the prescribed textbook and recommended readings. We suggest that you briefly skim read through the entire guide to get an overview of its contents. At the beginning of each Unit, you will find a list of Learning Outcomes and Assessment Standards. This outlines the main points that you should understand when you have completed the Unit/s. Do not attempt to read and study everything at once. Each study session should be 90 minutes without a break This module should be studied using the recommended textbook/s and the relevant sections of this Module Guide. You must read about the topic that you intend to study in the appropriate section before you start reading the textbook in detail. Ensure that you make your own notes as you work through both the textbook and this module. In the event that you do not have the prescribed textbook, you must make MANCOSA 2 Management Accounting use of any other source that deals with the sections in this module. If you want to do further reading, and want to obtain publications that were used as source documents when we wrote this guide, you should look at the reference list and the bibliography at the end of the Module Guide. In addition, at the end of each Unit there is a link to the PowerPoint presentation and other useful reading. D. Study Material The study material for this module includes tutorial letters, programme handbook, this Module Guide, prescribed textbook which is supplemented by recommended readings. The Module Guide is written based on a prescribed textbook which is supplemented by recommended readings. E. Prescribed Textbook The textbook presents a tremendous amount of material in a simple, easy-to-learn format. You should read ahead during your course. Make a point of it to re-read the learning content in your module textbook. This will increase your retention of important concepts and skills. You may wish to read more widely than just the Module Guide and the prescribed textbook, the Bibliography and Reference list provides you with additional reading. There is no prescribed book for this module. This study guide will serve as your prescribed reading. F. Recommended Readings In addition to the prescribed textbook, the following should be considered for recommended books/readings: • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • 3 The Essence of Management Accounting First edition, 2003. Chadwick, L MANCOSA Management Accounting G. Special Features In the Module Guide, you will find the following icons together with a description. These are designed to help you study. It is imperative that you work through them as they also provide guidelines for examination purposes. Prescribed Textbook Title, author, publisher and edition details of the prescribed textbook/s must be written here. Think Point A think point asks you to stop and think about an issue. Sometimes you are asked to apply a concept to your own experience or to think of an example. Activity You may come across activities that ask you to carry out specific tasks. In most cases, there are no right or wrong answers to these activities. The aim of the activities is to give you an opportunity to apply what you have learned. Readings At this point, you should read the reference supplied. If you are unable to acquire the suggested readings, then you are welcome to consult any current source that deals with the subject. This constitutes research. MANCOSA 4 Management Accounting Practical Application or Examples Real business examples or cases will be discussed to enhance understanding of business ethics. Self-Test Questions Real business examples or cases will be discussed to enhance understanding of business ethics. Revision Questions You may come across self-assessment questions that test your understanding of what you have learned so far. These may be attempted with the aid of your textbooks, journal articles and Module Guide. Case Study It is advisable to include Case Studies after Sections of the guide. This activity must give students an opportunity to apply theory to practice. 5 MANCOSA Management Accounting Unit 1: MANCOSA Management Accounting– An Introduction 6 Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: ASSOCIATED ASSESSMENT CRITERIA OF THIS On successful completion of this Unit, the student UNIT: will be able to: The student needs to: Complete the relevant activities and think • Define Management accounting and the • points to be able to define management purpose thereof. accounting. • Explain the nature of management • Complete the relevant activities and think accounting and be able to distinguish it points to be able to distinguish between from financial accounting. management and financial accounting. • Explain the functions of management • Complete the relevant activities and think accounting. points to be able to discuss the functions of • State the reasons and requirements for management accounting. effective management accounting. • To demonstrate an understanding of the requirements for effective management • Identify the limitations and drawbacks of accounting management accounting. • To demonstrate an understanding of the limitations management accounting Key Concepts 1.1 What is management? 1.2 Differences between management accounting and financial accounting 1.3 Management accounting serving the needs of managers 1.4 Requirements for effective management accounting 1.5 Limitations of management accounting Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L 7 MANCOSA Management Accounting 1.1 What Is Management Accounting? Management accounting may be defined as the identification, analysis, interpretation and communication of financial information that enables management to do planning and controlling within the business as well as to make a number of management decisions. Management accounting is thus concerned with providing information within the business that will assist in making informed decisions in 1.2 Differences Between Management Accounting and Financial Accounting Management accounting involves the use of financial information to meet the needs of managers or internal users. Financial accounting provides financial information about the business to external users i.e. those who not involved in the day-to-day running of the enterprise. The major differences between the two may be tabulated as follows: order to improve the efficiency and profitability of the business. User groups Management accounting Financial accounting Internal users: Managers External: Owner(s); Lenders, Creditors; Investors Nature of Reports tend to be specific usually with Reports tend to be general-purpose reports some decision in mind. useful to a wide range of users. Legal Management accounting reports are not Financial reports are required by law requirements required by law since they are for internal and are also regulated in terms of use only. content and format. Management accounting reports are not Financial reports must conform to subject to the practices and principles of the practices and principles set by GAAP (Generally Accepted Accounting GAAP. GAAP Practice). Time focus The emphasis is on the future but also It reflects on the financial result and provides information on past financial position for the past period. performance. Nature of Information used may be less objective Objective and verifiable information information and verifiable. is needed to prepare reports. MANCOSA 8 Management Accounting Frequency of Reports are produced as often as Reports are produced annually reporting required by managers even on a weekly although some businesses prepare basis. half-yearly or even quarterly reports. Focuses on parts of the business e.g. a Focuses on the performance of the Focus on the whole or parts of certain department as well as the the business business as a whole. business as a whole. 1.3 Management Accounting Serving the Needs of Managers Management accounting serves the following functions: It provides information for managers that enable them to make better and informed decisions. Management requires a steady flow of information to respond to possible problems that may be starting to develop or to be proactive in ensuring that certain problems do not occur. This information could be in the form of reports, spreadsheets, graphs etc.It advises management about the likely results of its intended decisions. Management accounting information is concerned with planning and control decisions that managers are required to make regularly. Planning decisions relate to the setting of goals or objectives and the formulation of policy. Control involves the comparison of actual results with standards set e.g. actual expenditure compared to budgeted expenditure. Deviations from the standard are analysed with a view to implementing remedial measures. 1.4 Requirements for Effective Management Accounting Information intended for managers must be effectively and timeously communicated. The information must also be user-friendly and understandable. The environment in which the enterprise operates is never static and management accounting must therefore be flexible so that it can respond to changes. The environment must be monitored closely so that information can be updated or amended. There must be good co-operation between the management accounting section and the other business functions. For example, the preparation of budgets requires the co-operation of all departments in the enterprise. The management accounting department must ensure that the managers who use the information it provides are well trained in the techniques and the processes that go into making the information usable. 9 MANCOSA Management Accounting 1.5 Limitations of Management Accounting • Management accounting is not an exact science. A lot of information is based on assumptions and making judgements which are subjective. • It cannot solve all financial problems or help in providing the best alternatives. It is merely one tool amongst others that are available to help managers to make appropriate or informed decisions. Self-Test Questions For each of the following, state whether it is concerned mainly with financial accounting or management accounting. Place a tick in the appropriate column. No. Statement 1. Prepares financial statements. 2. Emphasis is on the past rather than Financial Management Accounting Accounting the future. 3. Focuses on parts as well as the entire enterprise. 4. It is subject to the principles of GAAP. 5. It provides information for internal users. 6. Information is used for planning and control. 7. Provides information that is precise and objective. 8. Specific purpose reports are prepared. 6.2 Tabulate 5 differences between financial accounting and management accounting. 6.3 Management accounting is not required in non-profit organisations such as welfare bodies and state clinics. Do you agree with this statement? Give reasons for your answer. MANCOSA 10 Management Accounting SOLUTIONS 6.1 No. Statement Financial Management Accounting Accounting 1. Prepares financial statements. P 2. Emphasis is on the past rather than the future. P 3. Focuses on parts as well as the entire enterprise. 4. It is subject to the principles of GAAP. 5. It provides information for internal users. P 6. Information is used for planning and control. P 7. Provides information that is precise and objective. 8. Specific-purpose reports are prepared. P P P P 6.2 Refer to paragraph 2. 6.3 disagree with the statement for the following reasons: Management accounting provides information that is useful in planning, controlling and making decisions. The elements of planning, organising and decision-making are characteristic of both profitmaking and non-profit organisations. Non-profit organisations are also concerned with the control of income and expenditure and therefore rely on management accounting information. 11 MANCOSA Management Accounting Unit 2: MANCOSA Classification of Costs 12 Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: On successful completion of this Unit, the student will be able to: • Define costs • • • • • to be able to define costs. • Complete the relevant activities and think points Define direct costs and provide an to be able to differentiate and distinguish example between direct and indirect costs. Define indirect costs and provide an • Complete the relevant activities and think points example to be able to discuss the meaning and Distinguish between Fixed and understanding of the concept-Direct Costs Variable costs. • The student needs to: • Complete the relevant activities and think points Distinguish between Direct and Indirect Costs • ASSOCIATED ASSESSMENT CRITERIA OF THIS UNIT: • Complete the relevant activities and think points What are fixed costs and explain by an to be able to discuss the meaning and example understanding of the concept-Indirect Costs What are variable costs and explain by • Complete the relevant activities and think points an example to be able to discuss how to improve an Explain the elements of product organisation’s ethical climate manufacturing costs • To understand the concept of fixed costs and how to apply it to the business context • To understand the concept of variable costs and how to apply it to the business context • Complete the relevant activities and think points to be able to discuss the definition of all the manufacturing costs and the relevant sub-costs relating to them. 13 MANCOSA Management Accounting Key Concepts 2.1 What are costs? 2.2 Direct and indirect costs 2.3 Fixed and variable costs 2.4 Manufacturing costs and non-manufacturing costs Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L MANCOSA 14 Management Accounting 2.1 What Are Costs? Costs may be defined as the value of economic resources used for the production of a product or service. Costs may be viewed as a necessity in producing a product or service. Costs may be classified according to type e.g. direct and indirect costs as well as by behaviour e.g. fixed and variable costs. 2.2 Direct and Indirect Costs All costs may be categorised as direct or indirect costs. Costs are considered to be direct or indirect to the extent to which they can be accurately traced to a cost centre. A cost centre may be defined as any part of a business to which costs are charged e.g. a particular product or job or department. 2.2.1 Direct costs Direct costs are costs that can be accurately identified as forming part of a cost centre. Examples of such costs would include the materials used to make the product (direct materials) and the wages of the employees who work with these materials (direct labour). 2.2.2 Indirect costs Indirect costs are costs that cannot be easily traced to a particular cost centre. They may be said to include all costs with the exception of direct costs. For example, indirect product costs include all manufacturing costs excluding direct materials and direct labour. Costs that are shared between different departments or products are also considered to be indirect costs e.g. common advertising on national television that benefits two products of the same manufacturer. 2.3 Fixed and Variable Costs Costs behave differently relative to the output. They may remain constant or they may vary. There are no set rules to determine whether a cost is fixed or variable. It depends on the circumstances of each case. Fixed costs Fixed costs are those costs that remain the same irrespective of the level of output or activity. Examples include rent and insurance. However, it must be remembered that fixed costs remain fixed over a certain range. For example, if a factory is producing goods at full capacity and if more units have to be produced then additional premises would be needed resulting in additional rent expense being incurred. 2.3.1 Variable costs Variable costs are those costs that change in proportion to the changes in the level of output or activity. Examples include direct materials, direct labour and certain variable overheads e.g. packing materials. 15 MANCOSA Management Accounting The classification of costs into fixed and variable costs are important in many facets of management accounting e.g. break-even analysis. It must be remembered, though, that some costs e.g. water contain a fixed component (a fixed monthly charge) plus a variable component (additional charged based on usage). These costs may be termed semi-variable. 2.4 Manufacturing Costs and Non-Manufacturing Costs Manufacturing costs consists of three elements viz. direct material, direct labour and manufacturing overheads. Included in manufacturing overheads are indirect materials and indirect labour. Nonmanufacturing costs include marketing costs and administrative costs. All these concepts are explained below. Material Material consists of direct material and indirect material. Direct material can be regarded as the primary material used to manufacture a product. It forms a part of the final product and its usage depends on the volume of production. Direct material forms one part of the primary (direct) cost of a product. Indirect material does not form part of the final product e.g. cleaning materials, maintenance materials. The quantity used is not linked to the volume of production. Indirect materials form part of manufacturing overheads. 2.4.1 Labour Labour can also be divided into two components viz. direct labour and indirect labour. Direct labour refers to labour that is physically applied to the manufacturing of a product and can also be easily traced to the manufactured product. Direct labour forms part of the primary (direct) cost of a product. Indirect labour refers to labour costs that cannot be directly linked to a particular product. For example, the wages of the employees who maintain and service the machines used during manufacturing are classified as indirect labour. Indirect labour forms part of manufacturing overheads. 2.4.2 Manufacturing overheads Manufacturing overheads include indirect materials, indirect labour and all other costs incurred during the manufacturing process that cannot be directly traced to the product. In other words, in includes all costs excluding direct material and direct labour that are incurred during the production process. Apart from indirect materials and indirect labour, manufacturing overheads include rent (of the factory floor space), insurance (of the factory stock and buildings), depreciation of production machinery etc. 2.4.3 Marketing costs Marketing costs are costs incurred to market the product and are largely expenses incurred in promoting sales, obtaining orders and delivery of products. Examples include advertising and commission on sales. MANCOSA 16 Management Accounting 2.4.4 Administrative costs These are costs incurred during the performance of administrative duties. They include costs that arise from departments such as finance, administration, human resources and management. Examples include salaries of executives, legal costs, clerical costs etc. Self-Test Questions 1.1 Classify the following costs as direct or indirect. Place a tick in the appropriate column. No. Cost 1. Fabric used in the manufacture of shirts 2. Grease for the factory machines 3. Depreciation of factory machinery 4. Cleaning materials 5. Salary of the supervisor 6. Wood used in making tables 7. Wages of the person who operates the machine Direct Indirect cost cost that makes the shoes 8. Rent of the factory 1.2 Classify the following costs as fixed or variable in terms of the level of output. Place a tick in the appropriate column. Cost Fixed cost Variable No. cost 1. Rent expense 2. Direct materials 3. Property rates and taxes 4. Commission of salesperson 5. Depreciation using straight-line method 17 6. Direct labour 7. Insurance 8. Salary of factory manager MANCOSA Management Accounting 5.3 Classify the following costs as manufacturing, marketing or administrative costs. Place a tick in the appropriate column. No. Cost Manufacturing 1. Advertising 2. Salary of the typist 3. Repairs to the factory Marketing Administrative machine 4. Depreciation on office furniture 5. Bad debts 6. Audit fees 7. Carriage costs on materials purchased 8. Rent of the office building MANCOSA 18 Management Accounting 2.6 Answers to Revision Questions and Activities SOLUTIONS 5.1 No. Cost Direct cost Indirect cost P 1. Fabric used in the manufacture of shirts 2. Grease for the factory machines P 3. Depreciation of factory machinery P 4. Cleaning materials P 5. Salary of the supervisor P 6. Wood used in making tables P 7. Wages of the person who operates the machine that makes the P shoes 8. P Rent of the factory 5.2 No. Cost Fixed cost Variable cost P 1. Rent expense 2. Direct materials 3. Property rates and taxes 4. Commission of salesperson 5. Depreciation using straight-line method 6. Direct labour 7. Insurance P 8. Salary of factory manager P 19 P P P P P MANCOSA Management Accounting 5.3 No. Cost 1. Advertising 2. Salary of the typist 3. Repairs to the factory machine 4. Depreciation on office furniture 5. Bad debts 6. Audit fees 7. Carriage costs on materials purchased 8. Rent of the office building MANCOSA Manufacturing Marketing Administrative P P P P P P P P 20 Management Accounting Unit 3: 21 Materials MANCOSA Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: On successful completion of this Unit, the student will be able to: • Be familiar with the various activities ASSOCIATED ASSESSMENT CRITERIA OF THIS UNIT: The student needs to: • Complete the relevant activities and think associated with materials. points to be able to define the terminology and • Explain the term primary material terms associated with materials. • Explain the term secondary material • Explain the term work-in-progress points to be able to calculate the economic • Explain the term finished goods order quantity • Explain the term Inventory • Calculate the economic order quantity points to be able to understand the inventory • Valuate materials according to the FIFO valuation methods and tabulate the and AVCO methods. movements in stock. Finally grasping that the Explain the FIFO method and understand units will remain the same for all methods , how to tabulate the movements in stock accept that the value of the units changes across this method. amongst the methods. • • Explain the FIFO method and understand • • • Complete the relevant activities and think Complete the relevant activities and think Complete the relevant activities and think how to tabulate the movements in stock points to be able to demonstrate the across this method. understanding and calculation of valuing stock • What is the market price method? using the FIFO method of inventory valuation. • State the advantages and shortcomings of • the just in time(JIT) inventory policy. Complete the relevant activities and think points to be able to demonstrate the understanding and calculation of valuing stock using the AVCO method of inventory valuation. • Explain what is the market price method and what it is used for. • Complete the relevant activities and think points to be able to understand the concepts and contrast the inventory piling versus the just in time inventory policy MANCOSA 22 Management Accounting Key Concepts 3.1 Introduction 3.2 Terminology associated with materials 3.3 Economic order quantity 3.4 Methods of valuation of materials 3.5 Inventory piling versus Just in time (JIT) inventory policy 3.6 Self-Assessment Activities 3.7 Answers to revision questions and activities Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L 23 MANCOSA Management Accounting 3.1 Introduction We have learnt from the previous topic that material is an important component of the cost of manufacturing a product. We have also learnt that material cost may be divided into direct materials and indirect materials. There are a few other terms that we need to be familiar with: 3.2 Terminology Associated with Materials 3.2.1 Primary material This is another term for direct material i.e. raw materials that are used in the manufacturing process. 3.2.2 Secondary material This is another term for indirect material i.e. material that usually does not form part of the finished product. 3.2.3 Work-in-progress This refers to raw materials that have been put into the production process but are not yet complete. They are part of unfinished products to which a certain amount of labour and overheads have also been applied. 3.2.4 Finished goods These are goods that have been completed from the raw materials that have been put into production. These goods are now ready for sale. 3.2.5 Inventory This refers to the stock of material (direct and indirect), work-in-progress and finished goods at any given time. 3.3 Economic Order Quantity With regard to the control of materials, one of the problems that managers face is what quantity of any item should be ordered each time. One must bear in mind that if too little is purchased, the enterprise may run out of stock. If too much is purchased, a lot of working capital is tied up unproductively in inventory and the cost of holding the stock is high. Therefore, managers have to find a balance between purchasing too little and purchasing too much. Managers need to also consider the two main costs in any purchasing order viz. the cost of purchasing and the cost of holding the inventory. The cost of purchasing inventory includes the costs involved in negotiations, cost of telephone and faxes, stationery, internet usage and receiving the goods. The cost of holding inventory include the cost of storage, loss of interest on capital tied up in inventory, personnel costs, insurance, goods going out of fashion or becoming obsolete. MANCOSA 24 Management Accounting Thus one finds that if small quantities are purchased each time, the cost of purchasing will be high as many orders need to be placed. On the other hand if larger quantities are purchased, the cost of holding inventory becomes high. Somewhere between these two extremes is a point where the total cost of purchasing and holding the inventory is at a minimum. The quantity ordered at this point is the economic order quantity (EOQ). The economic order quantity can be calculated using the following formula: 2CU H EOQ = Where: C = cost of placing an order U = annual usage H = inventory (stock) holding cost per unit Example 1 Arlen Limited purchases 800 school bags at R60 each per annum. The bags are sold at R80 each at a steady rate during the year. The cost of placing a single order amounts to R20,25. Inventory holding cost amounts to R4 per unit. Calculate the: 1.1 economic order quantity 1.2 the number of orders that should be placed each year 1.1 Solution EOQ = = 2CU H 2 X 20,25 X 800 4 8 100 = = 25 90 units MANCOSA Management Accounting 1.2 The number of orders that should be placed per year is calculated as follows: Total annual demand__ Economic order quantity = 800 90 = 8,89 or 9 orders (rounded off) Managers need to be aware that there are some limitations to the use of the basic EOQ model. These limitations relate to its assumptions. It assumes that annual demand can be predicted accurately. It also assumes that inventory can be purchased in single units e.g 73 but goods are often packaged in multiples of 20 or 50 units etc. Finally, it also assumes that quantity or bulk discounts are not available. Despite these limitations the EOQ model is still a useful tool in managing inventory. 3.4 Methods of Valuation of Materials The purchase price of materials is often subject to constant change. These changes could be through the effects of inflation, shortages in supply, unstable markets etc. Materials need to be valued for two purposes viz. • to determine the value of materials issued to production (affects cost of production) • .to determine the value of the materials on hand (inventory valuation). Various methods are used to value inventory. These include the first-in-first-out method (FIFO), last-infirst-out method (LIFO), the weighted average cost method (AVCO) and the market price method. The LIFO method is usually not allowed when calculating profit for tax purposes and will therefore not be discussed. 3.4.1 First-in-first-out method (FIFO) This method values material issued to production in the order in which it was received. It is based on the premise that material that is received first is issued first (to avoid losses due to deterioration or obsolescence). The following example explains the application of the FIFO method: MANCOSA 26 Management Accounting Example 2 The following transactions of BNM Ltd took place during April 20.6 in respect of a component used in production: April 01 Opening inventory 90 units at R10 per unit 07 Issued to production 50 units 10 Purchased from supplier 160 units at R11 per unit 17 Issued to production 30 units 20 Purchased from supplier 60 units at R12 per unit 24 Issued to production 60 units 30 Returned to supplier (bought on 10 April) 20 units Required Using the FIFO method, calculate the issue price to production and the value of closing inventory. Purchases Date Quantity Price Issues and returns Amount Quantity Price Balance Amount Quantity Price Amo unt 01 07 10 50 160 11 24 30 27 30 60 12 500 1 760 17 20 10 10 300 720 90 10 900 40 10 400 40 10 400 160 11 1 760 10 10 100 160 11 1760 10 10 100 160 11 1 760 60 12 720 10 10 100 110 11 1 210 50 11 550 60 12 720 20 11 220 90 11 990 60 12 720 MANCOSA Management Accounting 3.4.2 Weighted average cost method (AVCO) When using the AVCO method, all issues of material and inventory of material are valued at the average price. This average price is re-calculated each time materials are purchased from suppliers. When materials are purchased the quantity and monetary value is added to the previous stock balance and a new average unit price is available for additional issues of materials. If prices fluctuate greatly, AVCO method provides a good option for dealing with this. For a time all products will be charged at a uniform rate for the same material. However, the disadvantage of this method is that the average price may be fictitious and not be related to the market price. The following example explains the application of the AVCO method: Example 3 Required Refer to the information used in example 2. Using the AVCO method, calculate the issue price to production and the value of closing inventory. Purchases Date Quantity Price Issues and returns Amount Quantity Price Balance Amount 01 07 50 10 160 11 30 60 500 1 760 17 20 10 12 10,80 324 720 Quantity Price Amount 90 10 900 40 10 400 200 10,80 2 160 170 10,80 1 836 230 11,11 2 556 24 60 11,11 667 170 11,11 1 889 30 20 11 220 150 11,13 1 669 REMARKS n The weighted average per unit for the 10th is calculated as follows: (400 + 1 760) ÷ (40 + 160) 2 160 ÷ 200 R10,80 n The stock issued on the 7th, 17th and 24th are issued at the latest weighted average per unit. n The weighted average per unit for the 20th is calculated as follows: (1 836 + 720) ÷ (170 + 60) 2 556 ÷ 230 MANCOSA 28 Management Accounting 11,113043 or R11,11 n The weighted average per unit for the 30th is calculated as follows: (1 889 - 220) ÷ (170 - 20) 1 669 ÷ 150 11,126666 or R11,13 3.4.3 Market price method This method uses the current market price to determine the price at which materials are issued for production. 3.5 Inventory Piling Versus Just In Time (JIT) Inventory Policy A business may hold stock (inventory piling or stockpiling) for various reasons. It may want to ensure that production is uninterrupted. It is possible that future supplies may become scarce. It may be that the prices of the materials are expected to rise shortly. However, there are many costs that need to be borne in inventory piling. These include storage and handling costs, financing costs, theft and obsolescence. Moreover, large amounts of working capital may be tied up in inventory. A modern trend among many businesses is to eliminate the need to hold inventory by applying the just in time (JIT) inventory policy. Toyota (Pty) Ltd situated south of Durban (South Africa) uses the JIT stock management system. The advantages to the business are that: inventory is kept to a minimum (thus minimising costs associated with handling, theft, insurance and obsolescence). • the investment in inventory is kept to a minimum. • less storage facilities are required (inventory holding costs rest with the suppliers). The success of the JIT inventory policy depends a lot on maintaining an excellent relationship with suppliers. Suppliers must be informed of orders in advance and suppliers must deliver at the appropriate times. The downside of JIT inventory management is that if suppliers don’t deliver on time, production may be halted and the supply of products to customers could be interrupted. Furthermore, since suppliers are required to hold the inventory, they may compensate for this through increased prices. 29 MANCOSA Management Accounting 3.6 Self-Assessment Activities Self-Test Questions 3.6.1 What are the consequences to a business of holding a very low a level of inventory? 3.6.2 DNA Ltd sells 4 000 drums of grease each year. The inventory holding cost of one drum of grease is R8. The cost of placing an order for stock is estimated at R250. 3.6.3 Calculate the EOQ for drums of grease. Calculate the number of orders that should be placed per annum. (Round off calculations to the nearest whole number.) 3.6.4 You are the newly appointed management accountant at Kelso Industries. The company uses the EOQ model to determine the quantity of raw material Z54 to order from REM Ltd. The following details regarding raw material Z54 are brought to your attention: Kelso Industries consumes 2 400 units of material Z54 each working day. • It is estimated that there are 250 working days in the 20.7 financial year. • The cost of placing an order amounts to R120. • The cost of holding inventory per unit is estimated at R3,90 plus 11% of the invoice price per unit. • The invoice price per unit is R10. REQUIRED 3.6.5 Calculate the EOQ for raw material Z54 for the 20.7 financial year. 3.6.6 Calculate the number of orders that should be placed during 20.7. (Round off calculations to the nearest whole number.) 3.6.7 The following transactions of CAN Manufacturers took place during June 20.6 in respect of a raw material M321 used in production: June MANCOSA 01 Opening inventory 2 000 units at R30 per unit 08 Issued to production 1 600 units 11 Purchased from supplier 1 800 units at R31 per unit 18 Issued to production 1 900 units 21 Purchased from supplier 2 000 units at R32 per unit 30 Management Accounting 25 Issued to production 1 400 units 30 Returned to supplier (bought on 21 June) 100 units Required Use the FIFO method and weighted average cost methods to complete the tables below that include the issue price to production and the value of closing inventory. FIFO Purchases Date Quantity Price Issues and returns Amount Quantity Price Balance Amount Quantity Price Amount WEIGHTED AVERAGE COST METHOD Purchases Date 31 Quantity Price Issues and returns Amount Quantity Price Amount Balance Qty Price Amount MANCOSA Management Accounting 3.7 Answers to Revision Questions and Activities Solutions 3.6.1 • Production may be interrupted due to shortage of raw materials. • Loss of sales may result as goods cannot be provided immediately. • There may be a loss of goodwill from customers due to finished stock shortages. • Higher purchasing price may have to be paid in order to replenish inventory quickly. • High transport costs may be incurred to replenish inventory quickly. 3.6.2 EOQ = = 2CU H 2 X 250 X 4000 8 250 000 = = 500 units 3.6.3 The number of orders that should be placed per annum is calculated as follows Total annual demand Economic order quantity = 4 000 500 = 8 orders 6.3.1 EOQ = MANCOSA 2CU H 32 Management Accounting 2 X 120 X 600 000 5 = 28 800 000 = = 5 367 units (rounded off) 3.6.4 The number of orders that should be placed per annum is calculated as follows: Total annual demand Economic order quantity = 600 000 5 367 = 112 orders (rounded off) 3.6.5 FIFO Purchases Date Quantity Price Issues and returns Amount Quantity Price Amount Quantity Price Amount 2 000 30 60 000 400 30 12 000 400 30 12000 1 800 31 55 800 300 31 9 300 300 31 9 300 2 000 32 64 000 01 08 11 1 600 1 800 31 25 30 33 2 000 32 48 000 55 800 18 21 30 Balance 400 30 12 000 1500 31 46 500 64 000 300 31 9 300 1 100 32 35 200 900 32 28 800 100 32 3 200 800 32 25 600 MANCOSA Management Accounting 3.6.7 WEIGHTED AVERAGE COST METHOD Purchases Date Quantity Price Issues and returns Amount Quantity Price Amount Quantity Price Amount 2 000 30 60 000 400 30 12 000 2 200 30,82 67 800 300 30,82 9 245 2 300 31,85 73 245 01 08 1 600 11 1 800 31 1 900 2 000 32 48 000 55 800 18 21 30 Balance 30,82 64 000 25 1 400 31,85 44 584 900 31,85 28 661 30 100 32 3 200 800 31,83 25 461 n REMARKS The weighted average per unit for the 11th is calculated as follows: (12 000 + 55 800) ÷ (400 + 1 800) 67 800 ÷ 2 200 30,818181 or R31,82 n The stock issued on the 8th, 18th and 25th are issued at the latest weighted average per unit. n The weighted average per unit for the 21st is calculated as follows: (9 245 + 64 000) ÷ (300 + 2 000) 73 245 ÷ 2 300 31,845652 or R31,85 n The weighted average per unit for the 30th is calculated as follows: (28 661 – 3 200) ÷ (900 - 100) 25 461 ÷ 800 31,82625 or R31,83 MANCOSA 34 Management Accounting Unit 4: 35 Labour MANCOSA Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: On successful completion of this Unit, the student will be able to: • Familiar with the administrative ASSOCIATED ASSESSMENT CRITERIA OF THIS UNIT: The student needs to: • Complete the relevant activities and think points to be able to issues and various calculations demonstrate an understanding of administrative issues and related to labour. perform the necessary calculations accordingly. • Be familiar with the employee • Complete the relevant activities and think points to be able to. records maintained for labour • Complete the relevant activities and think points to be able to recognise the different remuneration methods. Additionally, be remuneration. able to calculate the net wage or net salary. • Calculate the net wage or net salary of an employee. • define wage incentive schemes and explain the different • Be familiar with the various wage aspects of the wage incentive schemes. As well as being able incentive schemes. to calculate wages according to the different wage incentive • State the principles of the wage schemes. incentive schemes • Calculate the hourly rate for • • Complete the relevant activities and think points to be able to calculate the hourly rates allocated to the various cost centres. centres. • Explain the essence of Taylor’s Complete the relevant activities and think points to be able to discuss the key principles of wage incentive schemes. employees that would be allocated to the various cost Complete the relevant activities and think points to be able to • Complete the relevant activities and think points to be able to differential piecework system and demonstrate an understanding and calculate the standard rate the calculation thereof. per unit of Taylor’s differential piecework system. • Explain the essence of the Halsey • demonstrate an understanding and calculate the time saved Bonus system and the calculation when manufacturing a product using the Halsey Bonus thereof. • To allocate the direct labour costs and calculate the hourly recovery tariff of an employee Complete the relevant activities and think points to be able to system. • Complete the relevant activities and think points to be able to demonstrate an understanding of the allocation of the direct labour costs and calculate the hourly recovery tariff of an employee. MANCOSA 36 Management Accounting Key Concepts 4.1 Introduction 4.2 Labour administration 4.3 Employee records 4.4 Calculation of net wage or net salary 4.5 Wage incentive schemes 4.6 Allocation of direct labor costs 4.7 Self-assessment activities 4.8 Answers to revision questions and activities Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L 37 MANCOSA Management Accounting 4.1 Introduction Labour may be described as the physical and mental effort of employees in the manufacturing process. Labour costs, as we already know, can be divided into direct labour (work that is directly related to the production of goods) and indirect labour (work that is not directly related to the production of goods). Direct labour costs form part of the primary (direct) cost of production while indirect labour forms part of the overhead costs. Labour costs can be substantial and it is therefore important for management to exercise effective control over matters relating to employees. If management can create an environment conducive to job satisfaction, then this should result in high levels of labour productivity. Productivity levels need to be monitored on an on-going basis. 4.2 Labour Administration Labour administration allows management to set standards for the manufacturing process and to measure and compare the actual results obtained. Management can determine whether labour is effectively employed or not. If necessary, remedial measures need to be taken. The following matters linked to personnel administration have a bearing on labour costs: determining the number of employees required to complete all the production tasks • recruitment and selection process • job analysis including job description and job specification • work study including method study and work measurement • training of employees including induction and in-service training • maintaining employee records. • resignations and dismissal of employees the number of resignations is high, this is an indication that all is not well. Labour turnover can be calculated by using the following formula: Number of employees who left X 100 Total number of employees Example 1 If the number of persons who left during 20.6 was 16 out of a total staff of 80 employees, then the labour turnover will be 20%, calculated as follows: 16 X 10 If 80 = 20% MANCOSA 38 Management Accounting The rate of labour turnover may also be calculated per department, per gender group, per age group etc. Managers need to establish why employees are leaving and analyse whether the reasons are controllable or not. Employees may resign for many reasons including remuneration, working conditions, relationship with manager, health reasons, promotion, working hours, transport problems etc. The cost of labour turnover includes all those costs mentioned above relating to recruitment, selection, training etc. 4.3 Employee Records It is important that proper records are kept relating to each employee. The human resources (personnel) department will keep records relating to the employee’s date of appointment, salary scale, leave, deductions, promotions etc. As far as labour costing is concerned, the following records are important: • clock cards • job cards 4.3.1 Clock cards A clock card machine is a device used to determine the exact time an employee works each day. Each employee is given a clock card. When the employee reports for duty, he/she inserts the card into the device that records the time on it. When the employee goes off duty, he/she clocks out and the time is once again printed. Using the clock card, the exact number of hours worked as normal time and overtime can be calculated. In this way, the gross wage of each employee is calculated. Computerised clocks are used nowadays that are designed to make it difficult for employees to dishonestly clock in for another employee. 4.3.2 Job cards Job cards are used to indicate the time an employee starts a job and the time when the job is completed. When an employee commences a new job, a new card is used. The supervisor fills in the start time and finishing time on the job card. The job card also indicates to the employee what job needs to be done. If the job is halted for some reason e.g. electricity failure, an idle time card is filled. It is important to reconcile the times reflected on the clock cards with the job cards. The times recorded form the basis for the allocation of labour costs to the various cost centres. 39 MANCOSA Management Accounting 4.4 Calculation of Net Wage or Net Salary Before we go on to the calculation of net wage or net salary, let us examine some of the methods of remunerating employees and the terminology used in labour costing. Employees may be remunerated by using any of the following methods: • Employees may be paid a fixed salary irrespective of the number of hours worked or the quantity of work done. • Employees may be paid an hourly rate. The amount an employee earns depends on the number of hours worked. • Employees may be paid for the work that he/she has performed (piecework) and not according to the time taken to do the work. The employer thus pays only for work that has been done. • The following terms are used in connection with labour costs: Normal time refers to remuneration employees receive for working during normal working hours (e.g. 45 hours per week). • Overtime is the remuneration employees receive for work done beyond normal working hours. • Idle time refers to time that is lost because of machine breakdown, power cuts, materials not available etc. Idle time is usually not regarded as an overhead. • Gross wage is the total remuneration (normal time, overtime, bonus etc) before any deductions are made. • Net wage is the gross wage less deductions (e.g. pension, medical aid, income tax etc). • Pension fund is a fund that employees contribute to in order to receive remuneration (pension) when they retire. The employer may also contribute to the fund on behalf of the employees. • Income tax is a compulsory deduction payable to the state. The employer deducts the money according to the “Pay As You Earn” (PAYE) system. • Unemployment insurance fund is a fund that employees contribute to in order to receive remuneration when they become unemployed. The employer also contributes to the fund on behalf of the employees. • Medical aid fund is a fund employees contribute to in exchange for having their medical expenses (up to certain limits) paid from the fund. The employer may also contribute to the fund on behalf of the employees. MANCOSA 40 Management Accounting The following example will be used show how net wage is calculated. Example 2 The following information applies to Mrs J. Tladi, an employee of Dermat Ltd, who is paid weekly. Calculate Mrs. J. Tladi’s net wage for the week. Also indicate the double entries to be made in the books of Dermat Ltd. Normal working hours (6 days) 45 hours Number of hours worked 51 hours Monday 8 hours Tuesday 8 hours Wednesday 9 hours Thursday 9 hours Friday 8 hours Saturday 5 hours Sunday 4 hours Normal hourly rate R20 Overtime: Normal working week 1½ times normal rate Sundays double normal rate Pension fund (calculated on normal pay): Employee’s deduction 7,5% Employer’s contribution 6% Unemployment insurance fund (UIF): Employee’s deduction 1% of normal pay Employer’s contribution 1% of normal pay Income tax (PAYE) 41 15% of taxable income MANCOSA Management Accounting Solution R Normal pay (45 hours X R20) 900,00 Overtime: 2 hours X R20 X 1,5 60,00 4 hours X R20 X 2 160,00 Gross wage 1 120,00 Pension deduction (R900 X 7,5%) (67,50) Taxable income 1 052,50 Other deductions (166,88) PAYE (R1 052,50 X 15%) UIF (R900 X 1%) Net wage 157,88 9,00 885,62 REMARKS • Gross wage = Normal wage + Overtime • Pension is calculated on normal pay (basic wage) and not on the gross wage i.e. no pension is deducted from overtime pay. • Taxable income = Gross wage – Pension deduction • Income tax (PAYE) is calculated on the taxable income and not on the gross wage. • UIF is calculated on the normal pay. • Net wage = Taxable income – Other deductions Double entries in the books of Dermat Ltd: The double entry relating to the calculation of the employee’s wage is: MANCOSA 42 Management Accounting Debit (R) Wages Credit (R) 1 120,00 Creditors for wages 885,62 Pension fund 67,50 South African Revenue Services - PAYE 157,88 Unemployment insurance fund 9,00 The double entry to record the employer’s contribution to the various funds is: Wages (or Contribution accounts) 63,00 Pension fund 54,00 Unemployment insurance fund 9,00 The double entry to pay off the liabilities created above is: Creditors for wages 885,62 Pension fund (R67,50 + R54) 121,50 South African Revenue Services - PAYE 157,88 Unemployment insurance fund (R9 + R9) 18,00 Bank 1 183,00 Remarks The double entry to pay off the liabilities is not done weekly (as shown above). Only the net wage is paid weekly. The rest of the liabilities are settled at the end of the month. Of course the amounts in respect of all employees are taken. • The employer’s contribution to the pension fund is calculated as follows: R900 X 6% = R54 4.5 Wage Incentive Schemes Wage incentive schemes are aimed at increasing the productivity of employees and to actually reduce total production costs. Employees are granted additional or increased remuneration if their performance is excellent and high productivity is maintained 43 MANCOSA Management Accounting 4.5.1 Principles of wage incentive schemes For wage incentive schemes to be successful they should adhere to certain principles. Some of these principles include: • The system must be fair towards the employees. • Employees must be paid their bonuses as soon as possible. • The system must be understandable to employees. • The standards set to qualify for the bonus must be realistic. • Control measures must be put in place to ensure efficiency. 4.5.2 Examples of wage incentive schemes Straight piecework Piecework remuneration involves paying an employee as follows: Units produced X rate per hour If an employee produces more than the target set, the rate per hour may be increased for the additional units produced. Example 3 John is employed by a building contractor to tile floors and walls. The standard time to tile 4 m2 is 20 minutes. He is paid R120 per hour and the normal working time is 9 hours per day. If he tiles more than his quota, he receives 1,5 times his hourly rate on the additional output. He tiled 124 m2 for the day. Calculate his earnings for the day. Solution Standard output: 4 m2 X 3 (20 minutes X 3 = 1 hour) X 9 hours = 108 m2 Additional output: (124 m2 – 108 m2) Standard wage: R1 080 (9 hours X R120) Bonus R240 (1,33 hours [16÷12] X R120 X 1,5) Earnings for the day R1 320 MANCOSA = 16 m2 44 Management Accounting Taylor’s differential piecework system Using this system an employee is paid according to extent he/she meets the predetermined standards set. If an employee performs below standard, he/she receives lower remuneration * than an employee whose performance is standard. Employees whose output is above standard are compensated at a higher rate per unit. The system works as follows: The standard rate per unit produced is first calculated. The following formula may be used: Standard rate per unit = * Hours worked X Rate per hour________ Standard units expected to be produced A premium expressed as a percentage is determined for two categories of employees viz. those that produce less than the standard units expected and those that produce the standard units expected or more than the standard. For example the premium for the first category may * be 85% and the premium for the second category may be 115%. The remuneration is then determined for each employee as follows: Number of units produced X Standard rate per unit X Premium While this system is meant to discourage employees from not maintaining the standard, it may be unfair on new employees. Example 4 Calculate the remuneration for each employee per day using Taylor’s differential piecework system from the information given. Information Standard time allowed : 150 units per hour Standard work day : 8 hours Normal wage rate : R24 per hour Premium : 85% of piecework rate if below standard 115% of piecework rate if standard or above standard Production of employees per day: 45 Mary 1 200 Harry 1 150 Gumede 1 250 MANCOSA Management Accounting Solution Standard rate per unit = hours worked X rate per hour standard units = 8 X R24 8 X 150 = R0,16 Remuneration for each employee (Standard units per day = 150 X 8 = 1 200) Mary: (1 200 units X R0,16) X 115% = R220,80 Harry: (1 150 units X R0,16) X 85% = R156,40 Gumede: (1 250 units X R0,16) X 115% = R230,00 REMARKS Harry is the only employee whose output (1 150 units) was below standard (1 200 units). That is why 85% is used in calculating his remuneration. 4.5.3 Halsey bonus system Using this system, the employee is rewarded for the time he/she saves. Suppose an employee manufactures 40 units in an eight-hour day for which the standard has been set at 32 units. The employee has saved 2 hours for the day (8 units X 15 minutes’ production time per unit = 120 minutes). (The production time per unit is 8 hours [or 480 minutes] ÷ 32 = 15 minutes). The employee will be compensated for his/her normal pay (8 hours per day) plus the additional 2 hours. Example 5 For example, Jacob’s normal wage is R32 per hour and his normal working day is 8 hours. Management has set a standard of 300 units per hour. On a given day, Jacob produced 3 000 units within his 8-hour shift. A bonus of 50% of the time saved is given to employees. Calculate the number of hours saved by Jacob and his remuneration for the day. Solution Time allocated 10 hours (3 000 units ÷ 300) Time worked 8 hours Time saved 2 hours MANCOSA 46 Management Accounting Normal pay: R256 (R32 X 8 hours) Bonus/Premuim R32 (50% X 2 hours X R32 per hour) Pay for the day R288 4.6 Allocation of Direct Labour Costs Direct labour costs are first calculated on an hourly basis and then allocated to the various cost centres (e.g. products) in proportion to the number of hours worked. Accurate calculations are essential to prevent under recovery or over recovery. Provision must also be made for holiday leave and idle time. The gross salaries and wages, bonuses and the employer’s portion of fringe benefits (e.g. pension, medical aid) must be allocated to the various cost centres. Example 6 The following information relates to an employee at MGM Ltd for the year 20.6. Calculate the hourly recovery tariff of the employee. Information Holiday leave 3 weeks Normal working hours 5 working days, 9 hours per day Public holidays 12 (all falling on work days) Idle time 10% Gross annual salary including leave R48 000 Holiday bonus R4 000 Employer’s contributions to fringe benefits R5 000 Solution Number of weeks in a year 52 Holiday leave (3) Weeks available 49 Normal working hours X 45 Available working hours 2 205 Public holidays (12 days X 9 hours) (108) 2 097 47 Idle time (209,7) Expected productive hours 1 887,3 MANCOSA Management Accounting Gross salary including leave R48 000 Holiday bonus R4 000 Employer’s contributions to fringe benefits R5 000 R57 000 Hourly recovery tariff = R57 000 1 887,3 Hours = R30,20 per hour = Self-Assessment Activities 4.7 Dube is employed by Restonic Manufacturers. The following details relate to him for the third week of June 20.6. Hours worked Monday 10 Tuesday 8 Wednesday 8 Thursday 8 Friday 8 Saturday 5 Sunday 3 Additional information 1. The income tax (PAYE) deduction is 18% of the taxable income. 2. The unemployment insurance fund deduction is 0,9% of the normal wages. The employer contributes the same amount as the employee to the fund. 3. The employee’s deduction for medical aid amounted to R150 for the week. The employer contributes 1,5 times the amount the employees pay to the fund. MANCOSA 48 Management Accounting 4. Employees are remunerated at R24 per hour during normal working hours. 5. Contributions to the pension fund is calculated on the normal time and is made up as follows: Employee’s deduction 7,5% Employer’s contribution 11,25% The normal working week is from Monday to Friday for 8 hours per day. Any time worked in 6. addition to this on weekdays and Saturdays is overtime calculated at 1½ times normal rate. Overtime on Sundays is remunerated at double the normal rate. 7. Required 7.1.1 Calculate the net wage due to D. Dube for the third week of June 20.6. 7.1.2 Calculate the contributions made by Restonic Manufacturers for pension, medical aid and unemployment insurance in respect of D. Dube for the week. 7.2 Compu Manufacturers produces a single product called Diskette A. The basic hourly rate is R20 for all four production workers. The following is an extract from the manufacturing records for the week ended 22 August 20.6: Employee Hours worked Number produced K. Naidoo 40 820 H. Grant 46 874 M. Mbeki 40 760 J. Lewis 45 945 Additional information n The normal working hours per week is 40. n Overtime is paid at 1,5 times the normal rate. n Standard production for all employees is 20 diskettes per hour. Required Calculate the gross wage of all the employees for the week ending 22 August 20.6 using the straight piecework scheme (bonus is 1½ times the hourly rate on the additional output). 49 MANCOSA Management Accounting 7.3 Calculate the remuneration for each employee using Taylor’s differential piecework system from the information given. Information Standard time allowed : 150 units per hour Standard work day : 9 hours Normal wage rate : R30 per hour Premium : 80% of piecework rate if below standard 120% of piecework rate if standard or above standard Production of employees per day: 7.4 Tom: 1 250 Dick: 1 350 Harry: 1 500 Jim’s normal wage is R36 per hour and his normal working day is 9 hours. Management has set a standard of 250 units per hour. On a given day, Jim produced 2 500 units within his 9hour shift. A bonus of 50% of the time saved is given to employees (Halsey bonus system). Calculate the number of hours saved by Jim and his remuneration for the day. 7.5 Manco Ltd has three employees whose basic monthly salary is as follows: V. Zuma R10 400 R. Singh R9 600 B. Botha R12 800 Each employee is entitled to 30 days’ pay vacation leave. Each employee receives an annual bonus of 90% of the basic monthly salary payable in the last month of the year. The employer contributes twice the amount that the employees contribute to the pension fund. The employee’s pension deduction is 8% of the basic salary and income tax is 18% on taxable income. The employees work for 8 hours per day, five days per week. There are 12 public holidays, of which 8 fall on weekdays. Required 7.5.1 Calculate the net salary of each employee for the second month of the year. 7.5.2 Calculate the hourly recovery tariff for each employee. MANCOSA 50 Management Accounting 4.7 Answers to revision questions and activities SOLUTIONS 7.1.1 R Normal pay (40 hours X R24) 960 Overtime: 7 hours X R24 X 1,5 252 3 hours X R24 X 2 144 Gross wage 1 356 Pension deduction (R960 X 7,5%) (72) Taxable income 1 284 Other deductions (389,76) PAYE (R1 284 X 18%) 231,12 UIF (R960 X 0,9%) 8,64 Medical aid 150 Net wage 7.1.2 7.2 894,24 Pension contributions: R108 (R960 X 11,25%) Medical aid contributions: R225 (R150 X 1,5) Unemployment insurance: R8,64 (R960 X 0,9%) K. Naidoo Expected output: 20 diskettes per hour X 40 hours = 800 diskettes Additional output: 820 – 800 = 20 diskettes Normal wage: R800 (40 hours X R20) = 920 diskettes Overtime 0 Bonus R30 (1 hour [20÷20] X R20 X 1,5) Gross wage R830 H. Grant Expected output: 20 diskettes per hour X 46 hours Additional output: 874 – 920 (below expected output) = Normal wage: R800 (40 hours X R20) Overtime R180 (6 hours X R20 X 1,5) Bonus Gross wage 51 0 0 R980 MANCOSA Management Accounting M. Mbeki Expected output: 20 diskettes per hour X 40 hours Additional output: 760 – 800 (below expected output) = Normal wage: R800 (40 hours X R20) Overtime 0 Bonus 0 Gross wage = 800 diskettes 0 R800 J. Lewis 7.3 Expected output: 20 diskettes per hour X 45 hours = 900 diskettes Additional output: 945 – 900 = 45 diskettes Normal wage: R800,00 (40 hours X R20) Overtime R150,00 (5 hours X R20 X 1,5) Bonus R67,50 (2,25 hours [45÷20] X R20 X 1,5) Gross wage R1 017,50 Standard rate per unit = hours worked X rate per hour standard units = 9 X R30 9 X 150 = R0,20 Remuneration for each employee (Standard units per day = 150 X 9 = 1 350) Tom: (1 250 units X R0,20) X 80% = R200,00 Dick: (1 350 units X R0,20) X 120% = R324,00 Harry (1 500 units X R0,20) X 120% = R360,00 MANCOSA 52 Management Accounting 7.4 Time allocated 10 hours (2 500 units ÷ 250) Time worked 9 hours Time saved 1 hour Normal pay: R324 (R36 X 9 hours) Bonus/Premuim R18 (50% X 1 hour X R36 per hour) Pay for the day R342 7.5.1 V. Zuma R. Singh B. Botha R R R 10 400 9 600 12 800 0 0 0 Gross salary 10 400 9 600 12 800 Pension deduction (basic salary X 8%) (832) (768) (1 024) Taxable income 9 568 8 832 11 776 Other deductions (1 722,24) (1 589,76) (2 119,68) 1 722,24 1 589,76 2 119,68 7 845,76 7 242,24 9 656,32 Basic salary Bonus PAYE (taxable income X 18%) Net salary 7.5.2 Number of days in the year Vacation leave 365 (30) 335 Public holidays (8) 327 53 Saturdays and Sundays (96) (52 X 2 – 8 from leave) Work days 231 Hours per day X 8 Expected productive hours 1 848 MANCOSA Management Accounting V. Zuma R. Singh B. Botha R R R 124 800 115 200 153 600 9 360 8 640 11 520 134 160 123 840 165 120 Employer’s contributions to pension 19 968 18 432 24 576 Total salary bill 154 128 142 272 189 696 R154 128 R142 272 R189 696 1 848 hrs 1 848 hrs 1 848 hrs R83,40 R76,99 R102,65 Basic annual salary (per month X 12) Annual bonus Hourly recovery tariff = = REMARKS n Annual bonus = 90% of the monthly salary. n Employer’s contribution to pension fund = 16% of the basic annual salary. MANCOSA 54 Management Accounting Unit 5: 55 Absorption Costing and Marginal Costing MANCOSA Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: ASSOCIATED ASSESSMENT CRITERIA OF On successful completion of this Unit, the THIS UNIT: student will be able to: The student needs to: • Distinguish between absorption costing • Complete the relevant activities and think and marginal costing. • Prepare the points to be able to identify and contrast the income statements differences between the two concepts; according to both the absorption and marginal costing methods. • • namely Marginal and Absorption costing. • Complete the relevant activities and think Calculate the net profit using absorption points to be able to populate the income costing and marginal costing methods statements in the legislated framework and and be able to reconcile the difference in structure for both formats including the the profits calculated. absorption and marginal costing methods. Reconcile the difference in net profit • Complete the relevant activities and think between the two costing methods points to be able to demonstrate the articulation and calculation of reconciling the profit between these two stipulated costing methods. Key Concepts 5.1 Introduction 5.2 Difference between absorption costing and marginal costing 5.3 Preparing income statements according to both the absorption and marginal costing methods 5.4 Reconciliation of profit calculated according to absorption costing with profit calculated according to marginal costing 5.5 Answers to Self-Test questions and activities Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L MANCOSA 56 Management Accounting 5.1 Introduction An important aspect of product costing is to calculate the manufacturing cost per unit. This is done by dividing the total manufacturing cost for a particular period by the number of units produced during this period. For example, if the total manufacturing costs for 30 000 units is R90 000, then the cost per unit is R3. The availability of a unit manufacturing cost makes it easy to determine the manufacturing costs of units sold and units on hand. This information has an impact on the calculation of the net profit. There are different opinions as to what should be included in the unit cost of manufacturing. Some people favour absorption costing. Others favour marginal costing. In absorption costing both the fixed cost and variable cost are included in the total manufacturing cost of a product. In marginal costing only the variable cost is included in the manufacturing cost of a product. 5.2 Difference Between Marginal Costing and Absorption Costing In marginal costing (also called direct costing or variable costing), the manufacturing cost takes only the variable manufacturing cost into account viz. direct material, direct labour and variable manufacturing overheads. When marginal income is calculated all variable costs (including selling and administrative costs) are taken into account. Fixed manufacturing overheads are considered to be a period cost and are written off in the period in which they were incurred. In absorption costing (also called total costing or full cost method) the manufacturing cost takes both the variable and fixed manufacturing costs into account. Fixed manufacturing overheads are classified as a product cost and not as a period cost (as is the case with marginal costing). The following is a summary of product costs and period costs using both methods of costing: PRODUCT COSTS MARGINAL COSTING ABSORPTION COSTING Direct materials Direct materials Direct labour Direct labour Variable overhead Variable overhead Fixed overhead PERIOD COSTS MARGINAL COSTING ABSORPTION COSTING Fixed overhead Selling expenses Selling expenses Administrative expenses Administrative expenses 57 MANCOSA Management Accounting 5.3 Preparing Income Statements According to Both the Marginal and Absorption Costing Methods The treatment of the period costs and product costs outlined above in the income statements of both costing methods may be illustrated as follows: MARGINAL COSTING METHOD ABSORPTION COSTING METHOD Sales Sales Less: Variable cost Less: Manufacturing cost Direct material Direct material Direct labour Direct labour Variable manufacturing overheads Variable manufacturing overheads Other variable costs: Fixed manufacturing overheads Administrative expenses Selling expenses = Marginal income = Gross profit Less: Fixed cost Less: Other costs Manufacturing cost Selling cost Selling cost (fixed & variable) Administrative cost Administrative cost (fixed & variable) = Net profit MANCOSA = Net profit 58 Management Accounting The income statements can also be represented as follows: MARGINAL COSTING METHOD ABSORPTION COSTING METHOD Sales Sales Less: Variable cost Less: Manufacturing cost of sales Opening inventory (finished goods) Opening inventory (finished goods) Add: Variable manufacturing costs Add: Variable manufacturing costs Add: Fixed manufacturing costs = Goods available for sale = Goods available for sale Less: Closing inventory (finished goods) Less: Closing inventory (finished goods) = Variable cost of goods sold + Variable selling expenses + Variable administrative expenses = Marginal income = Gross profit Less: Fixed cost Less: Other costs Manufacturing cost Selling cost Selling cost (fixed & variable) Administrative cost Administrative cost (fixed & variable) = Net profit = Net profit Income statements completed according to both costing methods will show the same net profit provided that the number of units produced and the number of units sold are the same and that there is no inventory on hand. If there is inventory on hand, the net profit computed for each costing method will be different. The difference will be due to the fact that in absorption costing fixed overheads are included in inventory valuation while in marginal costing they are treated as period costs. 59 MANCOSA Management Accounting Example 1 Valdo Ltd manufactures only one product. The following information pertains to June 20.6: Number of units manufactured 30 000 Number of units sold 24 000 Selling price per unit R100 Variable manufacturing cost R750 000 Fixed manufacturing cost R300 000 Selling and administrative cost: Variable Fixed R10 per unit sold R100 000 Required: Draft the income statement for June 20.6 using: (a) the marginal costing method (b) the absorption costing method Solution (a) MARGINAL COSTING METHOD INCOME STATEMENT FOR JUNE 20.6 R Sales 2 400 000 Less: Variable cost (840 000) Opening inventory 0 Variable manufacturing costs 750 000 Goods available for sale 750 000 Closing inventory (6 000 X R25)* (150 000) Variable cost of goods sold 600 000 Variable selling and administrative expenses (24 000 X R10) 240 000 Marginal income 1 560 000 Less: Fixed cost (400 000) Manufacturing cost 300 000 Selling and administrative cost 100 000 Net profit 1 160 000 MANCOSA 60 Management Accounting * REMARKS Closing inventory = 30 000 (manufactured) – 24 000 (sold) = 6 000 units Closing inventory is valued at R25 per unit calculated as follows: Variable manufacturing cost__ Number of units manufactured = R750 000 30 000 = R25 (variable manufacturing cost per unit) (b) ABSORPTION COSTING METHOD INCOME STATEMENT FOR JUNE 20.6 R Sales 2 400 000 Manufacturing cost of sales (840 000) Opening inventory 0 Fixed manufacturing cost 300 000 Variable manufacturing cost 750 000 Goods available for sale 1 050 000 Less: Closing inventory (6 000 X R35)* (210 000) Gross profit 1 560 000 Other costs (340 000) Fixed selling and administrative cost 100 000 Variable selling and administrative cost (24 000 X R10) 240 000 Net profit 1 220 000 61 MANCOSA Management Accounting n REMARKS *Closing inventory = 30 000 (manufactured) – 24 000 (sold) = 6 000 units *Closing inventory is valued at R35 per unit calculated as follows: Total manufacturing cost____ Number of units manufactured = R1 050 000 30 000 = R35 (manufacturing cost per unit) n There is a difference in the net profit calculated according to each costing method. This was due to the fact that there was closing inventory on hand. Using the absorption costing method the value of closing inventory includes both the variable and fixed manufacturing costs while with the marginal costing method the value of closing inventory includes only the variable manufacturing cost. n One could therefore say that the COST PRICE OF INVENTORY ON HAND is calculated according to each of the two costing methods using the following costs: MARGINAL COSTING METHOD ABSORPTION COSTING METHOD Direct material Direct material Direct labour Direct labour Variable manufacturing overheads Variable manufacturing overheads Fixed manufacturing overheads MANCOSA 62 Management Accounting 5.4 Reconciliation of Profit Calculated According to Marginal Costing with Profit Calculated According to Absorption Costing In example 1 above, the difference in the net profit between the absorption costing method (R1 220 000) and the marginal costing method (R1 160 000) is R60 000. As mentioned earlier, the difference is due to the fact that fixed manufacturing costs are included in calculating the closing inventory using the absorption costing method. The difference in profit may be explained as follows: Closing inventory according to absorption costing method R210 000 Closing inventory according to marginal costing method (R150 000) Difference R60 000 Another way of explaining the difference in the profits is as follows: Calculate the fixed manufacturing cost per unit: Fixed manufacturing cost Number of units produced = R300 000 30 000 = R10 per unit This R10 per unit is included in the value of closing inventory using the absorption costing method. Thus: 6 000 units (closing inventory) X R10 (fixed manufacturing cost per unit) = R60 000 5.5 Self-Assessment Activities and Solutions 5.1 The following information relates to the only product made by Bellini CC during May 20.6: Opening inventory 0 63 Number of units manufactured 9 000 Number of units sold (at R540 per unit) 7 200 Direct materials cost per unit R90 Direct labour cost per unit R180 Variable manufacturing overheads per unit R90 Variable selling cost per unit R20 Fixed manufacturing overhead cost R450 000 Fixed selling and administrative cost R180 000 MANCOSA Management Accounting Required: 5.1 Draft the income statement for May 20.6 using: 5.1.1 the marginal costing method 5.1.2 the absorption costing method 5.1.3 Reconcile the profit calculated according to absorption costing (in 5.1.2) with the profit calculated according to marginal costing (in 5.1.1). 5.2 Draft the income statements for May 20.6 using the marginal costing method and the absorption costing method but assume that all the goods manufactured (9 000 units) have been sold and that there is thus no closing inventory. Prove that the net profit calculated using both costing methods will be the same. 5.1.1 SOLUTION MARGINAL COSTING METHOD INCOME STATEMENT FOR MAY 20.6 R Sales (7 200 X R540) 3 888 000 Less: Variable cost (2 736 000) Opening inventory 0 Variable manufacturing costs ([R90 + R180 + R90 = 360] X 9 000)* 3 240 000 Goods available for sale 3 240 000 Closing inventory (1 800 X R360)** (648 000) Variable cost of goods sold 2 592 000 Variable selling expenses (7 200 X R20) 144 000 Marginal income 1 152 000 Less: Fixed cost (630 000) Manufacturing cost 450 000 Selling and administrative cost 180 000 Net profit 522 000 MANCOSA 64 Management Accounting REMARKS * Variable manufacturing costs = [Direct materials cost (R90 per unit) + Direct labour cost (R180 per unit) + Variable manufacturing overheads per unit (R90 per unit)] X number of units manufactured (9 000) ** Closing inventory = 9 000 (manufactured) – 7 200 (sold) = 1 800 units Closing inventory is valued at R360 per unit which is the variable manufacturing cost per unit as indicated above viz. R90 + R180 + R90 = R360 per unit 5.1.2 ABSORPTION COSTING METHOD INCOME STATEMENT FOR MAY 20.6 R Sales (7 200 X R540) 3 888 000 Manufacturing cost of sales (2 952 000) Opening inventory 0 Fixed manufacturing cost* 450 000 Variable manufacturing cost* ([R90 + R180 + R90 = 360] X 9 000) 3 240 000 Goods available for sale 3 690 000 Less: Closing inventory (1 800 X R410)** (738 000) Gross profit 936 000 Other costs (324 000) Fixed selling and administrative cost 180 000 Variable selling cost (7 200 X R20) 144 000 Net profit 65 612 000 MANCOSA Management Accounting REMARKS n * Instead of showing fixed manufacturing costs and variable manufacturing costs as two items, one item viz. the cost of goods manufactured could have been shown as follows: Cost of goods manufactured (9 000 X R410) n 3 690 000 Note: Fixed manufacturing cost per unit = R450 000= R50 per unit 9 000 Thus cost of goods manufactured per unit = R90 + R180 + R90 + R50 = R410 ** Closing inventory = 30 000 (manufactured) – 24 000 (sold) = 6 000 units Closing inventory is valued at R410 per unit calculated as above. n The effect of the two costing methods on net profit is that: - When production is greater than sales, a larger net profit will be reported using absorption costing. - When sales are greater than production, a larger net profit will be reported using marginal costing. - When sales and production are equal, the net profit will be the same under both methods. 5.1.3 Reconciliation of profit calculated according to marginal costing with profit calculated according to absorption costing The difference in the net profit between the absorption costing method (R612 000) and the marginal costing method (R522 000) is R90 000. The difference, as we already know, is due to the fact that fixed manufacturing costs are included in calculating the closing inventory using the absorption costing method. The difference in profit may be explained as follows: Closing inventory according to absorption costing method R738 000 Closing inventory according to marginal costing method (R648 000) Difference MANCOSA R90 000 66 Management Accounting Another way of explaining the difference in the profits is as follows: Calculate the fixed manufacturing cost per unit: Fixed manufacturing cost Number of units produced = R450 000 9 000 = R50 per unit This R50 per unit is included in the value of closing inventory using the absorption costing method. Thus: 1 800 units (closing inventory) X R50 (fixed manufacturing cost per unit) = R90 000 5.2 MARGINAL COSTING METHOD INCOME STATEMENT FOR MAY 20.6 R Sales (9 000 X R540) 4 860 000 Less: Variable cost (3 420 000) Opening inventory 0 Variable manufacturing costs ([R90 + R180 + R90 = 360] X 9 000) 3 240 000 Goods available for sale 3 240 000 Closing inventory 0 Variable cost of goods sold 3 240 000 Variable selling expenses (9 000 X R20) 180 000 Marginal income 1 440 000 Less: Fixed cost (630 000) Manufacturing cost 450 000 Selling and administrative cost 180 000 Net profit 67 810 000 MANCOSA Management Accounting ABSORPTION COSTING METHOD INCOME STATEMENT FOR MAY 20.6 R Sales (9 000 X R540) 4 860 000 Manufacturing cost of sales (3 690 000) Opening inventory 0 Fixed manufacturing cost 450 000 Variable manufacturing cost ([R90 + R180 + R90 = 360] X 9 000) 3 240 000 Goods available for sale 3 690 000 Less: Closing inventory 0 Gross profit 1 170 000 Other costs (360 000) Fixed selling and administrative cost 180 000 Variable selling cost (9 000 X R20) 180 000 Net profit 810 0 MANCOSA 68 Management Accounting Unit 6: Cost-Volume-Profit Analysis 69 MANCOSA Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: ASSOCIATED ASSESSMENT CRITERIA OF THIS UNIT: On successful completion of this Unit, the student will be able to: • Appreciate the importance of cost- The student needs to: • Complete the relevant activities and think points to volume-profit analysis as a be able to identify the differences between the management accounting tool and traditional and the marginal income statements and be able to perform the relevant the calculations thereof calculations between the two • • • Complete the relevant activities and think points to costing methods. be able to populate the income statements in the Understand what is meant by cost- legislated framework and structure for both formats volume-profit analysis. including the absorption and marginal costing Understand the concept of methods. marginal income and an example • thereof. Complete the relevant activities and think points to be able to understand and explain marginal income. • Calculate the break-even point. • Calculate the break- even value be able to demonstrate the understanding and the using the marginal income ratio calculation of the break-even analysis. method. • • • Complete the relevant activities and think points to Complete the relevant activities and think points to Prepare a marginal income be able to demonstrate the understanding and the statement that will provide the calculation of the break-even analysis using the necessary information required for marginal income ratio method. cost-volume-profit analysis. • Complete the relevant activities and think points to Calculate the sales required to be able to demonstrate the application of the CVP attain a targeted net profit analysis whilst preparing the marginal income • Calculate the margin of safety statement. • Apply the cost-volume-profit- • • Complete the relevant activities and think points to analysis when there are changes in be able to calculate the necessary sales required to selling price, variable costs, fixed attain a goal targeted net profit. costs and number of products marketed. • Complete the relevant activities and think points to be able to calculate and demonstrate an understanding the concept of margin of safety. MANCOSA 70 Management Accounting • • • The calculation and understanding be able to calculate the changes in different the results thereof. aspects (selling price, variable Calculate the effects of changes in • • costs, fixed costs and number of products variable costs marketed, whilst applying the CVP analysis to Calculate the effects of changes in obtain a relevant answer. • Complete the relevant activities and think points to Calculate the effects of the be able to calculate the changes in selling price and changes in the number of products demonstrate an understanding thereof marketed • Complete the relevant activities and think points to of the changes in selling price and fixed costs • • • Complete the relevant activities and think points to List the limiting assumptions be able to calculate the changes in variable costs between the Break-even and cost- and demonstrate an understanding thereof. volume- profit analysis Complete the relevant activities and think points to be Understand the ratios able to calculate the changes in variable costs and demonstrate an understanding thereof. • Complete the relevant activities and think points to be able to calculate the changes in with regards to the changes in the number of products marketed and demonstrate an understanding thereof. • Complete the relevant activities and think points to be able to understand the differences between the break even and CVP analysis in regards to the limiting assumptions thereof. • Complete the relevant activities and think points to be able to understand the relevance of the ratios and know how to use and calculate them, in making effective, succinct business decisions for the organisation. 71 MANCOSA Management Accounting Key Concepts 6.1 Introduction 6.2 Marginal income statement 6.3 Cost-volume-profit analysis using the marginal income approach 6.4 Applying the cost-volume-profit analysis 6.5 Applying the cost-volume-profit analysis with changes in selling price, variable costs, fixed costs and number of products marketed. 6.6 Limiting assumptions of break-even and cost-volume-profit analysis 6.7 Summary of the ratios 6.8 Self-assessment activities and solutions Recommended Readings Below is the prescribed reading for specific to this unit; • • MANCOSA Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R The Essence of Management Accounting First edition, 2003. Chadwick, L 72 Management Accounting 6.1 Introduction Cost-volume-profit (CVP) analysis is used to explain how profits and costs change with a change in volume. In particular, it examines the effect on profits when there are changes in factors such as selling price, variable costs, fixed costs, volume and the number of products marketed. CVP analysis puts management in a better position to cope with various short-term planning decisions. Using CVP analysis, managers would be able to get information relating to the following: § How profits are affected by a change in costs. § What effect a change in sales volume will have on profit. § The profit that is expected from a certain sales volume. § How many units need to be sold to achieve a targeted profit. § At what output of production will the income and costs be the same. 6.2 Marginal Income Statement The traditional income statement that we learnt in financial accounting does not distinguish between fixed costs and variable costs. Consequently, its use is limited as far as management accounting is concerned. Cost information needs to be in a format that makes the task of management easier when doing planning, control and decision-making. The marginal approach to drawing up an income statement where fixed and variable costs are available is more suitable. Using this approach all expenses are classified as fixed or variable. EXAMPLE 1 The following is an example of a traditional income statement and a marginal income statement: Traditional income statement R Sales 90 000 Cost of sales (45 000) Gross profit 45 000 Operating expenses: (37 500) Marketing costs 23 250 Administration costs 14 250 Net profit 73 7 500 MANCOSA Management Accounting Marginal income statement R Sales 90 000 Variable costs: (22 500) Production 15 000 Marketing 4 500 Administration 3 000 Marginal income 67 500 Fixed expenses: (60 000) Production 30 000 Marketing 18 750 Administration 11 250 Net profit 7 500 6.3 Cost-Volume-Profit Analysis Using the Marginal Income Approach CVP analysis is based on the marginal income approach. The marginal income statement is useful when determining the effects of changes in selling price, cost or volume on profit. A proper understanding of fixed and variable costs is needed for CPV analysis. The following example will be used to illustrate the CVP analysis: Example 2 The following is a budgeted marginal income statement of Mobeen Ltd, a manufacturer of a single product called component X. Marginal income statement for July 20.6 R Sales (40 000 units X R40 per unit) 1 600 000 Variable cost (40 000 units X R30 per unit) (1 200 000) Marginal income (R10 per unit) 400 000 Fixed costs (200 000) Net profit 200 000 MANCOSA 74 Management Accounting 6.3.1 Marginal income Marginal income is the excess of sales over the variable costs. It refers to the amounts of money available to cover firstly the fixed costs and then to generate profits. If the fixed costs are greater than marginal income, then a loss will result. Example 3 If Mobeen Ltd sells only one item of component X, the income statement will appear as follows: Marginal income statement for July 20.6 R Sales (1 unit X R40) 40 Variable cost (1 unit X R30) (30) Marginal income 10 Fixed costs (200 000) Net loss (199 990) For each additional unit of component X that Mobeen Ltd sells, an additional R10 marginal income becomes available to cover the fixed costs. The increase in the total costs as a result of an additional unit being manufactured is called marginal costs. Marginal costs may therefore be seen as the total variable costs incurred to manufacture or market a product. 6.3.2 Calculation of break-even point (using the marginal income method) The volume of sales at which marginal income is equal to fixed costs is called the break-even point. The break-even point can also be called the point of no profit and no loss. The breakeven quantity is the minimum quantity that must be sold to ensure that fixed cost are covered. Break-even quantity can be calculated using the marginal income method as follows: Break even quantity = Total fixed cost Marginal income per unit 75 MANCOSA Management Accounting Example 4 Using the figures from example 2, break-even quantity may be calculated as follows: Break-even quantity Total fixed cost = Marginal income per unit = R200 000 R10 = 20 000 units The break-even value (i.e. break even point in rands) is calculated as follows: Break-even value = Break-even quantity X Selling price per unit Example 5 Using the figures from example 2, break-even value may be calculated as follows: Break even value = Break-even quantity X Selling price per unit = 20 000 X R40 = R800 000 To reach break-even point during July 20.6 Mobeen Ltd needs to sell 20 000 units. This can be proven as follows: MANCOSA 76 Management Accounting Marginal income statement for July 20.6 R Sales (20 000 units X R40 per unit) 800 000 Variable cost (20 000 units X R30 per unit) (600 000) Marginal income (R10 per unit) 200 000 Fixed costs (200 000) Net profit/loss 6.3.3 0 Calculating break-even value using the marginal income ratio method Variable costs and marginal income may be expressed as a percentage of sales. Using the figures from example 2 (Mobeen Ltd), this can be illustrated as follows: Total (R) Per unit (R) Percentage (%) Sales (40 000 units) 1 600 000 40 100 Variable cost (1 200 000) 30 75 Marginal income 400 000 10 25 Marginal income ratio (also called profit volume ratio) is the percentage of marginal income to sales. Marginal income ratio may be expressed as follows: Marginal income ratio = Marginal income X Sales 100 1 Example 6 The marginal income ratio for Mobeen Ltd is: Marginal income ratio = Marginal income X Sales = R10 100 1 X 100 R40 1 = 25% 77 MANCOSA Management Accounting The break-even value may be calculated as follows: Break even value = Total fixed cost Marginal income ratio Example 7 The break-even value for Mobeen Ltd is calculated as follows: Break even value Total fixed cost = Marginal income ratio = R200 000 25% = R200 000 0,25 = R800 000 6.4 Applying The Cost-Volume-Profit Analysis The information contained in example 2 (Mobeen Ltd) will be used to illustrate the application of CVP analysis. This information is reproduced below: 6.4.1 Total (R) Per unit (R) Percentage (%) Sales (40 000 units) 1 600 000 40 100 Variable cost (1 200 000) 30 75 Marginal income 400 000 10 25 Fixed costs (200 000) Net profit 200 000 Calculation of sales required to attain a targeted net profit Cost-profit-volume analysis may be used to determine the sales required to attain a targeted net profit. This can be done in one of two ways. The first is as follows: MANCOSA 78 Management Accounting Target sales volume = Fixed cost + Target profit Marginal income per unit Target sales value = Target sales volume X Selling price per unit Example 8 If Mobeen Ltd targets a net profit of R40 000 from the sale of component X, the sales required will be as follows: Target sales volume = Fixed cost + Target profit Marginal income per unit = R200 000 + R40 000 R10 = 24 000 units Targets sales value Target sales volume X Selling price per unit = 24 000 units X R40 = R960 000 = The second way of calculating the required sales for a targeted net profit is as follows: Target sales value = Fixed cost + Target profit Marginal income ratio 79 MANCOSA Management Accounting Example 9 The sales required by Mobeen Ltd to realise a profit of R40 000 is: Target sales value = Fixed cost + Target profit Marginal income ratio = R200 000 + R40 000 25% = R200 000 + R40 000 0,25 = R960 000 6.4.2 Margin of safety The margin of safety is the amount by which the actual level of sales exceeds the break-even point. It is the amount by which the sales volume may drop before losses are incurred. The margin of safety may be expressed in value or in units: Margin of safety (in terms of value) = Margin of safety (in terms of units) = Budgeted sales units – Break-even sales units MANCOSA Budgeted sales – Break-even sales 80 Management Accounting Example 10 The margin of safety for Mobeen Ltd is: Margin of safety (in terms of value) Budgeted sales – Break-even sales = R1 600 000 – R800 000 = R800 000 = Budgeted sales units – Break-even sales units 40 000 – 20 000 Margin of safety (in terms of units) 20 000 units = = = 6.5 Applying the Cost-Volume-Profit Analysis with Changes in Selling Price, Variable Costs, Fixed Costs and Number of Products Marketed Thus far it has been assumed that factors such as prices, costs and volumes remained the same. We are now going to examine the application of the cost-volume-profit analysis with changes in selling price, variable costs, fixed costs and number of products marketed. To illustrate this the following information from example 2 (Mobeen Ltd) will be utilized. Selling price per unit R40 Variable cost per unit R30 Marginal income per unit R10 Total fixed costs for July 20.6 6.5.1 R200 000 Change in selling price Whenever enterprises increase the selling prices of their products, the result is usually a drop in sales volume. The decrease in sales is the result of consumer reaction to the price increase. The cost-volume-profit (CVP) analysis can be used by management to determine the level to which sales volume can decline before this impacts negatively on its targeted profit. 81 MANCOSA Management Accounting Example 11 Mobeen Ltd plans to increase the selling price of component X by 10% and targets a profit of R40 000. Using the information from example 2 (reproduced above), calculate the quantity of component X that must be sold (rounded off to nearest whole number) to: 11.1 break even 11.2 achieve the targeted profit Solution 11.1 11.2 Present situation After increase in price Selling price per unit R40 R44 Variable cost per unit R30 R30 Marginal income per unit R10 R14 Fixed costs = R200 000 = R200 000 Marginal income per unit R10 R14 = 20 000 units = 14 286 units Fixed cost + Target profit = R200 000 + R40 000 = R200 000 + R40 000 Marginal income per unit R10 R14 = 24 000 units = 17 143 units Break even quantity = Sales volume required to attain target profit of R40 000 6.5.2 Change in variable cost If management can succeed in reducing variable costs, then the number of units needed to achieve a targeted profit will fall. This is illustrated as follows: MANCOSA 82 Management Accounting Example 12 Using the information from example 2, suppose Mobeen Ltd succeeds in reducing variable costs by 10% (with the selling price remaining at R40). The targeted profit is R40 000. Required Calculate the quantity of component X that must be sold (rounded off to nearest whole number) to: 12.1 12.2 break even achieve the targeted profit Solution 12.1 12.2 Present situation After a 10% decrease in variable cost Selling price per unit R40 R40 Variable cost per unit R30 R27 Marginal income per unit R10 R13 Fixed costs = R200 000 = R200 000 Marginal income per unit R10 R13 = 20 000 units = 15 385 units Fixed cost + Target profit = R200 000 + R40 000 = R200 000 + R40 000 Marginal income per unit R10 R13 = 24 000 units = 18 462 units Break even quantity = Sales volume required to attain target profit of R40 000 83 MANCOSA Management Accounting 5.3 Change in fixed costs If fixed costs (e.g. rent) increase, then the number of units needed to achieve a targeted profit will increase. This is illustrated as follows: Example 13 Using the information from example 2, suppose the fixed costs increase by R20 000 (with no change to the selling price or variable cost). The targeted profit is still R40 000. Required Calculate the quantity of component X that must be sold (rounded off to nearest whole number) to: 12.1 break even 12.2 achieve the targeted profit Solution Present situation After increase in fixed cost Selling price per unit R40 R40 Variable cost per unit R30 R30 Marginal income per unit R10 R10 R200 000 R220 000 Fixed costs = R200 000 = R220 000 Marginal income per unit R10 R10 = 20 000 units = 22 000 units Fixed cost + Target profit = R200 000 + R40 000 = R220 000 + R40 000 Marginal income per unit R10 R10 = 24 000 units = 26 000 units Fixed costs 12.1 12.2 Break even quantity = Sales volume required to attain target profit of R40 000 MANCOSA 84 Management Accounting 6.5.4 Change in number of products marketed Break-even calculation becomes complicated when more than one product is marketed. As each product has its own marginal income ratio, a sales mix is determined so that a marginal income ratio based on the weighted average is calculated in order to determine break-even quantity and value. This is illustrated as follows: Example 14 XYZ Enterprises manufactures and sells 3 different products viz. product X, product Y and product Z. The following details apply: Product X Product Y Product Z Selling price per unit R12 R15 R18 Variable cost per unit R8 R11 R13 Sales mix 3 : 2 : 5 Fixed costs total R72 000 Required Calculate the break-even quantity and break-even value for each product. Solution Product X Product Y Product Z Selling price per unit R12 R15 R18 Variable cost per R8 R11 R13 unit R4 R4 R5 Marginal Income Sales mix Total Product X R4 3 R12 Product Y R4 2 R8 Product Z R5 5 R25 10 R45 Marginal income Average marginal income per unit = R45 ÷ 10 = R4,50 85 MANCOSA Management Accounting Break-even quantity Fixed costs = (Total) Average marginal income per unit = R72 000 R4,50 = 16 000 units Product X Product Y Product Z Break-even quantity for 3 X 16 000 2 X 16 000 5 X 16 000 each product 10 10 10 = 4 800 units = 3 200 units = 8 000 units 4 800 X R12 3 200 X R15 8 000 X R18 = R57 600 = R48 000 = R144 000 Break-even value for each product Total break-even value 6.6 = R57 600 + R48 000 + R144 000 = R249 600 Limiting Assumptions of Break-Even and Cost-Volume-Profit Analysis The Break-Even and Cost-Volume-Profit Models Discussed Above Are Based On Some Limiting Assumptions: § All costs are classified as either fixed or variable. § Variable costs are affected only by volume. § The behaviour of both sales income and expenses is linear. § There is only one product. § Inventories do not change a great deal from one period to the next. MANCOSA 86 Management Accounting 6.7 Summary of The Ratios 7.1 Break even quantity = Total fixed cost Marginal income per unit 7.2 Break even value 7.3 Marginal income ratio = Break-even quantity X Selling price per unit = Marginal income X 100 Sales 7.4 Break even value = (using marginal income ratio) 7.5 Target sales volume 1 Total fixed cost Marginal income ratio = Fixed cost + Target profit Marginal income per unit 7.6 Target sales value = 7.7 Target sales value = Target sales volume X Selling price per unit Fixed cost + Target profit (using marginal income ratio) 7.8 Marginal income ratio Margin of safety (in terms of value) Budgeted sales – Break-even sales = Budgeted sales units – Break-even sales units Margin of safety (in terms of units) 87 MANCOSA Management Accounting 6.8 SELF-ASSESSMENT ACTIVITIES AND SOLUTIONS 8.1 Complete the following sentences with the most appropriate answers. 8.1.1 The difference between sales and variable expenses is called ____________. 8.1.2 Break-even point is reached when ____________ is equal to ____________. 8.1.3 The _________is the amount by which the actual level of sales exceeds the break-even point. The break-even point will ____________ if there is an increase in fixed costs. 8.1.4 One of the key assumptions underlying break-even analysis is that costs are classified as 8.1.5 either ____________ or ____________. 8.2 Bysan Ltd plans to manufacture a new product and the following information is applicable: Estimated sales for the year 20.6 7 000 units at R40 each Estimated costs for the year 20.6 Direct material R12 per unit Direct labour R2 per unit Factory overheads (all fixed) R24 000 per annum Selling expenses 30% of sales Administrative expenses (all fixed) R32 000 per annum Required 8.2.1 Calculate the break-even quantity. 8.2.2 Calculate the break-even value. 8.2.3 Calculate the break-even value using the marginal income ratio. 8.2.4 Calculate the selling price per unit if the profit per unit is R2. 8.3 AIM Ltd supplies component J to furniture manufacturers. The marketing manager is of the opinion that if the selling price of component J is reduced, sales could increase by 25%. The following information is available: Present Proposed R6 R5 Sales volume 100 000 units 25% more Variable costs R400 000 Same unit variable cost Fixed costs R140 000 R140 000 Net profit R60 000 ? Selling price per unit MANCOSA 88 Management Accounting Required 8.3.1 Calculate the expected profit or loss on the marketing manager’s proposal. 8.3.2 Calculate the number of sales units required under the proposed price to make a profit of R60 000. 8.3.2 Calculate the sales value required under the proposed price to make a profit of R60 000. 8.4 Yashik CC manufactures one product. The following details relating to the product applies: Direct material cost per unit R20 Direct labour cost per unit R30 Variable overheads per unit R22 Total fixed cost R36 000 Selling price per unit R82 Number of units sold 6 000 Required 8.4.1 Calculate the marginal income ratio. 8.4.2 Calculate the break-even quantity and break-even value. 8.4.3 Calculate the margin of safety in terms of units and value. 8.5 Kivi (Pty) Ltd manufactures and sells only one product. The budgeted details for 20.7 are as follows: Sales 150 000 per month Selling price per unit R3 Variable cost per unit R1,40 Total fixed cost R1 350 000 Required 8.5.1 Calculate the budgeted profit for 20.7. 8.5.2 Calculate the break-even quantity and value. 8.5.3 Suppose Kivi (Pty) Ltd wants to make provision for a 10% increase in fixed costs and an increase in variable costs by R0,20 per unit. Taking these increases into account, calculate the following: 8.5.3.1 New break-even quantity and value 8.5.3.2 Safety margin (in terms of value) 8.5.3.3 The number of units that need to be sold to earn a net profit of R400 000 89 MANCOSA Management Accounting 8.6 Multi Vit Ltd has the following sales mix (fixed costs amount to R300 000): Product Sales Variable cost Proportion Vit A R600 000 R300 000 50% Vit B R300 000 R150 000 30% Vit C R100 000 R150 000 20% R1 000 000 R600 000 100% Required 8.6.1 Calculate the total break-even value. 8.6.2 Calculate the break-even value for each product. (Assume that the selling price per unit of each product is the same.) SOLUTIONS 8.1 8.1.1 marginal income 8.1.2 marginal income; fixed costs 8.1.3 margin of safety 8.1.4 increase 8.1.5 variable; fixed 8.2 Total (R) Per unit (R) Percentage (%) Sales (7 000 units) 280 000 R40 100 Variable cost (R84 000 + R14 000 + R84 182 000 R26 65 98 000 R14 35 000) Marginal income MANCOSA 90 Management Accounting Break even quantity = Total fixed cost 8.2.1 Marginal income per unit = R56 000 R14 = 4 000 units 8.2.2 Break even value = Break-even quantity X Selling price per unit = 4 000 X R40 = R160 000 8.2.3 Break even value = Total fixed cost Marginal income ratio = R56 000 35% = R56 000 0,35 = R160 000 91 MANCOSA Management Accounting 8.2.4 Let the selling price per unit be represented by P. Sales = Variable costs + Fixed costs + Net profit 7 000P = R14(7 000) + 0,3P(7 000) + R56 000 + R2(7 000) 7 000P = R98 000 + 2 100P + R56 000 + R14 000 7 000P – 2 100P = R168 000 4 900P = R168 000 P = R168 000 4 900 P = R34,29 (rounded off) 8.3.1 8.3.2 Expected profit or loss Total (R) Sales (125 000 X R5) 625 000 Variable cost (125 000 X R4) (500 000) Marginal income (125 000 X R1) 125 000 Fixed costs (140 000) Net loss (15 000) Sales volume required to attain target profit of R60 000 Fixed cost + Target profit = R140 000 + R60 000 Marginal income per unit R1 R1 = 200 000 units MANCOSA 92 Management Accounting 8.3.3 Sales value = 200 000 units X R5 = R1 000 000 8.4 8.4.1 Total (R) Per unit (R) Sales (6 000 units) 492 000 82 Variable cost (R20 + R30 + R22) X 6 000 (432 000) 72 Marginal income 60 000 10 Fixed costs (36 000) Net profit 24 000 Marginal income ratio = Marginal income X 100 Sales 1 = R10 X 100 R82 1 12,20% = 8.4.2 Break even quantity = Total fixed cost Marginal income per unit R36 000 = R10 = 3 600 units 93 MANCOSA Management Accounting 8.4.2 8.4.3 Break even value = Break-even quantity X Selling price per unit = 3 600 X R82 = R295 200 Margin of safety (in terms of value) Budgeted sales – Break-even sales = R492 000 – R295 200 = R196 800 = Budgeted sales units – Break-even sales units Margin of safety (in terms of units) = 6 000 – 3 600 = 2 400 units = 8.5.1 Calculation of budgeted profit Total (R) Per unit (R) Sales (150 000 units X 12 months= 1 800 000 units) 5 400 000 R3 Variable cost (2 520 000) R1,40 Marginal income 2 880 000 R1,60 Fixed costs (1 350 000) Net profit 1 530 000 MANCOSA 94 Management Accounting 8.5.2 Break even quantity = Total fixed cost Marginal income per unit = R1 350 000 R1,60 = 843 750 units 8.5.2 Break even value = Break-even quantity X Selling price per unit = 843 750 X R3 = R2 531 250 8.5.3 95 Total (R) Per unit (R) Sales (150 000 units X 12 months= 1 800 000 units) 5 400 000 R3 Variable cost (2 880 000) R1,60 Marginal income 2 520 000 R1,40 Fixed costs (R1 350 000 + R135 000) (1 485 000) Net profit 1 035 000 MANCOSA Management Accounting 8.5.3.1 Break even quantity Total fixed cost = Marginal income per unit = R1 485 000 R1,40 = 1 060 714 units Break even value = Break-even quantity X Selling price per unit = 1 060 714 X R3 = R3 182 142 8.5.3.2 Margin of safety (in terms of value) Budgeted sales – Break-even sales = R5 400 000 – R3 182 142 = R2 217 858 = MANCOSA 96 Management Accounting 8.5.3.3 Sales volume required to attain target profit of R400 000 Fixed cost + Target profit = R1 485 000 + R400 000 Marginal income per unit R1,40 = 1 346 429 units 8.6 Total sales R1 000 000 Total variable costs R600 000 Total marginal income R400 000 Marginal income ratio Marginal income X 100 = Sales 1 = R400 000__ X 100 R1 000 000 1 = 40% 97 MANCOSA Management Accounting 8.6.1 Break even value (total) Total fixed cost = Marginal income ratio = R300 000 40% = R300 000 0,40 = R750 000 8.6.2 Break-even value for each product MANCOSA Vit A Vit B Vit C R750 000 X 50% R750 000 X 30% R750 000 X 20% = R375 000 = R225 000 = R150 000 98 Management Accounting Unit 7: Budgets and Budgetary Control 99 MANCOSA Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: On successful completion of this Unit, the student will be able to: • Define budgets and budgetary control • • • • • • The student needs to: • Complete the relevant activities and think Apply the principles of effective points to be able to define budgets and the budgeting importance of budgetary control. Explain the advantages of budgets and • Complete the relevant activities and think budgetary control. points to be able to demonstrate an Explain the advantages of budgets and understanding of the principles relating to budgetary control. effective budgeting. Appreciate the importance of budgets • Complete the relevant activities and think and budgetary control and be able to points to be able to populate and illustrate prepare the various types of budgets. the pros / advantages relating to budgets Prepare a sales budget, cash budget, a and budgetary control. budgeted income statement and a • ASSOCIATED ASSESSMENT CRITERIA OF THIS UNIT: • Complete the relevant activities and think budgeted balance sheet. points to be able to populate and illustrate Explain how zero-based budgeting the cons/ disadvantages relating to budgets balance sheet and budgetary control. works • Complete the relevant activities and think points to be able to populate, demonstrate and illustrate in a structured format the necessary budgets such as Sales budget, Cash budget and a budgeted income statement and balance sheet. • Understand the fundamental principles of preparation of budgets and relevant support working schedules. • Complete the relevant activities and think points to be able to define and explain the concept zero-based budgeting and articulate the steps to follow in zero-based budgeting. MANCOSA 100 Management Accounting Key Concepts 7.1 Introduction 7.2 Concepts of budgets and budgetary control 7.3 Principles of effective budgeting 7.4 Advantages of budgets and budgetary control 7.5 Disadvantages of budgets 7.6 Preparation of budgets 7.7 Zero-based budgeting 7.8 Self-assessment activities and solutions 7.9 Answers to revision questions and activities Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L 101 MANCOSA Management Accounting 7.1 Introduction Proper planning and effective control of costs are important if an enterprise wishes to maximize profit. Budgets and budgetary control are important management tools that assist management in planning and cost control. 7.2 Concepts of Budgets and Budgetary Control It is important to distinguish between these two terms as they are not the same. 7.2 1 Budgets A budget may be described as a plan expressed in financial terms. It is the path that must be followed from the present time to the future. A budget must reveal the plans to achieve the objective of the enterprise for a given period. 7.2.2 Budgetary control As indicated above a budget is the path that an enterprise must follow to achieve its objective. Budgetary control, on the other hand, includes measures put into place to monitor any deviations from the path and to ensure that the objective is realised within the budgeted period. This can be achieved by regularly comparing actual results with the budgeted targets. Budgetary control must ensure that deviations from the plan are analysed and if necessary remedial measures are put in place to remedy or prevent problems that may occur. 7.3 Principles of Effective Budgeting The following principles are useful for those responsible for the budgeting process: The objective(s) that need to be achieved must be discussed. Those involved in the budgeting process must work in harmony and apply common sense during the process. • They must realise that there is an inter-relationship of the various budgets. • All workers, supervisors and managers whose inputs are required to draw up budgets should be given an opportunity to participate in the budgeting process. • It must be decided how to share scarce resources. • A timetable should be prepared for the preparation of budgets so that they are completed well in advance of the budgeted period. § Budgets must be flexible to allow for changes that may become necessary once they have been implemented. § The actual results and budgeted figures need to be monitored regularly to detect any deviations. MANCOSA 102 Management Accounting 7.4 Advantages of Budgets and Budgetary Control They act as a mean to achieving the objectives of the enterprise. § Manufacturing costs can be carefully planned and controlled. § Budgetary control facilitates the delegation of authority. § Budgets can motivate managers and employees to better performance. § Budgets can provide a basis for a system of control of employees. § Budgets promote forward thinking and the identification of possible problems. 7.5 Disadvantages of Budgets Predictions cannot be totally accurate as the information used to prepare budgets is obtained from estimates. § If targets are badly set, they may stifle the enthusiasm and flair of managers and employees. § Managers may spend to the limit of their budgets, although this may be wasteful. § If budget targets are set at a more difficult level than can be achieved, comparing actual results with the budget becomes less meaningful. § Budgets cannot be perfect since they have to adapt to changing circumstances. 7.6 Preparation of Budgets The main budget called the master budget is developed from the operating budget and the financial budget. The operating budget consists of the sales budget, production budget, direct labour budget, factory overhead budget, inventory budget, selling and administrative budget and budgeted income statement. The financial budget consists of the cash budget and budgeted balance sheet. For the purposes of this module, the preparation of the sales budget, cash budget, budgeted income statement and budgeted balance sheet will be discussed. 7.6.1 Sales budget The reliability of the sales budget is important as all other budgets are based on it. After the number of units that may be sold is estimated, the number of units that can be produced may be determined. Whilst the sales budget depends a lot on previous sales figures, consideration is also given to sales trends, future predictions and competitors. A sales budget may be described as a forecast of the number of units the enterprise expects to sell for a predetermined period. 103 MANCOSA Management Accounting Example 1 § The following is the sales forecast (in units) of Manco Ltd that manufactures two products viz. product X and product Y: November 20.6 December 20.6 January 20.7 Product X 3 000 4 500 4 000 Product Y 4 000 6 000 5 000 n The selling price per unit of product X is R20 and the selling price of product Y is R30. n All sales are on credit. Collections from debtors are as follows: *50% is collected during the month of sale. *30% is collected in the following month. *15% is collected in the second month after the sale. The balance is written off as bad debts at the end of the second month after the sale. Required n Prepare a sales budget for the period 1 December 20.6 to 31 January 20.7. n Prepare a schedule of collections from debtors for the period 1 December 20.6 to 31 January 20.7. Solution Sales budget Product November December January Units R Units R Units R Product X 3 000 60 000 4 500 90 000 4 000 80 000 Product Y 4 000 120 000 6 000 180 000 5 000 150 000 180 000 MANCOSA 270 000 230 000 104 Management Accounting Debtors collection schedule Credit Month Balance sales November R R December January Bad on 31 Jan R R debts R R November 180 000 90 000 54 000 27 000 9 000 - December 270 000 - 135 000 81 000 - 54 000 January 230 000 - - 115 000 - 115 000 680 000 90 000 189 000 223 000 9 000 169 000 REMARKS Collections of credit sales and bad debts for each month are calculated as follows: Credit sales for November Collection for November: R180 000 X 50% = R90 000 Collection for December: R180 000 X 30% = R54 000 Collection for January: R180 000 X 15% = R27 000 Bad debts: R180 000 X 5% = R9 000 Credit sales for December Collection for December: R270 000 X 50% = R135 000 Collection for January: R270 000 X 30% = R81 000 Balance on 31 January: R270 000 X 20% = R54 000 Credit sales for January Collection for January: R230 000 X 50% = R115 000 Balance on 31 January: R230 000 X 50% = R115 000 . 7.6.2 Cash budget Once all the other budgets including the sales budget are prepared, the cash budget can be drawn up. The cash budget shows the expected receipts and expected payments for a certain period of time. It usually depicts the monthly cash position of the enterprise. The cash budget is prepared for the purpose of cash planning and control. It helps in avoiding to keep cash lying idle for long periods and identifying possible cash shortages. 105 MANCOSA Management Accounting Note that a cash budget only involves amounts that affect the cash balance of the enterprise. Therefore, non-cash items such as depreciation, bad debts, discount allowed and discount received are not included. Since budgets are used internally by an enterprise, the style may vary from business to business. However, most cash budgets have the following features: • The budget period is broken down into sub-periods usually months. • Receipts of cash are identified and totalled. • Payments of cash are identified and totalled. • The surplus (or shortfall) in cash for each month is calculated (receipts minus payments). • The closing cash balance is calculated by taking into account the cash surplus (or shortfall) and the opening cash balance. The following example illustrates how a cash budget is prepared. Example 2 The following information is available for Timbuk Enterprises: 1. On 31 March 20.6 the bank account in the general ledger reflected a debit balance of R20 000. 2. 3. Sales figures before taking any discounts in respect of cash or credit sales are: March April May June R R R R Cash sales 30 000 34 000 32 000 35 000 Credit sales 21 000 18 000 16 000 20 000 The following discounts are given as incentives to customers: 12% on cash sales 5% on credit sales if accounts are settled after 30 days 4. Collections from debtors are expected to be as follows: 50% 30 days after the sale 30% 60 days after the sale 18% 90 days after the sale 2% written off after 90 days 5. 50% of the material purchased is bought on credit. Creditors are usually paid as follows: 70% within the same month of the purchase 30% 30 days after the purchase. MANCOSA 106 Management Accounting 6. Payment of overhead costs and selling and administrative costs are delayed by one month. Selling and administrative costs are as follows: March (actual) R6 500 April (expected) R7 000 May (expected) R7 200 June (expected) R8 000 7. Employees involved in the production of finished goods are paid wages. Since wages are paid on specific days, only 75% of a month’s budgeted wages are paid in that month. The rest are paid in the following month. 8. The proprietor is expected to increase her capital contribution by R50 000 in June 20.6. 9. The production records for finished goods reveal the following: Actual Budgeted March April May June R R R R 14 000 20 000 18 000 16 000 Direct material 20 000 16 000 14 000 15 000 Direct labour 16 000 12 000 10 000 8 000 Overheads 8 000 6 000 5 000 4 000 58 000 54 000 47 000 43 000 Closing inventory (20 000) (18 000) (16 000) (14 000) Cost of sales 38 000 36 000 31 000 29 000 Opening inventory Production costs: Required n Prepare the debtors collection schedule for the period 01 April to 30 June 20.6. n Prepare a creditors payment schedule for the period 01 April to 30 June 20.6. n Prepare the cash budget for the period 01 April to 30 June 20.6. 107 MANCOSA Management Accounting Solution Debtors collection schedule Credit Month sales April May June R R R R March 21 000 9 975 6 300 3 780 April 18 000 - 8 550 5 400 May 16 000 - - 7 600 June 20 000 - - - 9 975 14 850 16 780 REMARKS Collections of credit sales for each month are calculated as follows: Credit sales for March Collection for April: (R21 000 X 50%) – 5% = R9 975 Collection for May: R21 000 X 30% = R6 300 Collection for June: R21 000 X 18% = R3 780 Credit sales for April Collection for May: (R18 000 X 50%) – 5% = R8 550 Collection for June: R18 000 X 30% = R5 400 Credit sales for May Collection for June: (R16 000 X 50%) – 5% = R7 600 Creditors payment schedule Month Credit purchases April May June R R R R March 10 000 3 000 - - April 8 000 5 600 2 400 - May 7 000 - 4 900 2 100 June 7 500 - - 5 250 8 600 7 300 7 350 MANCOSA 108 Management Accounting REMARKS 50% of the purchase of materials is on credit. Payments to creditors each month are calculated as follows: Credit purchases for March Payment for April: R10 000 X 30% = R3 000 Credit purchases for April Payment for April R8 000 X 70% = R5 600 Payment for May: R8 000 X 30% = R2 400 Credit purchases for May Payment for May: R7 000 X 70% = R4 900 Payment for June R7 000 X 30% = R2 100 Credit purchases for June Payment for June: R7 500 X 70% = R5 250 Cash budget for the period 01 April to 30 June 20.6 April May June Cash receipts 39 895 43 010 97 580 Cash sales (after discount) 29 920 28 160 30 800 Receipts from debtors 9 975 14 850 16 780 - - 50 000 (44 100) (37 800) (35 550) Cash purchases of materials 8 000 7 000 7 500 Payments to creditors 8 600 7 300 7 350 Wages 13 000 10 500 8 500 Overheads 8 000 6 000 5 000 Selling and administrative costs 6 500 7 000 7 200 Cash surplus (shortfall) (4 205) 5 210 62 030 Opening cash balance 20 000 15 795 21 005 Closing cash balance 15 795 21 005 83 035 Capital Cash payments 109 MANCOSA Management Accounting REMARKS n Cash sales: 12% cash discount has been deducted from the figures provided. n Receipts from debtors: are obtained from the debtors collection schedule. n Capital: is expected to be received only in June. n Cash purchases of materials: is 50% of the total purchases. n Payments to creditors: are obtained from the creditors payment schedule. n Wages: are calculated as follows: April:(March R16 000 X 25%) = R4 000 (April R12 000 X 75%) = R9 000 May: (April R12 000 X 25%) = R3 000 (May R10 000 X 75%) = R7 500 June: (May R10 000 X 25%) = R2 500 (June R8 000 X 75%) = R6 000 R13 000 R10 500 R8 500 n Overheads: are paid in the month following the month in which they were incurred. n Selling and administrative expenses: are paid in the month following the month in which they were incurred. n Cash surplus: is expected for all May and June only as expected receipts exceed expected payments, whereas in April, payments exceed receipts (resulting in an expected cash shortfall). n Opening cash balance: for April is the closing cash balance for March, the opening cash balance for May is the closing cash balance for April and the opening cash balance for June is the closing cash balance for May. n Closing cash balance: is calculated using the cash surplus (shortfall) and the opening cash balance. 6.6.3 Budgeted income statement and budgeted balance sheet Once the sales budget, purchases budget, production budget and expenses budget have been prepared, the budgeted income statement can be prepared. The budgeted income statement is a summary of the various component projections of income and expenses for the budget period. MANCOSA 110 Management Accounting A budgeted balance sheet is prepared by starting with the balance sheet for the period just ended and adjusting it using all the activities which are expected to take place during the budgeted period. A budgeted balance sheet can help management to calculate a variety of ratios. It also highlights future resources, obligations and possible unfavourable conditions. The following example illustrates how a budgeted (projected) income statement and balance sheet is drawn up. Example 3 The following is an abridged balance sheet of KMS Manufacturers on 31 December 20.6. KMS Manufacturers Balance Sheet as at 31 December 20.6 R ASSETS Non-current assets 650 000 Land and buildings 500 000 Machinery 150 000 Current assets 300 000 Inventories 200 000 Debtors 90 000 Bank 10 000 Total assets 950 000 EQUITY AND LIABILITIES Equity Capital 900 000 Current liabilities 50 000 Creditors 50 000 Total equity and liabilities 950 000 111 MANCOSA Management Accounting Additional information 1. Costs for the year ended 31 December 20.6 are as follows: R Direct material 384 000 Direct labour 192 000 Variable overheads 96 000 Fixed overheads 208 000 2. The gross profit for the year ended 31 December 20.6 amounted to R80 000. 3. Budgeted sales for 20.7 are as follows: R First quarter 200 000 Second quarter 220 000 Third quarter 240 000 Fourth quarter 250 000 4. Fixed costs for 20.7 will be the same as for 20.6. 5. Variable costs will vary in the same ratio to sales as for 20.6. 6. Fixed costs include depreciation on the machinery. Depreciation is 10% p.a. on cost. The cost price of the machinery is R200 000. 7. KMS Manufacturers plan to extend the factory during January 20.7. The cost of the extension is expected to be R200 000 and ten monthly instalments of R20 000 will commence on 01 February 20.7. 8. Inventory and debtors are expected to be equal to two (latest) months’ sales. 9. The amount owing to creditors is expected to equal two (latest) months’ purchases of direct materials. 10. Selling and administrative expenses are estimated to be 7% of the sales for each quarter. Required n The budgeted income statement for each quarter of 20.7. n The budgeted balance sheet on 31 December 20.7. MANCOSA 112 Management Accounting Solution Budgeted income statement 1st Quarter 2nd quarter 3rd quarter 4th quarter Total R R R R R Sales 200 000 220 000 240 000 250 000 910 000 Cost of sales (192 000) (206 000) (220 000) (227 000) (845 000) Direct material 80 000 88 000 96 000 100 000 364 000 Direct labour 40 000 44 000 48 000 50 000 182 000 Variable 20 000 22 000 24 000 25 000 91 000 overheads 52 000 52 000 52 000 52 000 208 000 8 000 14 000 20 000 23 000 65 000 Other expenses (14 000) (15 400) (16 800) (17 500) (63 700) Selling & admin 14 000 15 400 16 800 17 500 63 700 Net profit (loss) (6 000) (1 400) 3 200 5 500 1 300 Fixed overheads Gross profit REMARKS n Since variable costs vary in the same ratio to sales as for 20.6, the sales figure for 20.6 and the percentage of direct materials, direct labour and variable overheads to sales are calculated: R % of sales Direct material 384 000 40 Direct labour 192 000 20 Variable overheads 96 000 10 Fixed overheads 208 000 Cost of sales 880 000 Gross profit 80 000 Sales 960 000 100 n Sales forecast for each quarter is provided in the information. n Cost of sales is the manufacturing cost of sales. Cost of sales = Direct material + Direct labour + Variable overheads + Fixed overheads 113 MANCOSA Management Accounting n Direct material = 40% of sales n Direct labour = 20% of sales n Variable overheads = 10% of sales n Fixed overheads are the same as 20.6. n Gross profit = Sales – Cost of sales n Selling and administration costs = 7% of sales. n Net profit (loss) = Gross profit – Other expenses A net loss is expected for the first two quarters while for the last two quarters a profit is predicted culminating in a net profit for the year of R1 300. Budgeted balance sheet as at 31 December 20.7 R ASSETS Non-current assets 830 000 Land and buildings (500 000 + 200 000) 700 000 Machinery ([150 000] – [200 000 X 10%]) 130 000 Current assets 333 334 Inventories (250 000 X 2 ÷ 3) 166 667 Debtors (250 000 X 2 ÷ 3) 166 667 Bank 0 Total assets 1 163 334 EQUITY AND LIABILITIES Equity Capital (900 000 + 1 300) 901 300 Current liabilities 262 034 Creditors (100 000 X 2 ÷ 3) 66 667 Bank overdraft (balancing figure i.e. Total assets – Capital – Creditors) 195 367 Total equity and liabilities 1 163 334 MANCOSA 114 Management Accounting 7.7 Zero-Based Budgeting Traditional budgeting tends to concentrate on the incremental change from the previous year. The focus is on examining what happened last year with some adjustments for any changes in factors (like inflation) that may affect the budgeted period. With zero-based budgeting cost estimates are built up from zero level and it rests on the philosophy that all spending must be justified. It is not automatically accepted that if some activity was financed this year it will be financed again in the future. A good case must be made for the allocation of scarce resources for that activity. The basic steps in zero-based budgeting are: - Describe each activity in the organisation in a “decision” package. - Analyse, evaluate and rank the packages in order of priority on the basis of the costbenefit analysis. - Resources are allocated accordingly. Zero-based budgeting forces managers to think carefully about certain activities and the way they are undertaken. This approach should result in more effective use of resources. However, zero-based budgeting is time-consuming and expensive to undertake. It appears to be more suited to enterprises that do not have a profit motive. 7.8 Self-Assessment Activities And Solutions 7.8.1 The following information is available for Thandi Enterprises for 20.6. 1. Actual Budgeted January February March April May R R R R R Cash sales 308 000 242 000 264 000 275 000 291 500 Credit sales 320 000 260 000 270 000 275 000 280 000 Purchases 400 000 320 000 340 000 350 000 360 000 Salaries and 72 000 72 000 79 200 79 200 79 200 wages 32 000 27 000 28 500 29 000 30 000 Sundry expenses 115 MANCOSA Management Accounting 2. Credit sales is expected to be collected as follows: 60% after 30 days (A discount of 5% is allowed to debtors who pay after 30 days.) 25% after 60 days 10% after 90 days 5% is written off as bad debts. 3. Customers who buy for cash receive a 10% discount. (The sales figures provided are before any discount.) 4. Salaries, wages and sundry expenses are settled in cash. 5. Seventy percent of all purchases are on credit and are paid one month after the purchases. 6. Sundry expenses include depreciation of R4 000 per month. 7. The cash in the bank on 31 March was R25 200. Required Prepare a debtors collection schedule for the period 01 April to 31 May 20.6 Prepare a cash budget for the period 01 April to 31 May 20.6 The following information has been obtained from Aliwal Ltd: 7.8.1.2 Total sales figures (actual and budgeted) are: Actual Total sales Budgeted January February March April May June R R R R R R 320 000 260 000 400 000 420 000 380 000 360 000 7.8.1.3 The abridged balance sheet on 31 March 20.6 is as follows: Balance Sheet as at 31 March 20.6 ASSETS Non-current assets 200 000 Property, plant and equipment 200 000 Current assets 605 600 Inventories 240 000 Debtors 361 600 Bank 4 000 Total assets MANCOSA 805 600 116 Management Accounting EQUITY AND LIABILITIES Equity Capital 693 600 Current liabilities 112 000 Creditors 112 000 Total equity and liabilities 805 600 3. Rent amounts to R240 000 per annum and is payable monthly. 4. Selling and administration expenses are estimated to be 25% of sales and are payable in the same month as the sale. 5. The gross profit percentage on sales is 60%. 6. Depreciation on fixed assets for the year amount to R28 000. 7. Cash sales account for 20% of total sales. Credit sales (80%) are usually collected as follows: 80% 1 month after the sale 20% 2 months after the sale. 8. Thirty percent (30%) of all purchases are for cash. The total purchases are as follows: March April May June R160 000 R168 000 R152 000 R144 000 9. Creditors are paid in full in the month after the purchase. 10. All other expenses are paid monthly and are expected to amount to R22 000 per month. Required 7.8.3.1 Prepare a monthly cash budget for April, May and June 20.6. 7.8.3.2 Prepare a budgeted income statement for the 3 months ended 30 June 20.6. 7.8.3.3 Prepare a budgeted balance sheet on 30 June 20.6. 117 MANCOSA Management Accounting 7.9 Answers to Revision Questions and Activities SOLUTIONS 7.9.1 Debtors collection schedule Credit sales April May R R R January (April R320 000 X 10%) 320 000 32 000 - February (April R260 000 X 25%) 260 000 65 000 26 000 270 000 153 900 67 500 April (May R275 000 X 60%) – 5% 275 000 - 156 750 May 280 000 - - 250 900 250 250 April May Cash receipts 498 400 512 600 Cash sales (after discount) 247 500 262 350 Receipts from debtors 250 900 250 250 Cash payments (447 200) (458 200) Cash purchases 105 000 108 000 Payments to creditors 238 000 245 000 Salaries and wages 79 200 79 200 Sundry expenses 25 000 26 000 Cash surplus (shortfall) 51 200 54 400 Opening cash balance 25 200 76 400 Closing cash balance 76 400 130 800 (May R260 000 X 10%) March (April R270 000 X 60%) – 5% (May R270 000 X 25%) 7.9.2 Cash budget for April and May 20.6 MANCOSA 118 Management Accounting REMARKS n Cash sales: 10% cash discount has been deducted from the figures provided. n Receipts from debtors: are obtained from the debtors collection schedule. n Cash purchases: is 30% of total purchases. n Payments to creditors: 70% of the total purchases for March is paid in April and 70% of the total purchases for April is paid in May. n Salaries and wages: are the same amounts provided in the information. n Sundry expenses: Since depreciation is a non-cash item, R4 000 per month is deducted from sundry expenses. n Cash surplus: is expected for both months as expected receipts exceed expected payments. n Opening cash balance: for April is the closing cash balance for March and the opening cash balance for May is the closing cash balance for April. n Closing cash balance: is calculated using the cash surplus (shortfall) and the opening cash balance. 7.9.3 Cash budget for the period 01 April to 30 June 20.6 119 April May June Cash receipts 381 600 408 800 382 400 Cash sales 84 000 76 000 72 000 Receipts from debtors 297 600 332 800 310 400 Cash payments (309 400) (300 200) (281 600) Cash purchases 50 400 45 600 43 200 Payments to creditors 112 000 117 600 106 400 Rent 20 000 20 000 20 000 Selling and administrative costs 105 000 95 000 90 000 Other expenses 22 000 22 000 22 000 Cash surplus (shortfall) 72 200 108 600 100 800 Opening cash balance 4 000 76 200 184 800 Closing cash balance 76 200 184 800 285 600 MANCOSA Management Accounting REMARKS n Cash sales: are 20% of total sales. n Receipts from debtors: are calculated as follows: Credit Month sales April May June R R R R February (April R208 000 X 20%) 208 000 41 600 - - March (April R320 000 X 80%) 320 000 256 000 64 000 336 000 - 268 800 67 200 304 000 - - 243 200 297 600 332 800 310 400 (May R320 000 X 20%) April (May R336 000 X 80%) (June R336 000 X 20%) May n (June R304 000 X 80%) Cash purchases and payments to creditors: The following calculations reflect the cash purchases and payments to creditors: March April May June R R R R Total purchases 160 000 168 000 152 000 144 000 Cash purchases (30% of purchases) 48 000 50 400 45 600 43 200 Credit purchases (70% of purchases) 112 000 117 600 106 400 100 800 112 000 117 600 106 400 Payments to creditors (1 month after) n Rent: is paid monthly (R240 000 ÷12 = R20 000) n Selling and administrative expenses: are 25% of sales. n Other expenses: are paid monthly. n Opening cash balance: for April is obtained from the Balance sheet as at 31 March 20.6. MANCOSA 120 Management Accounting 7.9.4 Budgeted income statement for the 3 months ended 30 June 20.6 R Sales (R420 000 + R380 000 + R360 000) 1 160 000 Cost of sales (40% of sales) (464 000) Gross profit (60% of sales) 696 000 Expenses (423 000) Rent expense (R20 000 X 3) 60 000 Selling and distribution (R1 160 000 X 25%) 290 000 Depreciation (R28 000 ÷4) 7 000 Other expenses (R22 000 X 3) 66 000 Net profit 273 000 REMARKS n Sales: reflects the total sales for April, May and June. n Cost of sales: is 40% of sales since the gross profit percentage on sales is 60%. n Rent expense: is R2 000 per month and includes rent for April, May and June. n Selling and distribution: is 25% of the total sales (R1 160 000). n Depreciation: is R28 000 per annum and this translates to R7 000 every 3 months. n Other expenses: are R22 000 per month for 3 months. Budgeted Balance Sheet as at 30 June 20.6 R ASSETS Fixed assets 193 000 Property, plant and equipment (200 000 – 7 000) 193 000 Current assets 874 400 Inventories 240 000 Debtors (60 800 + 288 000) 348 800 Bank 285 600 Total assets 1 067 400 121 MANCOSA Management Accounting EQUITY AND LIABILITIES Equity Capital (693 600 + 273 000) 966 600 Current liabilities 100 800 Creditors 100 800 Total equity and liabilities 1 067 400 REMARKS n Plant, property and equipment: was subject to an annual depreciation of R28 000. For 3 months it would amount to R7 000 and this is the amount by which property, plant and equipment decreases. n Inventories will remain the same as the previous month balance as all inventory sold is replaced during the month of sale. n Debtors: The amount owing by debtors includes 20% of the credit sales for May (R60 800) and the entire credit sales for June (R288 000). n Bank: The expected bank balance at the end of June is obtained from the cash budget. n Capital: increases by the expected profit as calculated in the income statement. n Creditors: The amount owing to creditors will be the credit purchases for June (R100 800). MANCOSA 122 Management Accounting Unit 8: 123 Standard Costing MANCOSA Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: On successful completion of this Unit, the student will be able to: • Understand the concept of standard ASSOCIATED ASSESSMENT CRITERIA OF THIS UNIT: The student needs to: • Complete the relevant activities and think points costing. to be able to identify and define standard • Explain the advantages of standard costing costing. • Compute material variances. • Calculate labour variances. to be able to list and understand the • Calculate the manufacturing overheads advantages of standard costing. standards and variances • • Complete the relevant activities and think points Complete the relevant activities and think points • Calculate the sales variances to be able to demonstrate the articulation and • Understand and know the summary of calculation of material price and quantity formulae variances. • Complete the relevant activities and think points to be able to demonstrate the articulation and calculation of labour rate and labour efficiency variances. • Complete the relevant activities and think points to be able to demonstrate the articulation and calculation of manufacturing overhead standards and variances as well as Variable and Fixed manufacturing overhead variances. • Complete the relevant activities and think points to be able to demonstrate the articulation and calculation of sales price variances. • Complete the relevant activities and think points to be able to demonstrate an understanding and calculation of the variance formulae. • MANCOSA Learn and know all the formuale 124 Management Accounting Key Concepts 8.1 Introduction 8.2 Advantages of standard costing 8.3 Material standards and variances 8.4 Labour standards and variances 8.5 Manufacturing overheads standards and variances 8.6 Sales variances 8.7 Summary of formulas 8.8 Self-assessment activities and solutions Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L 125 MANCOSA Management Accounting 8.1 Introduction What Are Standard Costs? A standard cost is a predetermined target cost that aims to provide a benchmark against which to measure actual performance. Factors such as quantities, prices, rates of pay and quality are considered in the setting of a standard. Standards may be set for materials, labour, manufacturing overheads and selling prices. The standard cost is determined by multiplying the standard quantity of an input by its standard price. One of the important tasks of management is to evaluate performance by comparing actual costs with standard costs. The difference between actual costs and standard costs is called the variance. All variances are the result of two factors viz. price and quantity. The variance could be either favourable or unfavourable to the enterprise. 8.2 Advantages of Standard Costing § Standard cost serve as a benchmark against which actual costs can be measured. § Control is exercise over the production process through the calculation and analysis of variances. § Greater control is exercised over the various costs. § The analysis of cost reports by management is facilitated. § Standard costs make it easier to value inventories. § The introduction of standards usually leads to greater efficiency. 8.3 Material Standards and Variances When material standards are set consideration is given to prices, quantity, quality, grades, wastages etc. A price and a quantity standard are set for material. The standard material price is usually based on past, present and expected future prices and also gives consideration to economic order quantities, suppliers’ quotations and market factors. The standard material quantity specifies the quantity required to manufacture one unit of a completed product. Two main variances can occur with respect to material viz. a price variance and a quantity variance. 3.1 Material price variance Two methods may be used to calculate material price variance viz. the purchase price variance and the issue price variance. MANCOSA 126 Management Accounting 3.1.1 Purchase price variance The purchase price variance is calculated when the material is received and occurs when the actual price is not the same as the standard price. The purchasing department is responsible for any material price variance that may arise e.g. incorrect calculation of discounts and delivery costs. However, material price variances may be the result of mistakes made when the standard price was set and unexpected price changes. The variance is calculated by subtracting the actual cost of the quantity purchased with the standard cost for the same quantity. The following formula may be used to calculate purchase price variance. (Actual price – Standard price) X Actual quantity purchased or (AP – SP) AQ 3.1.2 Issue price variance Issue price variance is calculated when raw materials are issued to production. It is based on the number of units issued and used. It is the difference between the actual quantity issued at actual cost and the actual quantity issued at standard price. The formula to calculate issue price variance is similar to purchase price variance except that the actual quantity (AQ) now refers to actual quantity issued instead of actual quantity purchased. The formula for issue price variance is: (Actual price – Standard price) X Actual quantity issued or (AP – SP) AQ 3.2 Material quantity variance This variance is the difference between the actual quantity of material used (at the standard price) and the standard quantity of material allowed (at standard price). Assume that 2 kg of raw material is used to manufacture one unit of a finished product. If 200 units are manufactured, then the standard material quantity allowed is 400 kg (200 X 2 kg). The 127 MANCOSA Management Accounting production department is responsible for any material quantity variances that might occur e.g. poor control over materials. However, variances may be due to faulty standards and changes in the quality of the material supplied. The formula to calculate the material quantity variance is: (Actual quantity – Standard quantity) X Standard price or (AQ – SQ) SP The total material variance i.e. the total of the material price and quantity variances may be calculated as follows: (Actual quantity X Actual price) – (Standard quantity X Standard price) or (AQ X AP) – (SQ X SP) Example 1 The standard cost of material of product C for the third quarter of 20.6 was: 4 kg per unit at R3 per kg 45 000 kg of material was purchased at R2,80 for the third quarter. The actual production of product C for the third quarter of 20.6 was: 9 000 units which took 37 000 kg of material Required In respect of material, calculate the following variances: n Purchase price variance n Issue price variance n Quantity variance n Total material variance for the 37 000 kg of material issued. Solution Material purchase price variance = (Actual price – Standard price) X Actual quantity purchased = (R2,80 – R3,00) X 45 000 = R9 000 (favourable) MANCOSA 128 Management Accounting Material issue price variance = (Actual price – Standard price) X Actual quantity issued = (R2,80 – R3,00) X 37 000 = R7 400 (favourable) Material quantity variance = (Actual quantity – Standard quantity) X Standard price = (37 000 – 36 000) X R3 = R3 000 (unfavourable) Note: Standard quantity = 9 000 X 4 kg = 36 000 kg Total Material variance = (Actual quantity X Actual price) – (Standard quantity X Standard price) = (37 000 X R2,80) – (36 000 X R3) = R103 600 – R108 000 = R4 400 (favourable) or Material issue price variance R7 400 (favourable) Material quantity variance R3 000 (unfavourable) Total material variance R4 400 (favourable) 8.4 Labour Standards and Variances Labour standards are set in terms of rate (tariff) and efficiency (time). With respect to rate, wages scales that have been devised for various types of labour usually form the basis of the rate standards. Efficiency relates to how long it should take to complete a task. Efficiency standards are set with the help of work study and in particular work measurement. Let us examine the two variances concerning labour viz. labour rate variance and labour efficiency variance. 129 MANCOSA Management Accounting 8.4.1 Labour rate variance The labour rate variance is calculated by multiplying the difference between the standard rate and the actual rate to the number of hours worked. Labour rate variance formula is: (Actual rate – Standard rate) X Actual hours worked or (AR – SR) AH The personnel manager will usually be responsible for this variance. However the variance could be ascribed to change to wage rates, unscheduled overtime, use of lower skilled workers with lower pay etc. 8.4.2 Labour efficiency variance This variance is related to the time it takes to manufacture a single product. It is calculated by finding the difference between the actual hours worked (at standard rate) and the standard time (hours) allowed for the actual production (at standard rate). The formula is: (Actual time worked – Standard time allowed) X Standard rate (AT – ST) SR The manager responsible for the supervision of labour is usually responsible for this variance. However this variance may be due to the quality of supervision, skill of employees, interruptions in production etc . Example 2 Details relating to labour in the production department of AMI Ltd are as follows: Standard labour cost 1,25 hours per unit at R5,50 per hour Actual hours worked and rate 600 hours @ R5,25 per hour Number of units manufactured 450 MANCOSA 130 Management Accounting Required Calculate the following: n Labour rate variance n Labour efficiency variance n Total labour variance Solution Labour rate variance = (Actual rate – Standard rate) X Actual hours worked = (R5,25 – R5,50) X 600 = R150 (favourable) Labour efficiency variance = (Actual time worked – Standard time allowed) X Standard rate = (600 – 562,5) X R5,50 = R206,25 (unfavourable) Note: Standard time allowed = 450 units X 1,25 hours per unit = 562,5 hours Total Labour variance = (Actual time worked X Actual rate) – (Standard time allowed X Standard rate) = (600 X R5,25) – (562,5 X R5,50) = R3 150 – R3 093,75 = R56,25 (unfavourable) or 131 Labour rate variance R206,25 (unfavourable) Labour efficiency variance R150,00 (favourable) Total labour variance R56,25 (unfavourable) MANCOSA Management Accounting 8.5 Manufacturing Overheads Standards and Variances Manufacturing overheads may be classified as fixed or variable and standards are set separately. Variable costs (the same for each product) change in direct proportion to level of business activity. The fixed overhead rate is calculated according to a predetermined level of business activity. Manufacturing overhead variances may be due to equipment lying idle, absenteeism, changes in demand, efficiency of employees, working conditions etc. Separate variances in respect of fixed and variable manufacturing may be calculated as follows: 5.1 Variable manufacturing overheads variance Overhead rates are often based on direct labour hours (used in this module) or machine hours. The efficiency variance is calculated as follows: (Actual hours – Standard hours allowed) X Standard rate or (AH – SH) SR Note: Standard hours allowed = Number of units produced X standard time to make one product Standard rate = Standard variable overheads ÷ standard number of labour hours The expenditure variance is calculated as follows: (Actual rate – Standard rate) X Actual hours or (AR – SR) AH Note: Actual rate = Actual variable overheads ÷ actual number of labour hours Standard rate = Standard variable overheads ÷ standard number of labour hours Example 3 The budgeted figures of GHI Manufacturers for August 20.6 are as follows: Variable overheads R49 000 Fixed overheads R60 025 Number of labour hours 24 500 Standard time to manufacture one product 12 hours The actual results are as follows: Variable overheads R50 652 Fixed overheads R60 300 MANCOSA 132 Management Accounting Number of labour hours worked 24 120 Units manufactured 2 000 Required Calculate the following variable manufacturing overheads variances: n Efficiency variance n Expenditure variance n Total variable overheads variance Solution Efficiency variance = (Actual hours – Standard hours allowed) X Standard rate = (24 120 – [2 000 X 12]) X (49 000 ÷ 24 500) = (24 120 – 24 000) X R2,00 = 120 X R2,00 = R240 (unfavourable) Expenditure variance = (Actual rate – Standard rate) X Actual hours = ([50 652 ÷ 24 120] – R2,00) X 24 120 = (R2,10 – R2,00) X 24 120 = R2 412 (unfavourable) Total variance = Actual amount – Standard amount = R50 652 – (24 000 X R2) = R50 652 – R48 000 = R2 652 (unfavourable) or R240 unfavourable (efficiency variance) R2 412 unfavourable (expenditure variance) R2 652 unfavourable (total variance) Note: Actual amount = Actual variable overheads Standard amount = Standard hours allowed X Standard rate per hour 133 MANCOSA Management Accounting 8.5.1 Fixed manufacturing overheads variance The total fixed overheads variance is the difference between the actual fixed overheads and the standard fixed overheads allowed. The expenditure variance and the volume variance are the main fixed manufacturing overheads variances. The expenditure variance is calculated as follows: Actual fixed overheads – Budgeted fixed overheads The volume variance is calculated as follows: Budgeted fixed overheads – Standard fixed overheads Note: Standard fixed overheads = Number of units produced X Standard time to make 1 product X Standard rate per hour Standard rate per hour = Standard fixed overheads ÷ standard number of labour hours Example 4 Refer to the information provided in example 3 and calculate the following fixed overhead variances: n Expenditure variance n Volume variance n Total fixed overheads variance Expenditure variance = Actual fixed overheads – Budgeted fixed overheads = R60 300 – R60 025 = R275 (unfavourable) Volume variance = Budgeted fixed overheads – Standard fixed overheads = R60 025 – (2 000 X 12 X R2,45) = R60 025 – R58 800 = R1 225 (unfavourable) Note: Standard fixed overheads = Number of units produced X Standard time to make 1 product MANCOSA 134 Management Accounting X Standard rate per hour Standard rate per hour = Standard fixed overheads ÷ standard number of labour hours = R60 025 ÷ 24 500 = R2,45 Total fixed overhead variance = Actual fixed overheads – Standard fixed overheads = R60 300 – (2 000 X 12 X R2,45) = R60 300 – R58 800 = R1 500 (unfavourable) or R275 unfavourable (expenditure variance) R1 225 unfavourable (volume variance) R1 500 unfavourable (total variance) 8.6. Sales Variances When one kind of product is manufactured, the sales variances will be related to the price and quantity. Sales price variance is calculated as follows: (Actual selling price – Standard selling price) X Actual quantity sold or (AP – SP) AQ Sales quantity variance is calculated as follows: (Actual quantity sold – Standard/Budgeted sales) X Standard selling price or (AQ – SQ) SP Example 5 135 Budgeted sales 2 000 units Standard cost per unit R12 Standard selling price per unit R15,50 Actual sales 1 900 units at R16 per unit MANCOSA Management Accounting Required Calculate the: n Sales price variance n Sales quantity variance Sales price variance = (Actual selling price – Standard selling price) X Actual quantity sold = (R16 – R15,50) X 1 900 = R950 (favourable) Sales quantity variance = (Actual quantity sold – Standard/Budgeted sales) X Standard selling price = (1 900 – 2 000) X R15,50 = R1 550 (unfavourable) 8.7 Summary of Formulas 8.7.1 Material Variances 7.8.7.1.1 Material purchase price variance = (Actual price – Standard price) X Actual quantity purchased 8.7.1.2 Material issue price variance = (Actual price – Standard price) X Actual quantity issued 8.7.1.3 Material quantity variance = (Actual quantity – Standard quantity) X Standard price 8.7.1.4 Total Material variance = (Actual quantity X Actual price) – (Standard quantity X Standard price) MANCOSA 136 Management Accounting 8.7.2 LABOUR VARIANCES 8.7.2.1 Labour rate variance = (Actual rate – Standard rate) X Actual hours worked 8.7.2.2 Labour efficiency variance = (Actual time worked – Standard time allowed) X Standard rate 8.7.2.3 Total Labour variance = (Actual time worked X Actual rate) – (Standard time allowed X Standard rate) 8.7.3 8.7.3.1 Variable Manufacturing Overheads Variance Efficiency variance = (Actual hours – Standard hours allowed) X Standard rate 8.7.3.2 Expenditure variance = (Actual rate – Standard rate) X Actual hours 8.7.3.3 Total variable overheads variance = Actual amount – Standard amount 8.7.4 Fixed Manufacturing Overheads Variance 8.7.4.1 Expenditure variance = Actual fixed overheads – Budgeted fixed overheads 8.7.4.2 Volume variance = Budgeted fixed overheads – Standard fixed overheads 8.7.4.3 Total fixed overheads variance = Actual fixed overheads – Standard fixed overheads 137 MANCOSA Management Accounting 8.7.5 Sales Variances Sales price variance = (Actual selling price – Standard selling price) X Actual quantity sold Sales quantity variance = (Actual quantity sold – Standard/Budgeted sales) X Standard selling price 8.8 8.1 Self-Assessment Activities And Solutions A standard quantity of 2 kilograms of material Z at a standard price of R4 per kilogram is allowed for the production of one unit of product Zeplin. The cost figures for the first quarter of 20.6 showed that 4 400 kg of material Z was purchased at R4,20 per kg. 2 000 units of product Zeplin were produced using 4 200 kg of material Z. Required In respect of material, calculate the following variances: 8.1.1 Purchase price variance 8.1.2 Issue price variance 8.1.3 Quantity variance 8.1.4 Total material variance for the 4 200 kg of material issued. 8.2 To produce one unit of product Zeplin a standard quantity of 4 direct labour hours at a standard rate of R6 per hour is allowed. The wage records show that it took 2 100 hours at R5,90 per hour to produce 500 units of product Zeplin. Required Calculate the following labour variances: 8.2.1 Labour rate variance 8.2.2 Labour efficiency variance 8.2.3 Total labour variance MANCOSA 138 Management Accounting 8.3 A manufacturer that manufactures product J provides the following information for May 20.6: Budgeted figures: Variable manufacturing overheads R20 000 Fixed manufacturing overheads R48 000 Labour hours 4 000 Expected production 1 000 units Actual results: Variable manufacturing overheads R19 135 Fixed manufacturing overheads R49 880 Labour hours worked 4 300 Actual production 1 050 units Required 8.3.1 Calculate the following variable manufacturing overheads variances: 8.3.1.1 Efficiency variance 8.3.1.2 Expenditure variance 8.3.1.3 Total variable overheads variance 8.3.2 Calculate the following fixed manufacturing overheads variances: 8.3.2.1 Expenditure variance 8.3.2.2 Volume variance 8.3.2.3 Total fixed overheads variance 8.4 The following information was provided by GHI Manufacturers for April 20.6: Budgeted sales 5 000 units Standard selling price per unit R36 Actual sales 5 200 units for R189 800 Required Calculate the: n Sales price variance n Sales quantity variance 139 MANCOSA Management Accounting SOLUTIONS 8.1 Material variances 8.1.1 Material purchase price variance = (Actual price – Standard price) X Actual quantity purchased = (R4,20 – R4,00) X 4 400 = R880 (unfavourable) 8.1.2 Material issue price variance = (Actual price – Standard price) X Actual quantity issued = (R4,20 – R4,00) X 4 200 = R840 (unfavourable) 8.1.3 Material quantity variance = (Actual quantity – Standard quantity) X Standard price = (4 200 – [2 000 X 2]) X R4,00 = (4 200 – 4 000) X R4,00 = R800 (unfavourable) 8.1.4 Total Material variance = (Actual quantity X Actual price) – (Standard quantity X Standard price) = (4 200 X R4,20) – (4 000 X R4,00) = R17 640 – R16 000 = R1 640 (unfavourable) or Material issue price variance R840 (unfavourable) Material quantity variance R800 (unfavourable) Total material variance R1 640 (unfavourable) 8.2 Labour variances 8.2.1 Labour rate variance = (Actual rate – Standard rate) X Actual hours worked = (R5,90 – R6,00) X 2 100 = R210 (favourable) MANCOSA 140 Management Accounting 8.2.2 Labour efficiency variance = (Actual time worked – Standard time allowed) X Standard rate = (2 100 – [500 X 4]) X R6,00 = (2 100 – 2 000) X R6,00 = R600 (unfavourable) Total Labour variance = (Actual time worked X Actual rate) – (Standard time allowed X Standard rate) = (2 100 X R5,90) – (2 000 X R6,00) = R12 390 – R12 000 = R390 (unfavourable) or 8.3.1 Labour rate variance R210,00 (favourable) Labour efficiency variance R600,00 (unfavourable) Total labour variance R390,00 (unfavourable) Variable manufacturing overheads variances 8.3.1.1 Efficiency variance = (Actual hours – Standard hours allowed) X Standard rate = (4 300 – [1 050 X 4*]) X (R20 000 ÷ 4 000) = (4 300 – 4 200) X R5,00 = R500 (unfavourable) Note: * Standard time to make 1 product is 4 hours (4 000 labour hours ÷ 1 000 units) 8.3.1.2 Expenditure variance = (Actual rate – Standard rate) X Actual hours = ([R19 135 ÷ 4 300] – [R20 000 ÷ 4 000]) X 4 300 = (R4,45 – R5,00) X 4 300 = R2 365 (favourable) 8.3.1.3 Total variable overheads variance = Actual amount – Standard amount = R19 135 – ([1 050 X 4]) X R5) 141 MANCOSA Management Accounting = R19 135 – (4 200 X R5) = R19 135 – R21 000 = R1 865 (favourable) or R500 unfavourable (efficiency variance) R2 365 favourable (expenditure variance) R1 865 favourable (total variance) 8.3.2 Fixed manufacturing overheads variances 8.3.2.1 Expenditure variance = Actual fixed overheads – Budgeted fixed overheads = R49 880 – R48 000 = R1 880 (unfavourable) 8.3.2.2 Volume variance = Budgeted fixed overheads – Standard fixed overheads = R48 000 – (1 050 X 4 X R12) = R48 000 – R50 400 =R2 400 (favourable) Note: Standard fixed overheads = Number of units produced X Standard time to make 1 product X Standard rate per hour Standard rate per hour = Standard fixed overheads ÷ standard number of labour hours = R48 000 ÷ 4 000 = R12 8.3.2.3 Total fixed overheads variance = Actual fixed overheads – Standard fixed overheads = R49 880 – (1 050 X 4 X R12) = R49 880 – R50 400 MANCOSA 142 Management Accounting = R520 (favourable) or R1 880 unfavourable (expenditure variance) R2 400 favourable (volume variance) R520 favourable (total variance) 8.4 Sales Variances 8.4.1 Sales price variance = (Actual selling price – Standard selling price) X Actual quantity sold = ([R189 800 ÷ 5 200] – R36] X 5 200 = (R36,50 – R36) X 5 200 = R2 600 8.4.2 Sales quantity variance = (Actual quantity sold – Standard/Budgeted sales) X Standard selling price = (5 200 – 5 000) X R36 = R7 200 143 MANCOSA Management Accounting Unit 9: MANCOSA Capital Investment Appraisal 144 Management Accounting UNIT LEARNING OUTCOMES AND ASSOCIATED ASSESSMENT CRITERIA LEARNING OUTCOMES OF THIS UNIT: ASSOCIATED ASSESSMENT CRITERIA OF THIS UNIT: On successful completion of this Unit, the student will be able to: The student needs to: • Understand the concept of present value of • Complete the relevant activities and think points • money to be able to identify, understand and define the Apply techniques to evaluate capital concept of present value of money. investment projects • • • • • Complete the relevant activities and think points Apply the payback and accounting rate of to be able to apply the techniques of capital return methods to capital investment investment projects. The candidate should be appraisal. able to demonstrate and calculate the payback Apply techniques to evaluate capital and accounting rate of return to assess the investment projects. relevant projects to discern their feasibility. Apply discounted cash flow methods to • Complete the relevant activities and think points capital investment appraisal. to be able to apply the discounted cash flow Demonstrate the effects of income tax, methods to capital investment projects. The depreciation and scrap value on capital candidate should be able to demonstrate and investment decisions. calculate the NPV and IRR methods to assess the relevant projects to discern their feasibility. • Complete the relevant activities and think points to be able to apply the techniques of capital investment projects. The candidate should be able to demonstrate the effects of income tax, depreciation and scrap value on capital investment decisions and the impact thereof. 145 MANCOSA Management Accounting Key Concepts 9.1 Introduction 9.2 Present value of money 9.3 Capital investment appraisal using techniques that ignore the time value of money 9.4 Capital investment appraisal using discounted cash flow methods 9.5 Influence of income tax, depreciation and scrap value 9.6 Self-assessment activities and solutions Recommended Readings Below is the prescribed reading for specific to this unit; • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L MANCOSA 146 Management Accounting 9.1 Introduction Capital investment appraisal is also known as capital budgeting. A capital budget is a financial plan for the replacement of fixed assets. Capital investments involve large sums of money and are usually financed from retained earnings, issue of shares or long-term borrowing. Management must be convinced of the profitability of these capital investments before a final decision is taken because: § Large amounts of resources are usually involved. § It is difficult and/or expensive to cancel an investment once it has been made. 9.2 Present Value of Money A sum of money today has a greater value than the same amount at any time in the future. This may be due to the effects of inflation, risk and loss of interest. The present value of money is very important in capital investment appraisal. A simple illustration of this is as follows: Example 1 Suppose Jack decides to sell his second-hand computer to Jill. Jill makes two proposals to Jack regarding the payment: - The first proposal is to pay R 980 immediately - The second proposal is to pay R1 100 in one year’s time. Required Determine which proposal Jack must accept if the current rate for investments is 10% p.a. Solution The two amounts cannot be compared as the amounts apply to different times (viz. present day and one year later). Both values must therefore be converted to a common base (common date). One way of doing this is to calculate the (future) value of R980 (first proposal) in one year’s time. This future value can then be compared to the R1 100 (second proposal). The second method is to use the present time as a common base. This means that the present value of R1 100 must be calculated and this value is then compared to R980. This can be done as follows: Future value = Present value + Interest rate = 100% + 10% = 110% We can thus state R1 100 = 110% To calculate the present value, we multiply 110 by 100/110 (to get 100%) and do the same for R1 100 (i.e. multiply it by 100/110). 147 MANCOSA Management Accounting Therefore R1 100 X 100 = 110 X 100 110 110 R1 000 = 100% The present value of the R1 100 is therefore R1 000. Jack should therefore accept the second proposal (present value R1 000) since it is more profitable than the first proposal (present value R980). Present value tables In order to eliminate the number of steps to calculate the present value of any amount, present value tables are available. The present value of R1 can be read from the tables. Two tables (Table 1 and Table 2) are available and appear at the end of this chapter. Table 1 shows the present value of R1 at various interest rates receivable after n years (n can represent any number). Table 2 reflects the present value of R1 at various interest rates receivable annually for n years. Example 2 Use the present value tables at the end of this chapter to calculate the present values for the following amounts at an interest rate of 12% p.a.: End of year Amount 1 R2 000 2 R3 500 3 R4 200 Solution End of year MANCOSA Calculation Present value 1 R2 000 X 0,8929 R1 786 2 R3 500 X 0,7972 R2 790 3 R4 200 X 0,7118 R2 990 148 Management Accounting Example 3 Use the present value tables at the end of this chapter to calculate the present values for the following amounts at an interest rate of 12% p.a.: End of year Amount 1 R2 000 2 R2 000 3 R2 000 4 R2 000 Solution Instead of calculating the present value for each year, table 2 can be used since we are working with a constant amount of R2 000 per year. Table 2 provides a quicker means of getting the answer: R2 000 X 3,0373 = R6 075 9.3 Capital Investment Appraisal Using Techniques That Ignore the Time Value Of Money When appraising investment decisions, net cash flows need to be calculated. Net cash flow is the difference between the cash inflow arising from an investment and the cash outflow that it requires. However, the minimum rate of return of an investment should be greater than the interest rate on borrowed funds or rate of return of the enterprise (depending on the source of financing – borrowed or own). Also note that cash flows = profit/(loss) + depreciation The following techniques that ignore the time value of money may be used to evaluate capital investment projects: n Payback period n Accounting rate of return 149 MANCOSA Management Accounting 9.3.1 Payback period Payback period measures the amount of time required to recover the initial cost of the investment from the net cash inflows from the project. The general decision rule to follow is to choose the project with a shorter payback period. The reason for this is that the shorter the payback period, the less risky the project and the greater the liquidity. Whilst the payback method is simple and easy to use, it does not recognise the time value of money. It also ignores the influence of cash inflows on profitability after the payback period. Payback period is calculated as follows if the net cash inflow is the same each year: Cost of project Net cash inflow (p.a.) Example 4 FDG Ltd obtained information in respect of two machines, one of which it intends purchasing. The following details are available: Machine X Machine Y Purchase price R60 000 R60 000 Economic lifetime 6 years 4 years Average annual net cash inflow over economic lifetime R20 000 R28 000 Depreciation (straight-line method) R10 000 R15 000 Average annual profits R10 000 R13 000 Required Calculate the payback period of each machine and recommend the machine that should be chosen based on the payback period. MANCOSA 150 Management Accounting Solution Payback period: Machine X Machine Y Cost of machine = R60 000 R60 000 Net cash inflow R20 000 R28 000 3 years 2,14 years = According to the calculation above FDG Ltd should choose machine Y since it recovers the purchase price in a shorter time (2,14 years) than Machine X (3 years). However, the management of FDG Ltd must also consider that machine X will be able to generate an income of R60 000 (R20 000 X 3) for 3 years after the payback period whereas machine Y will only be able to generate an income of R28 000 (for only 1 more year) after the payback period. When the cash inflows are not even, the payback period is determined as follows: Example 5 Consider two projects whose cash inflows are not even. Assume that the project costs R2 000. The net cash inflows for each year is as follows: Year Project X Project Y 1 R200 R1 000 2 R400 R800 3 R600 R600 4 R800 R200 5 R1 000 - 6 R1 200 - Required Calculate the payback period of each machine and recommend the project that should be selected based on the payback period. 151 MANCOSA Management Accounting Solution Investment Year 1 Cash flow Year 2 Cash flow Year 3 Cash flow Project X Project Y (2 000) (2 000) 200 1 000 (1 800) (1 000) 400 800 (1 400) (200) 600 600 (800) Year 4 Cash flow 800 0 Payback period is 4 years 2 years 4 months Note: 200 X 12 mths 600 = 4 months Project Y should be chosen since the payback period (2 years and 4 months) is less than that of project X (4 years). 9.3.2 Accounting rate of return (ARR) The accounting rate of return (ARR) measures profitability by relating the average investment to the future annual net profit. In other words, ARR uses the average profit an investment will generate and expresses it as a percentage of the average investment over the life of the project. The accounting rate of return of an investment is calculated as follows: ARR = Average annual profit X 100 Average investment 1 The average investment in respect of a machine is calculated as follows: Average investment = Cost of machine + Disposal value or scrap value or residual value 2 MANCOSA 152 Management Accounting Using the ARR method, the project that is expected to realise a higher rate of return is chosen. Example 6 Use the figures from example 4 to calculate the accounting rate of return. Solution Accounting rate of return: Average annual profit X 100 = Average investment Machine X Machine Y R10 000 X 100 R13 000 X 100 1 R30 000 1 R30 000 = 33% = 43% 1 Note: Since there is no disposal value, the average investment is R60 000 ÷ 2. Using ARR, machine Y gives a higher rate of return and appears to be a better investment. The advantage of the ARR method is that it is easy to calculate and it recognises profitability. However, it does not take into account the time value of money. Also it uses accounting data instead of cash flow data. 9.4 Capital Investment Appraisal Using Discounted Cash Flow Methods Since the two methods described above do not take into account the time value of money, the following methods are widely used to evaluate investment opportunities: § Net present value (NPV) § Internal rate of return (IRR) 9.4.1 Net present value (NPV) The NPV method takes into account all the costs and benefits of each investment opportunity and also makes provision for the timing of the costs and benefits. By applying the present value method (discussed earlier), the present values of future cash flows are calculated using the enterprise’s minimum rate of return. The net present value is the difference between the present value of the projected cash inflows 153 MANCOSA Management Accounting and the present value of the cash outflows. If the NPV is positive, then the project is considered for acceptance. If the NPV is negative, the project is rejected since it would not be profitable. Example 7 Excel Ltd has a choice of purchasing one of two machines. The following details relate to these machines: Machine A Machine B Purchase price R75 000 R80 000 Expected economic lifetime 6 years 6 years 12% 12% 1st year R20 000 R22 000 2nd year R22 000 R22 000 3rd year R24 000 R22 000 4th year R26 000 R22 000 5th year R23 000 R22 000 6th year R21 000 R22 000 Minimum required rate of return Net annual cash inflows Required Use the net present value method to determine which machine Excel Ltd should purchase. Solution Machine A Year Cash inflow Discount Present Factor value (see Table 1) 1 R20 000 0,8929 R17 858 2 R22 000 0.7972 R17 538 3 R24 000 0,7118 R17 083 4 R26 000 0,6355 R16 523 5 R23 000 0.5674 R13 050 6 R21 000 0,5066 R10 639 Total PV R92 691 Investment (R75 000) NPV (positive) R17 691 MANCOSA 154 Management Accounting Machine B Net inflow R22 000 Discount factor (see Table 2) X 4,1114 Total Present value R90 451 Investment (R80 000) NPV (positive) R10 451 Decision: Machine A should be purchased since it has a higher net present value. 9.4.2 Internal rate of return (IRR) This is the discount rate that will discount the cash flows to a net present value of zero. In other words, the present value of cash flows minus the initial investment equals a zero NPV. The IRR therefore indicates what a particular project is expected to earn. A project must only be considered if the IRR exceeds the cost of capital. The advantage of the IRR method is that it considers the time value of money and is therefore more realistic than the accounting rate of return (ARR). However, the calculation can be difficult especially when the cash flows are not even. When the cash flows are not even, the trial-and-error method for calculating IRR may be summarised as follows: n Calculate the NPV at the cost of capital rate (r1) n Check if the NPV is positive or negative. n If the NPV is positive, then pick another rate (r2) higher than the cost of capital rate. (If the NPV is negative, pick a smaller rate.) The correct IRR at which NPV = 0 lies somewhere between these two rates, with one rate indicating a positive NPV and the other rate indicating a negative NPV. n Calculate the NPV using r2. n Use interpolation to calculate the exact rate. Example 8 Use the information in example 7 and determine which machine should be purchased using the internal rate of return. 155 MANCOSA Management Accounting Solution Machine A Step 1 We notice that the NPV is positive, and is far away from zero. Step 2 We now pick a higher rate e.g. 18%. (Trial-and-error is used to obtain the higher rate.) Machine A Year Cash Discount Discount Discount Present Present Present inflow factor factor factor value value value 18% 19% 20% 18% 19% 20% 1 R20 000 0,8475 0,8403 0,8333 16 950 16 806 R16 666 2 R22 000 0,7182 0,7062 0,6944 15 800 15 536 R15 277 3 R24 000 0,6086 0,5934 0,5787 14 606 14 242 R13 889 4 R26 000 0,5158 0,4987 0,4823 13 411 12 966 R12 540 5 R23 000 0,4371 0,4190 0,4019 10 053 9 637 R9 244 6 R21 000 0,3704 0,3521 0,3349 7 778 7 394 R7 033 Total PV 78 598 76 581 74 649 Investment (75 000) (75 000) (75 000) NPV R3 598 R1 581 (R351) Step 3 Interpolation: The IRR is between 19% and 20%. IRR = 19 + 1581 1581 + 351 = 19 + 1 581 1 932 = 19,82% Machine B Step 1 We notice that the NPV is positive, and also far from zero. MANCOSA 156 Management Accounting Step 2 We now pick a higher rate e.g. 16%. (Trial-and-error is used to obtain the higher rate.) Machine B Year Cash Discount Discount Present Present inflow Factor Factor value value p.a. 16% 17% 16% 17% R22 000 3,6847 3,5892 81 063 78 962 Investment (80 000) (80 000) NPV R1 063 (R1 038) 1-6 Step 3 Interpolation: The IRR is between 16% and 17%. IRR = 16 + 1 063 1 063 + 1 038 = 16 + 1 063 2 101 = 16,51% Decision: Machine A should be chosen since the IRR is greater. 9.5 Influence of Income Tax, Depreciation and Scrap Value Income tax has an influence on capital investment decisions. A project that may be approved on a pretaxation basis may be rejected on an after-tax basis. Although depreciation is not a cash outflow, it is deducted when calculating taxable income. Scrap value has an influence on the calculation of depreciation. The following example illustrates the effects of income tax, depreciation and scrap value on capital investment decisions: 157 MANCOSA Management Accounting Example 9 Milton Ltd is considering buying a machine and has presented the following information: Machine A Purchase price R13 000 Expected economic lifetime 10 years Minimum required rate of return 12% Net annual cash inflows R2 500 Rate of taxation 30% Depreciation is calculated using the straight-line method Required Calculate the: n Net present value (NPV) n Internal rate of return (IRR) n Net present value if the machine has a scrap value of R1 500 at the end of 10 years. Solution Calculation of net present value: Machine A Calculation of tax Cash inflow Net annual cash inflow R2 500 R2 500 Depreciation (R13 000 ÷ 10) (R1 300) Taxable income R1 200 Income tax (30% of R1 200) (R360) (R360) Income after tax R840 ______ Net annual cash inflow after tax R2 140 The present value factor for 10 years at 12% p.a. is 5,6502 Present value of future cash flows after tax (R2 140 X 5,6502) R12 091 Present value of investment (R13 000) Net present value (negative) (R909) Internal rate of return The NPV is negative. We pick a lower rate e.g. 11%. (trial and error) MANCOSA 158 Management Accounting We now calculate the NPV at 10%. Machine A Year Cash Discount Discount Present Present inflow Factor Factor value value p.a. 11% 10% 11% 10% R2 140 5,8892 6,1446 R12 603 R13 149 Investment (13 000) (13 000) NPV (R397) R149 1-10 Interpolation: The IRR is between 10% and 11%. IRR = 10% + 149 149 + 397 = 10% + 149 546 = 10,27% Net present value if the machine has a scrap value of R1 500 at the end of 10 years. Calculation of tax Cash inflow Net annual cash inflow R2 500 R2 500 Depreciation [(13 000 – R1 500) ÷ 10] (R1 150) Taxable income R1 350 Income tax (30% of R1 350) (R405) (R405) Income after tax R945 ______ Net annual cash inflow after tax R2 095 The present value factor for 10 years at 12% p.a. is 5,6502. Present value of future cash flows after tax (R2 095 X 5,6502) Scrap value (R1 500 X 0,3220) R11 837 R483 R12 320 159 Present value of investment (13 000) Net present value (negative) (R680) MANCOSA Management Accounting 9.6 Self-Assessment Activities and Solutions An investment has the following cash flows: Year Cash flow 0 (R60 000) 1 R10 000 2 R12 000 3 R28 000 4 R20 000 5 R30 000 Required: 6.1.1 Calculate the following: 6.1.1.1 Payback period 6.1.1.2 Net present value (NPV) at 12% cost of capital 6.1.1.3 Accounting rate of return (ARR) (Assume that there is no depreciation) 6.1.2 Must the investment be considered positively or negatively? Give reasons for your answer. 6.2 The financial manager at Rico Ltd had to choose between these two projects, Alpha and Beta, which have the following after-tax cash inflows: Year Alpha Beta 1 0 R36 000 2 R18 500 R36 000 3 R36 200 R36 000 4 R123 000 R36 000 Both projects require an initial investment of R117 700. Required: Calculate the payback period for each project. Which project would you choose? Why? 6.2.1 Calculate the net present value (NPV) for each project, using a discount rate of 12%. Which 6.2.2 project would you choose? Why? Calculate the Internal Rate of Return (IRR) for both projects. Which project should be chosen? Why? MANCOSA 160 Management Accounting 6.3 Mica Ltd is considering buying a machine and has presented the following information: Machine Y Purchase price R100 000 Expected economic lifetime 4 years Minimum required rate of return 14% Net annual cash inflows R35 000 Rate of taxation 30% Depreciation is calculated using the straight-line method Required Calculate the: 6.3.1 Net present value (NPV) 6.3.2 Internal rate of return (IRR) 6.3.3 Net present value if the machine has a scrap value of R10 000 at the end of 4 years. Solutions 6.1.1.1 Investment (R60 000) Year 1 Cash flow R10 000 (R50 000) Year 2 Cash flow R12 000 (R38 000) Year 3 Cash flow R28 000 (R10 000) Year 4 Cash flow Payback period is R20 000 3 years 6 months Note: R10 000 X 12 mths R20 000 = 6 months 161 MANCOSA Management Accounting 6.1.1.2 Year Cash inflow Discount Present Factor value (see Table 1) 1 R10 000 0,8929 R8 929 2 R12 000 0.7972 R9 566 3 R28 000 0,7118 R19 930 4 R20 000 0,6355 R12 710 5 R30 000 0.5674 R17 022 Total PV R68 157 Investment (R60 000) NPV (positive) R8 157 6.1.1.3 Accounting rate of return: Machine X Average annual profit X 100 = Average investment R20 000 X 100 1 R30 000 1 = 66,67% Note: Average annual profit = R10 000 + R12 000 + R28 000 + R20 000 + R30 000 5 years = R20 000 p.a. Average investment R60 000 + 0 2 = R30 000 MANCOSA 162 Management Accounting 6.1.2 The investment should be considered positively because: - The payback period is only 2 ½ years. - The net present value (R8 157) is positive. - The accounting rate of return (66,67%) is higher than the cost of capital (12%). 6.2.1 Investment (R117 700 Year 1 Cash flow 0 (R117 700) Year 2 Cash flow R18 500 (R99 200) Year 3 Cash flow R36 200 (R63 000) Year 4 Cash flow R123 000 Payback period is 3 years 6 months 4 days Note: R63 000 X 12 mths R123 000 = 6,146 months 0,146 X 30 days = 4,38 days Project Beta Cost of project Net cash inflow = R117 700 R36 000 3,27 years = 163 MANCOSA Management Accounting Note: 0,27 X 12 = 3,24 months 0,24 X 30 = 7,2 days The payback period is 3 years 3 months 7-8 days Project Beta should be chosen since the payback period (3 years 3 months 7-8 days) is less than that of Project Alpha (3 years 6 months 4 days) 6.2.2 Project Alpha Year Cash inflow Discount Present Factor value (see Table 1) 1 0 0,8929 0 2 R18 500 0.7972 R14 748 3 R36 200 0,7118 R25 767 4 R123 000 0,6355 R78 167 Total PV R118 682 Investment (R117 700) NPV (positive) R982 Project Beta Net inflow R36 000 Discount factor (see Table 2) X 3,0373 Total Present value R109 343 Investment (R117 700) NPV (negative) (R8 357) Project Alpha should be chosen since the NPV is positive. The NPV for project Beta is negative and is therefore rejected. MANCOSA 164 Management Accounting 6.2.3 Project Alpha Step 1 We notice that the NPV is positive, and above zero, but not by a large margin. Step 2 We now pick a higher rate e.g. 13%. (Trial-and-error is used to obtain the higher rate.) Project Alpha Year Cash Discount Discount Present Present inflow Factor Factor value value 12% 13% 12% 13% 1 0 0,8929 0,8850 0 0 2 R18 500 0.7972 0,7831 R14 748 R14 487 3 R36 200 0,7118 0,6931 R25 767 R25 090 4 R123 000 0,6355 0,6133 R78 167 R75 436 Total PV R118 682 R115 013 Investment (R117 700) (R117 700) R982 (R2 687) NPV Step 3 Interpolation: The IRR is between 12% and 13%. IRR = 12 + 982 982 + 2 687 = 12 + 982 3 669 = 12,27% 165 MANCOSA Management Accounting Project Beta Step 1 We notice that the NPV is negative. Step 2 We now pick a lower rate e.g. 10%. (Trial-and-error is used to obtain the higher rate.) Project Beta Year Cash Discount Discount Discount Present Present Present inflow Factor Factor Factor value value value p.a. 10% 9% 8% 10% 9% 8% 1-4 R36 3,1699 3,2397 3,3121 114 116 116 629 119 236 Investment 000 117 700 117 700 117 700 (R3 584) (R1 071) R1 536 NPV Step 3 Interpolation: The IRR is between 8% and 9%. IRR =8+ 1 536 1 536 + 1 071 = 8 + 1 536 2 607 = 8,59% Decision: Project Alpha should be chosen as the IRR is greater. 6.3.1 Calculation of net present value Calculation of tax Cash inflow Net annual cash inflow R35 000 R35 000 Depreciation (R100 000 ÷ 4) (R25 000) Taxable income R10 000 Income tax (30% of R10 000) (R3 000) (R3 000) Income after tax R7 000 _______ Net annual cash inflow after tax MANCOSA R32 000 166 Management Accounting The present value factor for 4 years at 14% p.a. is 2,9137. Present value of future cash flows after tax (R32 000 X 2,9137) 6.3.2 R93 238 Present value of investment (R100 000) Net present value (negative) (R6 762) Internal rate of return The NPV is negative and far from zero. We pick a lower rate e.g. 12%. (trial and error) Machine B Year Cash Discount Discount Discount Present Present Present inflow Factor Factor Factor value value value p.a. 12% 11% 10% 12% 11% 10% 1-4 R32 3,0373 3,1024 3,1699 97 194 99 277 101 437 Investment 000 100 000 100 000 100 000 (R2 806) (R723) R1 437 NPV IRR = 10 + 1 437 1 437 + 723 = 10 + 1 437 2 160 = 10,67% 6.3.3 Net present value if the machine has a scrap value of R10 000 at the end of 4 years. Calculation of tax Cash inflow Net annual cash inflow R35 000 R35 000 Depreciation [(100 000 – R10 000) ÷ 4] (R22 500) Taxable income R12 500 Income tax (30% of R12 500) (R3 750) (R3 750) Income after tax R8 750 _______ Net annual cash inflow after tax R31 250 The present value factor for 4 years at 14% p.a. is 2,9137. 167 MANCOSA Management Accounting Present value of future cash flows after tax (R31 250 X 2,9137) R91 053 Scrap value (R10 000 X 0,5921) R5 921 R96 974 Present value of investment (R100 000) Net present value (negative) (R3 026) MANCOSA 168 Management Accounting Table 1: Present value interest factor of R1 per period at i% for n periods, PVIFA(i,n). Number of 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 25% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8696 0.8621 0.8547 0.8475 0.8403 0.8333 0.8000 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.7561 0.7432 0.7305 0.7182 0.7062 0.6944 0.6400 3 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.6575 0.6407 0.6244 0.6086 0.5934 0.5787 0.5120 4 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.5718 0.5523 0.5337 0.5158 0.4987 0.4823 0.4096 5 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5194 0.4972 0.4761 0.4561 0.4371 0.4190 0.4019 0.3277 6 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 0.4803 0.4556 0.4323 0.4104 0.3898 0.3704 0.3521 0.3349 0.2621 7 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.4251 0.3996 0.3759 0.3538 0.3332 0.3139 0.2959 0.2791 0.2097 8 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.3269 0.3050 0.2848 0.2660 0.2487 0.2326 0.1678 9 0.9143 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.3075 0.2843 0.2630 0.2434 0.2255 0.2090 0.1938 0.1342 10 0.9053 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.2697 0.2472 0.2267 0.2080 0.1911 0.1756 0.1615 0.1074 11 0.8963 0.8043 0.7224 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0.2607 0.2366 0.2149 0.1954 0.1778 0.1619 0.1476 0.1346 0.0859 12 0.8874 0.7885 0.7014 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2858 0.2567 0.2307 0.2076 0.1869 0.1685 0.1520 0.1372 0.1240 0.1122 0.0687 13 0.8787 0.7730 0.6810 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 0.2575 0.2292 0.2042 0.1821 0.1625 0.1452 0.1299 0.1163 0.1042 0.0935 0.0550 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 0.2320 0.2046 0.1807 0.1597 0.1413 0.1252 0.1110 0.0985 0.0876 0.0779 0.0440 15 0.8613 0.7430 0.6419 0.5553 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.2090 0.1827 0.1599 0.1401 0.1229 0.1079 0.0949 0.0835 0.0736 0.0649 0.0352 16 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.1883 0.1631 0.1415 0.1229 0.1069 0.0930 0.0811 0.0708 0.0618 0.0541 0.0281 17 0.8444 0.7142 0.6050 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 0.0802 0.0693 0.0600 0.0520 0.0451 0.0225 Periods MANCOSA 169 Management Accounting 18 0.8360 0.7002 0.5874 0.4936 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 0.1528 0.1300 0.1108 0.0946 0.0808 0.0691 0.0592 0.0508 0.0437 0.0376 0.0180 19 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 0.1377 0.1161 0.0981 0.0829 0.0703 0.0596 0.0506 0.0431 0.0367 0.0313 0.0144 20 0.8195 0.6730 0.5537 0.4564 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 0.1240 0.1037 0.0868 0.0728 0.0611 0.0514 0.0433 0.0365 0.0308 0.0261 0.0115 25 0.7798 0.6095 0.4776 0.3751 0.2953 0.2330 0.1842 0.1460 0.1160 0.0923 0.0736 0.0588 0.0471 0.0378 0.0304 0.0245 0.0197 0.0160 0.0129 0.0105 0.0038 30 0.7419 0.5521 0.4120 0.3083 0.2314 0.1741 0.1314 0.0994 0.0754 0.0573 0.0437 0.0334 0.0256 0.0196 0.0151 0.0116 0.0090 0.0070 0.0054 0.0042 0.0012 40 0.6717 0.4529 0.3066 0.2083 0.1420 0.0972 0.0668 0.0460 0.0318 0.0221 0.0154 0.0107 0.0075 0.0053 0.0037 0.0026 0.0019 0.0013 0.0010 0.0007 0.0001 50 0.6080 0.3715 0.2281 0.1407 0.0872 0.0543 0.0339 0.0213 0.0134 0.0085 0.0054 0.0035 0.0022 0.0014 0.0009 0.0006 0.0004 0.0003 0.0002 0.0001 * 60 0.5504 0.3048 0.1697 0.0951 0.0535 0.0303 0.0173 0.0099 0.0057 0.0033 0.0019 0.0011 0.0007 0.0004 0.0002 0.0001 0.0001 * * * * • The factor is zero to four decimal places MANCOSA 170 Management Accounting Table 2: Present value interest factor of an (ordinary) annuity of R1 per period at i% for n periods, PVIFA(i,n). Number of 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8696 0.8621 0.8547 0.8475 0.8403 0.8333 2 1.9704 1.9416 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.7591 1.7355 1.7125 1.6901 1.6681 1.6467 1.6257 1.6052 1.5852 1.5656 1.5465 1.5278 3 2.9410 2.8839 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.4869 2.4437 2.4018 2.3612 2.3216 2.2832 2.2459 2.2096 2.1743 2.1399 2.1065 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 2.8550 2.7982 2.7432 2.6901 2.6386 2.5887 5 4.8534 4.7135 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7908 3.6959 3.6048 3.5172 3.4331 3.3522 3.2743 3.1993 3.1272 3.0576 2.9906 6 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.9975 3.8887 3.7845 3.6847 3.5892 3.4976 3.4098 3.3255 7 6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883 4.1604 4.0386 3.9224 3.8115 3.7057 3.6046 8 7.6517 7.3255 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 4.7988 4.6389 4.4873 4.3436 4.2072 4.0776 3.9544 3.8372 9 8.5660 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 5.3282 5.1317 4.9464 4.7716 4.6065 4.4506 4.3038 4.1633 4.0310 10 9.4713 8.9826 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.6502 5.4262 5.2161 5.0188 4.8332 4.6586 4.4941 4.3389 4.1925 11 10.3676 9.7868 9.2526 8.7605 8.3064 7.8869 7.4987 7.1390 6.8052 6.4951 6.2065 5.9377 5.6869 5.4527 5.2337 5.0286 4.8364 4.6560 4.4865 4.3271 12 11.2551 10.5753 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 7.1607 6.8137 6.4924 6.1944 5.9176 5.6603 5.4206 5.1971 4.9884 4.7932 4.6105 4.4392 13 12.1337 11.3484 10.6350 9.9856 9.3936 8.8527 8.3577 7.9038 7.4869 7.1034 6.7499 6.4235 6.1218 5.8424 5.5831 5.3423 5.1183 4.9095 4.7147 4.5327 14 13.0037 12.1062 11.2961 10.5631 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667 6.9819 6.6282 6.3025 6.0021 5.7245 5.4675 5.2293 5.0081 4.8023 4.6106 15 13.8651 12.8493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 8.0607 7.6061 7.1909 6.8109 6.4624 6.1422 5.8474 5.5755 5.3242 5.0916 4.8759 4.6755 16 14.7179 13.5777 12.5611 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 7.3792 6.9740 6.6039 6.2651 5.9542 5.6685 5.4053 5.1624 4.9377 4.7296 17 15.5623 14.2919 13.1661 12.1657 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216 7.5488 7.1196 6.7291 6.3729 6.0472 5.7487 5.4746 5.2223 4.9897 4.7746 Periods MANCOSA 171 Management Accounting 18 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 7.7016 7.2497 6.8399 6.4674 6.1280 5.8178 5.5339 5.2732 5.0333 4.8122 19 17.2260 15.6785 14.3238 13.1339 12.0853 11.1581 10.3356 9.6036 8.9501 8.3649 7.8393 7.3658 6.9380 6.5504 6.1982 5.8775 5.5845 5.3162 5.0700 4.8435 20 18.0456 16.3514 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136 7.9633 7.4694 7.0248 6.6231 6.2593 5.9288 5.6278 5.3527 5.1009 4.8696 25 22.0232 19.5235 17.4131 15.6221 14.0939 12.7834 11.6536 10.6748 9.8226 9.0770 8.4217 7.8431 7.3300 6.8729 6.4641 6.0971 5.7662 5.4669 5.1951 4.9476 30 25.8077 22.3965 19.6004 17.2920 15.3725 13.7648 12.4090 11.2578 10.2737 9.4269 8.6938 8.0552 7.4957 7.0027 6.5660 6.1772 5.8294 5.5168 5.2347 4.9789 40 32.8347 27.3555 23.1148 19.7928 17.1591 15.0463 13.3317 11.9246 10.7574 9.7791 8.9511 8.2438 7.6344 7.1050 6.6418 6.2335 5.8713 5.5482 5.2582 4.9966 50 39.1961 31.4236 25.7298 21.4822 18.2559 15.7619 13.8007 12.2335 10.9617 9.9148 9.0417 8.3045 7.6752 7.1327 6.6605 6.2463 5.8801 5.5541 5.2623 4.9995 60 44.9550 34.7609 27.6756 22.6235 18.9293 16.1614 14.0392 12.3766 11.0480 9.9672 9.0736 8.3240 7.6873 7.1401 6.6651 6.2402 5.8819 5.5553 5.2630 4.9999 MANCOSA 172 Management Accounting Bibliography • Fundamentals of Cost and Management Accounting Sixth edition, 2012. Els. G, Meyer, L., van der Walt. R, de Wet. S.R • The Essence of Management Accounting First edition, 2003. Chadwick, L MANCOSA 173 Management Accounting MANCOSA 174