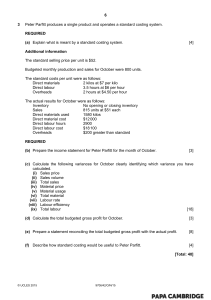

MA THEORY DIFFERENCES BETWEEN FA & MA Topic Meaning Is it compulsory? Information Objective Financial Accounting Focuses on the preparation of financial statement of an organization to provide the financial information to the interested parties. Management Accounting Provides relevant information to the managers to make policies, plans and strategies for running the business effectively is known as Management Accounting. Yes No Monetary information only. Monetary and non-monetary information To assist the management in planning and decision making process by providing detailed information on various matters. Not specified To provide financial information to outsiders. Format Specified Financial Statements are prepared The reports are prepared as per the need Time Frame at the end of the accounting period and requirements of the organization. which is usually one year. User Internal and external parties Only internal management. Summarized Reports about the Complete and Detailed reports regarding Reports financial position of the various information. organization Publishing and Required to be published and Neither published nor audited by auditing audited by statutory auditors statutory auditors. Management Accounting - It is the presentation of accounting information in such a way as to assist the management in the creation of policies and the day to day operations of the undertaking. Overhead apportionment - The overheads, which can be easily shared by the two or more departments on suitable basis, are called apportionment. Profit centre - a part of a business which is expected to make an identifiable contribution to the organization's profits. CATEGORIES OF ACCOUNTING INFORMATION 1. Operating information. Info required for day to day activities 2. Financial accounting information. Meant both for owners and managers and also for the use of individuals and agencies external to the business. 3. Management accounting information makes use of both historical and estimated data in assisting management in daily operations and in planning for future operations. 4. Cost accounting information Provides multi dimensional information that helps in decision making. EQUIVALENT UNITS The number of units that would have been produced during a period if all of a department’s effort had resulted in completed units of a product. MANUFACTURING OVERHEADS These includes all costs of manufacturing other than direct materials and direct labour. E.g - Indirect costs, indirect labour. OPPORTUNITY COST - Cost that's forgone for choosing an alternative. SUNK COST - Cost incurred from a past time-frame DIRECT COSTS - Those that can be traced to a particular cost object. INDIRECT COSTS - Those that are not attributed directly to a particular good/service. BUDGETED COSTS - Estimates of expenditure for different phases of business operations such as manufacturing, administrative , sales, STANDARD COSTS - Are scientifically predetermined costs of every aspect of business activity and are control tools. NON-MANUFCTURING COSTS. 1. Marketing and selling costs 2. Administrative costs INDUSTRIAL ENGINEERING APPROACH. This method involves an estimation of the required production inputs for certain output by the engineers. DISTINGUISH BETWEEN JOB-ORDER COSTING and PROCESS COSTING. Job order costing system - Used in those manufacturing companies where many different products or jobs are produced each period. In such a system, the cost of materials used, direct labour and manufacturing overheads arc accumulated separately for each job. Process costing - Used in situations where manufacturing involves a single homogenous product that is produced for long periods of time. The cost of raw materials used, direct labour and overhead applicable are accumulated by department or process. The focal point is therefore the department. ASSUMPTIONS OF C.V.P ANALYSIS. 1. 2. 3. 4. 5. 6. 7. Fixed costs will remain constant. Variable costs will change proportionately with volume Total cost = FC + VC All units that are produced are sold. Selling price remains constant Sales volume is fixed. Costs are only affected by volume IMPORTANCE OF C.V.P 1. 2. 3. 4. 5. Used for planning and budgeting Used to evaluate projects and investments, Used to determine the maximum sales level. Used to find profitable combination of costs, i.e. FC & VC Used for marketing.