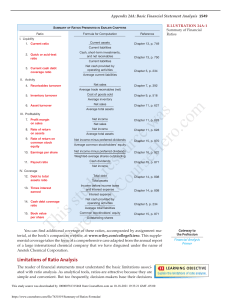

BMSH2003 ANALYSIS AND INTEPRETATION OF FINANCIAL STATEMENTS Introduction to Financial Statement Analysis Financial statement (FS) analysis involves careful selection of data from financial statements in order to assess and evaluate the firm’s past performance, present condition, and future business potentials. Objectives of Financial Statement Analysis (Garrison, Noreen, & Brewer, 2018) The primary purpose of FS analysis is to evaluate and forecast the company’s financial condition. Interested parties, such as managers, investors, and creditors, can identify the company’s financial strengths and weaknesses and know about the following: • Profitability of the firm; • Solvency of the firm; • Safety of the investment in the business; and • Effectiveness of management in running the firm. Limitations of Financial Statement Analysis (Garrison, Noreen, & Brewer, 2018) The following are the limitations of financial statement analysis. 1. Comparison of financial data across companies Comparisons of one company with another can provide information about the financial health of an organization. However, the following factors make it difficult to compare their financial data: • • • Differences in accounting methods and estimates Valuation problem – Financial statements are based on historical costs and, therefore, do not reflect the current market value of the firm’s assets. Moreover, the effects of price level changes must be considered. The timing of transactions and the use of averages in applying the various techniques in FS analysis affect the results obtained. 2. The need to look beyond ratios These refer to the financial ratios. The ratios are designed to show relationships between financial statement accounts. For example, Company A might have a debt of P2 million and interest charges of P150,000, while Company B might have a debt of P20 million and interest charges of P1.5 million. Which company is stronger? It depends. The burden of these debts and the company’s ability to repay them can be ascertained by comparing each firm’s debt to its assets or by comparing the interest to the income available for the payment of interest. However, financial ratios should not be viewed as an end, but rather as a starting point. Ratios are not sufficient in themselves as a basis for judgment about the future. Other factors must be considered, such as the following: Internal factors • Employee learning and growth • Business process performance • Customer satisfaction External factors • Industry trends • Technological changes • Changes in consumer tastes • Changes in broad economic indicators 05 Handout 1 student.feedback@sti.edu *Property of STI Page 1 of 10 BMSH2003 Horizontal analysis An item on a balance sheet or income statement has little meaning by itself. Suppose a company’s sales for a year were P2,500,000. In isolation, that is not particularly useful information. How is that item compared to last year’s sales? How do the sales relate to the cost of goods sold? In making these comparisons, three (3) analytical techniques are widely used: 1. Horizontal analysis 2. Vertical analysis 3. Ratio analysis. Also known as trend analysis, horizontal analysis involves analyzing data over time, such as computing yearto-year peso and percentage changes within a set of financial statements. Each item on the most recent statement is compared with the same item on one (1) or more earlier statements, in which the earlier statement is normally used as the base year for computing increases and decreases (Garrison, Noreen, & Brewer, 2018). Percentage change = Most recent value - Base period value Most recent value Peso change = Most recent value - Base period value A comprehensive illustration of the horizontal analysis in the comparative financial statements of Mighty Warrior Corporation is shown below. Note that the amounts are in pesos. Mighty Warrior Corporation Comparative Statement of Financial Position December 31, 201B and 201A Increase (Decrease) Peso change % change 201B 201A Assets Current Assets Cash Marketable Securities Accounts Receivable, Net Inventory Prepaid Expenses Total Current Assets 100,000 40,000 80,000 200,000 30,000 450,000 127,000 40,000 100,000 140,000 20,000 427,000 (27,000) 0 (20,000) 60,000 10,000 23,000 (21.3%) 0.0% (20.0%) 42.9% 50.0% 5.4% Long-Term Investments Property, Plant, and Equipment Intangible Assets Total Assets 180,000 510,400 90,000 1,230,400 162,500 603,000 120,000 1,312,500 17,500 (92,600) (30,000) (82,100) 10.8% (15.4%) (25.0%) (6.3%) 140,000 130,000 270,000 162,000 220,000 382,000 (22,000) (90,000) (112,000) (13.6%) (40.9%) (29.3%) 630,000 330,400 960,400 630,000 300,500 930,500 0 29,900 52,900 0.00% 10.0% 5.7% 1,253,400 1,312,500 (82,100) (6.3%) Liabilities Current Liabilities Long-Term Liabilities Total Liabilities Stockholders' Equity Common Stock, P30 par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Table 1. Horizontal analysis – Comparative statement of financial position 05 Handout 1 student.feedback@sti.edu *Property of STI Page 2 of 10 BMSH2003 Mighty Warrior Corporation Comparative Income Statement December 31, 201B and 201A 201B 455,000 5,000 450,000 297,000 153,000 52,000 101,000 18,250 82,750 24,825 57,925 Sales Less: Sales Returns and Allowances Net Sales Less: Cost of goods sold Gross Profit Less: Operating Expenses Income from operations Less: Interest expense Income before income tax Less: Income Tax (30%) Net Income Increase (Decrease) Peso change % change 65,000 16.7% 2,000 66.7% 63,000 16.3% 8,250 2.9% 54,750 55.7% 30,000 136.4% 24,750 32.5% (2,750) (13.1%) 27,500 49.8% 8,250 49.8% 19,250 49.8% 201A 390,000 3,000 387,000 288,750 98,250 22,000 76,250 21,000 55,250 16,575 38,675 Table 2. Horizontal analysis – Comparative income statement An extended horizontal analysis can be developed, and it is called trend analysis. For example, assume the sales and net income items for the past seven (7) years are as follows: Sales Net Income 201A 313,425 100% 201B 341,805 109% 201C 352,830 113% 201D 341,175 109% 201E 361,125 115% 201F 421,590 135% 201G 411,615 131% 53,160 100% 35,925 68% 64,695 122% 68,265 128% 74,190 140% 83,790 158% 71,370 134% Table 3. Trend analysis The data above shows that sales increased every year except for years 201D and 201G and the net income increased every year except 201B and 201G. In the table, both the sales and net income have been restated as percentages of the 201A sales and net income. Note that the earliest year should be the base period unless otherwise stated. For example, the sales during 201E of P361,125 is 115% of the sales during 201A of P313,425. This trend analysis is plotted in Figure 1. TREND ANALYSIS Sales Net income 200% 150% 100% 128% 113% 109% 115% 201C 201D 201E 158% 134% 109% 100% 50% 140% 122% 135% 131% 201F 201G 68% 0% 201A 201B Figure 1. Trend analysis Vertical Analysis Vertical analysis focuses on the relations among financial statements at a given point in time (Garrison, Noreen, & Brewer, 2018). A common-size financial statement is a vertical analysis in which each account is expressed as a percentage. In the statement of financial position, all items are expressed as a percentage of total assets and total liabilities and equity, while in income statements, all items are expressed as a percentage of net sales. A common size balance sheet and income statement are shown below. 05 Handout 1 student.feedback@sti.edu *Property of STI Page 3 of 10 BMSH2003 Mighty Warrior Corporation Common-Size Statement of Financial Position December 31, 201B and 201A 201B 201A Assets Current Assets Cash Marketable Securities Accounts Receivable, net Inventory Prepaid Expenses Total Current Assets 100,000 40,000 80,000 200,000 30,000 450,000 8.13% 3.25% 6.50% 16.25% 2.44% 36.57% 127,000 40,000 100,000 140,000 20,000 427,000 9.68% 3.05% 7.62% 10.67% 1.52% 32.53% Long-Term Investments Property, Plant, and Equipment 180,000 510,400 14.63% 41.48% 162,500 603,000 12.38% 45.94% 90,000 1,230,400 7.31% 100% 120,000 1,312,500 9.14% 100% 140,000 130,000 270,000 11.38% 10.57% 21.94% 162,000 220,000 382,000 12.34% 16.76% 29.10% 630,000 330,400 960,400 1,230,400 51.20% 26.85% 78.06% 100% 630,000 300,500 930,500 1,312,500 48.00% 22.90% 70.90% 100% Intangible Assets Total Assets Liabilities Current Liabilities Long-Term Liabilities Total Liabilities Stockholders' Equity Common Stock, P30 par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity Table 4. Vertical analysis – Common-size statement of financial position Mighty Warrior Corporation Common-Size Income Statement December 31, 201B and 201A (in pesos) 201B Sales 455,000 101.11% Less: Sales Returns and Allowances 5,000 1.11% Net Sales 450,000 100.00% Less: Cost of goods sold 297,000 66.00% Gross Profit 153,000 34.00% Less: Operating Expenses 52,000 11.56% Income from operations 101,000 22.44% Less: Interest expense 18,250 4.06% Income before income tax 82,750 18.39% Less: Income Tax (30%) 24,825 5.52% Net Income 57,925 12.87% 201A 390,000 3,000 387,000 288,750 98,250 22,000 76,250 21,000 55,250 16,575 38,675 100.8% 0.8% 100.0% 74.6% 25.4% 5.7% 19.7% 5.4% 14.3% 4.3% 10.0% Table 5. Vertical analysis – Common-size income statement Ratio Analysis Financial statements are fundamentally related. Data contained in one statement is also related to that information found in another. In the financial ratio analysis, the account used from the financial statements shall be as follows: Financial Statements Income Statement Statement of Financial Position 05 Handout 1 student.feedback@sti.edu Basis Net amount Average Examples Net sales, net income, net purchases (Beginning balance + Ending Balance) 2 *Property of STI Page 4 of 10 BMSH2003 The following are the most common ratios used by financial analysts: I. STATEMENT OF FINANCIAL POSITION Liquidity Ratios Liquidity refers to how quickly an asset can be converted into cash. Companies need to continuously monitor the amount of liquid assets (current assets) relative to the amount they owe to short-term creditors (current liabilities), such as suppliers. If a company’s liquid assets are not enough to support timely payments to creditors, this presents an important management problem that, if not remedied, can lead to bankruptcy. RATIO FORMULA 1 Net working capital 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠 − 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 2 Current ratio 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 SIGNIFICANCE If a company has enough working capital, it assures that the company can pay its creditors in full and on time. However, it must be financed with long-term debt and equity—both of which are expensive. Furthermore, a large and growing working capital may indicate troubles, such as excessive growth in inventories. It is the basic test of liquidity of the firm. This will determine the adequacy of working capital to meet current obligations. It measures a rough estimate of the ability of the business to meet its currently maturing obligations; this ratio varies in great disparity from one industry to another. The higher the current ratio, the better, as it would mean more current assets are available for paying its current obligations. 3 𝑄𝑢𝑖𝑐𝑘 𝑎𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 Quick ratio (Acid-test ratio) A ratio of 1.0 means current assets can fully cover its current liabilities. However, some creditors require a current ratio of 2.0 as a margin of safety. It is a more severe test of immediate liquidity to meet currently maturing obligations. OR 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠 − 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 − 𝑃𝑟𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 Quick assets include cash, marketable securities, and receivables. Current assets such as inventory takes a longer time to liquidate and prepaid expenses are not convertible to cash, thus, they are not included. The higher the quick ratio, the better the liquidity position of the firm. A quick ratio of 1.0 is acceptable. 05 Handout 1 student.feedback@sti.edu *Property of STI Page 5 of 10 BMSH2003 Creditors give greater importance to net working capital and current ratio as indicators of the company’s ability to pay if the company’s sources of cash inflows are uncertain and unstable, for example, creditors may allow current ratios lower than 2.0 for those companies with constant and stable cash flows (Salazar, 2017). Asset Management Ratios It measures how the firm uses its assets to generate revenue and income. It is a set of ratios that measures how effectively a firm is managing its assets. These ratios are called utilization ratios, and these measure how effectively the firm utilized its assets to earn profits. Normally, companies borrow or obtain capital from other sources to acquire assets. If a company has too many assets acquired through borrowings, the interest expenses will be too high, hence a lower profit. On the other hand, if assets are too low, profitable sales may be lost. Managing assets, most especially current assets, will help the firm avoid borrowing funds to finance operations. 1 2 3 4 RATIO Accounts receivable turnover FORMULA 𝑁𝑒𝑡 𝑐𝑟𝑒𝑑𝑖𝑡 𝑠𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 Number of days in accounts receivable 365 𝑑𝑎𝑦𝑠 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 𝑡𝑢𝑟𝑛𝑜𝑣𝑒𝑟 Average collection period Inventory turnover Number of days in inventory SIGNIFICANCE It measures the efficiency of collections. The higher the turnover, the better, as it would mean a greater number of times receivable is reinvested for more profit. It measures the average number of days to collect a receivable. The shorter, the better. 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑎𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑑𝑎𝑖𝑙𝑦 𝑠𝑎𝑙𝑒𝑠 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 365 𝑑𝑎𝑦𝑠 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑡𝑢𝑟𝑛𝑜𝑣𝑒𝑟 It determines how fast the inventories are converted to sales. It indicates if a firm holds excessive inventories that are unproductive, which lessens the company’s productivity. Note that it is measured based on cost of sales or cost of goods sold, and not sales, because upon sale, the cost of inventory is transferred to the cost of goods sold. For a manufacturing company, the number of days and turnover is determined for each item in the inventory. • Raw materials turnover • Work in process turnover • Finished goods turnover It measures the average number of days that inventory is held before sale. 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑑𝑎𝑖𝑙𝑦 𝑐𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 5 Fixed assets turnover 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑒𝑡 𝑓𝑖𝑥𝑒𝑑 𝑎𝑠𝑠𝑒𝑡𝑠 6 Total assets turnover 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 05 Handout 1 student.feedback@sti.edu It measures the level of use of fixed assets such as property, plant, and equipment to generate sales. It measures the effectiveness of asset utilization and determines the number of times investments in assets are used to generate sales. The more the number of times it turns over, the higher profit the company utilized its assets. *Property of STI Page 6 of 10 BMSH2003 Solvency Ratios or Financial Leverage It measures the ability of the business to use debt in maximizing the shareholder’s value. These measure the extent to which the firm uses its debt financing or financial leverage. Some important implications can be raised: 1. By raising funds through debt, owners can maintain control of the firm with limited investment. 2. Creditors look to the equity, or owner-supplied funds, to provide a margin of safety, that is, if the owners have provided only a small proportion of the total financing, the risks of the enterprise are borne mainly by its creditors. However, financial leverage raises the expected rate of return to stockholders for two (2) reasons: 1. Since interest is deductible, the use of debt financing lowers the tax and leaves more of the firm’s operating income available to its shareholders. 2. If the rate of return on assets (net income/total assets) exceeds the interest rate on debt, as it generally does, then the company can use debts to finance assets, pay the interest on the debt, and have something left over for its stockholders. Normally, firms with high debt ratios are exposed to more risks of losses and have higher expected returns. Conversely, firms with low debt ratios are less risky, but they also forego the opportunity to leverage up on their return on equity. 1 Ratio Debt-to-equity ratio 2 Debt ratio or Debt-to-assets ratio 3 Equity ratio 4 Times-interestearned (TIE) or interest coverage ratio Formula 𝑇𝑜𝑡𝑎𝑙 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝑠𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝑒𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 Significance It measures the use of debt to finance operations and provides a measure of relative amount of resources contributed by the creditors and owners. It measures the relative share of creditors over the total resources of the firm. 1 − 𝐸𝑞𝑢𝑖𝑡𝑦 𝑟𝑎𝑡𝑖𝑜 𝑇𝑜𝑡𝑎𝑙 𝑠𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝑒𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 It measures the amount of resources provided by the owners of the firm. 1 − 𝐷𝑒𝑏𝑡 𝑟𝑎𝑡𝑖𝑜 II. 𝐸𝐵𝐼𝑇 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 Earnings before income and taxes (EBIT) is the income from operations before deducting interest and taxes. This is the ability of the firm to meet its annual interest payments with its operating income before interest and taxes. A ratio greater than 1.0 means that the company’s EBIT can meet its interest expense. However, creditors prefer a higher TIE ratio to ensure that the company will be able to meet interest payments as they become due. INCOME STATEMENT Profitability Ratios Profitability is a measure of operating effectiveness. It measures the ability of the business to recover long-term investments from money generated by its normal operating activities. It also measures earnings in relation to some base such as assets, sales, or capital. 05 Handout 1 student.feedback@sti.edu *Property of STI Page 7 of 10 BMSH2003 1 Ratio Profit margin on sales / Return on sales (ROS) 2 Gross Profit ratio 3 Cost ratio Formula 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 𝐺𝑟𝑜𝑠𝑠 𝑝𝑟𝑜𝑓𝑖𝑡 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 4 Return on investment (ROI) / Return on assets (ROA) 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 5 Return on equity (ROE) 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝐴𝑣𝑒𝑟𝑔𝑎𝑔𝑒 𝑠𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝑒𝑞𝑢𝑖𝑡𝑦 Significance It measures net profit percentage per peso sales.it is the peso value of the net income earned for every pesos of sales. It measures the gross profit percentage on sales to recover operating expenses. It measures the proportion of the cost of goods sold to sales. For example, if the cost ratio is 60%, the gross profit margin is 40%. It measures the overall asset profitability and indicates how the management has employed effective assets to produce income. A high ratio is indicative of a high operating efficiency of the business, and a low ratio indicates low operating efficiency. A company with high ROA is judged to be more profitable. It measures the percentage of income derived for every peso of the owner’s equity. A company with high ROE is judged to be more profitable. Note: All ratios could be more meaningful if they are compared to the industry standards so that the financial analyst could assess the performance of the company in relation to its competitors. ILLUSTRATIVE PROBLEM: Financial statement analysis of Mighty Warrior Corporation 1. Net working capital Current assets Current liabilities 2. Current ratio Current assets Current liabilities 3. Quick Ratio Quick assets Current liabilities Year 1 Year 2 P427,000 162,000 P265,000 P450,000 140,000 P310,000 P427,000 162,000 2.64 P450,000 140,000 3.21 P267,000 162,000 1.65 P220,000 140,000 1.57 4. Accounts receivable (A/R) turnover (assuming all sales are on credit) 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑃450,000 = = 𝟓. 𝟎 𝒕𝒊𝒎𝒆𝒔 𝑃100,000 + 𝑃80,000 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝐴/𝑅 + 𝐸𝑛𝑑𝑖𝑛𝑔 𝐴/𝑅 ) ( ) ( 2 2 05 Handout 1 student.feedback@sti.edu *Property of STI Page 8 of 10 BMSH2003 5. Number of days in accounts receivable / Average collection period 365 𝑑𝑎𝑦𝑠 365 𝑑𝑎𝑦𝑠 = = 𝟕𝟑 𝒅𝒂𝒚𝒔 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒 𝑡𝑢𝑟𝑛𝑜𝑣𝑒𝑟 5 OR 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴/𝑅 𝑃90,000 = = 𝟕𝟑 𝒅𝒂𝒚𝒔 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑑𝑎𝑖𝑙𝑦 𝑠𝑎𝑙𝑒𝑠 (𝑃450,000) 365 𝑑𝑎𝑦𝑠 6. Inventory turnover 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 𝑃297,000 = = 𝟏. 𝟕𝟓 𝒕𝒊𝒎𝒆𝒔 𝑃140,000 + 𝑃200,000 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 + 𝐸𝑛𝑑𝑖𝑛𝑔 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 ) ( ) ( 2 2 7. Number of days in inventory 365 𝑑𝑎𝑦𝑠 365 𝑑𝑎𝑦𝑠 = = 𝟐𝟎𝟖. 𝟓𝟕 𝒅𝒂𝒚𝒔 𝒐𝒓 𝟐𝟎𝟗 𝒅𝒂𝒚𝒔 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑡𝑢𝑟𝑛𝑜𝑣𝑒𝑟 1.75 OR 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑃170,000 = = 𝟐𝟎𝟖. 𝟗𝟐 𝒅𝒂𝒚𝒔 𝒐𝒓 𝟐𝟎𝟗 𝒅𝒂𝒚𝒔 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑑𝑎𝑖𝑙𝑦 𝑐𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 (𝑃297,000) 365 𝑑𝑎𝑦𝑠 8. Fixed assets turnover 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 450,000 = = 𝟎. 𝟖𝟏 𝒕𝒊𝒎𝒆𝒔 (𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 + 𝐸𝑛𝑑𝑖𝑛𝑔) (𝑃603,000 + 𝑃510,400) 2 2 9. Total assets turnover 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑃450,000 = = 𝟎. 𝟑𝟓 𝒕𝒊𝒎𝒆𝒔 (𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠) (𝑃1,312,500 + 𝑃1,230,400) 2 2 10. Debt-to-equity ratio 𝑇𝑜𝑡𝑎𝑙 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝑠𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝑒𝑞𝑢𝑖𝑡𝑦 Year 201A 𝑃382,000 = 𝑃930,500 Year 201B 𝑃270,000 = 𝑃960,400 = 𝟎. 𝟒𝟏 = 𝟎. 𝟐𝟖 Year 201A 𝑃382,000 = 𝑃1,312,500 Year 201B 𝑃270,000 = 𝑃1,230,400 = 𝟎. 𝟐𝟗 = 𝟎. 𝟐𝟐 Year 201A 𝑃930,500 = 𝑃1,312,500 Year 201B 𝑃960,400 = 𝑃1,230,400 = 𝟎. 𝟕𝟏 = 𝟎. 𝟕𝟖 11. Debt ratio / Debt-to-assets ratio 𝑇𝑜𝑡𝑎𝑙 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 12. Equity ratio 𝑇𝑜𝑡𝑎𝑙 𝑠𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 ′ 𝑒𝑞𝑢𝑖𝑡𝑦 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 05 Handout 1 student.feedback@sti.edu *Property of STI Page 9 of 10 BMSH2003 13. Times-interest-earned 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑏𝑒𝑓𝑜𝑟𝑒 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑎𝑛𝑑 𝑡𝑎𝑥𝑒𝑠 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 Year 201A 𝑃76,250 = 𝑃21,000 Year 201B 𝑃101,000 = 𝑃18,250 = 𝟑. 𝟔𝟑 𝒕𝒊𝒎𝒆𝒔 = 𝟓. 𝟓𝟑 𝒕𝒊𝒎𝒆𝒔 14. Profit margin on sales / Return on sales (ROS) 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑃57,925 = = 𝟏𝟐. 𝟖𝟕% 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑃450,000 15. Gross profit ratio 𝐺𝑟𝑜𝑠𝑠 𝑃𝑟𝑜𝑓𝑖𝑡 𝑃153,000 = = 𝟑𝟒% 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑃450,000 16. Cost ratio 𝐶𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑠𝑜𝑙𝑑 𝑃450,000 = = 𝟔𝟔% 𝑁𝑒𝑡 𝑠𝑎𝑙𝑒𝑠 𝑃297,000 17. Return on investment (ROI) / Return on assets (ROA) 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑃57,925 = = 𝟒. 𝟓𝟔% (𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 + 𝐸𝑛𝑑𝑖𝑛𝑔) (𝑃1,312,500 + 𝑃1,230,400) 2 2 18. Return on equity 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 𝑃57,925 = = 𝟔. 𝟏𝟑% ′ 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑠𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 𝑒𝑞𝑢𝑖𝑡𝑦 (𝑃930,500 + 960,400) 2 References: Garrison, R. H., Noreen, E. W., & Brewer, P. C. (2018). Managerial Accounting, Sixteenth Edition. McGraw-Hill Education. International Accounting Standards Board. (n.d.). IAS 1 — Presentation of Financial Statements. Retrieved from IASPlus: https://www.iasplus.com/en/standards/ias/ias1 Payongayong, L. S. (2016). Management Services. Polytechnic University of the Philippines. Salazar, D. (2017). Fundamentals of Accountancy, Business and Management 2. Rex Book Store, Inc. 05 Handout 1 student.feedback@sti.edu *Property of STI Page 10 of 10