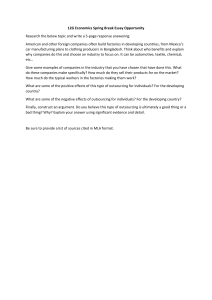

Boost Your Business Efficiency with Accounting Outsourcing Services in the USA Outsourcing is becoming a more popular option for businesses looking to simplify operations and concentrate on their core skills in the fast-paced corporate world. Two essential tasks that stand to gain greatly from outsourcing are bookkeeping and accounting. This article examines the best bookkeeping and Accounting Outsourcing Services in the USA and how they might improve compliance, growth, and business efficiency. The Need for Outsourcing By outsourcing their bookkeeping and accounting needs, businesses can lower operating expenses, guarantee regulatory compliance, and take advantage of the experience of specialized service providers. This strategy is especially helpful for small and medium-sized businesses (SMEs), which might not have the funding to keep an internal accounting staff. Benefits of Accounting Outsourcing Services in the USA 1. Cost Efficiency ○ Example: Outsourcing to a specialized firm means a small business in the USA can save up to 60% on accounting costs. The savings can then be reinvested into other crucial areas like product development and marketing. 2. Access to Expertise ○ Example: Through outsourcing, a company can have access to a group of accountants with extensive knowledge of accounting and compliance guidelines, guaranteeing accurate and current financial records. 3. Focus on Core Business Activities ○ As an illustration, a technological business can focus on developing new products and attracting clients while leaving the financial reporting and compliance to its external accounting team. 4. Scalability and Flexibility ○ Example: To ensure that all transactions are accurately and promptly recorded, a retail organization might grow its accounting demands during peak seasons by outsourcing more duties. 5. Technological Advancements ○ Example: Outsourcing companies frequently use the newest accounting software and technology to deliver real-time financial data and insights, such as cloud-based platforms. Top Accounting Outsourcing Services in the USA 1. PwC (PricewaterhouseCoopers) In the USA, PwC is one of the top suppliers of accounting outsourcing services in the USA. They provide all-inclusive solutions for bookkeeping, payroll processing, tax preparation, and financial reporting. PwC's broad knowledge and global presence guarantee that businesses receive top-notch service that is customized to meet their unique needs. ● Services Offered: ○ Accounting and bookkeeping ○ Planning and preparation for taxes ○ Processing payroll ○ Analysis and reporting of financial data ○ Regulatory and compliance services 2. Deloitte With a focus on assisting companies in increasing productivity and compliance, Deloitte offers a broad range of accounting outsourcing services in the United States. They offer risk management, tax advice, bookkeeping, and financial reporting. ● Services Offered: ○ Maintaining financial records and keeping books ○ Analysis and reporting of financial data ○ Internal controls and risk management ○ Advice on taxes and compliance 3. KPMG KPMG provides tailored outsourced solutions for bookkeeping, accounting, and compliance. They help companies comply with regulatory regulations by offering services like risk management, tax compliance, and financial statement production. ● Services Offered: ○ Accounting and bookkeeping services ○ Preparation of financial statements ○ Planning and adherence to taxes ○ Internal audits and risk management 4. Ernst & Young (EY) In the USA, Ernst & Young is well-known for providing complete accounting outsourcing services. To assist businesses in effectively managing their financial operations, they provide bookkeeping, tax services, financial reporting, and compliance solutions. ● Services Offered: ○ Maintaining financial records and books ○ Services and compliance related to taxes ○ Analysis and reporting of financial data ○ Regulatory advice and compliance 5. BDO USA, LLP BDO offers comprehensive accounting outsourcing services in the United States, emphasizing providing solutions for bookkeeping, financial reporting, and compliance. Their professional team ensures that companies keep correct financial records and comply with all legal obligations. ● Services Offered: ○ Accounting and bookkeeping services ○ Analysis and reporting of financial data ○ Planning and adherence to taxes ○ Regulatory and compliance services 6. RSM US LLP RSM US LLP provides specialized accounting outsourcing services in the USA to meet the specific requirements of companies in a range of industries. These services include advising, tax compliance, bookkeeping, and financial statement preparation. ● Services Offered: ○ Maintaining financial records and keeping books ○ Preparing and analyzing financial statements ○ Advisory and compliance with taxes ○ Regulatory and compliance services Choosing the Right Outsourcing Partner Choosing the correct outsourcing partner is essential to get the most out of bookkeeping and accounting outsourcing. Here are some things to think about: 1. Knowledge and Experience—Make sure the outsourcing company is knowledgeable about accounting and compliance rules and has extensive experience in your sector. 2. Tools and Technology—Select a company that offers real-time data and insights by utilizing the latest technology and accounting software. 3. Ability to scale—Make sure the outsourcing partner can adjust their services to meet your company's demands, especially during times of expansion or high demand. 4. Price- Examine the prices of various services and make sure there are no hidden costs in the pricing 5. Credibility—Check the company's reputation and customer testimonials to ensure a history of providing high-caliber services. Industry Trends and Innovations in Accounting Outsourcing The USA's accounting outsourcing market is always changing due to shifting corporate requirements and technological breakthroughs. Keeping up with these developments can assist companies in making wise choices and maximizing the advantages of outsourcing. 1. Automation and Artificial Intelligence Artificial intelligence (AI) and automation are changing the accounting sector. Outsourcing companies are increasingly using AI-powered solutions to automate repetitive processes like data entry, transaction processing, and financial reconciliation. This decreases the possibility of human error while increasing efficiency. For instance, an AI-driven system may provide financial reports, automatically classify spending, and highlight inconsistencies, freeing up accountants to work on other strategic projects. 2. Blockchain Technology The accounting industry is seeing a rise in the use of blockchain technology since it offers a transparent and unchangeable record. Because it improves the confidentiality and integrity of financial records, this technology is a desirable choice for companies trying to streamline their accounting procedures. Example: An outsourcing company can provide clients more confidence in the security and correctness of their financial data by utilizing blockchain to guarantee that all transactions are safely documented and readily traceable. 3. Cloud-Based Accounting Since they provide real-time access to financial data from anywhere in the globe, cloud-based accounting solutions are starting to become the standard. This flexibility is especially helpful for companies that have several locations or remote personnel. For instance, business owners can work with their outsourced accounting team, keep an eye on their financial situation, and make decisions based on current information by utilizing a cloud-based platform such as QuickBooks Online. 4. Data Analytics and Business Intelligence Outsourcing companies are using business intelligence and data analytics solutions to offer more in-depth analyses of financial performance. These tools recognize patterns, project performance in the future, and provide tactical advice. Example: By evaluating financial data, an outsourcing company can assist a retail organization in determining its most successful products, streamlining inventory control, and creating winning price plans. 5. Regulatory Compliance and Risk Management Compliance is becoming increasingly important in accounting outsourcing as regulatory settings become more complicated. Outsourcing companies are strengthening their compliance expertise to assist companies in navigating these obstacles and reducing risks. Example: An outsourcing partner with experience in accounting and compliance can lower the chance of fines and legal problems by ensuring that a business's financial procedures comply with the most recent standards. Emerging Outsourcing Destinations Although the United States continues to be the leading outsourcing market, other areas are becoming important participants in the sector. Nations such as India, the Philippines, and Eastern European countries offer a combination of cost-effectiveness, highly qualified personnel, and cutting-edge technology. Example: To save money and get top-notch service, an American company may think about contracting out some of its accounting work to an Eastern European company. Sustainability and Corporate Social Responsibility (CSR) CSR and sustainability are starting to matter when choosing an outsourcing partner. Businesses are searching more and more for outsourcing partners who place a high priority on moral behavior, environmental sustainability, and constructive social impact. Example: A business can achieve its sustainability objectives and receive critical services from an accounting outsourcing company that adopts green practices, like cutting back on paper use and encouraging remote work. Conclusion There are several advantages to outsourcing bookkeeping and accounting services in the United States, such as cost-effectiveness, access to knowledge, concentration on core competencies, scalability, and cutting-edge technology. Through collaboration with leading outsourcing companies such as PwC, Deloitte, KPMG, Ernst & Young, BDO, and RSM US LLP, companies may guarantee precise financial administration, adherence to legal requirements, and optimal operational effectiveness. When contemplating this calculated action, be sure the partner you select shares your vision for your company and has the knowledge, resources, and adaptability needed to help you succeed with the help of some leading accounting outsourcing services in the USA.