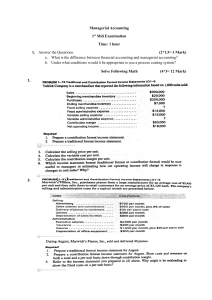

CHAPTER 1 MANAGERIAL ACCOUNTING IN THE INFORMATION AGE CHAPTER INTRODUCTION Financial accounting stresses accounting concepts and procedures that relate to preparing reports for external users of accounting information. In comparison, managerial accounting stresses accounting concepts and procedures that are relevant to preparing reports for internal users of accounting information. This chapter provides an overview of the role of managerial accounting in planning, control, and decision making. It also defines important cost concepts and introduces key ideas that will be emphasized throughout the text. The chapter concludes with a discussion of the information age and the impact of information technology on business, a framework for ethical decision-making and the role of the controller as the top management accountant. Note that you can enhance and test your knowledge of the chapter using Wiley’s online resources, the self-assessment quiz and review problems at the end of the chapter. Objectives, Terms, and Discussions LO1 Explain the primary goal of managerial accounting and distinguish between financial and managerial accounting. GOAL OF MANAGERIAL ACCOUNTING Managers need to plan and control their operations and make a variety of decisions. The goal of managerial accounting is to provide the information managers need for planning, control, and decision making. Planning A plan communicates a company's goals to employees and specifies the resources needed to achieve them. The financial plans prepared by managerial accountants are referred to as budgets. For example, a profit budget indicates planned income, a cash-flow budget indicates planned cash inflows and outflows, and a production budget indicates the planned quantity of production and the expected cost. Control Control of organizations is achieved by evaluating the performance of managers and the operations for which they are responsible. Managers are evaluated to determine how their performance should be rewarded or punished, motivating them to perform at a high level. Evaluations of managers are typically tied to compensation and promotion opportunities. Operations are evaluated to provide information as to whether or not they should be changed. An evaluation of an operation can be negative even when the evaluation of the manager responsible for the operation is basically positive. 2 Study Guide to accompany Jiambalvo Managerial Accounting Company plans often play an important role in the control process. Managers can compare actual results with planned results and decide if corrective action is needed. Actual results may differ from the plan for several reasons. The plan may not have been followed properly. The plan may not have been well thought out. Changing circumstances may have made the plan out of date. The reports used to evaluate the performance of managers and the operations they control are referred to as performance reports. Typically, performance reports only suggest areas that should be investigated; they do not provide definitive information on performance. Although there is no generally accepted method of preparing a performance report, such reports frequently involve a comparison of current period performance with prior period performance or with planned (budgeted) performance. Managers use performance reports to "flag" areas that need closer attention and to avoid areas that appear to be under control. For example, a manager would not investigate rent if the actual costs were equal to the planned level of rent costs. Managers typically follow the principle of management by exception when using performance reports. This means that managers investigate departures from the plan that appear to be exceptional; they do not investigate minor departures from the plan. Decision Making Decision making is an integral part of the planning and control process; decisions are made to reward or punish managers, to change operations, or to revise plans. Chapters 7, 8 and 9 are devoted to the topic of making good decisions. As seen below, one of the two key ideas of managerial accounting relates to decision making and its focus on so-called incremental analysis. A COMPARISON OF MANAGERIAL AND FINANCIAL ACCOUNTING There are several important differences between managerial and financial accounting. 1. Managerial accounting is directed at internal rather than external users of accounting information. External users include investors, creditors, and government agencies that use information to make investment, lending, and regulatory decisions. Internal managers need information for planning, control, and decision making. 2. Managerial accounting may deviate from generally accepted accounting principles (GAAP). Companies prepare financial accounting information in accordance with GAAP to satisfy creditors, investors, and governmental agencies. Managerial accounting is completely optional and stresses information that is useful to internal managers for planning, control, and decision making. If deviating from GAAP will provide more useful information to internal managers, GAAP need not be followed. 3. Managerial accounting may present more detailed information. Financial accounting presents information in a highly summarized form. For example, net income is presented for the company as a whole. Managers need more detailed information. Information about the cost of operating individual departments is needed by internal managers versus the cost of operating the company as a whole, or sales broken out by product versus total company sales. Chapter 1 Managerial Accounting in the Information Age 3 4. Managerial accounting may present more nonmonetary information. Both managerial and financial accounting reports generally contain monetary information (information expressed in dollars such as revenues and expenses). However, managerial accounting reports often contain a substantial amount of additional nonmonetary information. For example, the quantity of material consumed in production, the number of hours worked by employees, and the number of product defects are important data that appear in managerial accounting reports. 5. Managerial accounting places more emphasis on the future. Financial accounting is concerned with presenting the results of past transactions. One of the primary purposes of managerial accounting is planning, which involves estimating the costs and benefits of future transactions. Several differences between managerial and financial accounting have been presented. However, external and internal users often seek similar information. Managers make significant use of financial accounting reports, and external users occasionally request financial information that is appropriate for internal users. For example, creditors may request a detailed cash-flow projection. LO2 Define cost terms used in planning, control, and decision making. COST TERMS USED IN DISCUSSING PLANNING, CONTROL, AND DECISION MAKING Variable costs are costs that increase or decrease in proportion to increases or decreases in the level of business activity. Material and direct labor are generally considered to be variable costs because in many situations they fluctuate in proportion to changes in production (business activity). Variable cost per unit does not change when production changes. Suppose Surge Performance Beverage Company incurred $188,000 of variable costs in the prior month when production was 400,000 bottles. How much variable cost should be incurred in the current month if production is expected to increase by 20 percent to 480,000 bottles? If production increases by 20 percent, the total variable cost would be expected to increase to $225,600 ($188,000 × 120%). Note that the variable cost per unit remains $0.47 per bottle ($188,000/400,000 bottles or $225,600/480,000 bottles). Fixed costs are costs that remain constant when there are changes in the level of business activity. Examples of fixed costs are depreciation and rent. Suppose that in the prior month, Surge Performance Beverage Company incurred $20,000 of fixed costs including rent, depreciation, and miscellaneous fixed costs. If the company increases production to 480,000 bottles in the current month, the levels of rent, depreciation, and other fixed costs should remain the same as when production was only 400,000 bottles. The cost per unit of fixed costs does change when there are changes in production. When production increases, the constant amount of fixed cost is spread over a larger number of units. This drives down the fixed cost per unit. At an activity level of 480,000 bottles, total fixed costs remains at $20,000. However, fixed cost per unit decreases from $0.0500 ($20,000/400,000 bottles) per unit to $0.0417 ($20,000/480,000 bottles) per unit. Costs incurred in the past are referred to as sunk costs. Sunk costs are not relevant for decision making because they do not change when decisions are made. Assume that after you purchase a ticket to a play for $30, a friend invites you to a party scheduled for the same night. If you go to the party you will not be able to attend the play. The cost of the ticket is irrelevant to the decision as to whether or not you should go to the party. What is relevant is how much you 4 Study Guide to accompany Jiambalvo Managerial Accounting will enjoy the party versus the play and the amount for which you can sell the ticket (not how much you paid for it). The $30 price of the ticket is a sunk cost. Opportunity cost is the value of benefits foregone when one decision alternative is selected over another. For example, suppose Surge Performance Beverage Company refuses an order to produce 50,000 bottles for a grocery chain because taking the order will require the company to miss delivery deadlines on orders already taken. If the order would have generated $50,000 of additional revenue (the product sells for $1 per bottle) and $23,500 of additional costs, the opportunity cost (the net benefit foregone) is $26,500 ($50,000 - $23,500). Direct costs are costs that are directly traced to a product, activity, or department. Indirect costs are those that either cannot be directly traced to a product, activity, or department, or are not worth tracing. The distinction between a direct and an indirect cost depends on the object of the cost tracing. A manager can influence a controllable cost, but cannot influence a noncontrollable cost. The distinction between controllable and noncontrollable costs is especially important when evaluating manager performance. A manager should not be evaluated unfavorably if a noncontrollable cost sharply increases. LO3 Explain the two key ideas in managerial accounting. TWO KEY IDEAS IN MANAGERIAL ACCOUNTING Key Idea I: Decision making relies on incremental analysis—an analysis of the revenues that increase (decrease) and the costs that increase (decrease) if a decision alternative is selected. Essentially, incremental analysis involves the calculation of the difference in revenue and the difference in cost between decision alternatives. The difference in revenue is the incremental revenue of one alternative over another, whereas the difference in cost is the incremental cost of one alternative over another. If an alternative yields an incremental profit, it is the preferred alternative. Incremental analysis is the appropriate way to approach the solution to all business problems. Key Idea 2: You get what you measure. In other words, performance measures greatly influence the behavior of managers. Companies can select from a vast number of performance measures. Examples of performance measures include profit, market share, sales to new customers, product development time, number of defective units produced, and number of late deliveries. Companies need to develop a balanced set of performance measures and avoid placing too much emphasis on any single measure. LO4 Discuss the impact of information technology on competition, business processes, and the interactions companies have with suppliers and customers. THE INFORMATION AGE AND MANAGERIAL ACCOUNTING Advances in information technology have radically changed access to information and, in consequence, the business landscape—so much so, that the current business era is frequently referred to as the information age. Competition and information technology: Business competition since the 1970s has been intense. Deregulation of airlines and banking, the dropping of trade barriers, the organization of the European Union, and the economic development in Asia have all played a role. Now, advances in information technology are redefining the meaning of intense competition. While advances in information technology have increased competition, they have Chapter 1 Managerial Accounting in the Information Age 5 also created opportunities and cost savings for firms that use information for strategic advantage in dealing with customers, suppliers, and improving internal processes. The impact of information technology on management of the value chain: The value chain comprises the fundamental activities a firm engages in to create value. According to Michael Porter in his book, Competitive Advantage, the primary activities in a firm are inbound logistics, operations to transform material into finished products, outbound logistics, marketing and sales, and after sales customer service. Secondary activities include firm infrastructure, technology development and procurement of goods and services. Information flows up and down a firm’s value chain and between the firm and its suppliers and customers. For example, assume Milano Clothiers has 35 stores throughout the United States and annual sales of over $800 million. For Milano to be successful, its suppliers must provide high quality items, on time, to the right location, at a reasonable price. Its own operations must be efficient, able to market effectively, and offer products that customers want. How can Milano ensure that this happens? The key is to take advantage of information flows up and down the value chain and between Milano and its suppliers and between Milano and its customers. This is where advances in information technology are having an impact. Information flows between Milano and customers: When customers make purchases, a Milano employee scans a bar code automatically transferring information on the sale into a data base. This information can be used to update inventory records and ensure the company does not stock-out of “hot” items. It also provides information on slow moving merchandise. Analysis of sales data can reveal regional tastes in clothes and can track buying patterns of customers. Information flows between Milano and suppliers: With several key suppliers, Milano has set-up processes whereby the suppliers monitor Milano’s sales of their merchandise using information from Milano’s internal data base. Milano shares this information because the suppliers use it to improve their productions scheduling, gain efficiencies, and pass along some of the related cost savings to Milano in the form of lower prices. Milano also tracks the status of orders using its suppliers’ Web sites. Using information technology to gain internal efficiencies: Milano uses information technology to automate purchasing and accounts payable, sales and customer billing, as well as other accounting and finance functions. Software systems that impact value chain management: This section discusses three systems. Enterprise Resource Planning (ERP) Systems grew out of material requirements planning (MRP) systems that computerized inventory control and production planning. Key features included an ability to prepare a master production schedule and a bill of materials and generate purchase orders. ERP systems update MRP systems with better integration, relational data bases, and graphical user interfaces. Various ERP components now include accounting and finance, human resources, and various e-commerce applications. Supply Chain Management (SCM) is the organization of activities among multiple companies in an effort to provide for the profitable development, production, and delivery of goods to customers. By sharing information, production lead times and inventory holding costs have been reduced, while on-time deliveries to customers have been improved. SCM software systems support the planning of the best way to fill orders and help tracking of products and components among companies in the supply chain. Customer Relationship Management (CRM) Systems are used to manage a variety of customer interactions. At its heart is a database of many, if not all, customer interactions. Company employees (and possibly customers) can access this database. Sales people can examine the history of sales calls and customer responses. Analysis of data on the CRM system can support suggested targeted direct mail advertising taking into account past 6 Study Guide to accompany Jiambalvo Managerial Accounting purchases. A CRM system can be used to suggest future purchases to customers based on their past purchases, allow customers to tract the status of their orders and access information on product updates. LO5 Describe a framework for ethics decision making and discuss the duties of the controller. ETHICAL CONSIDERATIONS IN MANAGERIAL DECISION MAKING In addition to performing incremental analysis, managers must consider the ethical aspects of their decisions. In addition to being the “right thing to do” when managers behave ethically, they gain the confidence of their customers, suppliers, subordinates, and company stockholders. Ethical behavior requires that managers recognize the difference between right and wrong and then make decisions consistent with what is right. Ethical dilemmas are often complex and the situations managers face are often gray rather than black and white. We have witnessed a plethora of disclosures, indictments, and convictions indicating that key managers in major companies either can’t tell right from wrong or don’t care to make decisions consistent with what’s right. Corporate abuses led Congress to enact the Sarbanes-Oxley Act in 2002. This law has changed the financial reporting landscape for public companies and their auditors. Some of the most important provisions are: Chief executive officers and chief financial officers of a company certify that, based on their knowledge, their financial statements do not contain any untrue statements or omissions of material facts that would make the statements misleading. A ban on certain types of work by a company’s auditors to ensure their independence. Longer jail sentences and larger fines for corporate executives who knowingly and willfully misstate financial statements. A requirement that companies report on the existence and reliability of their internal controls as they relate to financial reports. The following framework for ethical decision making consists of seven questions. Hopefully answering these seven questions will serve as an aid in identifying “what’s right”. However, answering them does not guarantee ethical decision making. When evaluating a decision ask: 1. What decision alternatives are available? 2. What individuals or organizations have a stake in the outcome of my decision? 3. Will an individual or an organization be harmed by any of the alternatives? 4. Which alternative will do the most good with the least harm? 5. Would someone I respect find any of the alternatives objectionable? After deciding on a course of action, but before taking an action, ask: 6. At a gut level, am I comfortable with the decision I am about to make? Chapter 1 Managerial Accounting in the Information Age 7 7. Will I be comfortable telling my friends and family about this decision? The Institute of Management Accountants (IMA) is a professional organization that focuses on management accounting and on its contributions on the development of a Statement of Ethical Professional Practice. The organization also developed an ethics hotline for members, publishes Strategic Finance and Management Accounting Quarterly, and conducts the exam and issues the Certified Management Accountant (CMA). THE CONTROLLER AS THE TOP MANAGEMENT ACCOUNTANT The controller prepares reports for planning and evaluating company activities (e.g., budgets and performance reports) and provides the information needed to make management decisions (e.g., decisions related to adding or dropping a product). The controller may also be responsible for filing all financial accounting reports and tax filings with the Internal Revenue Service and other taxing agencies, as well as coordinating the activities with the firm’s external auditors. Most companies want controllers who have the capacity to be an integral part of the top management team. Not only does the controller need strong accounting skills, but also excellent written and oral communication skills, solid interpersonal skills, and a deep knowledge of the industry in which the firm competes. The treasurer has custody of cash and funds invested in various marketable securities. In addition to money management duties, the treasurer is generally responsible for maintaining relationships with investors, banks, and other creditors. The treasurer plays a major role in managing cash and marketable securities, preparing cash forecasts, and obtaining financing from banks and other lenders. The chief information officer (CIO) is the person responsible for a company’s information technology and computer systems. Both the controller and the treasurer report to the chief financial officer (CFO) who is the senior executive responsible for both accounting and financial operations. At some companies, the CIO also reports to the CFO. However, information technology is playing a critical role in managing the value chain, and therefore, it is not surprising that the CIO is frequently part of the senior management team reporting directly to the chief executive officer (CEO). Appendix – IMA Statement of Ethical Professional Practice Members of IMA shall behave ethically. A commitment to ethical professional practice includes: overarching principles that express our values and standards that guide our conduct. PRINCIPLES IMA’s overarching ethical principles include: Honesty, Fairness, Objectivity, and Responsibility. Members shall act in accordance with these principles and shall encourage others within their organizations to adhere to them. STANDARDS A member’s failure to comply with the following standards may result in disciplinary action. I. Competence. Each member has a responsibility to: 1. Maintain an appropriate level of professional expertise by continually developing knowledge and skills. 2. Perform professional duties in accordance with relevant laws, regulations, and technical standards. 3. Provide decision support information and recommendations that are accurate, clear, concise, and timely. 8 Study Guide to accompany Jiambalvo Managerial Accounting II. III. IV. 4. Recognize and communicate professional limitations or other constraints that would preclude responsible judgment or successful performance of an activity. Confidentiality. Each member has a responsibility to: 1. Keep information confidential except when disclosure is authorized or legally required. 2. Inform all relevant parties regarding appropriate use of confidential information. Monitor subordinates’ activities to ensure compliance. 3. Refrain from using confidential information for unethical or illegal advantage. Integrity. Each member has a responsibility to: 1. Mitigate actual conflicts of interest. Regularly communicate with business associates to avoid apparent conflicts of interest. Advise all parties of any potential conflicts. 2. Refrain from engaging in any conduct that would prejudice carrying out duties ethically. 3. Abstain from engaging in or supporting any activity that might discredit the profession. Credibility. Each member has a responsibility to: 1. Communicate information fairly and objectively. 2. Disclose all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, analyses, or recommendations. 3. Disclose delays or deficiencies in information, timeliness, processing, or internal controls in conformance with organization policy and/or applicable laws. In applying the Standards of Ethical Professional Practice, you may encounter problems identifying unethical behavior or resolving an ethical conflict. When faced with ethical issues, you should follow your organization’s established policies on the resolution of such conflict. If the policies do not resolve the conflict, consider the following courses of action: 1 Discuss the issue with your immediate supervisor except when the supervisor is involved. In that case, submit the issue to the next management level. If the immediate supervisor is the chief executive officer or equivalent, the acceptable reviewing authority may be a group such as the audit committee, executive committee, board of directors, board of trustees, or owners. Contact the levels above your supervisor with your supervisor’s knowledge, assuming that he or she is not involved. Communication with external authorities or individuals not employed or engaged by the organization is not considered appropriate unless there is a clear violation of the law. 2 Clarify relevant ethical issues by initiating a confidential discussion with an IMA Ethics Counselor or other impartial advisor to obtain a better understanding of possible courses of action. 3 Consult your attorney as to legal obligations and rights concerning the ethical conflict. Chapter 1 Managerial Accounting in the Information Age Review of Key Terms Budget: A formal document that quantifies a company’s plan for achieving its goals. Chief financial officer (CFO): The senior executive responsible for accounting and financial operations. Chief information officer (CIO): The manager responsible for a company’s information technology and computer systems. Controllable cost: A cost that a manager can influence by the decisions he or she makes. Controller: The top accounting executive responsible for financial and managerial accounting information and tax filings. Customer relationship management (CRM) systems: Systems that automate call center management and customer service, provide customer data analysis, and support e-commerce storefronts. Direct cost: A cost that is directly traceable to a product, activity, or department. Enterprise Resource Planning (ERP) Systems: Systems that computerize inventory and production planning, support accounting, human resources, and various e-commerce applications. Fixed cost: Costs that do not change when there is a change in business activity. Incremental analysis: An analysis of the revenues and costs that will change if a decision alternative is selected. Incremental cost: A cost that increases or decreases if a decision alternative is selected. Incremental revenue: Revenue that increases or decreases if a decision alternative is selected. Indirect cost: A cost that either is not directly traceable to a product, activity, or department or is not worth tracing. . Management by exception: Policy by which managers investigate departures from planned results that appear to be exceptional; they do not investigate minor departures from the plan. Managerial accounting: Accounting that stresses concepts and procedures relevant to preparing reports for internal users of accounting information. It focuses on information that is useful in planning, control, and decision making. Noncontrollable cost: A cost that managers cannot influence. Opportunity cost: The value of benefits foregone by selecting one decision alternative over another. Performance report: Report used to evaluate managers and the operations they control. Frequently, performance reports involve a comparison of planned and actual results. Supply chain management (SCM) systems: Software systems that support the planning of the best way to fill orders and tacking of products and components among companies in the supply chain. Sunk cost: Cost incurred in the past—they are irrelevant to current decisions. Treasurer: Company official who has custody of cash and funds invested in various marketable securities. In addition to money management duties, the treasurer is generally responsible for maintaining relationships with investors, banks, and other creditors. Value chain: The internal operations of a company and its relationships and interactions with suppliers and customers aimed at creating maximum value for the least possible cost. Variable cost: A cost that increases or decreases in proportion to increases or decreases in the level of business activity. 9 10 Study Guide to accompany Jiambalvo Managerial Accounting Chapter 1 – True/False ________ 1. The goal of managerial accounting is to provide information managers need for planning control and decision making. ________ 2. A negative evaluation of an operation will always result in a negative evaluation of the manager responsible for the operation. ________ 3. Performance reports frequently involve a comparison of prior period performance with planned performance. ________ 4. Managerial accounting stresses accounting concepts and procedures that are relevant to preparing reports for internal users of accounting information. ________ 5. A performance report indicates the planned quantity of production and the expected cost. ________ 6. One difference between managerial accounting and financial accounting is that managerial accounting may not deviate from GAAP. ________ 7. Sunk costs are relevant to present decisions. ________ 8. An opportunity cost is the value of benefits forgone when one decision alternative is selected over another. ________ 9. Key features of CRM systems include an ability to prepare a master production schedule and a bill of materials and generate purchase orders. ________ 10. In addition to performing incremental analysis, it is equally important that managers consider the ethical aspects of their decisions. ________ 11. While the Sarbanes-Oxley Act added civil and criminal penalties for corporate executives, the cost of complying with the Act has been insignificant. ________ 12. The treasurer is generally responsible for maintaining relationships with investors, banks, and other creditors. Chapter 1 Managerial Accounting in the Information Age 11 Chapter 1 – Key Terms Matching Match the terms found in Chapter 1 with the following definitions: a. Chief Information Officer b. Controllable cost c. Customer relationship management systems d. Direct cost e. Incremental cost f. Management by exception g. Opportunity cost h. Supply chain management systems i. Sunk cost j. Treasurer k. Value chain l. Variable cost ________ 1. A cost that increases or decreases if a decision alternative is selected. ________ 2. Company official who has custody of cash and funds invested in various marketable securities. In addition to money management duties, the treasurer is generally responsible for maintaining relationships with investors, banks, and other creditors. ________ 3. Software systems that support the planning of the best way to fill orders and tracking of products and components among companies in the supply chain. ________ 4. The manager responsible for a company’s information technology and computer systems. ________ 5. Policy by which managers investigate departures from planned results that appear to be exceptional; they do not investigate minor departures from the plan. ________ 6. A cost that increases or decreases in proportion to increases or decreases in the level of business activity. ________ 7. The value of benefits foregone by selecting one decision alternative over another. ________ 8. A cost that a manager can influence by the decisions he or she makes. ________ 9. The internal operations of a company and its relationships and interactions with suppliers and customers aimed at creating maximum value for the least possible cost. ________ 10. A cost that is directly traceable to a product, activity, or department. ________ 11. Cost incurred in the past—they are irrelevant to current decisions. ________ 12. Systems that automate call center management and customer service, provide customer data analysis, and support e-commerce storefronts. 12 Study Guide to accompany Jiambalvo Managerial Accounting Chapter 1 – Multiple Choice 1. The goal of managerial accounting is to provide managers with the information they need for: a. planning, decision making, and performance evaluation. b. planning, control, and decision making. c. decision making, performance evaluation, and efficiency in management. d. control, planning, and efficiency in management. 2. Operations are evaluated to provide information as to whether: a. management compensation is adequate. b. managers value a sense of accomplishment from operations. c. operations should be changed or not. d. actual results exceed budgeted levels. 3. Compared to financial accounting, managerial accounting places more emphasis on: a. information for internal users. b. past performance. c. generally accepted accounting principles (GAAP). d. information in a highly summarized form. 4. Which of the following statements regarding performance reports is false? a. They are used to evaluate the performance of managers and the operations the managers control. b. There is no generally accepted method of preparing a performance report. c. They frequently involve a comparison of current period performance with performance in a prior period or with planned performance. d. They provide suggested areas that should be investigated as well as definitive information on performance. 5. Which of the following questions need not be considered in making an ethical decision? a. Which alternative will do the most good with the least harm? b. What’s in it for me? c. Will I be comfortable telling my friends and family about this decision? d. What decision alternatives are available? 6. Which of the following would not be considered an internal user? a, Plant manager. b. Chief Financial Officer. c. Controller. d. Investor. 7. Which of the following is not the responsibility of the controller? a. Managing cash and marketable securities. b. Preparing performance reports. c. Preparing tax filings. d. Providing information for management decisions such as adding or dropping a product. Chapter 1 Managerial Accounting in the Information Age 13 8. Which of the following would not be considered a fixed cost? a. Rent. b. Depreciation. c. Cost of bottles used in the production of a beverage company. d. Property taxes. 9. Last period ABC Company produced 100 units and incurred variable costs of $300 and fixed costs of $150. If ABC produces 110 units this month, which of the following will be the company’s costs? a. $300 variable costs and $150 fixed costs. b. $330 variable costs and $150 fixed costs. c. $330 variable costs and $165 fixed costs. d. $300 variable costs and $165 fixed costs. 10. If variable cost per unit is $12 and fixed costs per unit is $5 when 300 units are produced, what are total costs if 320 units are produced? a. $3,600 variable costs and $1,500 fixed costs. b. $3,600 variable costs and $1,600 fixed costs. c. $3,840 variable costs and $1,500 fixed costs. d. $3840 variable costs and $1,600 fixed costs. 11. Which of the following is not a contribution of the Institute of Management Accounting (IMA)? a. Development of a Statement of Ethical Professional Practice. b. Development of an ethics helpline that members can call to discuss ethical dilemmas. c. Conducting the CMA examination. d. Establishing financial accounting standards for CMAs. 12. Tom owns Olsen Manufacturing Company. Tom recently purchased a used calibrator for $5,200. He is not happy with its performance and wishes to replace it. A new calibrator will cost $9,800 plus another $300 delivery charge. He has not been able to find a buyer for the used calibrator. Which of the following costs associated with the purchase of the new calibrator is relevant to his decision? a. $4,600 b. $4,900 c. $5,200 d. $10,100 14 Study Guide to accompany Jiambalvo Managerial Accounting Exercise 1 – 1 Managers have to plan operations, evaluate subordinates, and make a variety of decisions using accounting information. Much of the information found in the basic financials are more relevant to external users than to internal users. Required: a. List five differences between managerial accounting and financial accounting. b. Give one example for each of these differences using a sales manager’s and banker’s needs. Exercise 1 – 2 A key idea in this chapter is that “You get what you measure!” Basically, this means that performance measures have a great influence on the behavior of managers. Required: Analyze the campus police department on your campus. Identify three performance measures that the university might use in evaluating its police chief. For each measure, identify a favorable outcome and an unfavorable outcome that might occur because the measure is used to evaluate manager performance. Chapter 1 Managerial Accounting in the Information Age 15 Exercise 1 – 3 Sarah Richards owns Campus Cleaning, a reasonably-priced maid service used by many students who live in campus housing. Sarah uses a vacuum cleaner she purchased several years ago for $800. She also purchased a floor polisher last year at a cost of $1,000. Recently a salesperson got Sarah to try a new floor cleaner/polisher that would eliminate her having to vacuum and then polish floors. The time saving is important to Sarah since she is a full-time student and works at her cleaning service approximately 40 hours per week. Sarah is interested, but the new cleaner/polisher would cost $3,500 and she cannot trade in her vacuum cleaner or polisher. Required: a. List the costs that are relevant to Sarah in making her decision. b. List the costs that are not relevant to Sarah in making her decision. c. In addition to the incremental analysis, what factors might influence Sarah’s decision? Exercise 1 – 4 In Chapter 1, your author outlines a framework for ethical decision making that consists of seven questions. Hopefully, answering these seven questions will serve as an aid in identifying “what’s right”. Required: List the seven questions and discuss two situations in which managers should ask the seven questions. 16 Study Guide to accompany Jiambalvo Managerial Accounting Problem 1 – 5 Fast Wheels, Inc. is a large manufacturer of racing bikes. The following information is available for the two most recent years: 2016 90,000 2017 80,000 $3,600,000 2,430,000 400,000 20,000 65,000 $6,515,000 $3,200,000 2,160,000 410,000 20,000 70,000 $5.860,000 Number of bikes produced Direct materials Direct labor Rent Depreciation Supervisory salaries Total production cost Required: 1. Identify the behavior of each following expenses as variable or fixed cost. a. Direct materials ____________________ b. Direct labor _______________________ c. Rent _____________________________ d. Depreciation _______________________ e. Supervisory salaries_________________ 2. Calculate the cost per bike for 2016 and 2017? 3. Assume Mr. Cross, president of Fast Wheels, has told you that in the year 2018, the company expects to manufacture and sell 120,000 bikes. Prepare a budget of production costs for Fast Wheels. Assume there will be no increase in fixed costs. ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ Chapter 1 Managerial Accounting in the Information Age 17 ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ 18 Study Guide to accompany Jiambalvo Managerial Accounting Problem 1 – 6 Assume that in 2016, Fast Wheels actually produced and sold 115,000 bicycles and incurred the following costs: Number of bikes produced Direct materials Direct labor Rent Depreciation Supervisory salaries Total production costs 115,000 $5,290,000 2,990,000 410,000 20,000 70,000 $8,780,000 1. Prepare a performance report for production costs for the year 2016. ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ 2. Mr. Cross is concerned because in some actual costs exceeded budgeted costs. Are his concerns justified? Why or why not? ________________________________________________________________ _ ________________________________________________________________ _ Chapter 1 Managerial Accounting in the Information Age 19 3. Mr. Cross has noticed that the cost per bike has increased each year. Compute the cost per bike and explain to Mr. Pedal why the cost per bike has increased. ________________________________________________________________ _ ________________________________________________________________ _ ________________________________________________________________ _ 20 Study Guide to accompany Jiambalvo Managerial Accounting Solutions – True/False 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. T F A negative evaluation of an operation will not always result in a negative evaluation of the manager responsible for the operation. F Performance reports frequently involve a comparison of current period performance with performance in a prior period or with planned performance. T F A performance report is used to evaluate the performance of managers and the operations they control. The reports frequently involve a comparison of current-period performance with performance in a prior period or with planned performance. A production budget indicates the planned quantity of production and the expected cost. F One difference between managerial accounting and financial accounting is that managerial accounting may deviate from GAAP. F Sunk costs are not relevant to present decisions. T F Key features of ERP systems include an ability to prepare a master production schedule and a bill of materials and generate purchase orders T F The cost of complying with the Sarbanes-Oxley Act has been significant. T Solutions – Key Terms Matching 1. 2. 3. 4. 5. 6. e. Incremental cost j. Treasurer h. Supply chain management system a. Chief information officer f. Management by exception l. Variable cost 7. g. Opportunity cost 8. b. Controllable cost 9. k. Value chain 10. d. Direct cost 11. i. Sunk cost 12. c. Customer relationship management system Solutions – Multiple Choice 1. 2. 3. 4. 5. 6. b c a d b d 7. 8. 9. 10. 11. 12. a c b c d d Chapter 1 Managerial Accounting in the Information Age 21 Solution – Exercise 1 – 1 Managers have to plan operations, evaluate subordinates, and make a variety of decisions using accounting information. Much of the information found in the basic financials are more relevant to external users than to internal users. Required: a. List five differences between managerial accounting and financial accounting. 1. Managerial accounting is directed at internal rather than external users of accounting information. 2. Managerial accounting may deviate from generally accepted accounting principles. 3. Managerial accounting may present more detailed information. 4. Managerial accounting may present more nonmonetary information. 5. Managerial accounting places more emphasis on the future. b. Give one example for each of these differences using a sales manager’s and banker’s needs. Answers will vary. Some possible answers may be: 1. A report prepared for the sales manager will be a managerial accounting report while a report given to a banker will probably be financial accounting information. 2. A report prepared for a sales manager will not have all information required by GAAP while most likely audited financial statements using GAAP will be provided to a banker. 3. A sales manager’s report may show detailed information for each sales person or territory while the audited financial statements provided to the banker will show only aggregated sales figures. 4. A sales manager’s report may show how many miles were reported by each sales person or for each territory while the banker’s would not have such information. 5. A budget for the sales manager will cover future periods while audited financial statements given to a banker are past on past performance. Solution – Exercise 1 – 2 A key idea in this chapter is that “You get what you measure!” Basically, this means that performance measures have a great influence on the behavior of managers. Required: Analyze the campus police department on your campus. Identify three performance measures that the university might use in evaluating its police chief. For each measure, identify a favorable outcome and an unfavorable outcome that might occur because the measure is used to evaluate manager performance. Answers will vary. Some possible answer may be: 22 Study Guide to accompany Jiambalvo Managerial Accounting Performance Measure Favorable Outcome Response time for emergency calls Avoidance of serious negative outcomes Crime rate Lower crime rate Satisfaction with police Better perception of police department by students, faculty and staff and visitors Unfavorable Outcome Additional calls for non-emergency reasons because students know police will respond Fewer incidents reported as crime by police officers Police officers become lax in duties that might offend wrongdoers Solution – Exercise 1 – 3 Sarah Richards owns Campus Cleaning, a reasonablypriced maid service used by many students who live in campus housing. Sarah uses a vacuum cleaner she purchased several years ago for $800. She also purchased a floor polisher last year at a cost of $1,000. Recently a salesperson got Sarah to try a new floor cleaner/polisher that would eliminate her having to vacuum and then polish floors. The time saving is important to Sarah since she is a full-time student and works at her cleaning service approximately 40 hours per week. Sarah is interested, but the new cleaner/polisher would cost $3,500 and she cannot trade in her vacuum or polisher. Required: a. List the costs that are relevant to Sarah in making her decision. $3,500, the cost of the new floor cleaner/polisher b. List the costs that are not relevant to Sarah in making her decision. $800 and $1,000, these are sunk costs c. In addition to the incremental analysis, what factors might influence Sarah’s decision? Sarah should evaluate how important the extra time will be to her. If her grades are suffering because of the hours she is spending in her cleaning business, she may be willing to spend the extra money on the new equipment. She should also consider how much longer she will be involved in her cleaning business. If she is in her final year of college she may not want to invest in a machine that she will only be using a few more months. She should also consider how long it will be before she has to replace her vacuum cleaner. If she believes it will soon fail, she should also consider the cost she will have to incur to replace it. Solution – Exercise 1 – 4 In Chapter 1, your author outlines a framework for ethical decision making that consists of seven questions. Hopefully, answering these seven questions will serve as an aid in identifying “what’s right”. List the seven questions and discuss two situations in which managers should ask the seven questions. When evaluating a decision ask: 1. What decision alternatives are available? 2. What individuals or organizations have a stake in the outcome of my decision? 3. Will an individual or an organization be harmed by any of the alternatives? 4. Which alternative will do the most good with the least harm? 5. Would someone I respect find any of the alternatives objectionable? Chapter 1 Managerial Accounting in the Information Age 23 After deciding on a course of action, but before taking an action, ask: 6. At a “gut” level, am I comfortable with the decision I am about to make? 7. Will I be comfortable telling my friends and family about this decision? Answers to this question will vary. One situation in which managers should ask these questions is in the development and evaluation of the company’s code of ethics. Another situation relates to the recent accounting scandals in large publicly-traded. The CEOs and CFOs would have been well served to ask these questions before they chose the accounting treatments that ultimately led to their demise and the loss of money to stockholders and creditors. Solution – Problem 1 – 5 Fast Wheels, Inc. is a large manufacturer of racing bikes. The following information is available for the two most recent years: 2016 90,000 2017 80,000 $3,600,000 2,430,000 400,000 20,000 65,000 $6,515,000 $3,200,000 2,160,000 410,000 20,000 70,000 $5.860,000 Number of bikes produced Direct materials Direct labor Rent Depreciation Supervisory salaries Total production cost 1. Identify the behavior of each following expenses as variable or fixed cost. a. b. c. d. e. Direct materials – Variable cost Direct labor – Variable cost Rent – Fixed cost Depreciation – Fixed cost Supervisory salaries – Fixed cost 2. 2016 - $6,515,000/90,000 = $72.39 per bike 2017 - $5,860,000/80,000 = $73.25 per bike 3. Assume Mr. Cross, president of Fast Wheels, has told you that in the year 2018, the company expects to manufacture and sell 120,000 bikes. Prepare a budget of production costs for Fast Wheels. Assume there will be no increase in fixed costs. Direct materials (120,000 @ $40) Direct labor (120,000 @ $27) Rent Insurance Supervisory salaries Total budgeted production cost $4,800,000 3,240,000 410,000 20,000 70,000 $8,540,000 24 Study Guide to accompany Jiambalvo Managerial Accounting Solution – Problem 1 – 6 Assume that in 2018, Fast Wheels actually produced and sold 115,000 bicycles and incurred the following costs: Number of bikes produced Direct materials Direct labor Rent Depreciation Supervisory salaries Total production costs 115,000 $5,290,000 2,990,000 410,000 20,000 70,000 $8,780,000 4. Prepare a performance report for production costs for the year 2018. Budget 120,000 Actual 115,000 Direct material Direct labor Rent Insurance Supervisory salaries $4,800,000 3,240,000 410,000 20,000 70,000 $5,290,000 2,990,000 410,000 20,000 Total production costs $8,540,000 70,000 $8,780,000 Difference (Actual Minus Budget) ($490,000) 250,000 -0-0-0($240,000) 5. Mr. Cross is concerned because in some actual costs exceeded budgeted costs. Are his concerns justified? Why or why not? Mr. Cross should be concerned about the cost of direct material. He budgeted direct materials at $40 per unit while actual cost per unit was $46. 6. Mr. Cross has noticed that the cost per bike has increased each year. Compute the cost per bike and explain to Mr. Pedal why the cost per bike has increased. $6,515,000/90,000 = $72.39 $5,860,000/80,000 =$73.25 $8,780,000/115,000 = $76.35 The cost per bike has increased from 2016 to 2017 because fixed costs increased. The cost per bike increased from 2017 to 2018 because direct material and direct labor increased.