Twitter

Portfolio

Management

based

Is it possible?

Anand Bindumadhavan

Abstract

Dataset: The dataset is raw twitter tweets containing FX trade ideas/results

Question: Are the buy/sell advices for forex currency pairs from twitter feeds worth

following and will they make one profitable?

Method: I used rudimentary text processing, identifying and isolating tweets containing trade

ideas/results indicating a profit or loss per trade, and used it to build a portfolio with 10K as

initial capital, and derived the equity curve by following each trade/trade result.

Findings: While the analysis shows 50% of the analysts were successful in their trades with

positive portfolio values, the hypothesis and the question is answered: i.e. it is indeed

possible to manage a portfolio by smart monitoring of twitter feeds and selective

tagging of trades!!

Motivation

There are quite a few analysts/companies who frequently tweet about whether to buy or sell

some asset, say an equity or currency at a certain price, with some profit targets. I always

wondered whether one could manage his/her own investment portfolio by following the

buy/sell advice from these twitter users.

As there could be quiet a variety of such advice/tweets, I will narrow the analysis to tweets

from a few such users/analysts, to (optionally) a specific currency pair like EUR/USD, grab

as many tweets as possible with buy/sell advices, and build a equity curve based on the

profit/loss generated from each advice/signal. I will compare the results to understand

whether it is worthwhile following these tweets.

A positive equity at the end of the period of analysis, would indicate that following the tweets

is worthwhile, while a negative equity would indicate that we should not follow such tweets.

Dataset(s)

The data is from historical tweets.

First we grab all tweets from a few randomly picked users (relevant to the topics #

forextrading, # eurusd ), understand the structure of their tweets, parse them and

extract the profit/loss value in pips, per trade, and use it to build an equity curve.

Data Preparation and Cleaning

At a high-level, what did you need to do to prepare the data for analysis?

The first step was to identify which users to follow. A search on twitter for the topic

‘#forextrading’ resulted in a very broad range of tweets – I had to really go back and forth to

eventually come up with a query such as: ‘‘topic is #eurusd and contains the words ‘buy or

sell’’ to narrow the results, from where I picked 7 users randomly for the analysis.

Describe what problems, if any, did you encounter with the dataset?

As the tweets were raw text, I really had to study them closely to identify an appropriate

tweet that can be used for data extraction. Even then, different users recorded the profit/loss

differently. Eg: for +20 pips, vs Profit: 20 pips

I also had to drop one of the users eventually because that user tweeted only trade entries,

but never recorded a follow-up tweet with the actual profit/loss figures.

Research Question(s)

Are the buy/sell advices for the EUR/USD (or other) currency pair(s) from twitter

feeds worth following and will they make you profitable?

Methods

What methods did you use to analyze the data and why are they appropriate? Be

sure to adequately, but briefly, describe your methods.

I used a very simple method of analyzing tweets and extracting the relevant info using very

simple string manipulation/regular expression operations. I did not use any sophisticated

natural language analysis or any ML model for sentiment analysis etc.

Rather, I employed a very simple and straightforward method: look at all the tweets, filter for

relevant tweets, extract the piece of info that is required, and use it to build a model for

evaluation. It is simple, but yet very powerful in my opinion, because it opens a whole new

world of possibilities, for me at least.

Findings – Summary (refer the next two slides: the equity curve and profit/loss distribution)

The analysis shows that although some analysts consistently lose money and the equity

drops significantly for them, others do make profits and have a healthy equity, over a range

of months. So the hypothesis that, we could follow twitter feeds and manage our portfolio is

very much a possibility. However, it requires a structured analysis, in addition to the

preliminary research above, that re-confirms this possibility.

Specific to this analysis, we can see that three out of the six analysts have lost money, while

the other three have shown positive returns. Two of them, have even shown enormous

returns, which at first glance seems to be too good to be true. As mentioned above, a second

set of validation, by correlating the entry price and the timeline, with the actual price of the

currency pair at that same timeline, along with the corresponding exit, would re-confirm that

the trades were indeed profitable, and the tweets were not made up.

So it is indeed possible to manage a portfolio by smart monitoring of twitter feeds and

selective tagging of trades!!

Limitations

If applicable, describe limitations to your findings:

1. This analysis cannot be generalized for all tweets, because each user records his/her

trade ideas/results in a different format, although there is some structure to it

2. The analysis also assumes that there is a position size logic in place, which makes the

value of each profitable pip to be 1 USD. i.e. normally 10000 units of EUR/USD = 1 pip, and

this is different for EUR/GBP or GBP/USD etc. However, the analysis ignores this difference,

as it is beyond the scope of this project

3. The analysis is based only on tweets, and hence the authenticity of the tweets cannot be

guaranteed. To re-confirm the authenticity of the tweets, we have to extract the underlying

entry/exit points, and validate them with the actual entry/exit prices at the same timeline.

However, I believe this is a good starting point, that can be expanded very easily.

Conclusions

Report your overall conclusions, preferably a conclusion per research question

My conclusion is that the research question has been positively answered. i.e. it is

indeed possible to follow trade ideas from twitter, and if we time them correctly, we

will be able to manage a portfolio well and show a profitable equity curve.

However, it is important to do an extensive research to know and understand,

which users to follow, and which trade ideas to follow. This analysis, shows one

way of doing this research, with the above preliminary conclusion.

Acknowledgements

Where did you get your data?

All data is from historical twitter feeds

Did you use other informal analysis to inform your work?

I used the “search.twitter.com” website, to understand how different search strings

work, and how to optimize the search further.

Did you get feedback on your work by friends or colleagues?

No I did not get any feedback from friends or colleagues.

References

If applicable, report any references you used in your work.

I mostly used online blogs as references for checking the actual syntax for

specifying search strings, syntax for dataframe manipulation, equity curve, plotting

etc.

PDF copy of the jupyter notebook

is attached below

In [1]:

# Data Source: Forex trade tweets from Twitter

# Analysis: We build a sample portfolio based on historical trade ideas/tweets and evaluate the performance

# Research question: Are the buy/sell advices for the EUR/USD currency pair from twitter feeds worth following

#

and will they make you profitable?

Twitter based portfolio management

Can we rely on trade ideas from Twitter:

A portfolio simulation based on real trade tweets

In [2]:

# As we already have our twitter credentials in the pickle file from chapter 8,

# we will load the twitter credentials from this file and grab an API context/handle

# Also, while researching the internet for python twitter documentation, I came across tweepy

# tweepy is another python wrapper for twitter API, and it seems much more simpler, at least for me

# So I am using tweepy instead of the twitter package

In [3]:

import pickle

import os

#import twitter

import pandas as pd

import tweepy

import tweepy

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

import numpy as np

%matplotlib inline

In [4]:

if not os.path.exists('secret_twitter_credentials.pkl'):

print('Twitter auth file missing - please make sure, a valid secret_twitter_credentials file is present')

else:

Twitter = pickle.load(open('secret_twitter_credentials.pkl','rb'))

In [5]:

auth = tweepy.OAuthHandler(Twitter['Consumer Key'],

Twitter['Consumer Secret'])

auth.set_access_token(Twitter['Access Token'],Twitter['Access Token Secret'])

twitter_api = tweepy.API(auth)

type(twitter_api)

Out[5]:

tweepy.api.API

Step 1: Initial exploration of forex trading related tweets

In [6]:

# Let's start by searching for all tweets related to forextrading

In [7]:

topic = '#forextrading'

num = 100

status = twitter_api.search(q=topic,count=num)

print(type(status))

print(len(status))

for tweet in status[:15]:

print (tweet.user.screen_name,tweet.text)

print (tweet.user.screen_name,tweet.text)

<class 'tweepy.models.SearchResults'>

96

moralfx Fundamental &amp; Technical Analysis in Forex Trading

https://t.co/OJyAbspRjB

#forextrading #forextrader #forex https://t.co/psAfhg7dcx

mxandrv The ULTIMATE GUIDE on how to trade less and make more: https://t.co/bbbLRr4KUR #forex #fx #forextrading

FerruFx #MT4 #MT5 FFx Basket Scanner

See if a currency / related basket is tradable!

https://t.co/zQTWyymFRO

#FerruFx #fx… https://t.co/ee5yugwL2K

closed__ Fx=Full Gelir #forex #forextrading #forextrading #FxCanli #FX

ultraltdnet Entrepreneur Quote of the day!

If you like this quote, Share it Now!

#entrepreneurquotes #founderwords… https://t.co/TcSLpBFkL7

CityofInvestmnt https://t.co/rki7PPm5b5 I CHOOSE TO INVEST #wealth #forextrading #managedforex #money #invest

#Dollar #fx #pension… https://t.co/J6dZt7Majj

FerruFx #MT4 FFx Hidden TP/SL Manager

Hide your targets and stops to your broker

https://t.co/fGy3oOMYZE

#FerruFx #fx… https://t.co/PIFlBPXYC0

FX_haroldShan The first system uses 3 indicators to determine if there is up- or https://t.co/vJ80FBbV9w #Market

#ForexTrading #Invest #Fibonacci #ECN #EA

ForexFalcon_com If you have an edge be the casino. Play every setup. Don't fear the outcome of the next trade #Fo

rex #ForexTrading https://t.co/0bDFKzQMgK

CityofInvestmnt Greetings from City Of Investment #cityofinvestment #managedforex #money #wealth #winners #fx #Fo

rex #trading… https://t.co/8o7lUeZVRJ

CityofInvestmnt Forex Managed Accounts Exclusive x3 45%-75% #forextrading #stocks #forexsignals #cityofinvestment

#fx #Mexico… https://t.co/sv9k0zQuTH

MyForexYoda here's the information for tonights #forextrading #meetup https://t.co/ogCasriQPg

AliceElisson How to REDUCE UNNECESSARY #FOREX LOSSES and increase the number of winning trades ==&gt; https://t.c

o/MCLsFL1Kag #forextrading #fx

forextradingbay Laser accurate and very fast #forex signals directly on your chart ==&gt; https://t.co/kDNOAjvPMl

#forextrading #fx

SO4FRbcwQSyMhb8 ﻋﺒﺪ: دﻟﯿﻠﻚ اﱃ ﻋﺎﱂ اﳌﺎل واﻻﻋﻤﺎل

اﻟﻮﺻﻮل اﱃ اﻟﺜﺮاء ﲞﻄﻮات ﺑﺴﯿﻄﺔ

ﲢﻘﯿﻖ اﻻرﺑﺎح واﻧﺖ ﲡﻠﺲ ﰲ ﻣﻨﺰﻟﻚ

…اﻟﻌﺰﯾﺰhttps://t.co/u6lSat9Bdj

In [8]:

# A search on the topic 'forextrading' is too broad,

# it does not provide any useful tweets that we can analyse in a structured way.

# Let's narrow it down further to a specific currency pair to look for trade ideas.

# I am picking eurusd, as this is the most popular currency pair thats traded

In [9]:

topic = '#forextrading AND #eurusd'

num = 100

status = twitter_api.search(q=topic,count=num)

print(type(status))

print(len(status))

for tweet in status[:5]:

print (tweet.text)

<class 'tweepy.models.SearchResults'>

74

ApaChE and KproteKT THE #eurusd #trading algos now available for #free at https://t.co/lWI4i6w3Bu #forex

#forextrading #forexsignals #EA #…

ApaChE and KproteKT #eurusd #trading algos now above the 23% mark in real account. Try them out at

https://t.co/lsA88jkAa2 #forextrading #…

ApaChE and KproteKT THE #eurusd #trading algos now available for #free at https://t.co/tHzYJptV9a #forex

#forextrading #forexsignals #EA #…

ApaChE and KproteKT #eurusd #trading algos now above the 23% mark in real account. Try them out at

https://t.co/TfoRnOzeOE #forextrading #…

https://t.co/lxLDmyVqqO http://www.tradingzine.comGuide to Binary Options in US #asset #binary #Binary #options…

https://t.co/9d7dtr6dgl

In [10]:

# We still don't have any useful tweets

# let's narrow the search further using the keywords buy or sell as below

In [11]:

topic = '#eurusd AND buy OR sell'

num = 100

status = twitter_api.search(q=topic,count=num)

print(type(status))

print(len(status))

print(len(status))

for tweet in status[:5]:

print (tweet.text)

<class 'tweepy.models.SearchResults'>

59

Need much money now? Buy FX Robot to generate cash for you! Proven REAL accounts, big money, big fun!

https://t.co/n5k7LXC8b7 #EURUSD #Rich

No need to buy the EA or pay upfront fees. Money Management for every one with best brokers. Over 500%2,000%/month. #Analize #EURUSD

#EURUSD #TRADESIGNAL

December 18 - 22, 2017

Sell Limit #1 @ 1.17667

and

Sell Limit #2 @ 1.17627

TAKE PROFIT @… https://t.co/TsksgKPO5q

EUR/USD Weekly Technical Analysis: Risk of a Euro Sell-off Rising https://t.co/gPi8a6Vvhj #forex #eurusd #fx #new

s

EUR/USD Weekly Technical Analysis: Risk of a Euro Sell-off Rising https://t.co/4mrCeMgi9t #forex #eurusd #fx #new

s

In [12]:

# This query above results in a better response set

# In a sample run, I got useful tweets such as the structured tweet below

# "SELL #EURUSD at 1.17584 SL:1.19184 TP:1.14784 , check live performances at...."

# Lets grab some tweets and the screennames, and present them in a dataframe format

# this will allow us to pick two screen names in random that post structured tweets

In [13]:

all_text = []

filtered_results = []

for s in status:

if not s.text in all_text:

all_text.append(s.text)

filtered_results.append(s)

results = filtered_results

len(results)

#print (results[0])

Out[13]:

56

In [14]:

tweet_data = pd.DataFrame(data=[[s.user.screen_name,s.text] for s in results],columns=['Author','Tweet'])

pd.set_option('max_colwidth',140)

tweet_data

Out[14]:

Author

Tweet

0

jerrry_fx

Need much money now? Buy FX Robot to generate cash for you! Proven REAL accounts, big money, big fun!

https://t.co/n5k7LXC8b7 #EURUSD #Rich

1

fxolivia_sh

No need to buy the EA or pay upfront fees. Money Management for every one with best brokers. Over 500%-2,000%/month.

#Analize #EURUSD

2

kenya_forex

#EURUSD #TRADESIGNAL December 18 - 22, 2017\n\nSell Limit #1 @ 1.17667\nand \nSell Limit #2 @ 1.17627\n\nTAKE

PROFIT @… https://t.co/T...

3

thefxcoach

EUR/USD Weekly Technical Analysis: Risk of a Euro Sell-off Rising https://t.co/gPi8a6Vvhj #forex #eurusd #fx #news

4

thefxcoach

EUR/USD Weekly Technical Analysis: Risk of a Euro Sell-off Rising https://t.co/4mrCeMgi9t #forex #eurusd #fx #news

5

myfxdataprov

2017_12_15_SYD_CALL: Monthly Buy/Sell Signals #EURUSD [December, 2017] https://t.co/u1ehOe3QJg

6

myfxdataprov

2017_12_15_SYD_CALL: Weekly Buy/Sell Signals #EURUSD [Dec. 11 to Dec. 15, 2017] https://t.co/kW8gp8MxTK

7

JohnFXCorona

Don't gamble anymore! Don't lose any more money! Be a winner! Buy our EA and make $50k/month. #EuropeanUnion #EURUSD

8

SuperHeroInvest Closed Buy for BLI Fund #EURUSD 1.18043 for -42.2 pips, total for today -8.8 pips #Investors welcome https://t.co/QKLgwlVjta

9

forex22com

Forex Signals - 2017-12-15 19:45:01 : BUY EURUSD@1.17582 SL@1.17432 TP@1.17732 #EURUSD #ForexSignal

https://t.co/LwMgoUUihA

10 B52Finance

Closed Buy 0.01 Lots #EURUSD 1.18061 for -21.0 pips, total for today -109.6 pips

11 B52Finance

Closed Buy 0.1 Lots #EURUSD 1.18069 for -20.4 pips, total for today -88.6 pips

12 B52Finance

Closed Sell 0.1 Lots #EURUSD 1.17897 for -20.4 pips, total for today -192.3 pips

13 B52Finance

Closed Buy 0.01 Lots #EURUSD 1.17778 for +3.2 pips, total for today -90.4 pips

13 B52Finance

Closed Buy 0.01 Lots #EURUSD 1.17778 for +3.2 pips, total for today -90.4 pips

Author

14 B52Finance

Closed Buy 0.1 Lots #EURUSD 1.17794 for +1.6 pips, total for today -93.6 pips

15 thefxcoach

Tweet

EUR/USD strategy is to buy on dips https://t.co/D2NYn1SAez #forex #eurusd #fx #news

16 DayTradeScalps $EURUSD #EURUSD | SELL now | Open: 11762.1 | Target: 11755.8 (6.3) | Stop: 11769.8 (7.7) | #fx #forex #daytrading

17 forex22com

Forex Signals - 2017-12-15 17:00:00 : BUY EURUSD@1.17769 SL@1.17619 TP@1.17919 #EURUSD #ForexSignal

https://t.co/LwMgoUUihA

18 DOlefirov

#EurUsd sell 1.15

19 fxcapitalonline

Wednesday Trading Results\n12/13/17\n\n✅Sell #USDJPY Tp Hit +65 Pips\n✅ Sell #USDCAD Manual Close +30pips \n✅ Buy…

https://t.co/SjstAz7f7z

20 fxcapitalonline

Tuesday results 12/12/17\n\n❌Buy #GBPUSD Manual Close -8 pips❤\n❌Buy #EURUSD SL triggered - 10 pips❤\n❌Sell

#USDJPY S… https://t.co/KR...

21 fxcapitalonline

Monday results 12/11/17\n\n❌Buy #EURUSD SL triggered -12 #pips❤\n❌Buy #GBPUSD SL triggered -25 pips❤\n❌ #Buy

#AUDUSD… https://t.co/jNc...

22 thefxcoach

EUR/USD: Buy On Dips https://t.co/PKrGVg4Pcw #forex #eurusd #fx #news

23 Wermelgion_Co Closed Sell #Forex #Fx #EURUSD 1.17848 for +12.2 pips, total for today +66.5 pips

24 Wermelgion_Co Closed Sell #Forex #Fx #EURUSD 1.17998 for +9.9 pips, total for today +43.9 pips

25 cosmos4unet

#EURUSD buy signal on 15 DEC 2017 02:00 PM UTC by AdMACD Trading System (Timefr https://t.co/6dzr1x9AMY #Forex…

https://t.co/HbYNZy4MZz

26 DayTradeScalps $EURUSD #EURUSD | BUY now | Open: 11806.6 | Target: 11812.9 (6.3) | Stop: 11798.8 (7.8) | #fx #forex #daytrading

27 DayTradeScalps $EURUSD #EURUSD | BUY now | Open: 11804.1 | Target: 11810.4 (6.3) | Stop: 11796.3 (7.8) | #fx #forex #daytrading

28 myfxdataprov

2017_12_15_NYC_CALL: Monthly Buy/Sell Signals #EURUSD [December, 2017] https://t.co/u1ehOe3QJg

29 Limitforex

Decision time at #EURUSD.\n#EUR #USD #dollar #euro #gold #buy #sell #graphic #analysis #forex #fx #trade #limitforex…

https://t.co/gT0vm...

30 arbtrader100

#ARBsignals | BUY #EURUSD @ 1.1797 | SL:1.1777 | TP:1.1817 | SENT 2017-12-15 12:27:08 GMT | #forexsignal #fx #forex #fb

31 myfxdataprov

2017_12_15_NYC_CALL: Weekly Buy/Sell Signals #EURUSD [Dec. 11 to Dec. 15, 2017] https://t.co/kW8gp8MxTK

32 forex22com

Forex Signals - 2017-12-15 12:00:00 : SELL EURUSD@1.17998 SL@1.18148 TP@1.17848 #EURUSD #ForexSignal

https://t.co/LwMgoUUihA

Author Closed Buy #Forex #Fx #EURUSD 1.18083 for -8.2 pips, total for today +34.0 pips

33 Wermelgion_Co

Tweet

34 Wermelgion_Co Closed Buy #Forex #Fx #EURUSD 1.17791 for +21.0 pips, total for today +42.2 pips

35 limitforextr

#EURUSD'da karar anı.\n#EUR #USD #dolar #euro #sterlin #yen #gold #altın #kazanç #buy #sell #grafik #analiz #forex…

https://t.co/WfrIh59ZWx

36 smart4trade

Bought #NAS100 6404.0 #smart4trader #sp500 #eurusd #dowjones #nasdaq #buy #sell #вк #vk мой сайт

https://t.co/RGfOk0hSXL

37 smart4trade

Bought #US30 24644.0 #smart4trader #sp500 #eurusd #dowjones #nasdaq #buy #sell #вк #vk мой сайт

https://t.co/RGfOk0hSXL

38 forex22com

Forex Signals - 2017-12-15 08:15:00 : SELL EURUSD@1.17864 SL@1.18014 TP@1.17714 #EURUSD #ForexSignal

https://t.co/LwMgoUUihA

39 EuroBulls_Forex

RT @Thai_TraderFX: GM, traders. #EURUSD buy.\n\nLearn to trade like a pro https://t.co/1961yQ4HIV \n\nJoin my telegram

chann...

40 thirdbrainfx

#x112 SELL #EURUSD at 1.17925 SL:1.19525 TP:1.15125 , check live performances at https://t.co/aTfkud3mWf

https://t.co/E5GbZJw0Ss

41 myfxdataprov

2017_12_15_LON_CALL: Monthly Buy/Sell Signals #EURUSD [December, 2017] https://t.co/u1ehOe3QJg

42 Thai_TraderFX

GM, traders. #EURUSD buy.\n\nLearn to trade like a pro https://t.co/1961yQ4HIV \n\nJoin my telegram channel… https://t.co/4X...

43 myfxdataprov

2017_12_15_LON_CALL: Weekly Buy/Sell Signals #EURUSD [Dec. 11 to Dec. 15, 2017] https://t.co/kW8gp8MxTK

44 SuperHeroInvest Closed Sell for BLI Fund #EURUSD 1.18324 for +48.1 pips, total for today +48.1 pips #Investors welcome https://t.co/QKLgwlVjta

45 tj_fx_live

Closed Sell USDJPY 112.559 for +23.8 pips, total for today +6.6 pips #trading #EURUSD #FX #forex #GBPUSD #USDJPY

46 myfxdataprov

2017_12_15_TYO_CALL: Monthly Buy/Sell Signals #EURUSD [December, 2017] https://t.co/u1ehOe3QJg

47 tj_fx_live

Closed Sell GBPUSD 1.34295 for -17.2 pips, total for today -17.2 pips #trading #EURUSD #FX #forex #GBPUSD #USDJPY

48 myfxdataprov

2017_12_15_TYO_CALL: Weekly Buy/Sell Signals #EURUSD [Dec. 11 to Dec. 15, 2017] https://t.co/kW8gp8MxTK

49 forex22com

Forex Signals - 2017-12-15 01:45:04 : SELL EURUSD@1.17812 SL@1.17962 TP@1.17662 #EURUSD #ForexSignal

https://t.co/LwMgoUUihA

50 forex22com

Forex Signals - 2017-12-14 23:45:03 : BUY EURUSD@1.1774 SL@1.1759 TP@1.1789 #EURUSD #ForexSignal

https://t.co/LwMgoUUihA

51 DarrenwongMfx

Closed Sell 0.1 Lots EURUSD 1.17885 for +21.2 pips, total for today +21.2 pips #forex #eurusd

51 DarrenwongMfx Closed Sell 0.1 Lots EURUSD 1.17885 for +21.2 pips, total for today +21.2 pips #forex #eurusd

Author

52 DarrenwongMfx Closed Sell 0.1 Lots EURUSD 1.17919 for +20.8 pips, total for today +20.8 pips #forex #eurusd

Tweet

53 Forexrulebook

Nice buy opportunity on #EURJPY not to be missed. \nUpward sequence likely to continue\n\nGenesis Asset &gt;&gt; Join for $…

https://t....

54 myfxdataprov

2017_12_14_SYD_CALL: Monthly Buy/Sell Signals #EURUSD [December, 2017] https://t.co/u1ehOe3QJg

55 DarrenwongMfx

Closed Sell 0.1 Lots EURUSD 1.17952 for +20.3 pips, total for today +20.3 pips #forex #eurusd

Step 2: Grabbing tweets from specific screennames

In [15]:

# After a few trial runs of the above query, I have narrowed the below screen names:

#

@fuchstraders

#

@DayTradeScalps

#

@SignalFactory

#

@tj_fx_live

#

@Wermelgion_Co

#

@MaggiecharFx

#

@DanielWr_fx

# I picked them mainly because of the consistent structure they follow in their tweets,

# making it easier for us to parse and analyse the data. Also another important factor for

# choosing them is that they record the profit/loss per trade in the tweet, so

# we don't need special processing to analyse a portofolio based on their tweets

In [16]:

# grabbing user specifc tweets using the screen names picked above

# note that we are not using any hashtag filter or text filter

# i am doing a generic grab of the tweets from these users, to understand

# how often they tweet a trade idea/signal vs something else

In [17]:

for name in

['fuchstraders','DayTradeScalps','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

tweets = twitter_api.user_timeline(screen_name=name, count=1000)

print("*"*60)

print("*"*60)

print("Number of tweets extracted for: {} is: {}.\n".format(name,len(tweets)))

for tweet in tweets[:5]:

print (tweet.text)

************************************************************

Number of tweets extracted for: fuchstraders is: 200.

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/Lnaq3rA8Pv

https://t.co/3WvOOlHGhW

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/eKRWSL9OH2

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/U2SORrE3XQ

https://t.co/7cJJ7P6xQL

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNxnXG https://t.co/jDWyz0tQa0

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/R1dPfi6neR

https://t.co/NggCw9jZXE

************************************************************

Number of tweets extracted for: DayTradeScalps is: 200.

$EURUSD #EURUSD | SELL now | Open: 11762.1 | Target: 11755.8 (6.3) | Stop: 11769.8 (7.7) | #fx #forex #daytrading

$EURCHF #EURCHF | SELL now | Open: 11667.8 | Target: 11663.1 (4.7) | Stop: 11677 (9.2) | #fx #forex #daytrading

$AUDJPY #AUDJPY | SELL now | Open: 8614.2 | Target: 8609.1 (5.1) | Stop: 8623.1 (8.9) | #fx #forex #daytrading

$NZDUSD #NZDUSD | SELL now | Open: 7006.5 | Target: 7001.6 (4.9) | Stop: 7015.6 (9.1) | #fx #forex #daytrading

$USDCHF #USDCHF | BUY now | Open: 9927.5 | Target: 9932.5 (5) | Stop: 9918.5 (9) | #fx #forex #daytrading

************************************************************

Number of tweets extracted for: SignalFactory is: 200.

Forex Signal | Close(TP) Sell CADJPY@87.394 | Profit: +79 pips | 2017.12.15 19:34 GMT | #fx #forex #fb

Forex Signal | Buy EURAUD@1.53770 | SL:1.53370 | TP:1.54570 | 2017.12.15 19:32 GMT | #fx #forex #fb

Forex Signal | Close(SL) Sell AUDCAD@0.98526 | Loss: -40 pips | 2017.12.15 19:27 GMT | #fx #forex #fb

Forex Signal | Close(SL) Buy CADCHF@0.76917 | Loss: -40 pips | 2017.12.15 19:19 GMT | #fx #forex #fb

Forex Signal | Close(SL) Sell AUDCAD@0.98433 | Loss: -40 pips | 2017.12.15 19:13 GMT | #fx #forex #fb

************************************************************

Number of tweets extracted for: tj_fx_live is: 200.

Bought GBPUSD 1.34391 #trading #EURUSD #FX #forex #GBPUSD #USDJPY

Bought USDJPY 112.239 #trading #EURUSD #FX #forex #GBPUSD #USDJPY

Closed Sell USDJPY 112.559 for +23.8 pips, total for today +6.6 pips #trading #EURUSD #FX #forex #GBPUSD #USDJPY

Closed Sell GBPUSD 1.34295 for -17.2 pips, total for today -17.2 pips #trading #EURUSD #FX #forex #GBPUSD #USDJPY

Closed 0.0 for 0.0 pips, total for today 0.0 pips #trading #EURUSD #FX #forex #GBPUSD #USDJPY

************************************************************

************************************************************

Number of tweets extracted for: Wermelgion_Co is: 200.

Closed Sell #Forex #Fx #USDCHF 0.99072 for +10.4 pips, total for today +131.4 pips

Closed Buy #Forex #Fx #AUDCAD 0.98236 for +9.4 pips, total for today +121.0 pips

Closed Buy #Forex #Fx #AUDCAD 0.9805 for +12.2 pips, total for today +111.6 pips

Closed Sell #Forex #Fx #USDCHF 0.99234 for +7.7 pips, total for today +99.4 pips

Closed Sell #Forex #Fx #AUDCAD 0.97858 for -15.2 pips, total for today +91.7 pips

************************************************************

Number of tweets extracted for: MaggiecharFx is: 200.

Closed Sell 1.0 Lots EURUSD 1.17946 for +25.5 pips, total for today +693.4 pips #Online #ForexTrading #Advisor #B

ase #Code

Closed Sell 1.0 Lots EURUSD 1.17947 for +25.5 pips, total for today +667.9 pips #Online #ForexTrading #Advisor #B

ase #Code

Closed Sell 1.0 Lots EURUSD 1.17947 for +25.5 pips, total for today +642.4 pips #Online #ForexTrading #Advisor #B

ase #Code

Closed Sell 1.0 Lots EURUSD 1.1796 for +25.1 pips, total for today +616.9 pips #Online #ForexTrading #Advisor #Ba

se #Code

Closed Sell 1.0 Lots EURUSD 1.17984 for +27.0 pips, total for today +591.8 pips #Online #ForexTrading #Advisor #B

ase #Code

************************************************************

Number of tweets extracted for: DanielWr_fx is: 200.

Maximum Equity Drop (also called "Draw-Down" or "Risk Management") is less than 25% (usually no more than 10-15%)

. #GetMoney #FreeRobot #FX

You can withdraw your initial deposit after a few days and then we trade only with the profits, so you don't risk

your money any more. #Help

You can exit when 2 of 3 indicators reverse or use Trailing Stop Loss, Take Profit, Risk Management, etc.…

https://t.co/zEXnpOus5b

How to start? Let us know which broker you prefer and we tell you further details about deposit, account type, et

c. #IntroducingBroker #Job

You don't need to have any Forex knowledge whatsoever. I trade for you – you just watch the profits coming.… http

s://t.co/xfr8LQQN7d

Step 3: Extract all tweets from one user and load it into a dataframe

In [18]:

# Now that we have some structured tweets at hand, we can move on to the next step

# extracting all tweets from a user and loading them into a dataframe

# extracting all tweets from a user and loading them into a dataframe

In [19]:

# Before the extraction, I am going to note down the structure of the tweet that

# is of interest for us, from each of these users - we will use this structure for

# parsing the tweets

In [20]:

for name in

['fuchstraders','DayTradeScalps','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

tweets = twitter_api.user_timeline(screen_name=name, count=1000)

print("*"*60)

for tweet in tweets:

if 'RT' not in tweet.text and 'close' in tweet.text or 'Close' in tweet.text:

print("The relevant tweet from: {} that we will use for our analysis is: \n {} \n".format(name,tweet.t

ext))

break

************************************************************

The relevant tweet from: fuchstraders that we will use for our analysis is:

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/Lnaq3rA8Pv

https://t.co/3WvOOlHGhW

************************************************************

************************************************************

The relevant tweet from: SignalFactory that we will use for our analysis is:

Forex Signal | Close(TP) Sell CADJPY@87.394 | Profit: +79 pips | 2017.12.15 19:34 GMT | #fx #forex #fb

************************************************************

The relevant tweet from: tj_fx_live that we will use for our analysis is:

Closed Sell USDJPY 112.559 for +23.8 pips, total for today +6.6 pips #trading #EURUSD #FX #forex #GBPUSD #USDJPY

************************************************************

The relevant tweet from: Wermelgion_Co that we will use for our analysis is:

Closed Sell #Forex #Fx #USDCHF 0.99072 for +10.4 pips, total for today +131.4 pips

************************************************************

The relevant tweet from: MaggiecharFx that we will use for our analysis is:

Closed Sell 1.0 Lots EURUSD 1.17946 for +25.5 pips, total for today +693.4 pips #Online #ForexTrading #Advisor #

Closed Sell 1.0 Lots EURUSD 1.17946 for +25.5 pips, total for today +693.4 pips #Online #ForexTrading #Advisor #

Base #Code

************************************************************

The relevant tweet from: DanielWr_fx that we will use for our analysis is:

Closed Sell 2.3 Lots EURUSD 1.17644 for +10.5 pips, total for today +797.4 pips #Online #ForexTrading #Advisor #

Base #Code

In [21]:

# I can't seem to find the word 'close' or 'Close' in the tweets from DayTradeScalps !!

# Let's do some further specific analysis of this user's tweets, to understand

# whether he tweets the closure of his trades

In [22]:

# After a few trials, I had to goto the twitter search site to search there

# https://twitter.com/search?l=en&q=buy%20OR%20sell%20from%3ADayTradeScalps&src=typd

# The results showed that this user only tweets the trade entries, but does not record

# whether the targets were hit or stop loss was triggered

# such an open ended tweet requires further correlation of the targets in the tweets

# with the actual price movements at those times

# Such an analysis is beyond the scope of this project, so I am dropping the user

#

@DayTradeScalps from my analysis

In [23]:

# Let's continue with loading the tweets into a df

# Here we define two helper functions that will help us retrieve all tweets from a specific user

# and load them all up into one dataframe that will help us with the analysis

# I guess there is a max throttle somewhere, but we will proceed to retrieve all tweets

In [24]:

def get_all_unique_tweets(screen_name):

all_tweets = []

new_tweets = twitter_api.user_timeline(screen_name = screen_name,count=200)

all_tweets.extend(new_tweets)

oldest = all_tweets[-1].id - 1

oldest = all_tweets[-1].id - 1

# According to twitter api documents, we can request the next set of tweets based on the max_id

# parameter - so we continue looping retrieving old tweets, and if the number of tweets returns is

# zero we exit the loop

while len(new_tweets) != 0:

new_tweets = twitter_api.user_timeline(screen_name = screen_name,count=200,max_id=oldest)

all_tweets.extend(new_tweets)

oldest = all_tweets[-1].id - 1

# we repeat the filter for unique tweets

# we could have written a function, but I will get on with it for now

all_tweet_text = []

filtered_tweets = []

for t in all_tweets:

if not t.text in all_tweet_text:

all_tweet_text.append(t.text)

filtered_tweets.append(t)

return filtered_tweets

In [25]:

def load_tweets_into_df(all_tweets):

tweet_df = pd.DataFrame(data=[[s.created_at,s.user.screen_name,s.text] for s in all_tweets],columns=['CreatedA

t','Author','Tweet'])

return tweet_df

In [26]:

all_tweet_df = []

all_tweet_df = pd.DataFrame(columns=['CreatedAt','Author','Tweet'])

for name in ['fuchstraders','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

a_tweets = get_all_unique_tweets(name)

tweet_df = load_tweets_into_df(a_tweets)

all_tweet_df = all_tweet_df.append(tweet_df)

print('Loaded {} tweets from {} into a dataframe'.format(len(tweet_df),name))

print('Total tweets loaded = {}'.format(len(all_tweet_df)))

Loaded 3204 tweets from fuchstraders into a dataframe

Loaded 3118 tweets from SignalFactory into a dataframe

Loaded 3118 tweets from SignalFactory into a dataframe

Loaded 763 tweets from tj_fx_live into a dataframe

Loaded 219 tweets from Wermelgion_Co into a dataframe

Loaded 3206 tweets from MaggiecharFx into a dataframe

Loaded 1960 tweets from DanielWr_fx into a dataframe

Total tweets loaded = 12470

Step 4: Data transformation and cleansing

In [27]:

all_tweet_df.head(5)

Out[27]:

CreatedAt

Author

Tweet

0

2017-12-15

15:33:39

fuchstraders

1

2017-12-15

13:02:14

fuchstraders Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/eKRWSL9OH2

2

2017-12-15

09:33:21

fuchstraders

3

2017-12-15

07:04:23

fuchstraders Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNxnXG https://t.co/jDWyz0tQa0

4

2017-12-15

03:33:19

fuchstraders

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/Lnaq3rA8Pv

https://t.co/3WvOOlHGhW

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/U2SORrE3XQ

https://t.co/7cJJ7P6xQL

Closed # 0.0 for 0.0 pips, total for today 0.0 pips https://t.co/BMg2rNOZmg https://t.co/R1dPfi6neR

https://t.co/NggCw9jZXE

In [28]:

# This dataframe has all tweets from these four users

# we need to look for tweets that book profits or losses

# Initial analysis shows, such tweets usually contain the word 'pips'

# as we observed in our analysis of the tweet structure

In [29]:

# We could have either filtered such tweets in the twitter_api search

# or we could have filtered those tweets during the dataframe loading exercise

# The third option is to filter them in the dataframe

# I will use the third option for now, as this gives us a good example

# of loading raw tweets into a dataframe and filtering them there

In [30]:

before = len(all_tweet_df)

print(before)

12470

In [31]:

all_tweet_df.isnull().any()

Out[31]:

CreatedAt

Author

Tweet

dtype: bool

False

False

False

In [32]:

# To build an equity curve out of the profit/loss values,

# we first need to extract the profit/loss values per trade

# we note that that profit/loss is in between 'for' and 'pips' for all users, except for tweets from SignalFactor

y

# For tweets from SignalFactory, the profit/loss is in between 'Profit:' and 'pips' or 'Loss:' and 'pips'

In [33]:

# There are multiple ways to handle this

# one way is to split the dataframe again by the tweet authors and

# apply a different extraction logic for each tweet author

# another way is to do a text replace, to bring all records in the tweet to contain the same pattern

# to keep it simple, let's choose the second way i.e. replace the text 'Profit:' and Loss: to the text 'for'

# however, as each user's tweet's will follow a different structure, a possible future extension

# could be to write a dedicated profit/loss extractor for each user and apply it to the dataframe

# could be to write a dedicated profit/loss extractor for each user and apply it to the dataframe

In [34]:

# Let's first create a filter and see the values that are present

closed_tweet = all_tweet_df['Tweet'].str.contains('Close')

author = all_tweet_df['Author'] == 'SignalFactory'

df_match = closed_tweet & author

print(all_tweet_df[df_match][:5])

all_tweet_df['Tweet'] = all_tweet_df['Tweet'].str.replace('Profit:','for')

all_tweet_df['Tweet'] = all_tweet_df['Tweet'].str.replace('Loss:','for')

# Now if we print the rows based on the same filter, they should contain

# 'for' instead of the words 'Profit:' or 'Loss:'

print(all_tweet_df[df_match][:5])

CreatedAt

0 2017-12-15 19:47:07

2 2017-12-15 19:32:03

3 2017-12-15 19:30:00

4 2017-12-15 19:17:03

7 2017-12-15 17:15:00

Author

SignalFactory

SignalFactory

SignalFactory

SignalFactory

SignalFactory

\

Tweet

0 Forex Signal | Close(TP) Sell CADJPY@87.394 | Profit: +79 pips | 2017.12.15 19:34 GMT | #fx #forex #fb

2

Forex Signal | Close(SL) Sell AUDCAD@0.98526 | Loss: -40 pips | 2017.12.15 19:27 GMT | #fx #forex #fb

3

Forex Signal | Close(SL) Buy CADCHF@0.76917 | Loss: -40 pips | 2017.12.15 19:19 GMT | #fx #forex #fb

4

Forex Signal | Close(SL) Sell AUDCAD@0.98433 | Loss: -40 pips | 2017.12.15 19:13 GMT | #fx #forex #fb

7

Forex Signal | Close(SL) Buy CADCHF@0.77068 | Loss: -40 pips | 2017.12.15 17:06 GMT | #fx #forex #fb

CreatedAt

Author \

0 2017-12-15 19:47:07 SignalFactory

2 2017-12-15 19:32:03 SignalFactory

3 2017-12-15 19:30:00 SignalFactory

4 2017-12-15 19:17:03 SignalFactory

7 2017-12-15 17:15:00 SignalFactory

0

2

3

Tweet

Forex Signal | Close(TP) Sell CADJPY@87.394 | for +79 pips | 2017.12.15 19:34 GMT | #fx #forex #fb

Forex Signal | Close(SL) Sell AUDCAD@0.98526 | for -40 pips | 2017.12.15 19:27 GMT | #fx #forex #fb

Forex Signal | Close(SL) Buy CADCHF@0.76917 | for -40 pips | 2017.12.15 19:19 GMT | #fx #forex #fb

3

4

7

Forex Signal | Close(SL) Buy CADCHF@0.76917 | for -40 pips | 2017.12.15 19:19 GMT | #fx #forex #fb

Forex Signal | Close(SL) Sell AUDCAD@0.98433 | for -40 pips | 2017.12.15 19:13 GMT | #fx #forex #fb

Forex Signal | Close(SL) Buy CADCHF@0.77068 | for -40 pips | 2017.12.15 17:06 GMT | #fx #forex #fb

In [35]:

# Now all the rows that contain the profit/loss values are normalized to contain the

# profit/loss value between the strings 'for' and 'pips'

In [36]:

# The next step is to extract the profit/loss values, and create a new column out of it

# we can use a combination of the extract function and regular expressions

# however if i try to extract the text between 'for' and 'pips' using regular expressions,

# I am getting the second match instead of the first match

# as the words 'for' and 'pips' appear twice in the tweet

# Closed Sell #Forex #Fx #AUDNZD 1.09677 for +23.2 pips, total for today +9.2 pips

# I am using a work around here which is to split the text

# and then extract the text between the words 'for' and 'pips'

In [37]:

all_tweet_df['Profit/Loss String'] = all_tweet_df['Tweet'].str.split(',').str.get(0)

all_tweet_df['Profit/Loss'] = all_tweet_df['Profit/Loss String'].str.extract('.*for(.*)pips.*',expand=True)

In [38]:

len(all_tweet_df)

Out[38]:

12470

In [39]:

# Let's check to make sure we extracted the profit/loss correctly for all tweet authors

for name in ['fuchstraders','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

author = all_tweet_df['Author'] == name

print(all_tweet_df[author][['CreatedAt','Author','Profit/Loss']][:10])

CreatedAt

0 2017-12-15 15:33:39

1 2017-12-15 13:02:14

Author Profit/Loss

fuchstraders

0.0

fuchstraders

0.0

1 2017-12-15 13:02:14

2 2017-12-15 09:33:21

3 2017-12-15 07:04:23

4 2017-12-15 03:33:19

5 2017-12-15 01:02:14

6 2017-12-14 21:33:28

7 2017-12-14 18:33:44

8 2017-12-14 18:33:43

9 2017-12-14 18:33:41

CreatedAt

0 2017-12-15 19:47:07

1 2017-12-15 19:45:04

2 2017-12-15 19:32:03

3 2017-12-15 19:30:00

4 2017-12-15 19:17:03

5 2017-12-15 19:15:01

6 2017-12-15 17:30:01

7 2017-12-15 17:15:00

8 2017-12-15 17:00:00

9 2017-12-15 16:15:00

CreatedAt

0 2017-12-15 07:05:00

1 2017-12-15 02:53:48

2 2017-12-15 02:48:49

3 2017-12-15 02:28:42

4 2017-12-14 22:23:23

5 2017-12-14 14:09:14

6 2017-12-14 14:04:13

7 2017-12-14 07:00:45

8 2017-12-13 22:20:50

9 2017-12-13 22:05:42

CreatedAt

0 2017-12-15 21:35:28

1 2017-12-15 17:35:58

2 2017-12-15 16:55:25

3 2017-12-15 16:25:24

4 2017-12-15 15:44:59

5 2017-12-15 15:44:58

6 2017-12-15 15:24:49

7 2017-12-15 14:59:38

8 2017-12-15 14:29:22

9 2017-12-15 14:24:39

CreatedAt

fuchstraders

0.0

fuchstraders

0.0

fuchstraders

0.0

fuchstraders

0.0

fuchstraders

0.0

fuchstraders

0.0

fuchstraders

NaN

fuchstraders

NaN

fuchstraders

NaN

Author Profit/Loss

SignalFactory

+79

SignalFactory

NaN

SignalFactory

-40

SignalFactory

-40

SignalFactory

-40

SignalFactory

NaN

SignalFactory

NaN

SignalFactory

-40

SignalFactory

-40

SignalFactory

NaN

Author Profit/Loss

tj_fx_live

NaN

tj_fx_live

NaN

tj_fx_live

+23.8

tj_fx_live

-17.2

tj_fx_live

0.0

tj_fx_live

NaN

tj_fx_live

+48.4

tj_fx_live

NaN

tj_fx_live

0.0

tj_fx_live

-35.1

Author Profit/Loss

Wermelgion_Co

+10.4

Wermelgion_Co

+9.4

Wermelgion_Co

+12.2

Wermelgion_Co

+7.7

Wermelgion_Co

-15.2

Wermelgion_Co

+24.0

Wermelgion_Co

+16.4

Wermelgion_Co

+12.2

Wermelgion_Co

+10.4

Wermelgion_Co

+9.9

Author Profit/Loss

CreatedAt

0 2017-12-15 19:32:12

1 2017-12-15 19:32:12

2 2017-12-15 19:32:11

3 2017-12-15 19:32:11

4 2017-12-15 19:32:11

5 2017-12-15 15:16:40

6 2017-12-15 15:16:40

7 2017-12-15 15:16:40

8 2017-12-15 15:16:40

9 2017-12-15 15:16:39

CreatedAt

0 2017-12-16 11:00:52

1 2017-12-16 10:00:53

2 2017-12-16 09:20:24

3 2017-12-16 09:00:16

4 2017-12-16 08:45:24

5 2017-12-16 08:00:52

6 2017-12-16 07:01:04

7 2017-12-16 06:00:49

8 2017-12-16 05:00:47

9 2017-12-16 04:45:23

Author Profit/Loss

MaggiecharFx

+25.5

MaggiecharFx

+25.5

MaggiecharFx

+25.5

MaggiecharFx

+25.1

MaggiecharFx

+27.0

MaggiecharFx

+26.0

MaggiecharFx

+25.5

MaggiecharFx

+25.9

MaggiecharFx

+28.9

MaggiecharFx

+28.2

Author Profit/Loss

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

DanielWr_fx

NaN

In [40]:

# The next imposrtant step is to drop the NaN values, as the rows with

# NaN values are tweets other than those that record the profit/loss

# They could be a valid trade entry related tweet, but we are

# not interested in those anyway, unless we want to follow the trade ideas

# That is a topic by itself - and is the follow-up research after this analysis :-)

In [41]:

all_tweet_df.isnull().any()

Out[41]:

CreatedAt

Author

Tweet

Profit/Loss String

Profit/Loss

False

False

False

False

True

dtype: bool

In [42]:

before = len(all_tweet_df)

all_tweet_df = all_tweet_df.dropna()

after = len(all_tweet_df)

print ('No. of records dropped = {}'.format(before - after))

No. of records dropped = 3948

In [43]:

all_tweet_df.isnull().any()

Out[43]:

CreatedAt

Author

Tweet

Profit/Loss String

Profit/Loss

dtype: bool

False

False

False

False

False

In [44]:

all_tweet_df.dtypes

Out[44]:

CreatedAt

Author

Tweet

Profit/Loss String

Profit/Loss

dtype: object

datetime64[ns]

object

object

object

object

In [45]:

# The very last but important step, is to convert the profit/loss column from

# a generic object into a float, so it is easier to process further

In [46]:

In [46]:

all_tweet_df['Profit/Loss'] = pd.to_numeric(all_tweet_df['Profit/Loss'])

all_tweet_df.dtypes

Out[46]:

CreatedAt

Author

Tweet

Profit/Loss String

Profit/Loss

dtype: object

datetime64[ns]

object

object

object

float64

Step 5: Visualization

In [47]:

# In order to visualize the growth in the portfolio, based on the

# profit/loss from individual trades, we start with a seed investment of

# 10000 USD and continue adding the profit/loss values.

# There is an important detail that has to be noted here

# If we place a trade, say buying 10000 units of EUR_USD, then 1 pip in profit results

# in 1 USD in profit

# So the general formula for pip to USD conversion for a EUR_USD trade is:

#

No. of units / 10000 * no. of pips in profit/loss

# In our tweet analysis, inititally I wanted to look at only EUR_USD trades, however

# since the no. of tweets were low, I included all currencies

# Applying a currency conversion factor is beyond the scope of this project

# So we will make an important assumption here that the no. of units traded

# for a specific currency pair i.e the position size, already takes into account this conversion factor

# such that a 1 pip profit always results in a 1 USD profit

In [48]:

# Let's filter out the dataframes according to their tweet authors

# and store them in a dictionary with author names as keys, for easy access

In [49]:

dict_of_author_tweets = {}

for name in ['fuchstraders','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

author = all_tweet_df['Author'] == name

dict_of_author_tweets[name] = all_tweet_df[author].copy()

print(dict_of_author_tweets[name][['CreatedAt','Author','Profit/Loss']].head())

CreatedAt

Author Profit/Loss

0 2017-12-15 15:33:39 fuchstraders

0.0

1 2017-12-15 13:02:14 fuchstraders

0.0

2 2017-12-15 09:33:21 fuchstraders

0.0

3 2017-12-15 07:04:23 fuchstraders

0.0

4 2017-12-15 03:33:19 fuchstraders

0.0

CreatedAt

Author Profit/Loss

0 2017-12-15 19:47:07 SignalFactory

79.0

2 2017-12-15 19:32:03 SignalFactory

-40.0

3 2017-12-15 19:30:00 SignalFactory

-40.0

4 2017-12-15 19:17:03 SignalFactory

-40.0

7 2017-12-15 17:15:00 SignalFactory

-40.0

CreatedAt

Author Profit/Loss

2 2017-12-15 02:48:49 tj_fx_live

23.8

3 2017-12-15 02:28:42 tj_fx_live

-17.2

4 2017-12-14 22:23:23 tj_fx_live

0.0

6 2017-12-14 14:04:13 tj_fx_live

48.4

8 2017-12-13 22:20:50 tj_fx_live

0.0

CreatedAt

Author Profit/Loss

0 2017-12-15 21:35:28 Wermelgion_Co

10.4

1 2017-12-15 17:35:58 Wermelgion_Co

9.4

2 2017-12-15 16:55:25 Wermelgion_Co

12.2

3 2017-12-15 16:25:24 Wermelgion_Co

7.7

4 2017-12-15 15:44:59 Wermelgion_Co

-15.2

CreatedAt

Author Profit/Loss

0 2017-12-15 19:32:12 MaggiecharFx

25.5

1 2017-12-15 19:32:12 MaggiecharFx

25.5

2 2017-12-15 19:32:11 MaggiecharFx

25.5

3 2017-12-15 19:32:11 MaggiecharFx

25.1

4 2017-12-15 19:32:11 MaggiecharFx

27.0

CreatedAt

Author Profit/Loss

19 2017-12-15 19:07:09 DanielWr_fx

10.5

20 2017-12-15 19:07:09 DanielWr_fx

10.1

21 2017-12-15 19:07:08 DanielWr_fx

-1.2

22 2017-12-15 19:07:08 DanielWr_fx

10.8

23 2017-12-15 19:07:08 DanielWr_fx

10.5

In [50]:

# Let's create a column named Equity with 0 values initially

# We will calculate the values for equity subsequently

In [51]:

for name in ['fuchstraders','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

dict_of_author_tweets[name]['Equity'] = 0

print(dict_of_author_tweets[name][['CreatedAt','Author','Profit/Loss','Equity']].head())

CreatedAt

0 2017-12-15 15:33:39

1 2017-12-15 13:02:14

2 2017-12-15 09:33:21

3 2017-12-15 07:04:23

4 2017-12-15 03:33:19

CreatedAt

0 2017-12-15 19:47:07

2 2017-12-15 19:32:03

3 2017-12-15 19:30:00

4 2017-12-15 19:17:03

7 2017-12-15 17:15:00

CreatedAt

2 2017-12-15 02:48:49

3 2017-12-15 02:28:42

4 2017-12-14 22:23:23

6 2017-12-14 14:04:13

8 2017-12-13 22:20:50

CreatedAt

0 2017-12-15 21:35:28

1 2017-12-15 17:35:58

2 2017-12-15 16:55:25

3 2017-12-15 16:25:24

4 2017-12-15 15:44:59

CreatedAt

0 2017-12-15 19:32:12

1 2017-12-15 19:32:12

2 2017-12-15 19:32:11

3 2017-12-15 19:32:11

4 2017-12-15 19:32:11

Author Profit/Loss Equity

fuchstraders

0.0

0

fuchstraders

0.0

0

fuchstraders

0.0

0

fuchstraders

0.0

0

fuchstraders

0.0

0

Author Profit/Loss Equity

SignalFactory

79.0

0

SignalFactory

-40.0

0

SignalFactory

-40.0

0

SignalFactory

-40.0

0

SignalFactory

-40.0

0

Author Profit/Loss Equity

tj_fx_live

23.8

0

tj_fx_live

-17.2

0

tj_fx_live

0.0

0

tj_fx_live

48.4

0

tj_fx_live

0.0

0

Author Profit/Loss Equity

Wermelgion_Co

10.4

0

Wermelgion_Co

9.4

0

Wermelgion_Co

12.2

0

Wermelgion_Co

7.7

0

Wermelgion_Co

-15.2

0

Author Profit/Loss Equity

MaggiecharFx

25.5

0

MaggiecharFx

25.5

0

MaggiecharFx

25.5

0

MaggiecharFx

25.1

0

MaggiecharFx

27.0

0

CreatedAt

19 2017-12-15 19:07:09

20 2017-12-15 19:07:09

21 2017-12-15 19:07:08

22 2017-12-15 19:07:08

23 2017-12-15 19:07:08

Author

DanielWr_fx

DanielWr_fx

DanielWr_fx

DanielWr_fx

DanielWr_fx

Profit/Loss

10.5

10.1

-1.2

10.8

10.5

Equity

0

0

0

0

0

In [52]:

# We also notice that the dataframe is in reverse chronological order because

# the tweets from retrieved from the latest to the oldest

# Let's sort the dataframes in a chronological order

# and let's reset the index, so that further manipulation and plotting becomes easier

In [53]:

for name in ['fuchstraders','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

dict_of_author_tweets[name] = dict_of_author_tweets[name].sort_values(by='CreatedAt')

dict_of_author_tweets[name] = dict_of_author_tweets[name].reset_index(drop=True)

print(dict_of_author_tweets[name][['CreatedAt','Author','Profit/Loss','Equity']].head())

CreatedAt

0 2017-03-24 01:07:36

1 2017-03-24 04:14:24

2 2017-03-28 21:08:48

3 2017-03-28 22:33:40

4 2017-03-30 14:21:07

CreatedAt

0 2017-05-30 21:39:20

1 2017-05-30 21:44:24

2 2017-05-30 21:59:27

3 2017-05-30 22:04:29

4 2017-05-31 01:15:01

CreatedAt

0 2017-05-18 14:14:55

1 2017-05-18 19:24:34

2 2017-05-19 03:42:31

3 2017-05-19 11:57:26

4 2017-05-19 23:49:18

CreatedAt

0 2017-11-26 23:03:03

1 2017-11-27 01:22:49

Author Profit/Loss Equity

fuchstraders

-23.4

0

fuchstraders

-12.4

0

fuchstraders

-199.0

0

fuchstraders

-199.0

0

fuchstraders

-19.5

0

Author Profit/Loss Equity

SignalFactory

0.0

0

SignalFactory

-26.4

0

SignalFactory

-15.8

0

SignalFactory

-9.3

0

SignalFactory

80.0

0

Author Profit/Loss Equity

tj_fx_live

249.7

0

tj_fx_live

12.6

0

tj_fx_live

-56.3

0

tj_fx_live

-45.5

0

tj_fx_live

16.7

0

Author Profit/Loss Equity

Wermelgion_Co

7.3

0

Wermelgion_Co

-34.9

0

1 2017-11-27 01:22:49

2 2017-11-27 01:22:49

3 2017-11-27 01:22:49

4 2017-11-27 01:27:51

CreatedAt

0 2017-04-19 10:12:29

1 2017-04-19 10:12:29

2 2017-04-19 10:12:30

3 2017-04-19 10:12:30

4 2017-04-19 10:12:30

CreatedAt

0 2017-10-13 15:19:11

1 2017-10-13 15:19:11

2 2017-10-13 15:19:12

3 2017-10-13 15:19:12

4 2017-10-13 18:04:27

Wermelgion_Co

-34.9

0

Wermelgion_Co

36.8

0

Wermelgion_Co

1.0

0

Wermelgion_Co

37.2

0

Author Profit/Loss Equity

MaggiecharFx

10.2

0

MaggiecharFx

10.6

0

MaggiecharFx

11.0

0

MaggiecharFx

9.8

0

MaggiecharFx

11.0

0

Author Profit/Loss Equity

DanielWr_fx

28.9

0

DanielWr_fx

25.4

0

DanielWr_fx

26.0

0

DanielWr_fx

26.1

0

DanielWr_fx

-1.2

0

In [54]:

# To calculate the running equity value, we need to start with an initial balance

# of 10000 USD, so let's insert a row in each dataframe at the first position

# with an equity value of 10000 USD

In [55]:

from datetime import timedelta

for name in ['fuchstraders','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

oldest_trade = dict_of_author_tweets[name]['CreatedAt'][0]

new_top_row = []

new_top_row.insert(0,{'CreatedAt':oldest_trade + timedelta(days=-1),'Author':name,'Tweet':'Initial Capital','P

rofit/Loss String':'Happy trading','Profit/Loss':0.0,'Equity':10000.0})

dict_of_author_tweets[name] = pd.concat([pd.DataFrame(new_top_row),dict_of_author_tweets[name]],ignore_index=T

rue)

print(dict_of_author_tweets[name][['CreatedAt','Author','Profit/Loss','Equity']].head())

CreatedAt

0 2017-03-23 01:07:36

1 2017-03-24 01:07:36

2 2017-03-24 04:14:24

3 2017-03-28 21:08:48

Author

fuchstraders

fuchstraders

fuchstraders

fuchstraders

Profit/Loss

0.0

-23.4

-12.4

-199.0

Equity

10000.0

0.0

0.0

0.0

4 2017-03-28 22:33:40

CreatedAt

0 2017-05-29 21:39:20

1 2017-05-30 21:39:20

2 2017-05-30 21:44:24

3 2017-05-30 21:59:27

4 2017-05-30 22:04:29

CreatedAt

0 2017-05-17 14:14:55

1 2017-05-18 14:14:55

2 2017-05-18 19:24:34

3 2017-05-19 03:42:31

4 2017-05-19 11:57:26

CreatedAt

0 2017-11-25 23:03:03

1 2017-11-26 23:03:03

2 2017-11-27 01:22:49

3 2017-11-27 01:22:49

4 2017-11-27 01:22:49

CreatedAt

0 2017-04-18 10:12:29

1 2017-04-19 10:12:29

2 2017-04-19 10:12:29

3 2017-04-19 10:12:30

4 2017-04-19 10:12:30

CreatedAt

0 2017-10-12 15:19:11

1 2017-10-13 15:19:11

2 2017-10-13 15:19:11

3 2017-10-13 15:19:12

4 2017-10-13 15:19:12

fuchstraders

-199.0

0.0

Author Profit/Loss

Equity

SignalFactory

0.0 10000.0

SignalFactory

0.0

0.0

SignalFactory

-26.4

0.0

SignalFactory

-15.8

0.0

SignalFactory

-9.3

0.0

Author Profit/Loss

Equity

tj_fx_live

0.0 10000.0

tj_fx_live

249.7

0.0

tj_fx_live

12.6

0.0

tj_fx_live

-56.3

0.0

tj_fx_live

-45.5

0.0

Author Profit/Loss

Equity

Wermelgion_Co

0.0 10000.0

Wermelgion_Co

7.3

0.0

Wermelgion_Co

-34.9

0.0

Wermelgion_Co

36.8

0.0

Wermelgion_Co

1.0

0.0

Author Profit/Loss

Equity

MaggiecharFx

0.0 10000.0

MaggiecharFx

10.2

0.0

MaggiecharFx

10.6

0.0

MaggiecharFx

11.0

0.0

MaggiecharFx

9.8

0.0

Author Profit/Loss

Equity

DanielWr_fx

0.0 10000.0

DanielWr_fx

28.9

0.0

DanielWr_fx

25.4

0.0

DanielWr_fx

26.0

0.0

DanielWr_fx

26.1

0.0

In [56]:

# Now we have all the required info to calculate the equity growth and

# subsequently visualize it to see how each analyst/author has performed

# over the duration

In [57]:

# We will use a simple formula to calculate the Equity evolution

# Equity[i] = Equity[i-1] + (Equity[i-1]/10000*Profit/Loss[i])

# Equity[i] = Equity[i-1] + (Equity[i-1]/10000*Profit/Loss[i])

# This formula takes position sizing into account, however, it ignores

# the differences in the Pip vs USD value for different currency pairs as mentioned earlier

In [58]:

for name in ['fuchstraders','SignalFactory','tj_fx_live','Wermelgion_Co','MaggiecharFx','DanielWr_fx']:

profitloss = dict_of_author_tweets[name]['Profit/Loss']

equity = dict_of_author_tweets[name]['Equity']

for x in range(1,len(profitloss)):

equity[x] = equity[x-1]*(1+1/10000*profitloss[x])

dict_of_author_tweets[name]['Equity'] = equity

print(dict_of_author_tweets[name][['CreatedAt','Author','Profit/Loss','Equity']].head())

/home/theerthan/anaconda3/envs/edx/lib/python3.5/site-packages/ipykernel_launcher.py:5: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame

See the caveats in the documentation: http://pandas.pydata.org/pandas-docs/stable/indexing.html#indexing-view-ver

sus-copy

"""

CreatedAt

0 2017-03-23 01:07:36

1 2017-03-24 01:07:36

2 2017-03-24 04:14:24

3 2017-03-28 21:08:48

4 2017-03-28 22:33:40

CreatedAt

0 2017-05-29 21:39:20

1 2017-05-30 21:39:20

2 2017-05-30 21:44:24

3 2017-05-30 21:59:27

4 2017-05-30 22:04:29

CreatedAt

0 2017-05-17 14:14:55

1 2017-05-18 14:14:55

2 2017-05-18 19:24:34

3 2017-05-19 03:42:31

4 2017-05-19 11:57:26

CreatedAt

0 2017-11-25 23:03:03

1 2017-11-26 23:03:03

Author Profit/Loss

Equity

fuchstraders

0.0 10000.000000

fuchstraders

-23.4

9976.600000

fuchstraders

-12.4

9964.229016

fuchstraders

-199.0

9765.940859

fuchstraders

-199.0

9571.598635

Author Profit/Loss

Equity

SignalFactory

0.0 10000.000000

SignalFactory

0.0 10000.000000

SignalFactory

-26.4

9973.600000

SignalFactory

-15.8

9957.841712

SignalFactory

-9.3

9948.580919

Author Profit/Loss

Equity

tj_fx_live

0.0 10000.000000

tj_fx_live

249.7 10249.700000

tj_fx_live

12.6 10262.614622

tj_fx_live

-56.3 10204.836102

tj_fx_live

-45.5 10158.404097

Author Profit/Loss

Equity

Wermelgion_Co

0.0 10000.000000

Wermelgion_Co

7.3 10007.300000

2 2017-11-27 01:22:49

3 2017-11-27 01:22:49

4 2017-11-27 01:22:49

CreatedAt

0 2017-04-18 10:12:29

1 2017-04-19 10:12:29

2 2017-04-19 10:12:29

3 2017-04-19 10:12:30

4 2017-04-19 10:12:30

CreatedAt

0 2017-10-12 15:19:11

1 2017-10-13 15:19:11

2 2017-10-13 15:19:11

3 2017-10-13 15:19:12

4 2017-10-13 15:19:12

Wermelgion_Co

-34.9

9972.374523

Wermelgion_Co

36.8 10009.072861

Wermelgion_Co

1.0 10010.073769

Author Profit/Loss

Equity

MaggiecharFx

0.0 10000.000000

MaggiecharFx

10.2 10010.200000

MaggiecharFx

10.6 10020.810812

MaggiecharFx

11.0 10031.833704

MaggiecharFx

9.8 10041.664901

Author Profit/Loss

Equity

DanielWr_fx

0.0 10000.000000

DanielWr_fx

28.9 10028.900000

DanielWr_fx

25.4 10054.373406

DanielWr_fx

26.0 10080.514777

DanielWr_fx

26.1 10106.824920

In [59]:

fig,axis = plt.subplots(2,3,figsize=[20,10])

out = plt.suptitle('Equity curve of various Analysts/FXTraders',y=1.08,fontsize=30)

# every year

years = mdates.YearLocator()

months = mdates.MonthLocator() # every month

yearsFmt = mdates.DateFormatter('%Y')

names = [['fuchstraders','SignalFactory','tj_fx_live'],

['Wermelgion_Co','MaggiecharFx','DanielWr_fx']]

for x in range(len(names)):

for y in range(len(names[x])):

dict_of_author_tweets[names[x][y]]['CreatedAt'] = pd.to_datetime(dict_of_author_tweets[names[x][y]]

['CreatedAt'])

axis[x][y].plot(dict_of_author_tweets[names[x][y]]['CreatedAt'].values,dict_of_author_tweets[names[x][y]]['

Equity'].values)

axis[x][y].set_title(names[x][y],fontsize=20)

axis[x][y].grid(True)

fig.autofmt_xdate()

plt.tight_layout()

In [62]:

# We can also look at the distribution of the trades with respect to the no. of pips

# gained or lost i.e. how many trades were executed that had a certain pip range in profit

# or loss

# this will give us an idea of the consistency of the analyst/author i.e. if he or she is

# consistently winning with a few bad trades or consistently losing with a few winning trades etc

# Based on the above equity curve, we would expect that for the first three, the histogram shows

# mostly trades less than 0 (mostly losing trades), while for the other three,

# mostly trades less than 0 (mostly losing trades), while for the other three,

# the histogram shows mostly trades above 0 (mostly winning trades)

In [63]:

fig,axis = plt.subplots(2,3,figsize=[20,10])

out = plt.suptitle('Histogram of Profit/Loss trades',y=1.08,fontsize=30)

names = [['fuchstraders','SignalFactory','tj_fx_live'],

['Wermelgion_Co','MaggiecharFx','DanielWr_fx']]

for x in range(len(names)):

for y in range(len(names[x])):

axis[x][y].hist(dict_of_author_tweets[names[x][y]]['Profit/Loss'].values,10, normed=False,

facecolor='green')

axis[x][y].set_title(names[x][y],fontsize=20)

axis[x][y].grid(True)

plt.tight_layout()

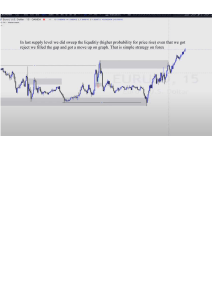

Observations

The analysis shows that although some analysts consistently lose money and the equity drops significantly for

them, others do make profits and have a healthy equity, over a range of months. So the hypothesis that we

could follow twitter feeds and manage our portfolio is very much a possibility. However, it requires a

structured analysis, in addition to the preliminary research above, that demonstrates this possibility.

Specific to this analysis, we can see that three out of the six analysts have lost money, while the other three

have shown positive returns. Two of them, have even shown enormous returns, which at first glance seems to

be too good to be true. As mentioned above, a second set of validation, by correlating the entry price and the

timeline, with the actual price of the currency pair at that same timeline, along with the corresponding exit,

would re-confirm that the trades were indeed profitable, and the tweets were not made up.

So it is indeed possible to manage a portfolio by smart monitoring of twitter feeds and selective tagging of

trades!!