Smart Farming Market Grows with Demand for Precision Agriculture

advertisement

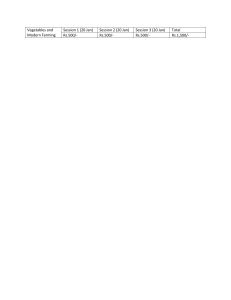

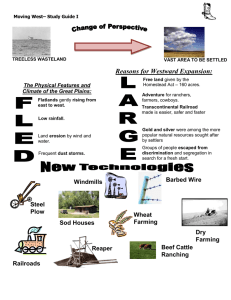

Overview Global smart farming market accounted for USD 19.5 billion and is expected to reach USD 53 billion in 2032. This market is estimated to register the highest CAGR of 10.5% between 2023 and 2032. Smart farming refers to the use of technology and data-driven solutions for improving efficiency, sustainability, and productivity in the agriculture industry. In the realm of smart farming, the term "1,3 smart farming" refers to a specific segment within the broader agricultural technology landscape. This segment focuses on integrating advanced technologies like IoT (Internet of Things), AI (Artificial Intelligence), and data analytics into farming practices. The goal is to enhance efficiency, productivity, and sustainability in agriculture. As a market research analyst, I would highlight that the 1,3 smart farming market is poised for significant growth. Farmers are increasingly adopting smart technologies to monitor and manage their crops and livestock more effectively. These technologies allow for real-time data collection on soil health, weather conditions, crop growth, and livestock behavior, enabling farmers to make informed decisions promptly. The integration of AI helps in predictive analytics, such as determining optimal planting times or identifying potential pest outbreaks early on. This proactive approach not only boosts yields but also minimizes resource wastage, making farming operations more sustainable. Investments in 1,3 smart farming solutions are driven by the increasing global demand for food coupled with the need to address challenges like climate change and limited natural resources. Key players in this market are developing innovative solutions, from smart sensors to automated machinery, tailored to meet the specific needs of modern agriculture. As adoption continues to expand, the 1,3 smart farming market is expected to reshape traditional farming practices, ushering in a new era of precision agriculture. Key Market Segments Based on Offering ● Hardware ● Software ● Services Based on Agriculture Type ● Precision Farming ● Livestock Monitoring ● Precision Aquaculture ● Precision Forestry ● Smart Greenhouse ● Other Types By Farm Size ● Small Farms ● Medium Farms ● Large Farms Download a sample report in MINUTES@https://market.us/report/smart-farming-market/request-sample/ The global smart farming market is segmented into hardware, software, and services. Among these, the software segment leads with a projected CAGR of 10.2%, holding 42.7% of the market share in 2022. In terms of agriculture types, the livestock monitoring segment is expected to dominate, capturing 34.8% of the market share with a projected CAGR of 10.3%. Regarding farm size, large farms constitute the largest segment, holding 47.3% market share with a CAGR of 10.8%. Large farms are at the forefront of adopting smart farming technologies due to their capacity to invest in advanced systems and equipment. Market Key Players Listed below are some of the most prominent smart farming industry players. ● Ag Leader Technology ● AGCO Corporation ● AgJunction Inc. ● AgEagle Aerial Systems Inc. ● Autonomous Solutions Inc. ● Argus Control Systems Ltd. ● BouMatic Robotic B.V. ● CropMetrics LLC. ● CLAAS KGaA mbH ● CropZilla Software Inc. ● Deere & Company ● DICKEY-john Corporation ● com ● DeLaval Inc. ● Farmers Edge Inc. ● Grownetics Inc. ● Granular Inc. ● Gamaya Inc. ● GEA Group Aktiengesellschaft ● Raven Industries Inc. ● Trimble Inc. ● Topcon Positioning Systems Inc. ● Other Key Players Driving Factors: The adoption of advanced technologies such as IoT, ROVs, and AI is propelling growth in the smart farming market. These innovations enable aquaculture farmers to enhance production efficiency, reduce resource wastage, and achieve higher profitability. Similarly, in traditional agriculture, technologies like drones, sensors, and AI streamline data collection and analysis, empowering farmers to make informed decisions that optimize crop yields and sustainability. Consumers' increasing environmental concerns and desire for food traceability further drive the adoption of smart farming practices. Restraining Factors: The fragmented nature of the agriculture industry poses challenges for widespread adoption of smart farming technologies. Farms vary widely in size, operation, and technological readiness, making standardized solutions difficult to implement. This fragmentation limits the scalability and cost-effectiveness of machine-to-machine solutions, hindering widespread adoption. Additionally, initial setup costs and complexities in managing and integrating diverse technologies across dispersed farmlands present barriers to entry for many farmers. Growing Opportunities: The rising adoption of livestock monitoring solutions and IoT-based farming technologies presents significant opportunities in the smart farming market. Despite initial slow adoption in some regions due to cost and awareness issues, increasing demand for livestock products and rising incomes among farmers are expected to drive growth. Precision agriculture, enabled by drones and IoT, offers opportunities to optimize crop yields and environmental sustainability, particularly in emerging markets where agricultural intensification is accelerating. Latest Trends: Recent trends in the smart farming market include the widespread adoption of AI and machine learning for data-driven decision-making in farm management. These technologies are increasingly utilized for analyzing crop health, weather patterns, and soil conditions, enhancing productivity and efficiency. The proliferation of IoT devices such as drones and sensors continues to revolutionize farming practices by automating tasks and providing real-time insights. Additionally, there is a growing trend towards vertical farming and the adoption of specialized farm management software, reflecting a shift towards more controlled and efficient agricultural practices.